Answered step by step

Verified Expert Solution

Question

1 Approved Answer

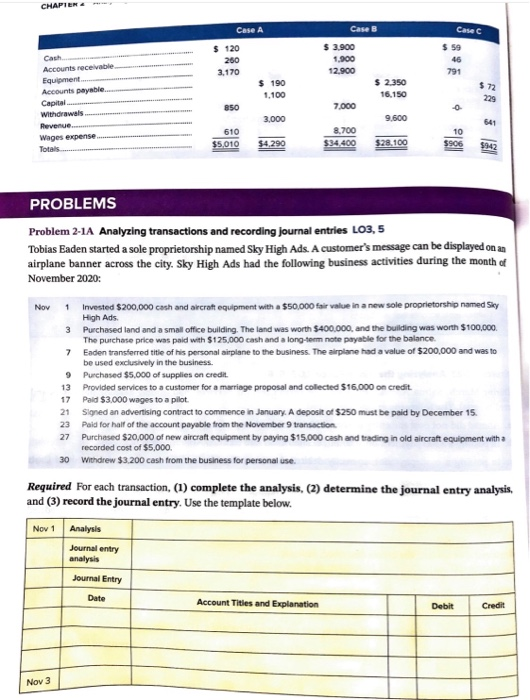

please help me analyze this problem. thank you From problem 2-1 to 2-5 CHAPTER Case A Case B Case C $ 120 260 3,170 $

please help me analyze this problem. thank you

From problem 2-1 to 2-5

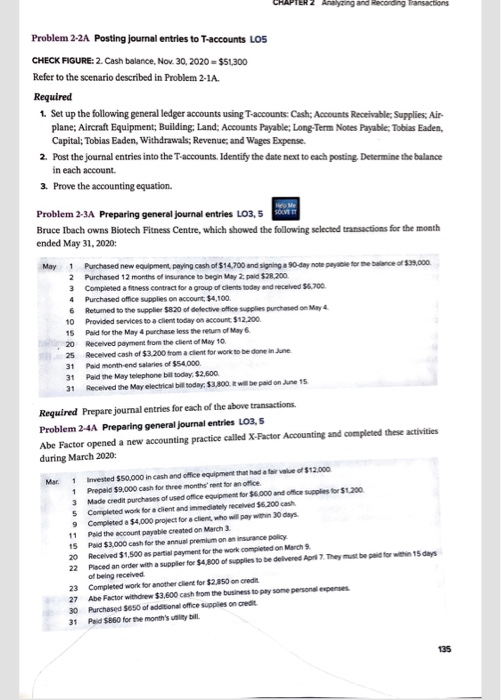

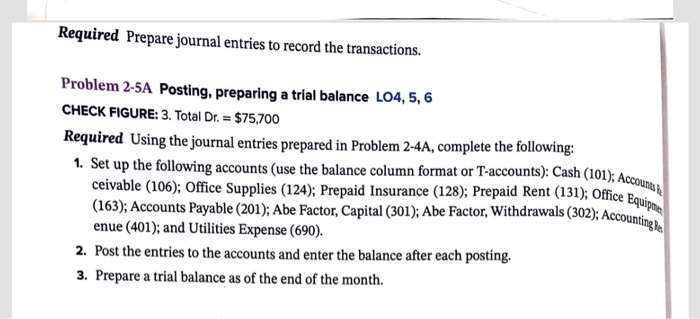

CHAPTER Case A Case B Case C $ 120 260 3,170 $ 3.900 1.900 12.900 $ 59 46 791 $ 190 1.100 $ 2.350 16.150 $72 229 Cash Accounts receivable Equipment Accounts payable Capital withdrawals Revenue.. Wages expense Total 850 7.000 0 3,000 9,600 610 8,700 $34 400 $5.010 $4,290 10 $906 $28.100 $942 PROBLEMS Problem 2-1A Analyzing transactions and recording journal entries L03,5 Tobias Eaden started a sole proprietorship named Sky High Ads. A customer's message can be displayed on an airplane banner across the city. Sky High Ads had the following business activities during the month of November 2020: Nov 1 Invested $200,000 cash and aircraft equipment with a $50,000 fair value in a new sole proprietorship named Sky High Ads 3 Purchased land and a small office building. The land was worth $400,000, and the building was worth $100,000 The purchase price was paid with $125,000 cash and a long-term note payable for the balance 7 Eaden transferred title of his personal airplane to the business. The airplane had a value of $200,000 and was to be used exclusively in the business. 9 Purchased $5,000 of supplies on credit. Provided services to a customer for a marriage proposal and collected $16,000 on credit Paid $3,000 wages to a pilot Signed an advertising contract to commence in January. A deposit of $250 must be paid by December 15. Paid for half of the account payable from the November 9 transaction Purchased $20,000 of new aircraft equipment by paying $15.000 cash and trading in old aircraft equipment with a 30 Withdrew $3.200 cash from the business for personal use. Required for each transaction, (1) complete the analysis, (2) determine the journal entry analysis, and (3) record the journal entry. Use the template below. Nov 1 Analysis Journal entry analysis Journal Entry 13 17 21 23 27 Date Account Titles and Explanation Debit Credit Nov 3 Analyzing and Recording Transactions Problem 2-2A Posting journal entries to T-accounts Los CHECK FIGURE: 2. Cash balance, Nov. 30, 2020 = $51.300 Refer to the scenario described in Problem 2-1A. Required 1. Set up the following general ledger accounts using T-accounts: Cash; Accounts Receivable; Supplies; Air plane; Aircraft Equipment; Building: Land: Accounts Payable; Long-Term Notes Payable; Tobias Eaden, Capital; Tobias Eaden, Withdrawals; Revenue and Wages Expense. 2. Post the journal entries into the T-accounts. Identify the date next to each posting Determine the balance in each account 3. Prove the accounting equation. Problem 2-3A Preparing general journal entries LO3,5 Bruce Ibach owns Biotech Fitness Centre, which showed the following selected transactions for the month ended May 31, 2020: May 1 Purchased new equipment paying cash of $14.700 and signing a 90-day note peyible for the balance of $30,000 2 Purchased 12 months of insurance to begin May 2 paid $28.200 3 Completed a fitness contract for a group of Clents today and received 56.700 4 Purchased office supplies on account: $4,100 6 Returned to the supplier $820 of defective office supplies purchased on May 10 Provided services to a client today on account $12,200 15 Paid for the May 4 purchase less the return of May 6. 20 Received payment from the client of May 10 25 Received cash of $3.200 from a clent for work to be done in June 31 Paid month-end salaries of $54.000 31 Paid the Maytelephone bil today, $2,600 31 Received the May electrical bill today, $3,800. It will be paid on June 15 Required Prepare journal entries for each of the above transactions Problem 2-4A Preparing general Journal entries L03,5 Abe Factor opened a new accounting practice called X-Factor Accounting and completed these activities during March 2020: Mar 1 Invested $50,000 in cash and office equipment that had a fair value of $12,000 1 Prepaid $9,000 cash for three months' rent for an office 3 Made credit purchases of used office equipment for $6.000 and office supplies for $1.200 5 Completed work for a client and immediately received $6.200 cash 9 Completed a $4.000 project for a client, who will pay within 30 days 11 Pald the account payable created on March 3. 15 Pald $3.000 cash for the annual premium on an insurance policy 20 Received $1.500 as partial payment for the work completed on March 22 Place an order with a supplier for $4.800 of supplies to be delivered on 7. They must be paid for win 15 days of being received 23 Completed work for another client for $2.850 son credit 27 Abe Factor withdrew $3,600 cash from the business to pay some personal expenses 30 Purchased $650 of additional office supplies on credit 31 Paid $860 for the month's utility bill 135 1. Set up the following accounts (use the balance column format or T-accounts): Cash (101); Accounts ceivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipmen (163); Accounts Payable (201); Abe Factor, Capital (301); Abe Factor, Withdrawals (302); Accounting Be Required Prepare journal entries to record the transactions. Problem 2-5A Posting, preparing a trial balance L04, 5, 6 CHECK FIGURE: 3. Total Dr. = $75,700 Required Using the journal entries prepared in Problem 2-4A, complete the following: enue (401); and Utilities Expense (690). 2. Post the entries to the accounts and enter the balance after each posting. 3. Prepare a trial balance as of the end of the month Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started