Please help me answer #7.

5. 3,174.90(1+0.006/12)^12*40=1,524,713.97

6.765.61 per month

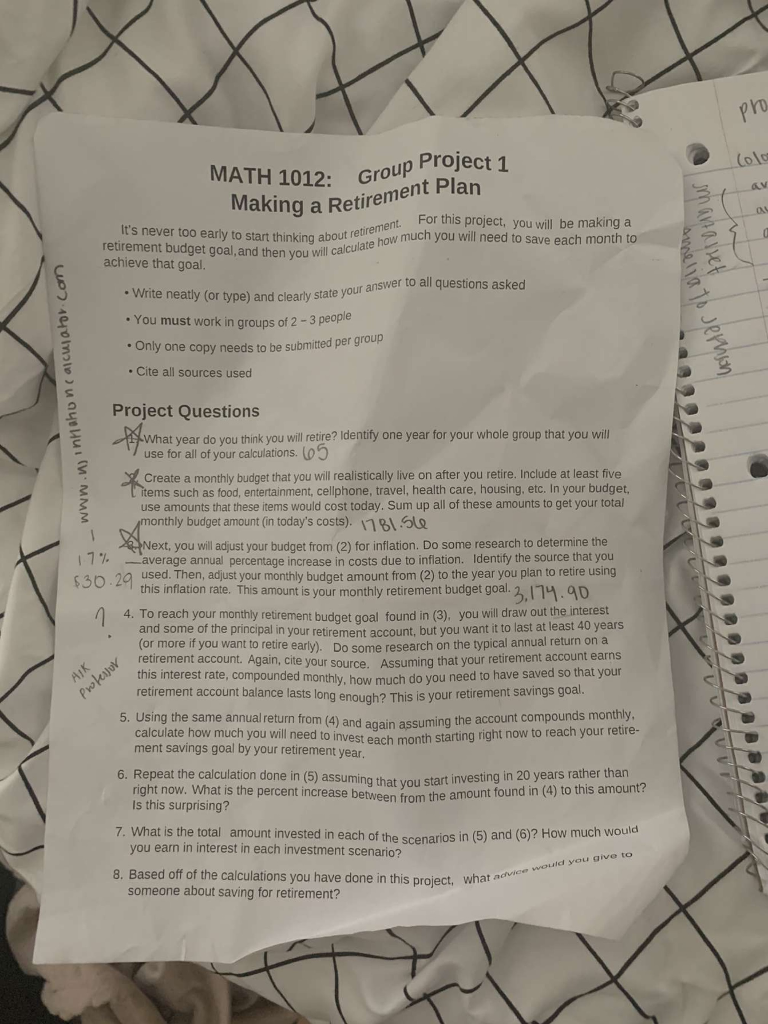

pro Project 1 10 12: Making Col Group a Retirement Plan For this project, you will be making a It's never too early to start thinking about retirement. retirement budget goal,and then you will calculate how much you will need to save each month to achieve that goal. Write neatly (or type) and clearly state your answer to all questions asked You must work in groups of 2 -3 people Only one copy needs to be submitted per group Cite all sources used Project Questions What year do you think you will retire? Identify one year for your whole group that you will use for all of your calculations. (0 Create a monthly budget that you will realistically live on after you retire. Include at least five items such as food, entertainment, cellphone, travel, health care, housing, etc. In your budget, use amounts that these items would cost today. Sum up all of these amounts to get your total monthly budget amount (in today's costs). 181 le Next, you will adjust your budget from (2) for inflation. Do some research to determine the 177 average annual percentage increase in costs due to inflation. Identify the source that you 30.29 used. Then, adjust your monthly budget amount from (2) to the year you plan to retire using this inflation rate. This amount is your monthly retirement budget goa .40 4. To reach your monthly retirement budget goal found in (3), you will draw out the interest and some of the principal in your retirement account. but you want it to last at least 40 years (or more if you want to retire early), Do some research on the typical annual return on a retirement acCount. Again, cite your sourceASSuming that your retirement account earns this interest rate, compounded monthly. how muIch do you need to have saved so that your retirement account balance lasts long enough? This is your retirement savings goal. AIK Pwkajor 5. Using the same annual return from (4) and again assuming the account compounds monthly, calculate how much you will need to invest each month starting right now to reach your retire- ment savings goal by your retirement year, 6. Repeat the calculation done in (5) assuming that you start investing in 20 years rather than right now. What is the percent increase between from the amount found in (4) to this amount? Is this surprising? 7. What is the total amount invested in each of the scenarios in (5) and (6)? How much would you earn in interest in each investment scenario? Based off of the calculations you have done in this project, what acvice would you give to someone about saving for retirement? www.ninaho n c aicuiator. Con h anavet pro Project 1 10 12: Making Col Group a Retirement Plan For this project, you will be making a It's never too early to start thinking about retirement. retirement budget goal,and then you will calculate how much you will need to save each month to achieve that goal. Write neatly (or type) and clearly state your answer to all questions asked You must work in groups of 2 -3 people Only one copy needs to be submitted per group Cite all sources used Project Questions What year do you think you will retire? Identify one year for your whole group that you will use for all of your calculations. (0 Create a monthly budget that you will realistically live on after you retire. Include at least five items such as food, entertainment, cellphone, travel, health care, housing, etc. In your budget, use amounts that these items would cost today. Sum up all of these amounts to get your total monthly budget amount (in today's costs). 181 le Next, you will adjust your budget from (2) for inflation. Do some research to determine the 177 average annual percentage increase in costs due to inflation. Identify the source that you 30.29 used. Then, adjust your monthly budget amount from (2) to the year you plan to retire using this inflation rate. This amount is your monthly retirement budget goa .40 4. To reach your monthly retirement budget goal found in (3), you will draw out the interest and some of the principal in your retirement account. but you want it to last at least 40 years (or more if you want to retire early), Do some research on the typical annual return on a retirement acCount. Again, cite your sourceASSuming that your retirement account earns this interest rate, compounded monthly. how muIch do you need to have saved so that your retirement account balance lasts long enough? This is your retirement savings goal. AIK Pwkajor 5. Using the same annual return from (4) and again assuming the account compounds monthly, calculate how much you will need to invest each month starting right now to reach your retire- ment savings goal by your retirement year, 6. Repeat the calculation done in (5) assuming that you start investing in 20 years rather than right now. What is the percent increase between from the amount found in (4) to this amount? Is this surprising? 7. What is the total amount invested in each of the scenarios in (5) and (6)? How much would you earn in interest in each investment scenario? Based off of the calculations you have done in this project, what acvice would you give to someone about saving for retirement? www.ninaho n c aicuiator. Con h anavet