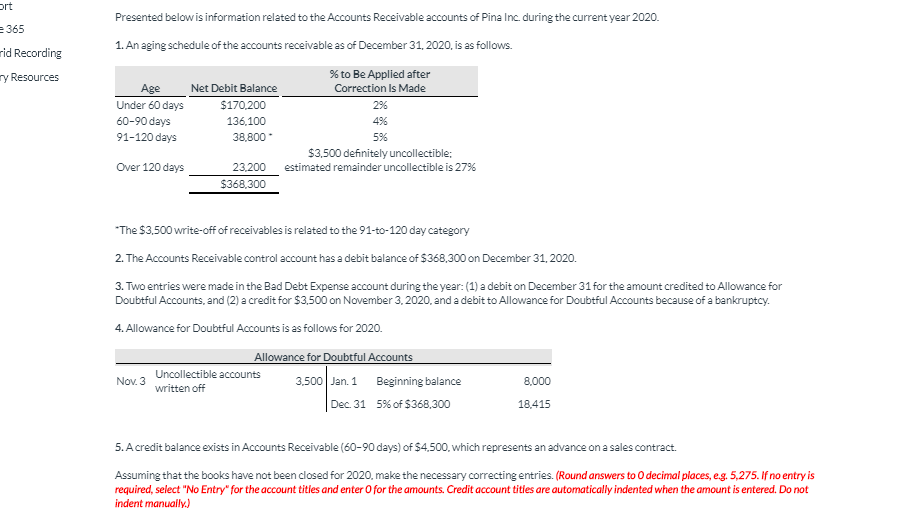

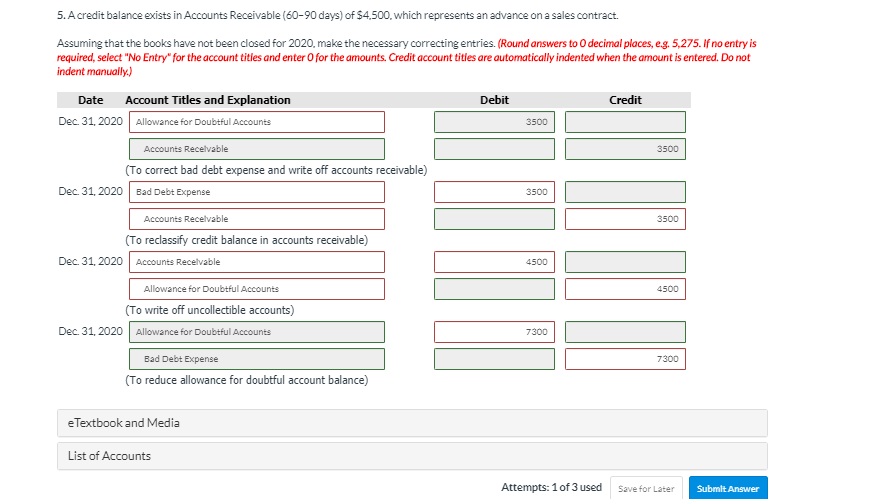

Presented below is information related to the Accounts Receivable accounts of Pina Inc. during the current year 2020. = 365 rid Recording ry Resources 1. An aging schedule of the accounts receivable as of December 31, 2020, is as follows. % to Be Applied after Correction Is Made 29 Age Net Debit Balance Under 60 days $170.200 60-90 days 136,100 91-120 days 38.800 496 596 Over 120 days $3.500 definitely uncollectible: estimated remainder uncollectible is 2796 23,200 $368,300 *The $3,500 write-off of receivables is related to the 91-to-120 day category 2. The Accounts Receivable control account has a debit balance of $368,300 on December 31, 2020. 3. Two entries were made in the Bad Debt Expense account during the year: (1) a debit on December 31 for the amount credited to Allowance for Doubtful Accounts, and (2) a credit for $3.500 on November 3, 2020, and a debit to Allowance for Doubtful Accounts because of a bankruptcy. 4. Allowance for Doubtful Accounts is as follows for 2020. Nov. 3 Allowance for Doubtful Accounts Uncollectible accounts 3.500 Jan 1 Beginning balance written off Dec 31 5% of $368,300 8,000 18.415 5. A credit balance exists in Accounts Receivable (60-90 days) of $4.500, which represents an advance on a sales contract. Assuming that the books have not been closed for 2020. make the necessary correcting entries. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry"for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 5. A credit balance exists in Accounts Receivable (60-90 days) of $4.500, which represents an advance on a sales contract. Assuming that the books have not been closed for 2020. make the necessary correcting entries. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry"for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Dec 31, 2020 Allowance for Doubtful Accounts 3500 | Accounts Recevable (To correct bad debt expense and write off accounts receivable) Dec 31, 2020 Bad Debt Expense Accounts Receivable (To reclassify credit balance in accounts receivable) Dec 31, 2020 Accounts Receivable Allowance for Doubtful Accounts (To write off uncollectible accounts) Dec 31, 2020 Allowance for Doubtful Accounts 7300 Bad Debt Expense (To reduce allowance for doubtful account balance) eTextbook and Media List of Accounts Attempts: 1 of 3 used Save for Later Submit Answer Presented below is information related to the Accounts Receivable accounts of Pina Inc. during the current year 2020. = 365 rid Recording ry Resources 1. An aging schedule of the accounts receivable as of December 31, 2020, is as follows. % to Be Applied after Correction Is Made 29 Age Net Debit Balance Under 60 days $170.200 60-90 days 136,100 91-120 days 38.800 496 596 Over 120 days $3.500 definitely uncollectible: estimated remainder uncollectible is 2796 23,200 $368,300 *The $3,500 write-off of receivables is related to the 91-to-120 day category 2. The Accounts Receivable control account has a debit balance of $368,300 on December 31, 2020. 3. Two entries were made in the Bad Debt Expense account during the year: (1) a debit on December 31 for the amount credited to Allowance for Doubtful Accounts, and (2) a credit for $3.500 on November 3, 2020, and a debit to Allowance for Doubtful Accounts because of a bankruptcy. 4. Allowance for Doubtful Accounts is as follows for 2020. Nov. 3 Allowance for Doubtful Accounts Uncollectible accounts 3.500 Jan 1 Beginning balance written off Dec 31 5% of $368,300 8,000 18.415 5. A credit balance exists in Accounts Receivable (60-90 days) of $4.500, which represents an advance on a sales contract. Assuming that the books have not been closed for 2020. make the necessary correcting entries. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry"for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 5. A credit balance exists in Accounts Receivable (60-90 days) of $4.500, which represents an advance on a sales contract. Assuming that the books have not been closed for 2020. make the necessary correcting entries. (Round answers to O decimal places, e.g. 5,275. If no entry is required, select "No Entry"for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Dec 31, 2020 Allowance for Doubtful Accounts 3500 | Accounts Recevable (To correct bad debt expense and write off accounts receivable) Dec 31, 2020 Bad Debt Expense Accounts Receivable (To reclassify credit balance in accounts receivable) Dec 31, 2020 Accounts Receivable Allowance for Doubtful Accounts (To write off uncollectible accounts) Dec 31, 2020 Allowance for Doubtful Accounts 7300 Bad Debt Expense (To reduce allowance for doubtful account balance) eTextbook and Media List of Accounts Attempts: 1 of 3 used