Please help me answer all the questions under the section required!!

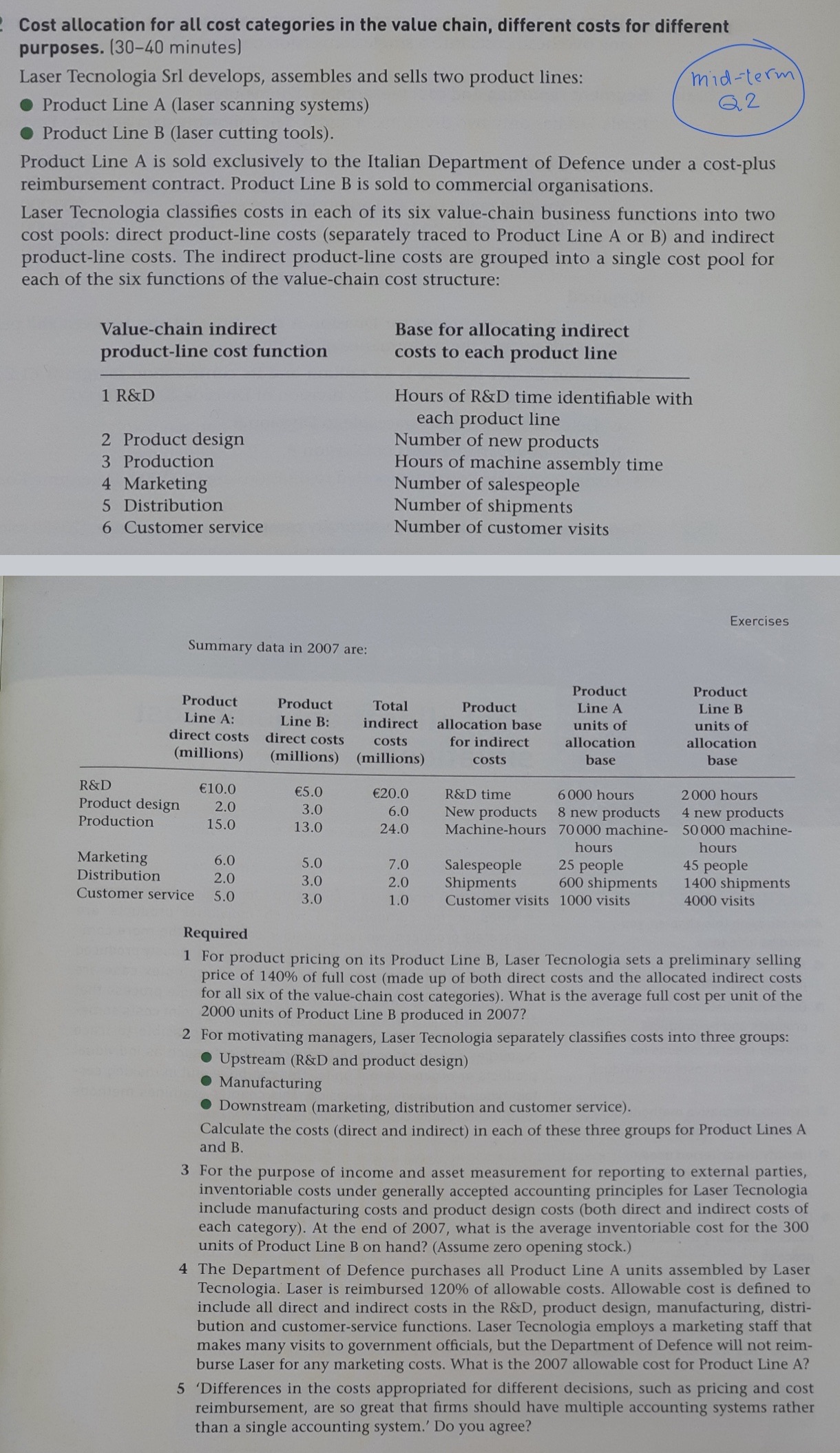

Cost allocation for all cost categories in the value chain, different costs for different purposes. (30-40 minutes) Laser Tecnologia Srl develops, assembles and sells two product lines: mid -term . Product Line A (laser scanning systems) Q2 Product Line B (laser cutting tools). Product Line A is sold exclusively to the Italian Department of Defence under a cost-plus reimbursement contract. Product Line B is sold to commercial organisations. Laser Tecnologia classifies costs in each of its six value-chain business functions into two cost pools: direct product-line costs (separately traced to Product Line A or B) and indirect product-line costs. The indirect product-line costs are grouped into a single cost pool for each of the six functions of the value-chain cost structure: Value-chain indirect Base for allocating indirect product-line cost function costs to each product line 1 R&D Hours of R&D time identifiable with each product line 2 Product design Number of new products 3 Production Hours of machine assembly time 4 Marketing Number of salespeople 5 Distribution Number of shipments 6 Customer service Number of customer visits Exercises Summary data in 2007 are: Product Product Product Product Product Line A Line B Line A: Total Line B: indirect allocation base units of units of direct costs direct costs (millions) costs for indirect allocation allocation (millions) (millions) costs base base R&D E10.0 E5.0 Product design E20.0 R&D time 6000 hours 2000 hours 2.0 Production 3.0 6.0 New products 8 new products 4 new products 15.0 13.0 24.0 Machine-hours 70000 machine- 50 000 machine- Marketing hours hours 6.0 5.0 Distribution 7.0 Salespeople 25 people 45 people 2.0 3.0 2.0 Shipments 600 shipments 1400 shipments Customer service 5.0 3.0 1.0 Customer visits 1000 visits 4000 visits Required 1 For product pricing on its Product Line B, Laser Tecnologia sets a preliminary selling price of 140% of full cost (made up of both direct costs and the allocated indirect costs for all six of the value-chain cost categories). What is the average full cost per unit of the 2000 units of Product Line B produced in 2007? 2 For motivating managers, Laser Tecnologia separately classifies costs into three groups: . Upstream (R&D and product design) .Manufacturing . Downstream (marketing, distribution and customer service). Calculate the costs (direct and indirect) in each of these three groups for Product Lines A and B. 3 For the purpose of income and asset measurement for reporting to external parties, inventoriable costs under generally accepted accounting principles for Laser Tecnologia include manufacturing costs and product design costs (both direct and indirect costs of each category). At the end of 2007, what is the average inventoriable cost for the 300 units of Product Line B on hand? (Assume zero opening stock.) 4 The Department of Defence purchases all Product Line A units assembled by Laser Tecnologia. Laser is reimbursed 120% of allowable costs. Allowable cost is defined to include all direct and indirect costs in the R&D, product design, manufacturing, distri- bution and customer-service functions. Laser Tecnologia employs a marketing staff that makes many visits to government officials, but the Department of Defence will not reim- burse Laser for any marketing costs. What is the 2007 allowable cost for Product Line A? 5 'Differences in the costs appropriated for different decisions, such as pricing and cost reimbursement, are so great that firms should have multiple accounting systems rather than a single accounting system.' Do you agree