Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me answer Question 3 I have done Question 1 and 2 and posted my answers. Question 3 is based on question 1 and

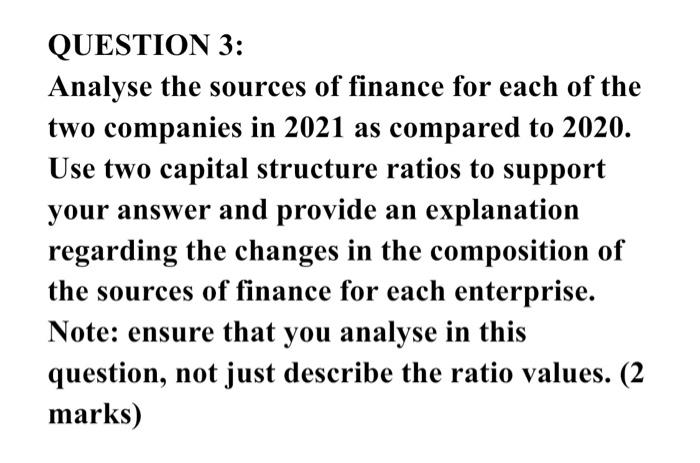

please help me answer Question 3

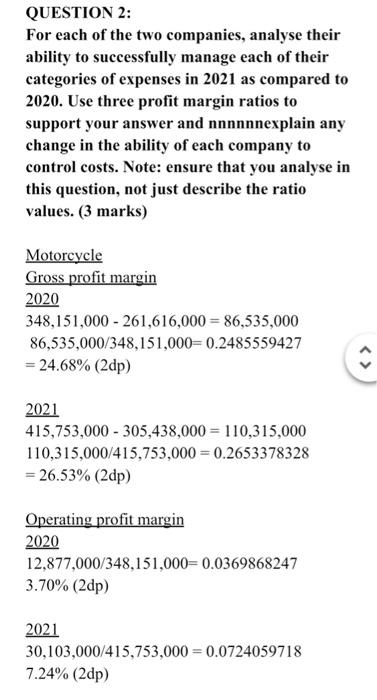

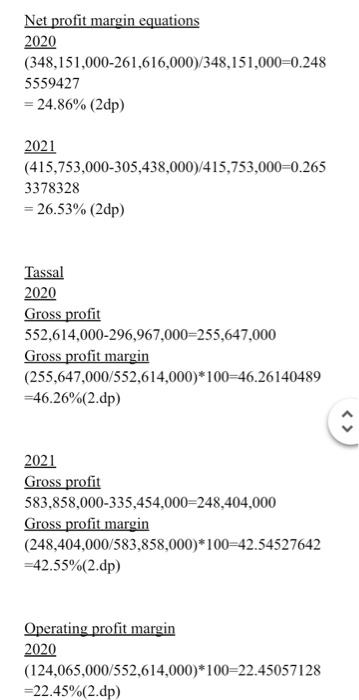

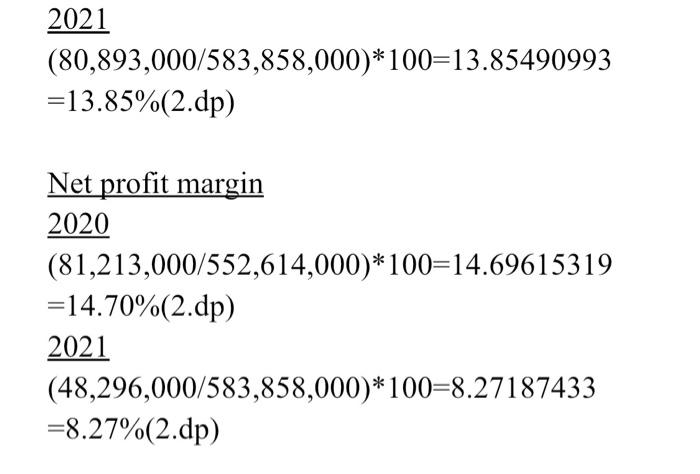

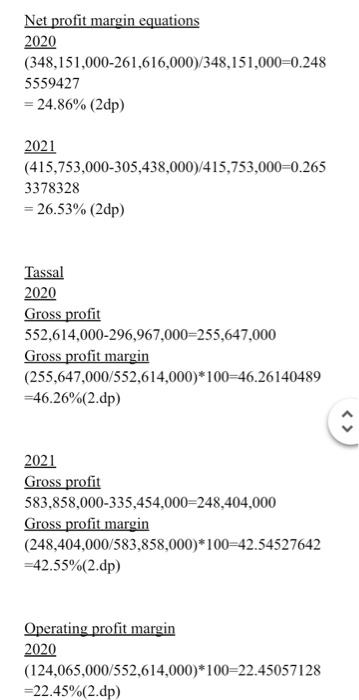

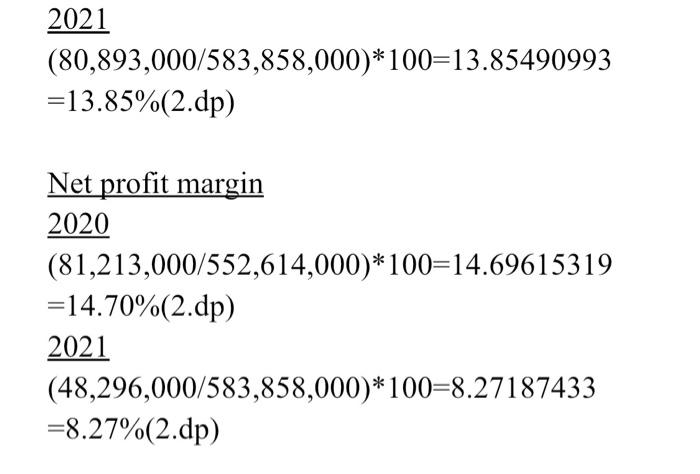

QUESTION 3: Analyse the sources of finance for each of the two companies in 2021 as compared to 2020. Use two capital structure ratios to support your answer and provide an explanation regarding the changes in the composition of the sources of finance for each enterprise. Note: ensure that you analyse in this question, not just describe the ratio values. (2 marks) QUESTION 1: Analyse the overall liquidity position for each of the two companies in 2021 as compared to 2020. Calculate the values for two liquidity ratios to help support your answer and justify why you have chosen these ratios. Note: ensure that you analyse in this question, not just describe the ratio values. (2 marks) Current ratio Current ratio has been used to determine whether the company is able to pay off their liabilities through revenue generated from the assets. A number larger than 1 is good as it means they are able to pay off debts whilst numbers that approach the $4 region can be seen as bad as it means the business is not efficiently using the money received. Furthermore, the current ratio has been used to see if they are making a profit or losing. Tassel group LTD (TG) in 2020 had a current ratio of 3.44:1 which means for every dollar they spent, they earned $3.44. While it is good that the company yielded profit, having such a high number means they are not using the money earned effectively. Despite this, the company is in a relatively good position as they are able to pay off any debt they have to pay off within the next 12 months. TG in 2021 had a current ratio of 4.16:1. Despite having a high current ratio, this is a bad number to have as they are not spending their profit effectively. Tassel Group Limited Quick ratio Tassel Group Limited had a quick ratio of 0.47:1 in 202 which means for every dollar in liability, they are able to repay 47c. Similarly to the current ratio, the number should be above 1 as this ratio determines how well a business is able to repay debt by determining the liquidity of the company but this ratio does not include current inventory.Inventory is not included as it is difficult to sell it within an extremely short time such as 3 months. 0.47:1 means they are unable to pay off more than half of their liabilities instantly Tassel Group Limited had a quick ratio of 0.48:1 in 2021 which is once again a poor number to have in the quick ratio. This means they are unable to pay off all their money instantly. The overall liquidity of TG is good as they are able to pay off their liabilities but must use their profits more effectively. Motorcycle Holdings Limited (LTD) Current ratio Motorcycle Holdings Limited (LTD) (MHL)in 2020 had a current ratio of 1.86:1, meaning they earned $1.86 for their dollar spent. In 2021, their current ratio was 1.56:1, meaning it had dropped by 30 cents. This can be attributed to the decrease in current assets, whilst maintaining its liabilities at a steady rate. Despite the drop in its current ratio for 2021, MHL has a good current ratio in 2020 and 2021, as they are not overspending and they have a solid income. Motorcycle Holdings Limited (LTD) Quick Ratio The Quick ratio for MHL in 2020 was 0.72:1, which means MHL is able to settle approximately 4 of its current liabilities instantaneously. This is not what MHL wants, as any number under 1 for the quick ratio is typically considered not good. This figure drops in 2021, where its quick ratio is now at 0.21 meaning they can only pay /s if its current liabilities. As with the current ratio for MHL, the decrease is due to MHL reducing its current assets, which means it has reduced its ability to generat cash. QUESTION 2: For each of the two companies, analyse their ability to successfully manage each of their categories of expenses in 2021 as compared to 2020. Use three profit margin ratios to support your answer and nnnnnnexplain any change in the ability of each company to control costs. Note: ensure that you analyse in this question, not just describe the ratio values. (3 marks) Motorcycle Gross profit margin 2020 348,151,000 - 261,616,000 = 86,535,000 86,535,000/348,151,000=0.2485559427 = 24.68% (20p) 2021 415,753,000 - 305,438,000 = 110,315,000 110,315,000/415,753,000 = 0.2653378328 = 26.53% (2dp) Operating profit margin 2020 12,877,000/348,151,000=0.0369868247 3.70% (2dp) 2021 30,103,000/415,753,000 = 0.0724059718 7.24% (2dp) Net profit margin equations 2020 (348,151,000-261,616,000)/348,151,000=0.248 5559427 = 24.86% (20p) 2021 (415,753,000-305,438,000)/415,753,000=0.265 3378328 = 26.53% (2dp) Tassal 2020 Gross profit 552,614.000-296,967,000=255,647,000 Gross profit margin (255,647,000/552,614,000)*100=46.26140489 =46.26%(2.dp) 2021 Gross profit 583.858,000-335,454,000=248,404,000 Gross profit margin (248,404,000/583,858,000)*100=42.54527642 =42.55%(2.dp) Operating profit margin 2020 (124,065,000/552,614,000)*100=22.45057128 =22.45%(2.dp) 2021 (80,893,000/583,858,000)*100=13.85490993 =13.85%(2.dp) Net profit margin 2020 (81,213,000/552,614,000)*100=14.69615319 =14.70%(2.dp) 2021 (48,296,000/583,858,000)*100=8.27187433 =8.27%(2.dp) I have done Question 1 and 2 and posted my answers. Question 3 is based on question 1 and 2 answers.

Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started