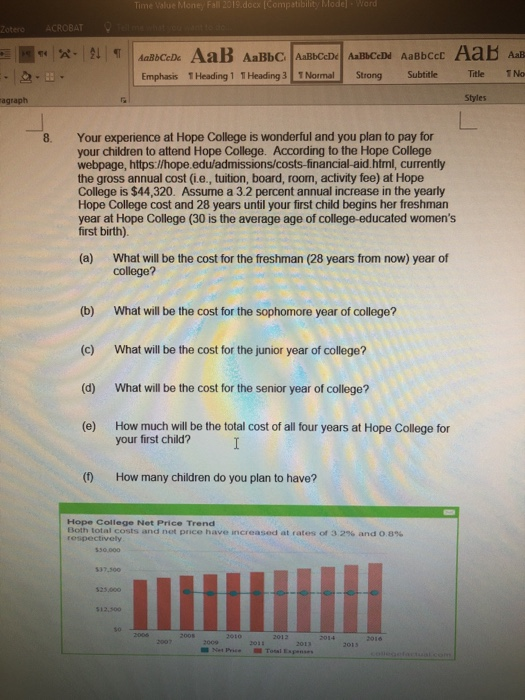

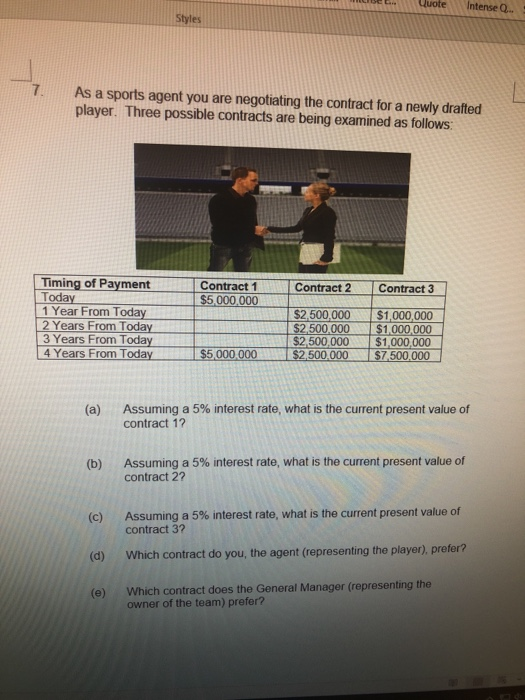

Time Value Money Fall 2019.docx (Compatibility Model Word Zotero ACROBAT U X 20 T . | Emphasis T Heading 1 1 Heading 3 T Normal Strong Subtitle Title T No ragraph Styles Your experience at Hope College is wonderful and you plan to pay for your children to attend Hope College. According to the Hope College webpage, https://hope.edu/admissions/costs-financial aid.html, currently the gross annual cost (i.e., tuition, board, room, activity fee) at Hope College is $44,320. Assume a 3.2 percent annual increase in the yearly Hope College cost and 28 years until your first child begins her freshman year at Hope College (30 is the average age of college educated women's first birth). (a) What will be the cost for the freshman (28 years from now) year of college? (b) What will be the cost for the sophomore year of college? (c) What will be the cost for the junior year of college? (d) What will be the cost for the senior year of college? (e) How much will be the total cost of all four years at Hope College for your first child? T (1) How many children do you plan to have? Hope College Net Price Trend Both total costs and not price have increased at rates of 3 296 and 0.896 rospectively 337.500 25.000 2012 2013 M EL. Vuote Intense Q... As a sports agent you are negotiating the contract for a newly drafted player. Three possible contracts are being examined as follows: Contract 1 $5.000.000 Contract 2 Contract 3 Timing of Payment Today 1 Year From Today 2 Years From Today 3 Years From Today 4 Years From Today $2,500,000 $2,500,000 $2,500,000 $2,500,000 $1,000,000 $1,000,000 $1,000,000 $7,500,000 $5,000,000 (a) Assuming a 5% interest rate, what is the current present value of contract 1? Assuming a 5% interest rate, what is the current present value of contract 22 Assuming a 5% interest rate, what is the current present value of contract 3? (d) Which contract do you, the agent (representing the player), prefer? (e) Which contract does the General Manager (representing the owner of the team) prefer? X 211 AaBCCDA -12 AA AAA ... X. x' A..A. TEME Emphasis Paragraph Font You have landed in wealth management for Bank of America. You have been assigned two clients, Isabelle who is 30 years old and Dominique who is 25 years old. Both want to retire at the age of 55. You advise both women to put $5,000 every year into Vanguard's S&P 500 Index mutual fund beginning one year from today. You are very optimistic and estimate the mutual fund's return to be 12 percent a year. (a) How much money will Isabelle have when she retires at the age of 55 (i.e., right after her 25th deposit of $5,000)? (b) How much money will Dominique have when she retires at the age of 55 (i.e., right after her 30th deposit of $5,000)? (c) What is the learning point of this problem? 6. To assure your immortality at Hope College, you wish to endow a $5,000 scholarship bearing your name. President-elect Matthew Scogin is delighted, and informs you that the assumed rate of return on endowments is 2.5%. How large of a donation must you make to Hope College? Or, in other words, what is the present value of perpetuity of $5,000 per year at a discount rate of 2.5%