Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME ANSWER THE BLANK PARTS. PLEASE SEE THE ATTATCHMENTS FOR BETTER UNDERSTANDING. PLEASE SHOW ALL YOUR WORK STEP BY STEP (i would like

PLEASE HELP ME ANSWER THE BLANK PARTS. PLEASE SEE THE ATTATCHMENTS FOR BETTER UNDERSTANDING. PLEASE SHOW ALL YOUR WORK STEP BY STEP (i would like to try it)

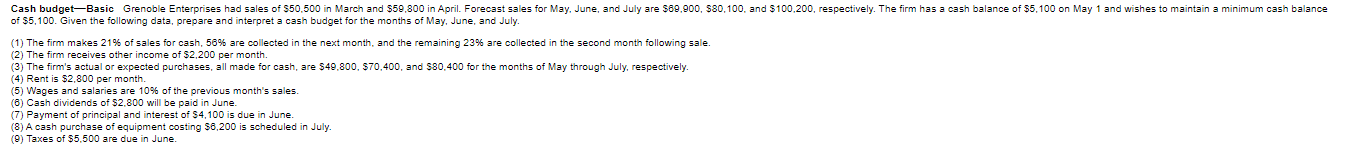

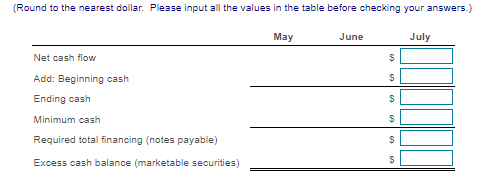

Cash budget-Basic Grenoble Enterprises had sales of $50.500 in March and $59.800 in April. Forecast sales for May, June, and July are $69.900, $80,100 and $100,200, respectively. The firm has a cash balance of $5,100 on May 1 and wishes to maintain a minimum cash balance of $5,100. Given the following data, prepare and interpret a cash budget for the months of May, June, and July. (1) The firm makes 21% of sales for cash, 58% are collected in the next month, and the remaining 23% are collected in the second month following sale. (2) The firm receives other income of $2,200 per month. (3) The firm's actual or expected purchases, all made for cash, are $49.800, $70,400, and $80.400 for the months of May through July, respectively (4) Rent is $2,800 per month (5) Wages and salaries are 10% of the previous month's sales. (6) Cash dividends of $2.800 will be paid in June. (7) Payment of principal and interest of $4,100 is due in June. (8) A cash purchase of equipment costing $6.200 is scheduled in July. (9) Taxes of $5,500 are due in June (Round to the nearest dollar. Please input all the values in the table before checking your answers.) May June July Net cash flow S S S Add: Beginning cash Ending cash Minimum cash Required total financing (notes payable) S 09 S Excess cash balance (marketable securities)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started