Answered step by step

Verified Expert Solution

Question

1 Approved Answer

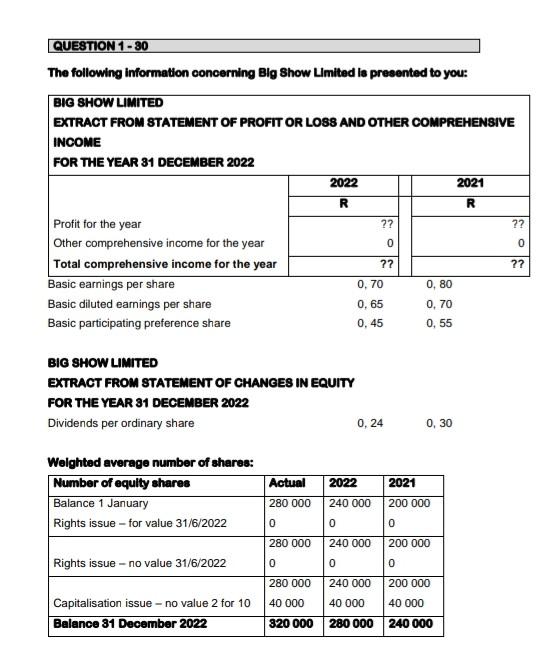

please help me answer the following questions The following information ooncerning Blg Show Lmited la preeented to you: BIC SHOW LIMITED EXTRACT FROM STATEMENT OF

please help me answer the following questions

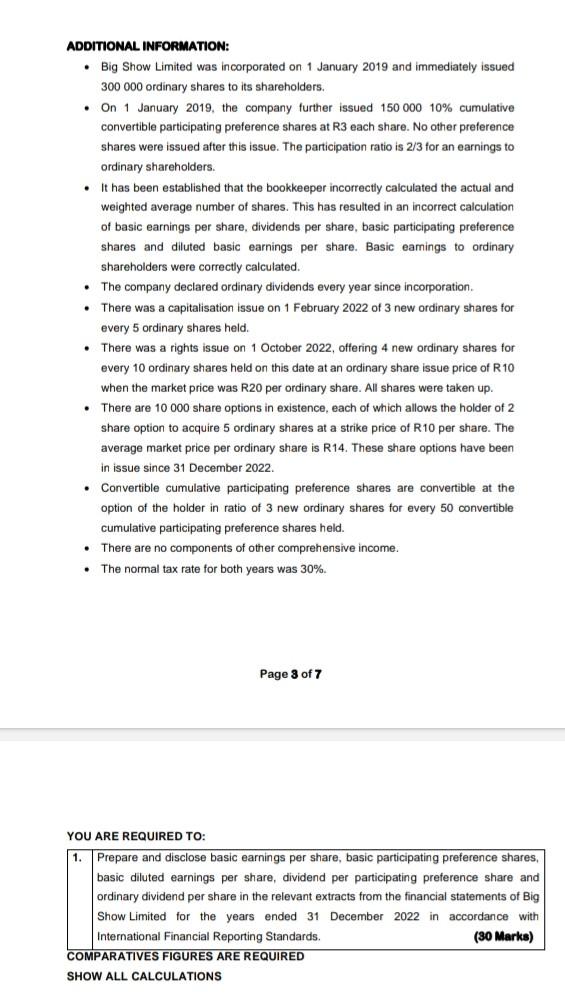

The following information ooncerning Blg Show Lmited la preeented to you: BIC SHOW LIMITED EXTRACT FROM STATEMENT OF CHANGES IN EQUITY FOR THE YEAR 31 DECEMBER 2022 Dividends per ordinary share 0,24 0,30 Welghted average number of shares: ADDITIONAL INFORMATION: - Big Show Limited was incorporated on 1 January 2019 and immediately issued 300000 ordinary shares to its shareholders. - On 1 January 2019, the company further issued 15000010% cumulative convertible participating preference shares at R3 each share. No other preference shares were issued after this issue. The participation ratio is 2/3 for an earnings to ordinary shareholders. - It has been established that the bookkeeper incorrectly calculated the actual and weighted average number of shares. This has resulted in an incorrect calculation of basic earnings per share, dividends per share, basic participating preference shares and diluted basic earnings per share. Basic eamings to ordinary shareholders were correctly calculated. - The company declared ordinary dividends every year since incorporation. - There was a capitalisation issue on 1 February 2022 of 3 new ordinary shares for every 5 ordinary shares held. - There was a rights issue on 1 October 2022, offering 4 new ordinary shares for every 10 ordinary shares held on this date at an ordinary share issue price of R10 when the market price was R20 per ordinary share. All shares were taken up. - There are 10000 share options in existence, each of which allows the holder of 2 share option to acquire 5 ordinary shares at a strike price of R10 per share. The average market price per ordinary share is R14. These share options have been in issue since 31 December 2022. - Convertible cumulative participating preference shares are convertible at the option of the holder in ratio of 3 new ordinary shares for every 50 convertible cumulative participating preference shares held. - There are no components of other comprehensive income. - The normal tax rate for both years was 30%. Page 3 of 7 YOU ARE REQUIRED TO: \begin{tabular}{|l|l} \hline 1. Prepare and disclose basic earnings per share, basic participating preference shares, \\ basic diluted earnings per share, dividend per participating preference share and \\ ordinary dividend per share in the relevant extracts from the financial statements of Big \\ Show Limited for the years ended 31 December 2022 in accordance with International Financial Reporting Standards. \\ (30 Marks) \\ \hline \end{tabular} COMPARATIVES FIGURES ARE REQUIRED SHOW ALL CALCUILATIONS The following information ooncerning Blg Show Lmited la preeented to you: BIC SHOW LIMITED EXTRACT FROM STATEMENT OF CHANGES IN EQUITY FOR THE YEAR 31 DECEMBER 2022 Dividends per ordinary share 0,24 0,30 Welghted average number of shares: ADDITIONAL INFORMATION: - Big Show Limited was incorporated on 1 January 2019 and immediately issued 300000 ordinary shares to its shareholders. - On 1 January 2019, the company further issued 15000010% cumulative convertible participating preference shares at R3 each share. No other preference shares were issued after this issue. The participation ratio is 2/3 for an earnings to ordinary shareholders. - It has been established that the bookkeeper incorrectly calculated the actual and weighted average number of shares. This has resulted in an incorrect calculation of basic earnings per share, dividends per share, basic participating preference shares and diluted basic earnings per share. Basic eamings to ordinary shareholders were correctly calculated. - The company declared ordinary dividends every year since incorporation. - There was a capitalisation issue on 1 February 2022 of 3 new ordinary shares for every 5 ordinary shares held. - There was a rights issue on 1 October 2022, offering 4 new ordinary shares for every 10 ordinary shares held on this date at an ordinary share issue price of R10 when the market price was R20 per ordinary share. All shares were taken up. - There are 10000 share options in existence, each of which allows the holder of 2 share option to acquire 5 ordinary shares at a strike price of R10 per share. The average market price per ordinary share is R14. These share options have been in issue since 31 December 2022. - Convertible cumulative participating preference shares are convertible at the option of the holder in ratio of 3 new ordinary shares for every 50 convertible cumulative participating preference shares held. - There are no components of other comprehensive income. - The normal tax rate for both years was 30%. Page 3 of 7 YOU ARE REQUIRED TO: \begin{tabular}{|l|l} \hline 1. Prepare and disclose basic earnings per share, basic participating preference shares, \\ basic diluted earnings per share, dividend per participating preference share and \\ ordinary dividend per share in the relevant extracts from the financial statements of Big \\ Show Limited for the years ended 31 December 2022 in accordance with International Financial Reporting Standards. \\ (30 Marks) \\ \hline \end{tabular} COMPARATIVES FIGURES ARE REQUIRED SHOW ALL CALCUILATIONSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started