Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me answer the questions. The explanations are confusing. 2.You purchase one IBM July 125 call contract for a premium of S5. You hold

Please help me answer the questions. The explanations are confusing.

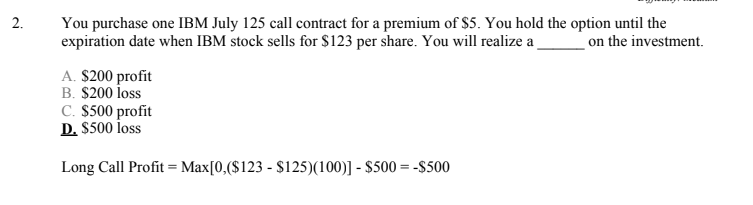

2.You purchase one IBM July 125 call contract for a premium of S5. You hold the option until the expiration date when IBM stock sells for $123 per share. You will realize a on the investment A. $200 profit B. $200 loss C. $500 profit D. S500 loss Long Call Profit = Max[0,(S123-$125)(100)]-$500 =-S500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started