Answered step by step

Verified Expert Solution

Question

1 Approved Answer

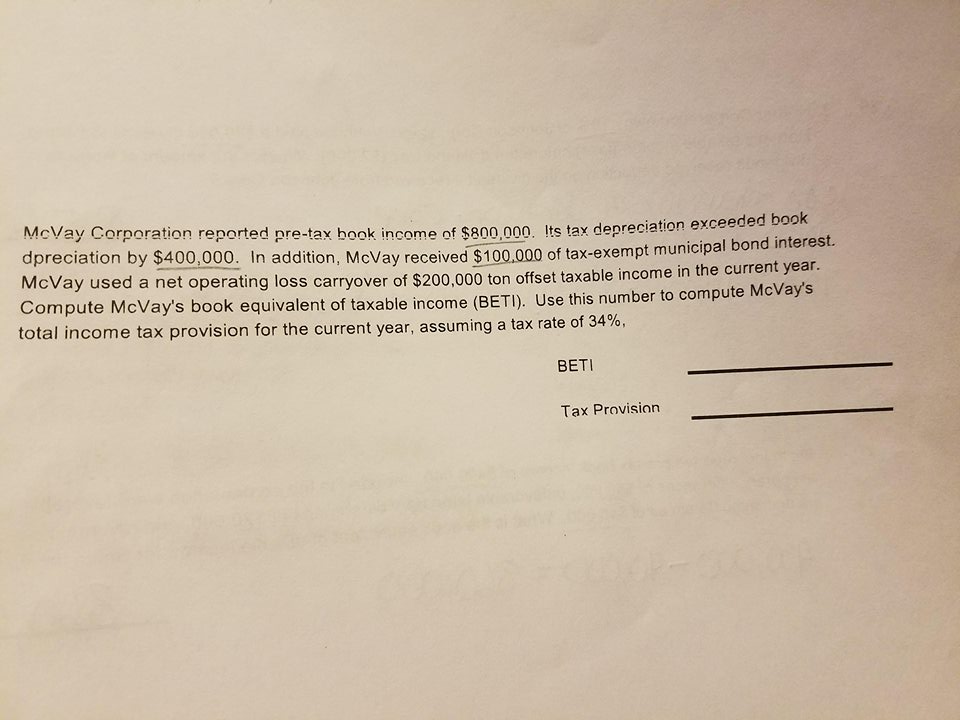

Please help me as soon as possible. Picture is clear. Thank you! McVay Corporation reported pre-tax book income of $800,000. dpreciation by $400,000. In addition,

Please help me as soon as possible. Picture is clear. Thank you!

McVay Corporation reported pre-tax book income of $800,000. dpreciation by $400,000. In addition, McVay received $100.000 o Its tax depreciation exceeded f tax-exempt m unicipal bond interest. used a net operating loss carryover of $200,000 ton offset taxable income in the current year. mpute McVay's book equivalent of taxable income (BETI). Use this number to compute McVay's total income tax provision for the current year, assuming a tax rate of 34% BETI Tax ProvisionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started