Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me correct my error. Which part did I do wrong?? Appendix 1: Adjustment Data on an End-of-Period Spreadsheet Alert Security Services Co. offers

Please help me correct my error. Which part did I do wrong??

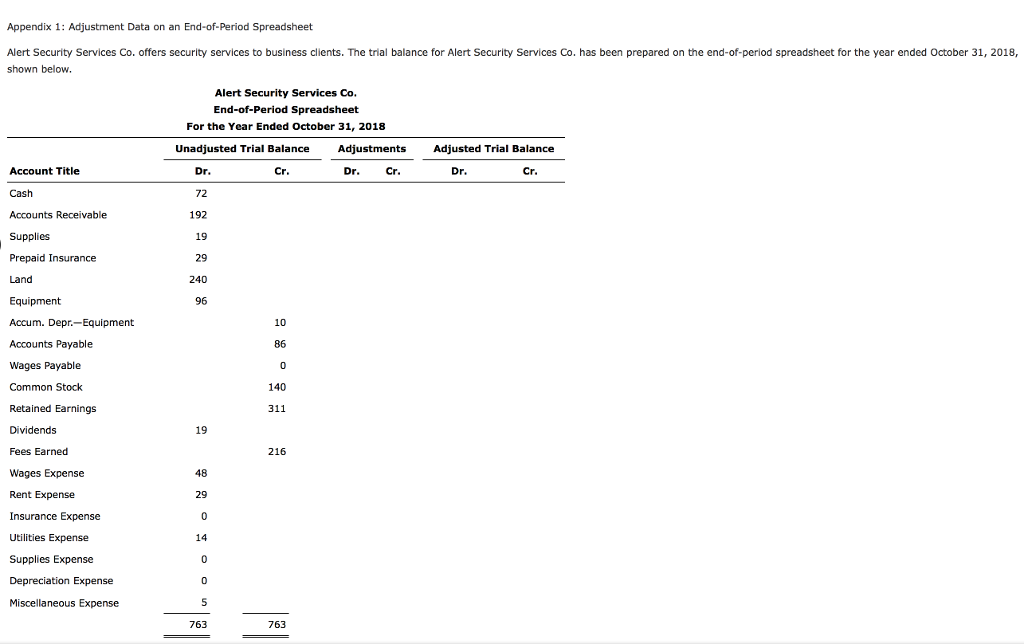

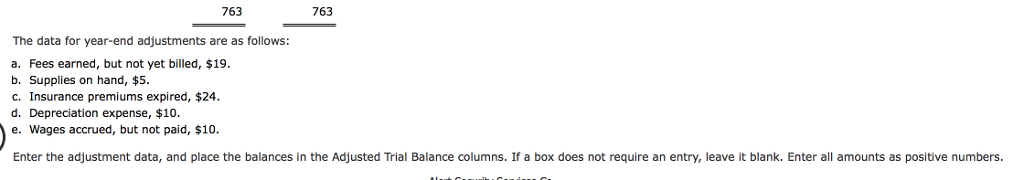

Appendix 1: Adjustment Data on an End-of-Period Spreadsheet Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services Co. has been prepared on the end-of-period spreadsheet for the year ended October 31, 2018, shown below Alert Security Services Co. End-of-Period Spreadsheet For the Year Ended October 31, 2018 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Account Title Dr 72 192 19 29 Dr. Cr Dr Cr Accounts Receivable Supplies Prepaid Insurance Land Equipment Accum. Depr.-Equipment Accounts Payable Wages Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Insurance Expense Utilities Expense Supplies Expense Depreciation Expense Miscellaneous Expense 10 140 311 19 216 48 29 14 763 763

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started