Please help me do all these questions please please

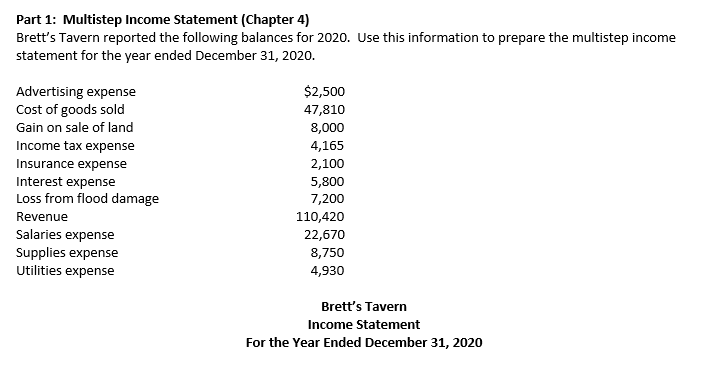

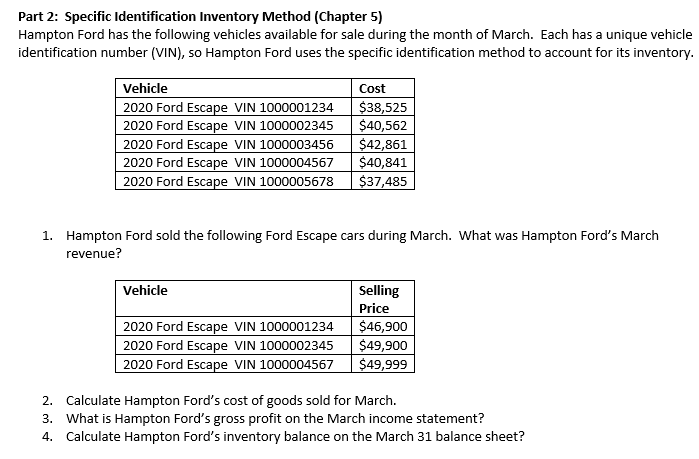

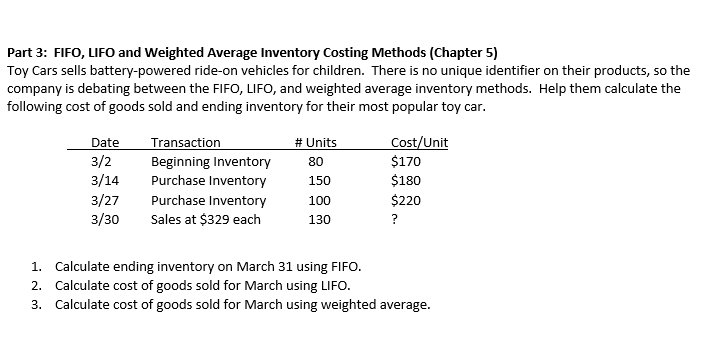

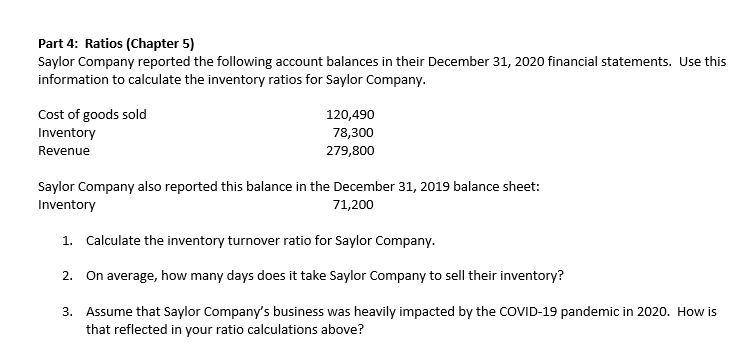

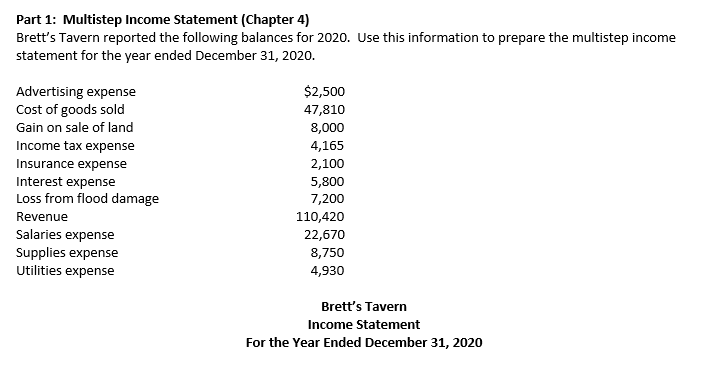

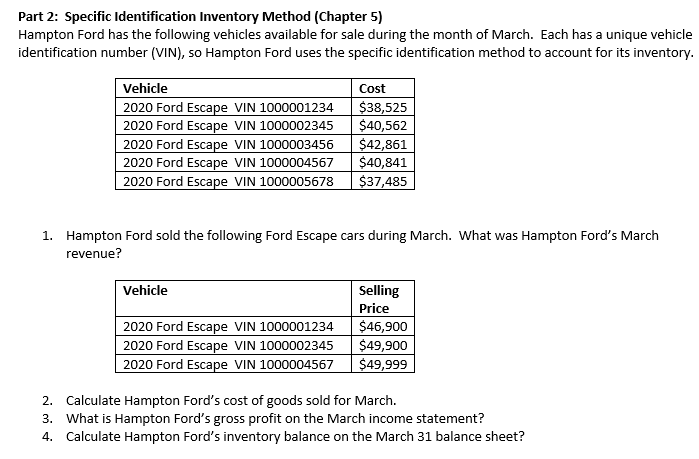

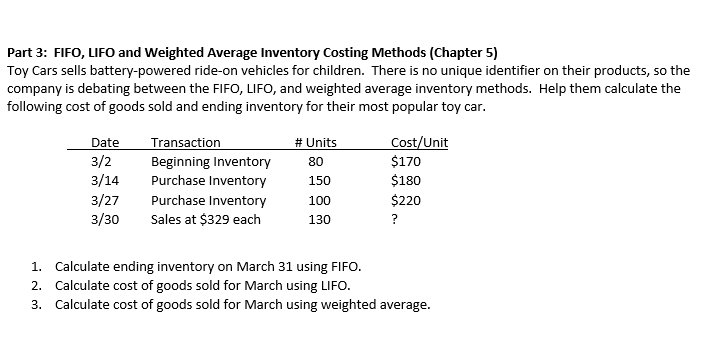

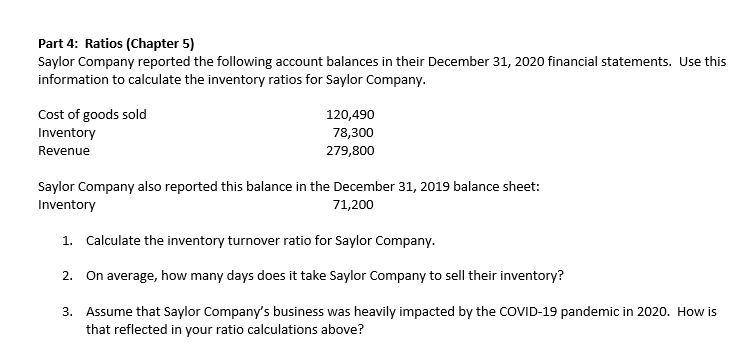

Part 1: Multistep Income Statement (Chapter 4) Brett's Tavern reported the following balances for 2020. Use this information to prepare the multistep income statement for the year ended December 31, 2020. Advertising expense Cost of goods sold Gain on sale of land Income tax expense Insurance expense Interest expense Loss from flood damage Revenue Salaries expense Supplies expense Utilities expense $2,500 47,810 8,000 4,165 2,100 5,800 7,200 110,420 22,670 8,750 4,930 Brett's Tavern Income Statement For the Year Ended December 31, 2020 Part 2: Specific Identification Inventory Method (Chapter 5) Hampton Ford has the following vehicles available for sale during the month of March. Each has a unique vehicle identification number (VIN), so Hampton Ford uses the specific identification method to account for its inventory. Vehicle 2020 Ford Escape VIN 1000001234 2020 Ford Escape VIN 1000002345 2020 Ford Escape VIN 1000003456 2020 Ford Escape VIN 1000004567 2020 Ford Escape VIN 1000005678 Cost $38,525 $40,562 $42,861 $40,841 $37,485 1. Hampton Ford sold the following Ford Escape cars during March. What was Hampton Ford's March revenue? Vehicle 2020 Ford Escape VIN 1000001234 2020 Ford Escape VIN 1000002345 2020 Ford Escape VIN 1000004567 Selling Price $46,900 $49,900 $49,999 2. Calculate Hampton Ford's cost of goods sold for March. 3. What is Hampton Ford's gross profit on the March income statement? 4. Calculate Hampton Ford's inventory balance on the March 31 balance sheet? Part 3: FIFO, LIFO and weighted Average Inventory Costing Methods (Chapter 5) Toy Cars sells battery-powered ride-on vehicles for children. There is no unique identifier on their products, so the company is debating between the FIFO, LIFO, and weighted average inventory methods. Help them calculate the following cost of goods sold and ending inventory for their most popular toy car. # Units 80 Date 3/2 3/14 3/27 3/30 Transaction Beginning Inventory Purchase Inventory Purchase Inventory Sales at $329 each 150 100 Cost/Unit $170 $180 $220 ? 130 1. Calculate ending inventory on March 31 using FIFO. 2. Calculate cost of goods sold for March using LIFO. 3. Calculate cost of goods sold for March using weighted average. Part 4: Ratios (Chapter 5) Saylor Company reported the following account balances in their December 31, 2020 financial statements. Use this information to calculate the inventory ratios for Saylor Company. Cost of goods sold Inventory Revenue 120,490 78,300 279,800 Saylor Company also reported this balance in the December 31, 2019 balance sheet: Inventory 71,200 1. Calculate the inventory turnover ratio for Saylor Company. 2. On average, how many days does it take Saylor Company to sell their inventory? 3. Assume that Saylor Company's business was heavily impacted by the COVID-19 pandemic in 2020. How is that reflected in your ratio calculations above