Please help me fill in the blanks by manual calculation.

thank you!

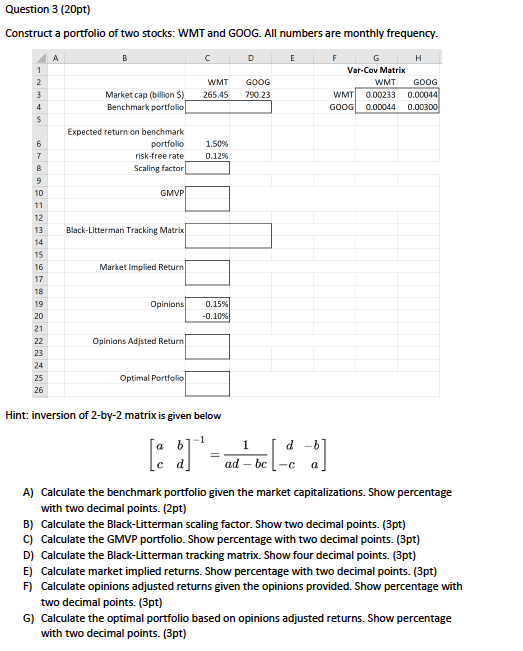

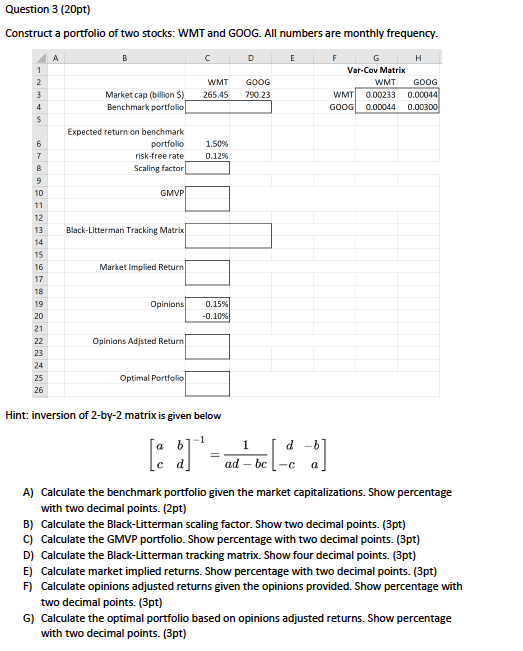

Question 3 (20pt) Construct a portfolio of two stocks: WMT and GOOG. All numbers are monthly frequency Var-Cov Matrix WMT GOOG WMT GOOG Market cap (billion S) Benchmark portfolio 265.45 790.23 WMT 0.00233 0 GOOG 0.00044 0 Expected return on benchmark portfolio risk-free rate Scaling factor 1.50% 0.12% 12 13 Black-Litterman Tracking Matrix 16 17 Market Implied Return 19 20 0.15 Opinions Adjsted Return 23 Optimal Portfolio 26 of 2-by-2 matrix is given below Hint: inversion ad bc -c a A) Calculate the benchmark portfolio given the market capitalizations. Show percentage with two decimal points. (2pt) B) Calculate the Black-Litterman scaling factor. Show two decimal points. (3pt) C) Calculate the GMVP portfolio. Show percentage with two decimal points. (3pt) D) Calculate the Black-Litterman tracking matrix. Show four decimal points. (3pt) E) Calculate market implied returns. Show percentage with two decimal points. (3pt) F) Calculate opinions adjusted returns given the opinions provided. Show percentage with two decimal points. (3pt) G) Calculate the optimal portfolio based on opinions adjusted returns. Show percentage with two decimal points. (3pt) Question 3 (20pt) Construct a portfolio of two stocks: WMT and GOOG. All numbers are monthly frequency Var-Cov Matrix WMT GOOG WMT GOOG Market cap (billion S) Benchmark portfolio 265.45 790.23 WMT 0.00233 0 GOOG 0.00044 0 Expected return on benchmark portfolio risk-free rate Scaling factor 1.50% 0.12% 12 13 Black-Litterman Tracking Matrix 16 17 Market Implied Return 19 20 0.15 Opinions Adjsted Return 23 Optimal Portfolio 26 of 2-by-2 matrix is given below Hint: inversion ad bc -c a A) Calculate the benchmark portfolio given the market capitalizations. Show percentage with two decimal points. (2pt) B) Calculate the Black-Litterman scaling factor. Show two decimal points. (3pt) C) Calculate the GMVP portfolio. Show percentage with two decimal points. (3pt) D) Calculate the Black-Litterman tracking matrix. Show four decimal points. (3pt) E) Calculate market implied returns. Show percentage with two decimal points. (3pt) F) Calculate opinions adjusted returns given the opinions provided. Show percentage with two decimal points. (3pt) G) Calculate the optimal portfolio based on opinions adjusted returns. Show percentage with two decimal points. (3pt)