Please help me fill in the yellow blanks

Please help me fill in the yellow blanks

Thanks!!

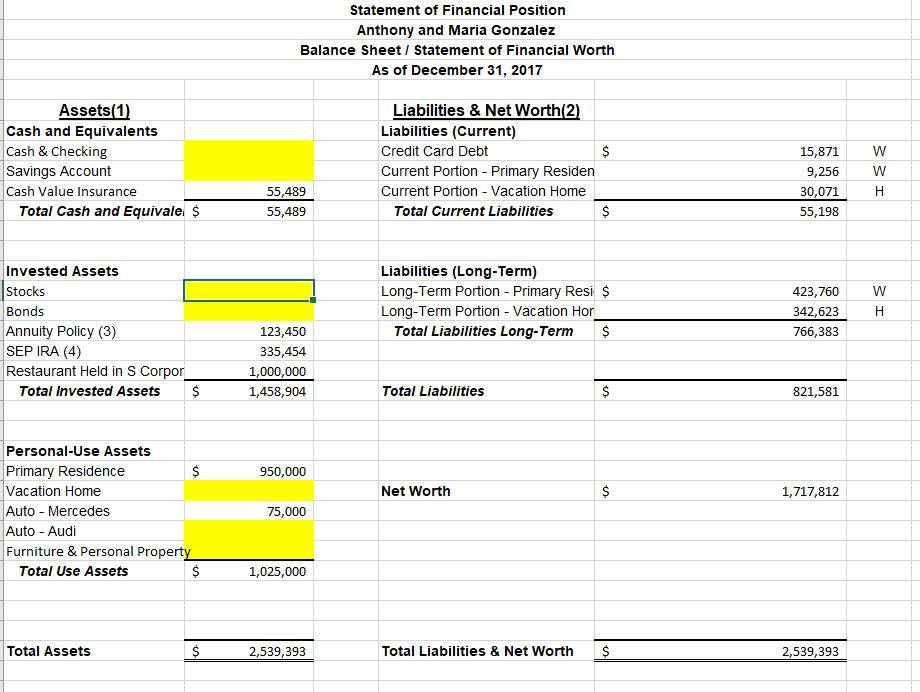

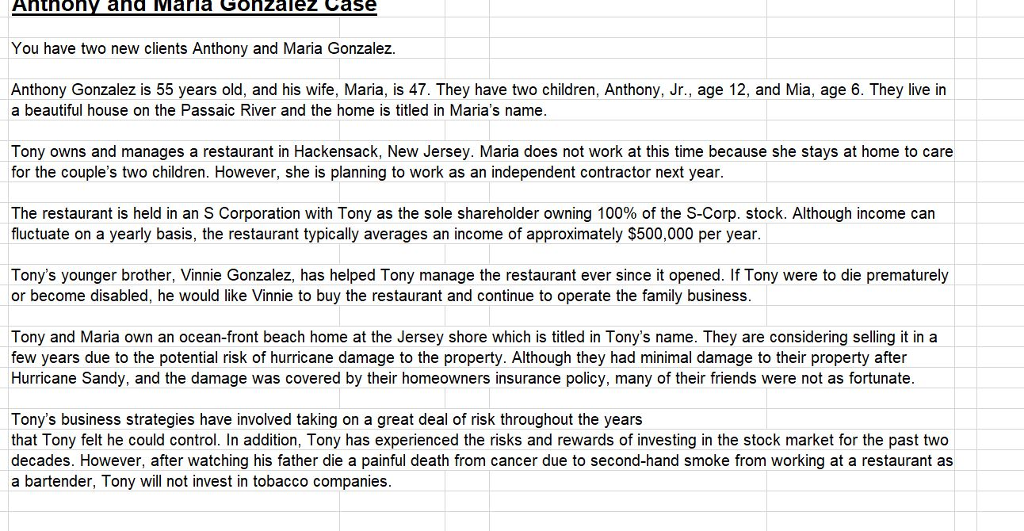

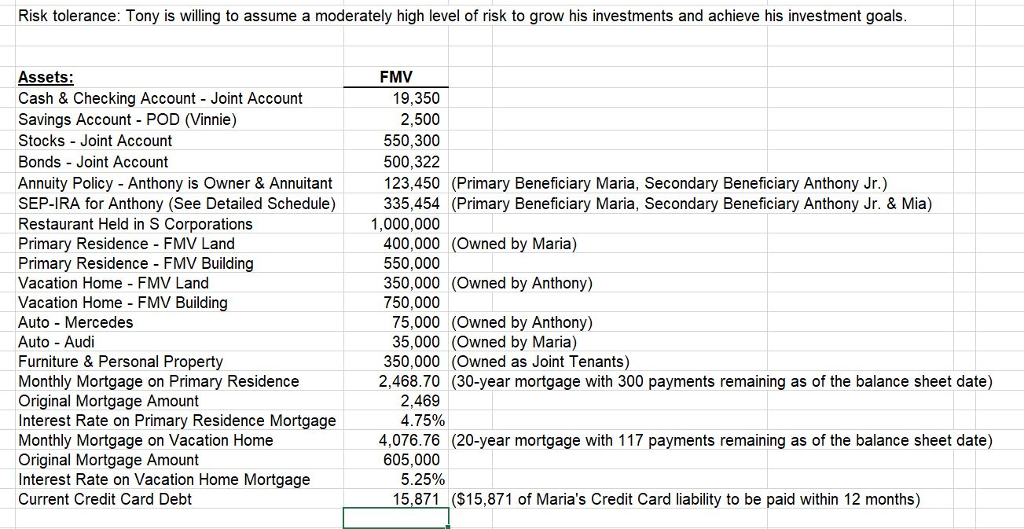

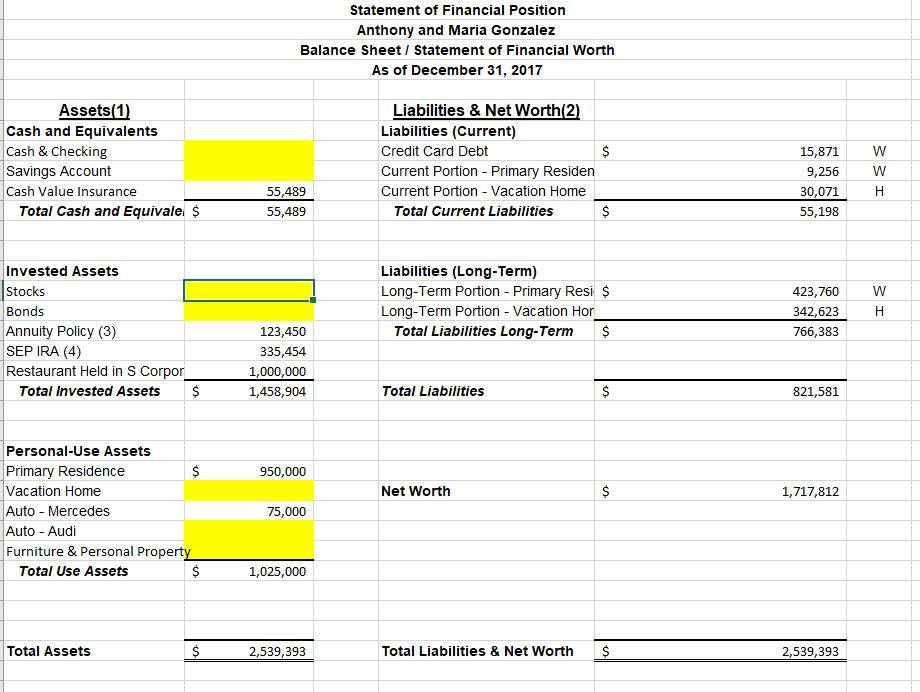

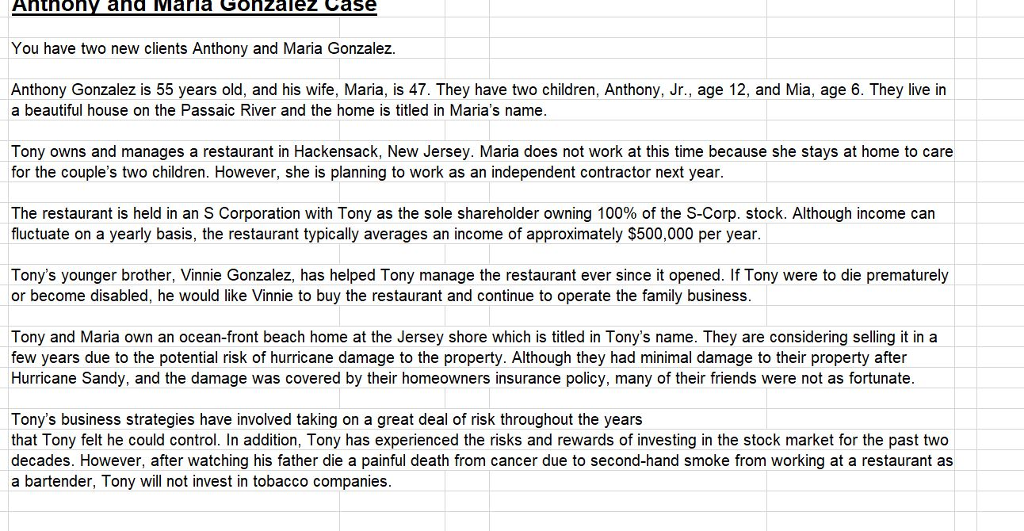

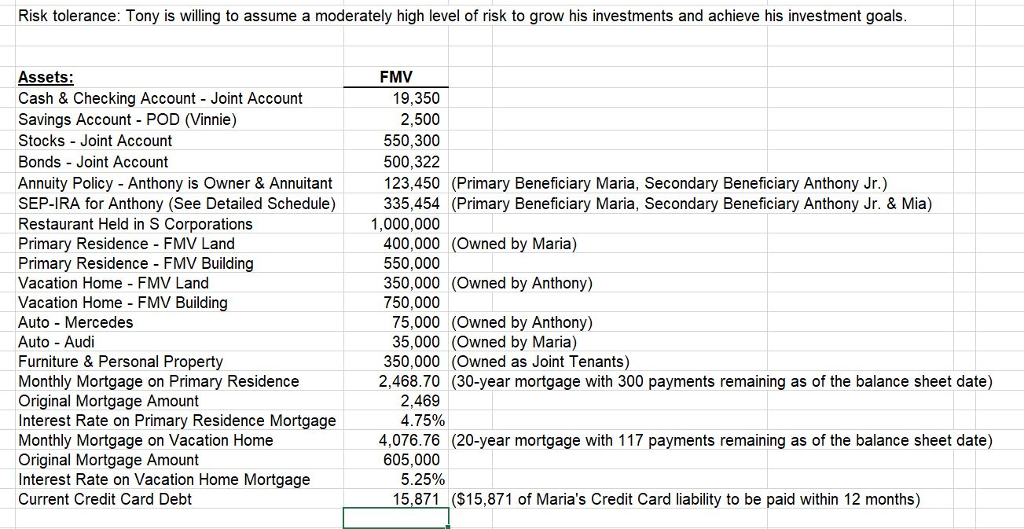

Anthonv and Marla Gonzalez Case You have two new clients Anthony and Maria Gonzalez. Anthony Gonzalez is 55 years old, and his wife, Maria, is 47. They have two children, Anthony, Jr., age 12, and Mia, age 6. They live in a beautiful house on the Passaic River and the home is titled in Maria's name Tony owns and manages a restaurant in Hackensack, New Jersey. Maria does not work at this time because she stays at home to care for the couple's two children. However, she is planning to work as an independent contractor next year The restaurant is held in an S Corporation with Tony as the sole shareholder owning 100% of the S-Corp. stock. Although income can fluctuate on a yearly basis, the restaurant typically averages an income of approximately $500,000 per year. Tony's younger brother, Vinnie Gonzalez, has helped Tony manage the restaurant ever since it opened. If Tony were to die prematurely or become disabled, he would like Vinnie to buy the restaurant and continue to operate the family business Tony and Maria own an ocean-front beach home at the Jersey shore which is titled in Tony's name. They are considering selling it in a few years due to the potential risk of hurricane damage to the property. Although they had minimal damage to their property after Hurricane Sandy, and the damage was covered by their homeowners insurance policy, many of their friends were not as fortunate Tony's business strategies have involved taking on a great deal of risk throughout the years that Tony felt he could control. In addition, Tony has experienced the risks and rewards of investing in the stock market for the past two decades. However, after watching his father die a painful death from cancer due to second-hand smoke from working at a restaurant as a bartender, Tony will not invest in tobacco companies Risk tolerance: Tony is willing to assume a moderately high level of risk to grow his investments and achieve his investment goals Assets: Cash & Checking Account Joint Account Savings Account POD (Vinnie) Stocks Joint Account Bonds Joint Account Annuity Policy - Anthony is Owner& Annuitant SEP-IRA for Anthony (See Detailed Schedule) Restaurant Held in S Corporations Primary Residence FMV Land Primary Residence FMV Building Vacation Home FMV Land Vacation Home FMV Building Auto Mercedes Auto Audi Furniture & Personal Property Monthly Mortgage on Primary Residence Original Mortgage Amount Interest Rate on Primary Residence Mortgage Monthly Mortgage on Vacation Home Original Mortgage Amount Interest Rate on Vacation Home Mortgage Current Credit Card Debt FMV 19,350 2,500 550,300 500,322 123,450 (Primary Beneficiary Maria, Secondary Beneficiary Anthony Jr.) 335,454 (Primary Beneficiary Maria, Secondary Beneficiary Anthony Jr. & Mia) 1,000,000 400,000 (Owned by Maria) 550,000 350,000 (Owned by Anthony) 750,000 75,000 (Owned by Anthony) 35,000 (Owned by Maria) 350,000 (Owned as Joint Tenants) 2,468.70 (30-year mortgage with 300 payments remaining as of the balance sheet date) 2,469 475% 4,076.76 (20-year mortgage with 117 payments remaining as of the balance sheet date) 605,000 5.25% 15,871 ($15,871 of Maria's Credit Card liability to be paid within 12 months) Statement of Financial Position Anthony and Maria Gonzalez Balance SheetI Statement of Financial Worth As of December 31, 2017 Assets(1 Cash and Equivalents Cash & Checking Savings Account Cash Value Insurance Liabilities & Net Worth(2 Liabilities (Current) Credit Card Debt Current Portion Primary Residen Current Portion Vacation Home 15,871 9,256 30,071 55,198 55,489 55,489 Total Cash and Equivale $ Total Current Liabilities Invested Assets Stocks Bonds Annuity Policy (3) SEP IRA (4) Restaurant Held in S Corpor Liabilities (Long-Term) Long-Term Portion Primary Resi $ Long-Term Portion Vacation Hor 423,760 342,623 766,383 Total Liabilities Long-Term $ 123,450 335,454 1,000,000 1,458,904 Total Invested Assets $ Total Liabilities 821,581 Personal-Use Assets Primary Residence Vacation Home Auto Mercedes Auto Audi Furniture & Personal Property 950,000 Net Worth 1,717,812 75,000 Total Use Assets 1,025,000 Total Assets 2,539,393 Total Liabilities & Net Worth$ 2,539,393

Please help me fill in the yellow blanks

Please help me fill in the yellow blanks