Answered step by step

Verified Expert Solution

Question

1 Approved Answer

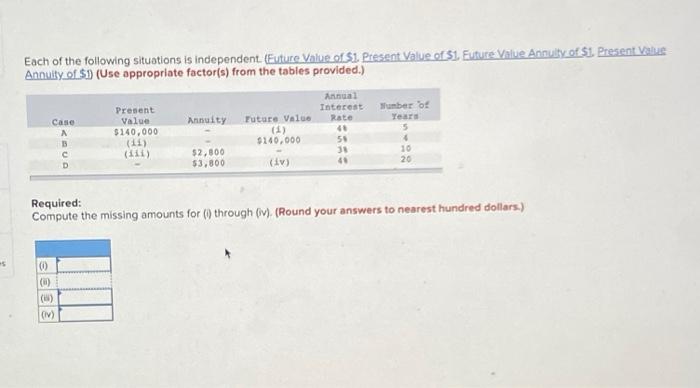

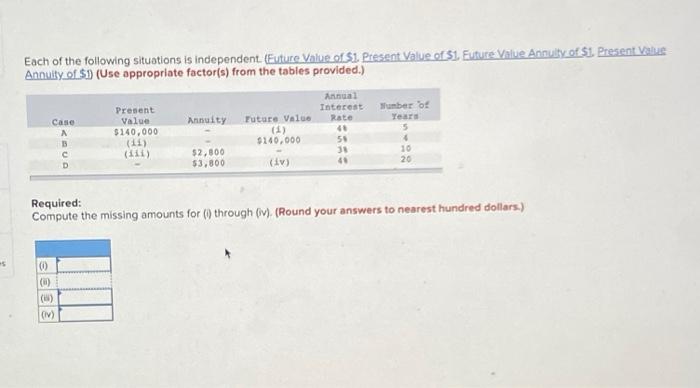

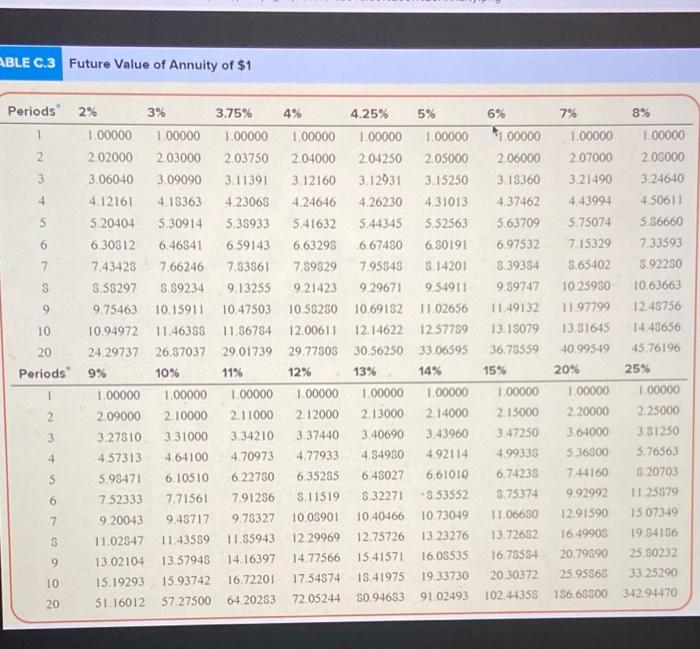

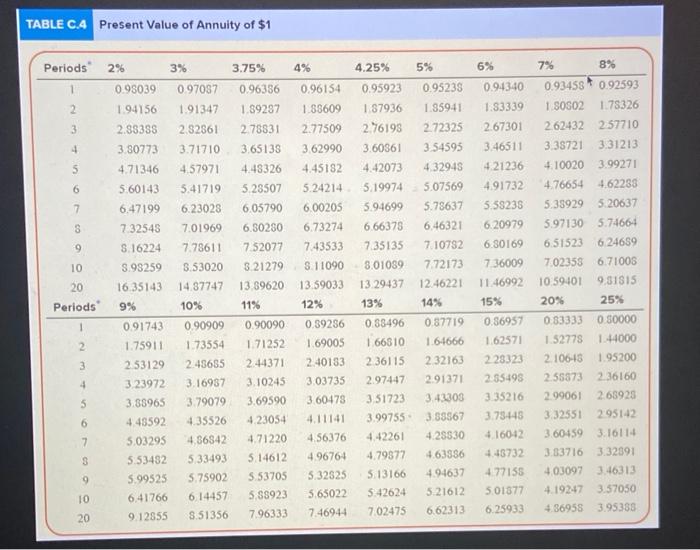

please help me fill out this problem Each of the following situations is independent. (Future Value of $1. Present Value of $1. Future Value Annuity

please help me fill out this problem

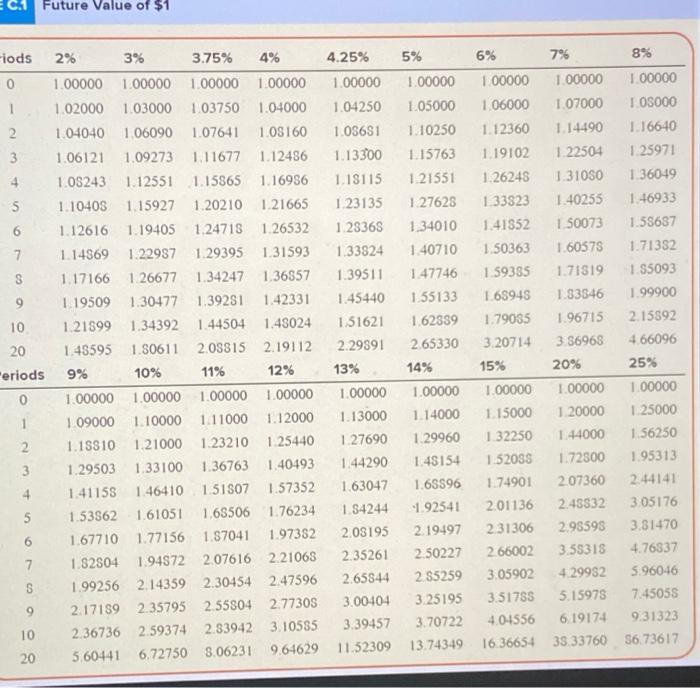

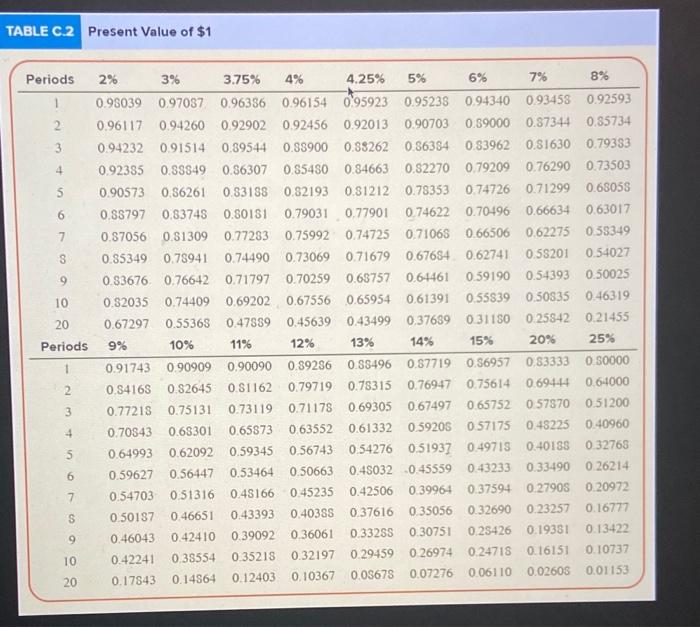

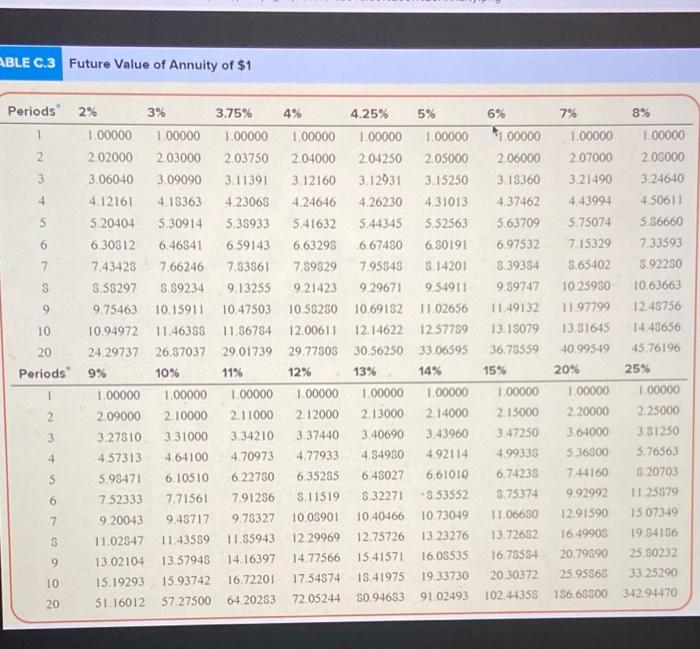

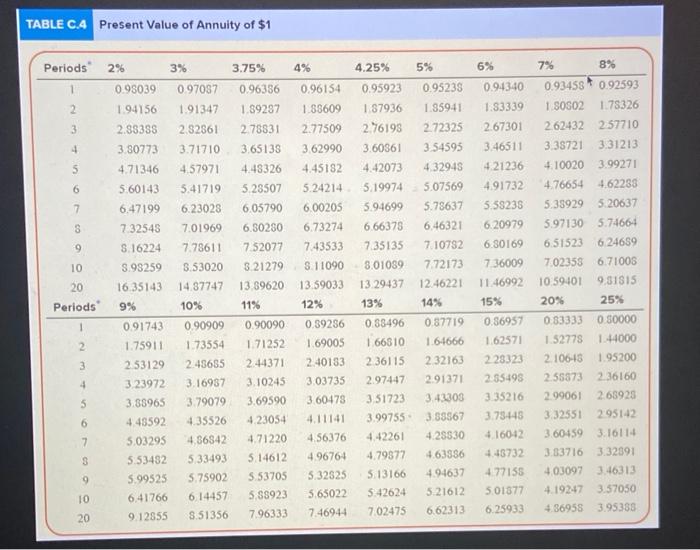

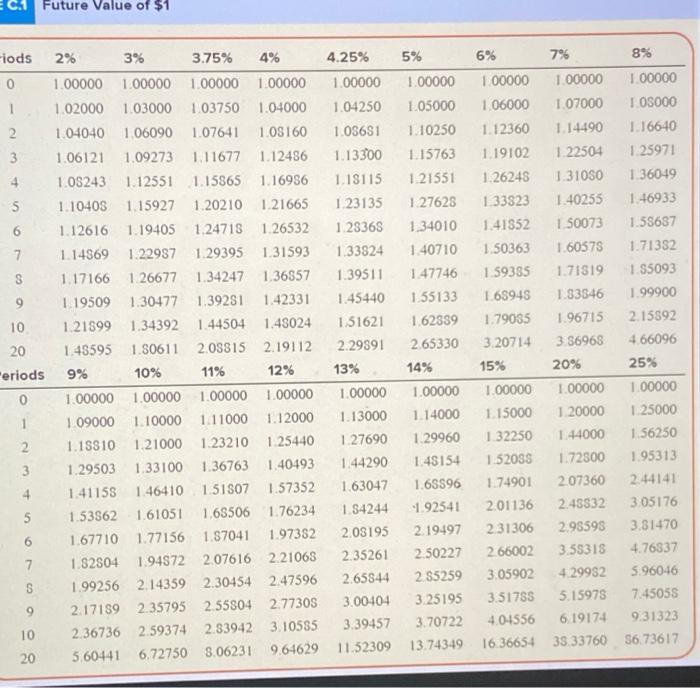

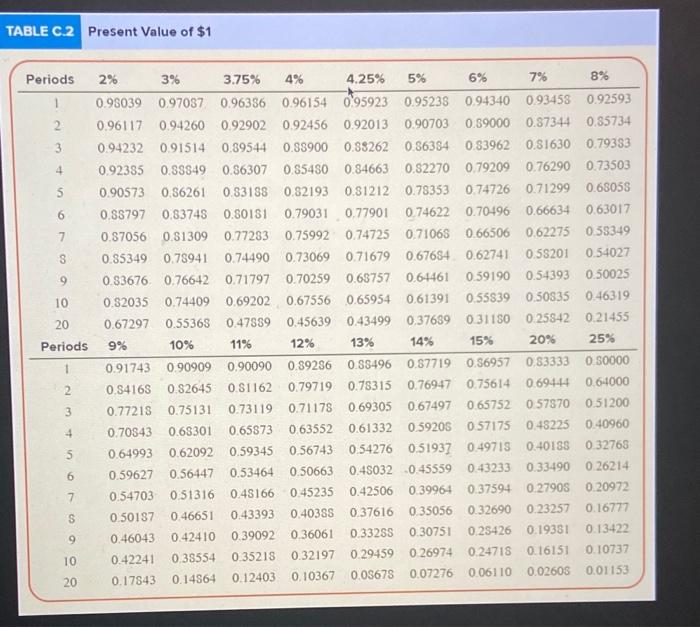

Each of the following situations is independent. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1 (Use appropriate factor(s) from the tables provided.) Annual Interest Rate Case Annuity Present Value $140,000 (11) (ii) Future Value (1) $140,000 Sumber : Years 5 4 10 20 c D $2,800 $3,800 55 30 40 Required: Compute the missing amounts for () through (V). (Round your answers to nearest hundred dollars) (6) (w) (V) Future Value of $1 5% -iods 0 1 2. 3 4 5 6 7 S 9 10 20 2% 3% 3.75% 4% 4.25% 1.00000 1.00000 1.00000 1.00000 1.00000 1.02000 1.03000 1.03750 1.04000 1.04250 1.04040 1.06090 1.07641 1.08160 1.08681 1.06121 1.09273 1.11677 1.12486 1.13300 1.08243 1.12551 1.15865 1.16956 1. 18115 1.1040S 1.15927 1.20210 1.21665 1.23135 1.12616 1.19405 1.24718 1.26532 1.28365 1.14869 1.22987 1.29395 1.31593 1.33824 1.17166 1.26677 1.34247 1.36857 1.39511 1.19509 1.30477 1.39281 1.42331 1.45440 1.21899 1.34392 1.44504 1.43024 1.51621 1.43595 1.80611 2.08815 2.19112 2.29891 9% 10% 11% 12% 13% 1.00000 1.00000 1.00000 1.00000 1.00000 1.09000 1.10000111000 1.12000 1.13000 1.18810 1.21000 1.23210 1.25440 1.27690 1.29503 1.33100 1.36763 1.40493 1.44290 1.41158 1.46410 1.51807 1.57352 1.63047 1.53562 1.61051 1.69506 1.76234 1 34244 1.67710 1.77156 1.87041 1.97352 2.08195 1.82804 1.945722.07616 2.21063 2.35261 1.99256 2.14359 2.30454 2.47596 2.65844 2.17189 2.35795 2.55804 2.7730S 3.00104 2.36736 2.59374 2.839423.10585 3.39457 5.60441 6,72750 8.06231 9.64629 11.52309 1.00000 1.05000 1.10250 1.15763 1.21551 1.27628 1.34010 1.40710 1.47746 1.55133 1.62389 2.65330 14% 1.00000 1.14000 1.29960 1.48154 1.68596 -1.92541 2.19497 2.50227 2 85259 3.25195 3.70722 13.74349 6% 7% 8% 1.00000 1.00000 1.00000 1.06000 1.07000 1 0S000 1.12360 1.14490 1.16640 1.19102 1 22504 1.25971 1.26248 1.31050 1.36049 1.33523 1.40255 1.46933 1.41852 1.50073 1.58687 1.50363 1.60575 1.71352 1.59355 1.71819 1.55093 1.68945 1.83346 1.99900 1.79035 1.96715 2.15892 3.20714 3.56968 466096 15% 20% 25% 1.00000 1.00000 1.00000 1.15000 1 20000 1.25000 1.32250 1.44000 1.56250 1.52035 1.72500 1.95313 1.74901 207360 2.44141 2.01136 2.48832 3.05176 2.31306 2.98598 3.81470 2 66002 3.55318 4.76337 3.05902 4.29952 5.96046 3.51755 5.15975 7.45055 4.04556 6.19174 9.31323 16.36654 35.33760 S6,73617 "eriods 0 1 2 3 4 5 6 7 S 9 10 20 TABLE C.2 Present Value of $1 Periods 1 2 3 4 5 6 7 S 9 10 20 2% 3% 3.75% 4% 4.25% 5% 6% 7% 8% 098039 0.97037 0.96336 0.96154 095923 0.95235 0.94340 0.93458 0.92593 0.96117 0.94260 0.92902 0.92456 0.92013 0.90703 0.39000 0.87344 0.85734 0.94232 0.91514 0.89544 0.88900 0.35262 0.86384 0.33962 0.81630 0.79383 0.92385 0.88849 0.86307 0.85450 0.84663 0.82270 0.79209 0.76290 0.73503 0.90573 0.56261 0.83188 0.82193 0.81212 0.78353 0.74726 0.71299 0.68058 0.88797 0.83748 0.80181 0.79031 0,77901 0.74622 0.70496 0.66634 0.63017 0.87056 0.81309 0.77283 0.75992 0.74725 0.710650.66506 0.62275 0.39349 0.853490.78941 0.74490 0.73069 0.71679 0.67684 0.62741 0.58201 0.54027 0.83676 0.76642 0.71797 0.70259 0.68757 0.61461 0.59190 0.54393 0.50025 0.82035 0.74409 0.69202 0.67556 0.65954 0.61391 0.55839 0.50835 0.46319 0.67297 0.55363 0.47889 0.45639 0.43499 0.37689 0.31180 0.25842 0.21455 9% 10% 11% 12% 13% 14% 15% 20% 25% 0.91743 0.90909 0.90090 0.89286 0.88496 0.57719 0.86957 0.83333 0 30000 0.84168 0.82645 O SI162 0.79719 0.78315 0.76947 0.75614 0.69444 0 641000 0.77215 0.75131 0.73119 0.71178 0.69305 0.67497 0.65752 057870 0.51200 0.70843 0.68301 0.65873 0.63552 0.61332 0.5920S 0.57175 0.48225 0.40960 0.64993 0.62092 0.59345 0.56743 0.54276 0.51937 0.49718 0.40188 0.32768 0.59627 0.56447 0.53464 0.50663 0.45032 0.45559 0.43233 0.33490 0.26214 0.54703 0.51316 0.48166 0.45235 0.42506 0.39964 0.37594 0.27905 0.20972 0.50187 0.46651 0.43393 0.403SS 0.37616 0.35056 0.32690 0.23257 0.16777 0.46043 0.42410 0.39092 0.36061 0.33255 0.30751 0.25426 0.19381 0.13422 0.42241 0.38554 0.35218 0.32197 0.29459 0.26974 0.24718 0.16151 0.10737 0.17843 0.14864 0.12403 0.10367 0.05678 0.07276 0.06110 0.02608 0.01153 Periods 1 2 3 4 S 6 7 S 9 10 20 ABLE C.3 Future Value of Annuity of $1 3% 7% 8% Periods 2% 3.75% 4% 4.25% 5% 1 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 2.02000 2.03000 203750 2.04000 2.04250 2.05000 3 3.06040 3.09090 3.11391 3.12160 3.12931 3.15250 4 4.12161 4.13363 4.23068 4.24646 4.26230 4.31013 5 3.20404 5.30914 5.38933 5.41632 5.44345 5.52563 6 6.30312 6,46841 6.59143 6.63295 6,67450 6.80191 7 743428 7.66246 7.33861 7.89829 7.95848 8.14201 S 8,58297 8.89234 9.13255 9.21423 9.29671 9.54911 9 9.75463 10.15911 10.47503 10.58280 10.69182 11 02656 10 10.94972 11.46388 11.86784 12.00611 12.14622 12.57789 20 2429737 26.37037 29.01739 29.77303 30.56250 33.06595 Periods 9% 10% 11% 12% 13% 14% 1 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 2 2.09000 2.10000 2.11000 2.12000 2.13000 2.14000 3 3.27810 331000 3.34210 3.37440 3.40690 3.43960 4 4.57313 4.64100 4.70973 4.77933 4.84930 4.92114 5 5.98471 6.10510 6,22730 6,35285 6.48027 6.61010 6 752333 7.71561 7.91256 8.11519 8.32271 -9.53552 7 9.20043 9.45717 9.78327 10.03901 10.40466 10.73049 S 11.02847 11.43589 11.85943 12.29969 12.75726 13 23276 9 13.02104 13.57948 14.16397 14.77566 15.41371 16.08535 10 15.19293 13.93742 16.72201 17.54874 18.41975 19.33730 20 51.16012 57 27500 64.20283 72 05244 S0.94683 91 02493 6% 1.00000 2.06000 3.13360 4.37462 5.63709 6.97532 8.39334 9.89747 11.49132 13.18079 36.78559 15% 1.00000 2.15000 347250 1.00000 1.00000 2.07000 2.08000 3.21490 3.24640 4.43994 4.50611 5.75074 5.56660 7.15329 7.33593 8.65402 8.92230 10.25930 10.63663 11.97799 12.48756 13.81645 14.45656 10.99549 45.76196 20% 25% 1.00000 1.00000 220000 2.25000 3.64000 3.81250 5.36800 5.76563 7.44160 5 20703 9.92992 11.25879 12.91590 15.07349 16.49903 19.54156 20.79590 25 80232 25 95865 33 25290 186.68300 342 94470 4.99338 6.74235 3.75374 11.06630 13.72652 16.75534 20.30372 102.44355 TABLE C.4 Present Value of Annuity of $1 Periods 3% 3.75% 4% 4.25% 5% 6% 1 2% 0.93039 1.94156 0.96154 0.95238 0.94340 2 1.88609 1.85941 1.93339 2.67301 3 2.88338 2.77509 4 3.80773 2.72325 3.54595 4.32948 5 0.95923 1 87936 2.76198 3.60361 4.42073 5.19974 5.94699 3.62990 4.45182 5.24214 4.71346 0.96336 1.89287 2.78831 3.65138 4.48326 5.23507 6.05790 6.30280 7.52077 3.21279 13 89620 6 097087 1.91347 2.32861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 3.53020 14.87747 10% 5.07569 7 6.00205 5.78637 6.46321 S 6.66375 7.35135 9 6.73274 7.43533 S. 11090 13.59033 7.10782 7.72173 10 3.01039 13.29437 20 12.46221 3.46511 4.21236 491732 5.38238 6 20979 6.80169 7.36009 1146992 15% 0.86957 1.62571 228323 2.35495 3.35216 3.73-143 416042 7% 8% 0.934587 0.92593 1 SOS02 1.78326 262432 2.57710 3.38721 3.31213 4.10020 3.99271 4.76654 4,62288 5.35929 5.20637 5.97130 5.74664 6.51523 6.24689 7.02358 6.71005 10.59-101 9.31815 20% 25% 0.83333 0.50000 1.52778 1.44000 2. 106-18 1.95200 2.55873 236160 2.99061 268925 3.32551 295142 3.60459 3.16114 3.13716 3.32391 403097 3.46313 4.192.47 3.57050 4.36958 3.95388 Periods 11% 1 5.60143 6,47199 732545 S. 16224 S.98259 16.35143 9% 091743 1.75911 253129 323972 3.88965 4.43592 5.03295 5.53432 5.99525 6,41766 9.12855 0.90909 2 3 0.90090 1.71252 2.44371 3.10245 3.69590 4.23054 4 12% 0.39286 1.69005 2.40133 3.03735 3.60478 4.11141 4.56.376 4.96764 5 1.73554 2.43655 3.16937 3.79079 4.35526 4.36842 533493 5.75902 6.14457 8.51356 13% 14% 0.88496 0.87719 1.66810 1.6-1666 2 36115 232163 2.97447 291371 3.51723 3.42308 3.99755 3.88567 4.42261 4.29330 4.79377 4.63386 5.13166 4.94637 5.42624 521612 7.02475 6.62312 6 7 S 4.43732 4.77155 9 4.71220 514612 5.53705 5.88923 7.96333 5.32825 5.65022 5.01877 10 20 7.46944 6.25933

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started