Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me find answers 1-Process costing works well w henever different products pass through a series of processes and receive different doses of materials

please help me find answers

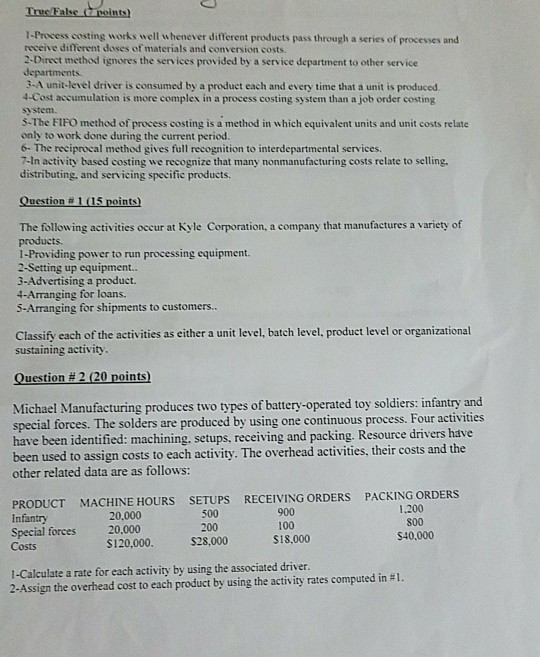

1-Process costing works well w henever different products pass through a series of processes and receive different doses of materials and conversion costs 2-Direct method ignores the services provided by a service department to other service departments. 3-A unit-level driver is consumed by a product each and every time that a unit is produced 4-Cost accumulation is more complex in a process costing system than a job order costing svstem. s-The FIFO method of process costing is a method in which equivalent units and unit costs relate only to work done during the current period. 6- The reciprocal method gives full recognition to interdepartmental services 7-In activity based costing we recognize that many nonmanufacturing costs relate to selling. distributing, and servicing specific products. The following activities occur at Kyle Corporation, a company that manufactures a variety of products I-Providing power to run processing equipment. 2-Setting up equipment. 3-Advertising a product 4-Arranging for loans. 5-Arranging for shipments to customers.. Classify each of the activities as either a unit level, batch level, product level or organizational sustaining activity Question # 2 (20 points) Michael Manufacturing produces two types of battery-operated toy soldiers: infantry and special forces. The solders are produced by using one continuous process. Four have been identified: machining, setups, receiving and packing. Resource drivers have been used to assign costs to each activity. The overhead activities, their costs and the other related data are as follows: activities PRODUCT MACHINE HOURS SETUPS RECEIVING ORDERS PACKING ORDERS 500 200 $28,000 900 100 S18,000 1.200 800 $40,000 20,000 Infantry Special forces Costs 20.000 $120,000. 1-Calculate a rate for each activity by using the associated driver. 2-Assign the overhead cost to each product by using the activity rates computed in #1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started