Answered step by step

Verified Expert Solution

Question

1 Approved Answer

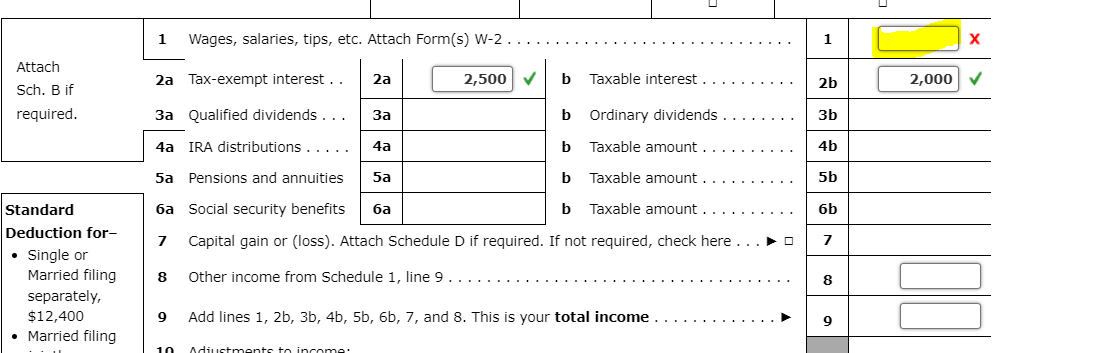

Please help me find the wages, salaries and tips on number 1 Note: This problem is for the 2020 tax year. David R. and Ella

Please help me find the wages, salaries and tips on number 1

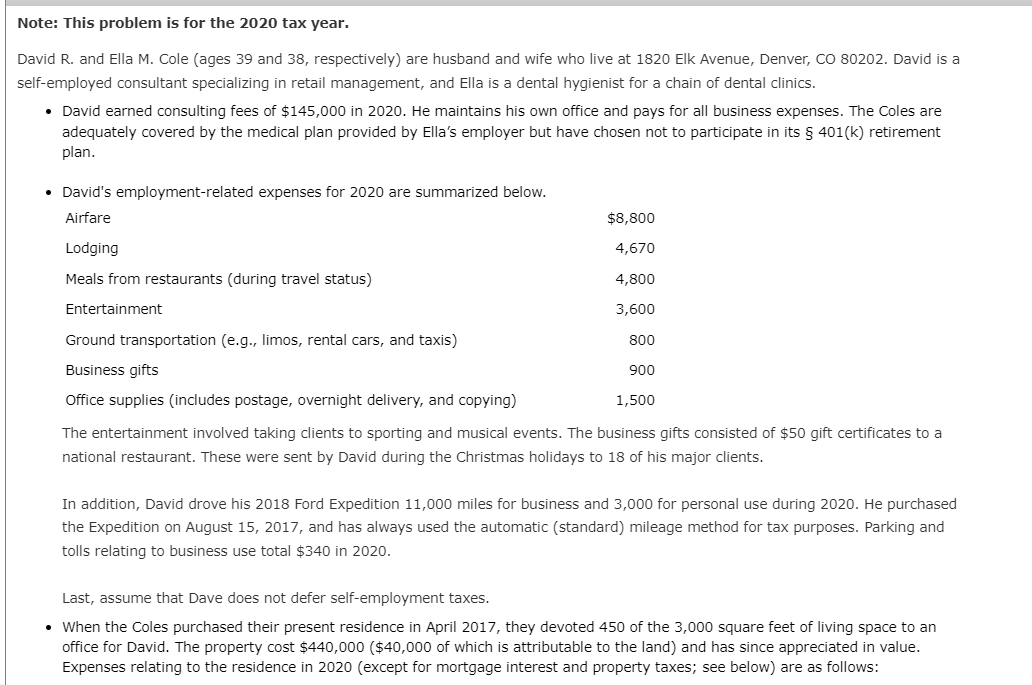

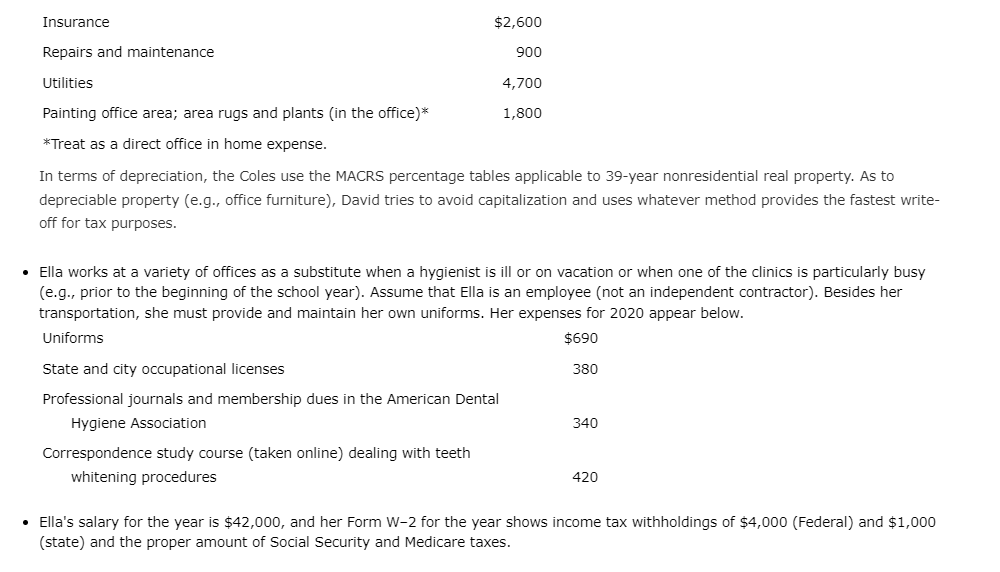

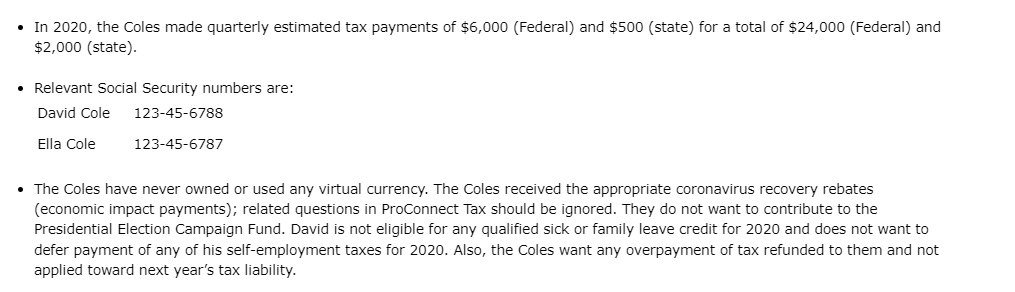

Note: This problem is for the 2020 tax year. David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202 . David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clinics. - David earned consulting fees of $145,000 in 2020 . He maintains his own office and pays for all business expenses. The Coles are adequately covered by the medical plan provided by Ella's employer but have chosen not to participate in its 401(k) retirement plan. - navid's emnlnvment-relater exnences for onon are slmmarized helnw The entertainment involved taking clients to sporting and musical events. The business gifts consisted of $50 gift certificates to a national restaurant. These were sent by David during the Christmas holidays to 18 of his major clients. In addition, David drove his 2018 Ford Expedition 11,000 miles for business and 3,000 for personal use during 2020. He purchased the Expedition on August 15, 2017, and has always used the automatic (standard) mileage method for tax purposes. Parking and tolls relating to business use total $340 in 2020. Last, assume that Dave does not defer self-employment taxes. - When the Coles purchased their present residence in April 2017, they devoted 450 of the 3,000 square feet of living space to an office for David. The property cost $440,000 ( $40,000 of which is attributable to the land) and has since appreciated in value. Expenses relating to the residence in 2020 (except for mortgage interest and property taxes; see below) are as follows: *Treat as a direct office in home expense. In terms of depreciation, the Coles use the MACRS percentage tables applicable to 39-year nonresidential real property. As to depreciable property (e.g., office furniture), David tries to avoid capitalization and uses whatever method provides the fastest writeoff for tax purposes. - Ella works at a variety of offices as a substitute when a hygienist is ill or on vacation or when one of the clinics is particularly busy (e.g., prior to the beginning of the school year). Assume that Ella is an employee (not an independent contractor). Besides her transportation, she must provide and maintain her own uniforms. Her expenses for 2020 appear below. - Ella's salary for the year is $42,000, and her Form W2 for the year shows income tax withholdings of $4,000 (Federal) and $1,000 (state) and the proper amount of Social Security and Medicare taxes. - In 2020, the Coles made quarterly estimated tax payments of $6,000 (Federal) and $500 (state) for a total of $24,000 (Federal) and $2,000 (state). - Relevant Social Security numbers are: David Cole 123-45-6788 Ella Cole 123456787 - The Coles have never owned or used any virtual currency. The Coles received the appropriate coronavirus recovery rebates (economic impact payments); related questions in Proconnect Tax should be ignored. They do not want to contribute to the Presidential Election Campaign Fund. David is not eligible for any qualified sick or family leave credit for 2020 and does not want to defer payment of any of his self-employment taxes for 2020. Also, the Coles want any overpayment of tax refunded to them and not applied toward next year's tax liability

Note: This problem is for the 2020 tax year. David R. and Ella M. Cole (ages 39 and 38, respectively) are husband and wife who live at 1820 Elk Avenue, Denver, CO 80202 . David is a self-employed consultant specializing in retail management, and Ella is a dental hygienist for a chain of dental clinics. - David earned consulting fees of $145,000 in 2020 . He maintains his own office and pays for all business expenses. The Coles are adequately covered by the medical plan provided by Ella's employer but have chosen not to participate in its 401(k) retirement plan. - navid's emnlnvment-relater exnences for onon are slmmarized helnw The entertainment involved taking clients to sporting and musical events. The business gifts consisted of $50 gift certificates to a national restaurant. These were sent by David during the Christmas holidays to 18 of his major clients. In addition, David drove his 2018 Ford Expedition 11,000 miles for business and 3,000 for personal use during 2020. He purchased the Expedition on August 15, 2017, and has always used the automatic (standard) mileage method for tax purposes. Parking and tolls relating to business use total $340 in 2020. Last, assume that Dave does not defer self-employment taxes. - When the Coles purchased their present residence in April 2017, they devoted 450 of the 3,000 square feet of living space to an office for David. The property cost $440,000 ( $40,000 of which is attributable to the land) and has since appreciated in value. Expenses relating to the residence in 2020 (except for mortgage interest and property taxes; see below) are as follows: *Treat as a direct office in home expense. In terms of depreciation, the Coles use the MACRS percentage tables applicable to 39-year nonresidential real property. As to depreciable property (e.g., office furniture), David tries to avoid capitalization and uses whatever method provides the fastest writeoff for tax purposes. - Ella works at a variety of offices as a substitute when a hygienist is ill or on vacation or when one of the clinics is particularly busy (e.g., prior to the beginning of the school year). Assume that Ella is an employee (not an independent contractor). Besides her transportation, she must provide and maintain her own uniforms. Her expenses for 2020 appear below. - Ella's salary for the year is $42,000, and her Form W2 for the year shows income tax withholdings of $4,000 (Federal) and $1,000 (state) and the proper amount of Social Security and Medicare taxes. - In 2020, the Coles made quarterly estimated tax payments of $6,000 (Federal) and $500 (state) for a total of $24,000 (Federal) and $2,000 (state). - Relevant Social Security numbers are: David Cole 123-45-6788 Ella Cole 123456787 - The Coles have never owned or used any virtual currency. The Coles received the appropriate coronavirus recovery rebates (economic impact payments); related questions in Proconnect Tax should be ignored. They do not want to contribute to the Presidential Election Campaign Fund. David is not eligible for any qualified sick or family leave credit for 2020 and does not want to defer payment of any of his self-employment taxes for 2020. Also, the Coles want any overpayment of tax refunded to them and not applied toward next year's tax liability Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started