Answered step by step

Verified Expert Solution

Question

1 Approved Answer

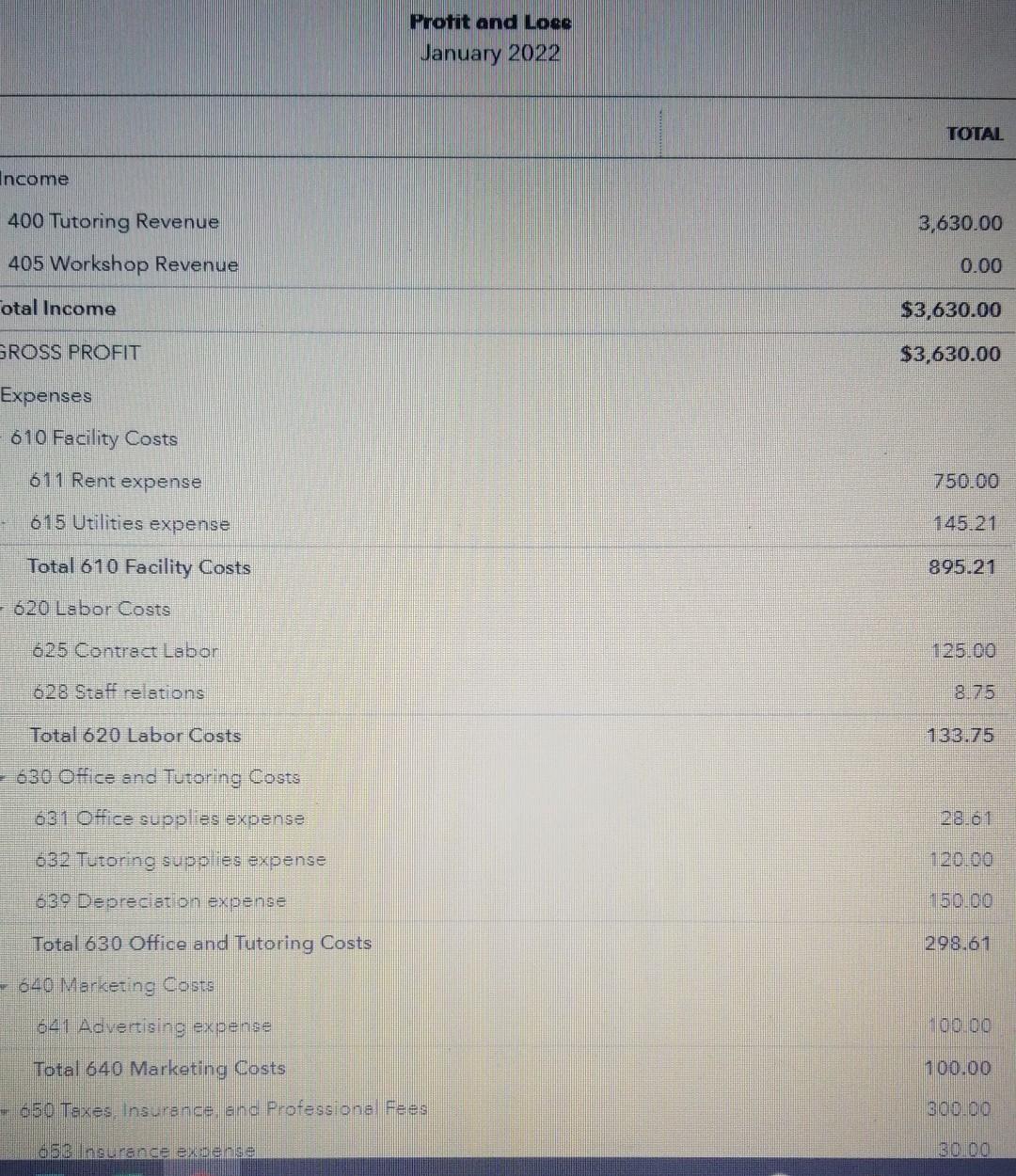

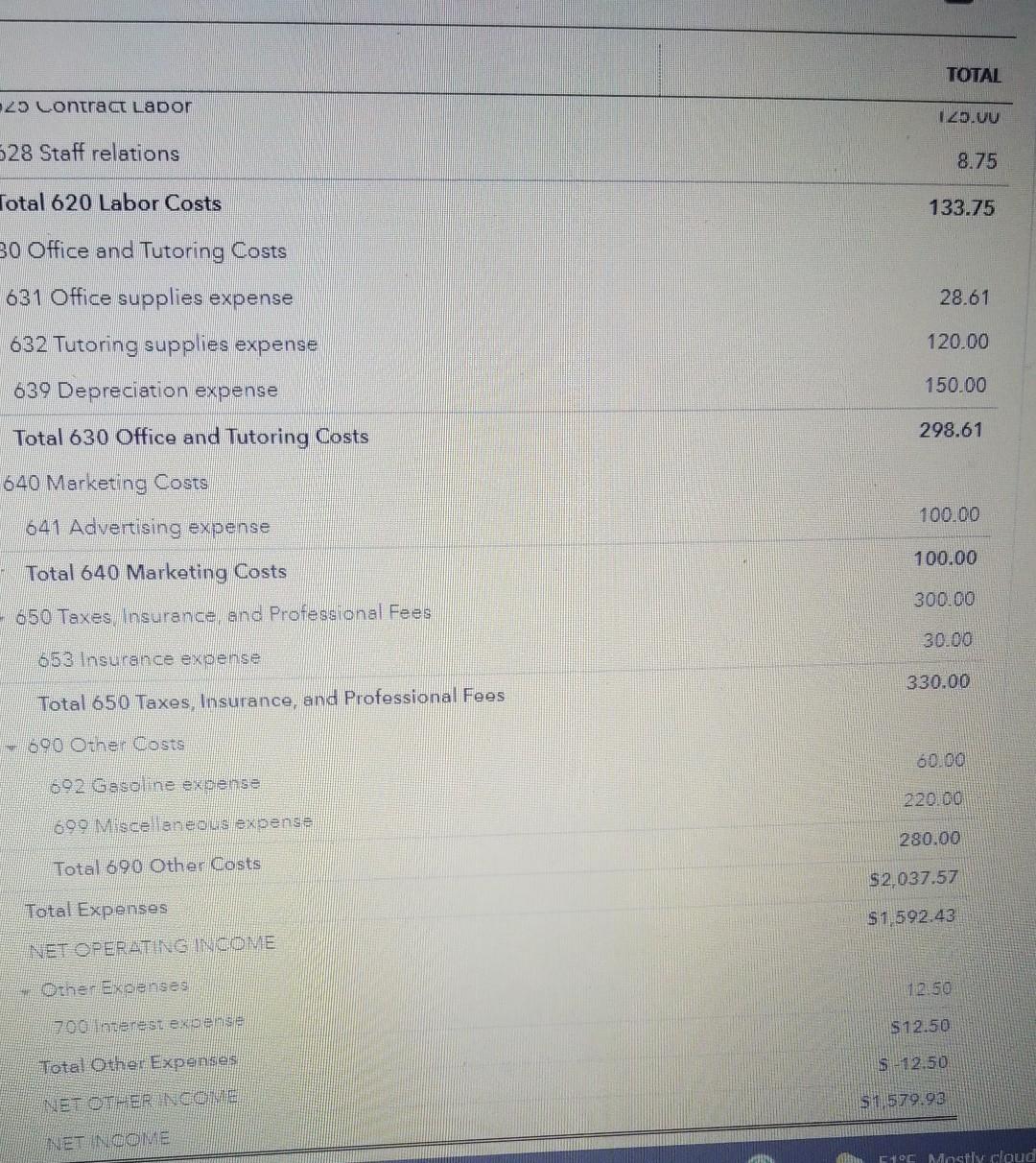

Please help me get the correct balance for Total current liabilities.($5976.07). You make adjusting journal entries for the month of January as needed. (Start with

Please help me get the correct balance for Total current liabilities.($5976.07).

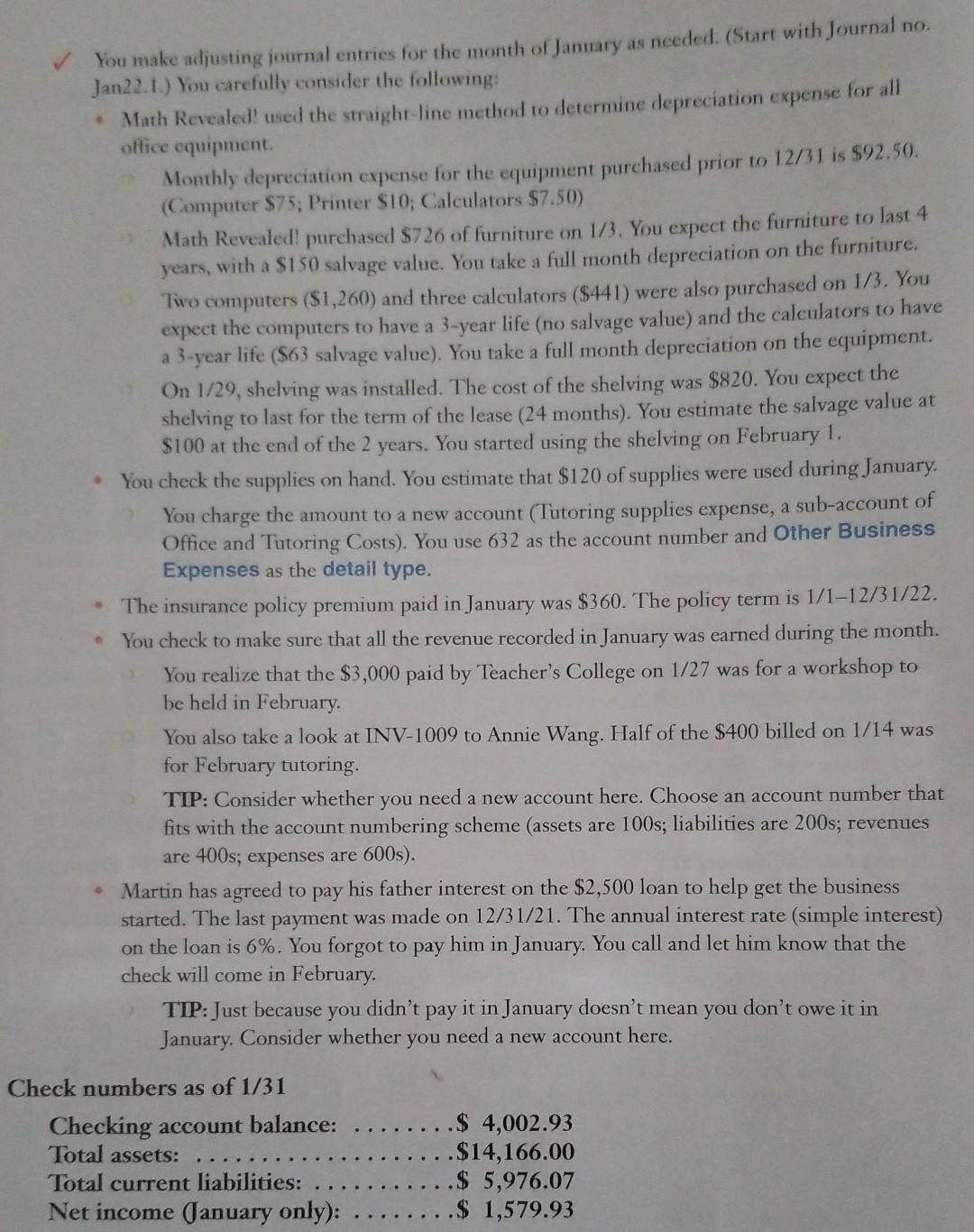

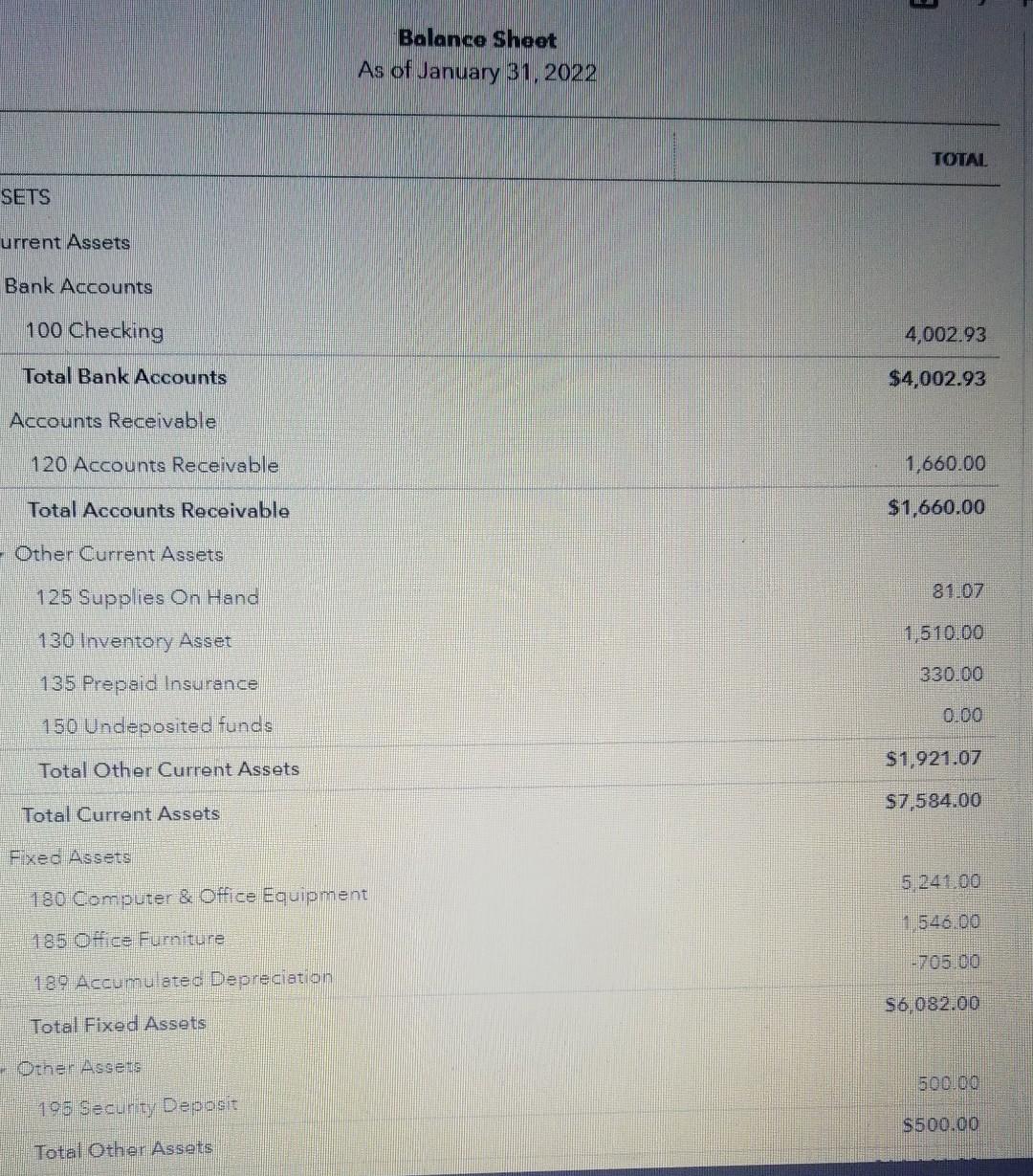

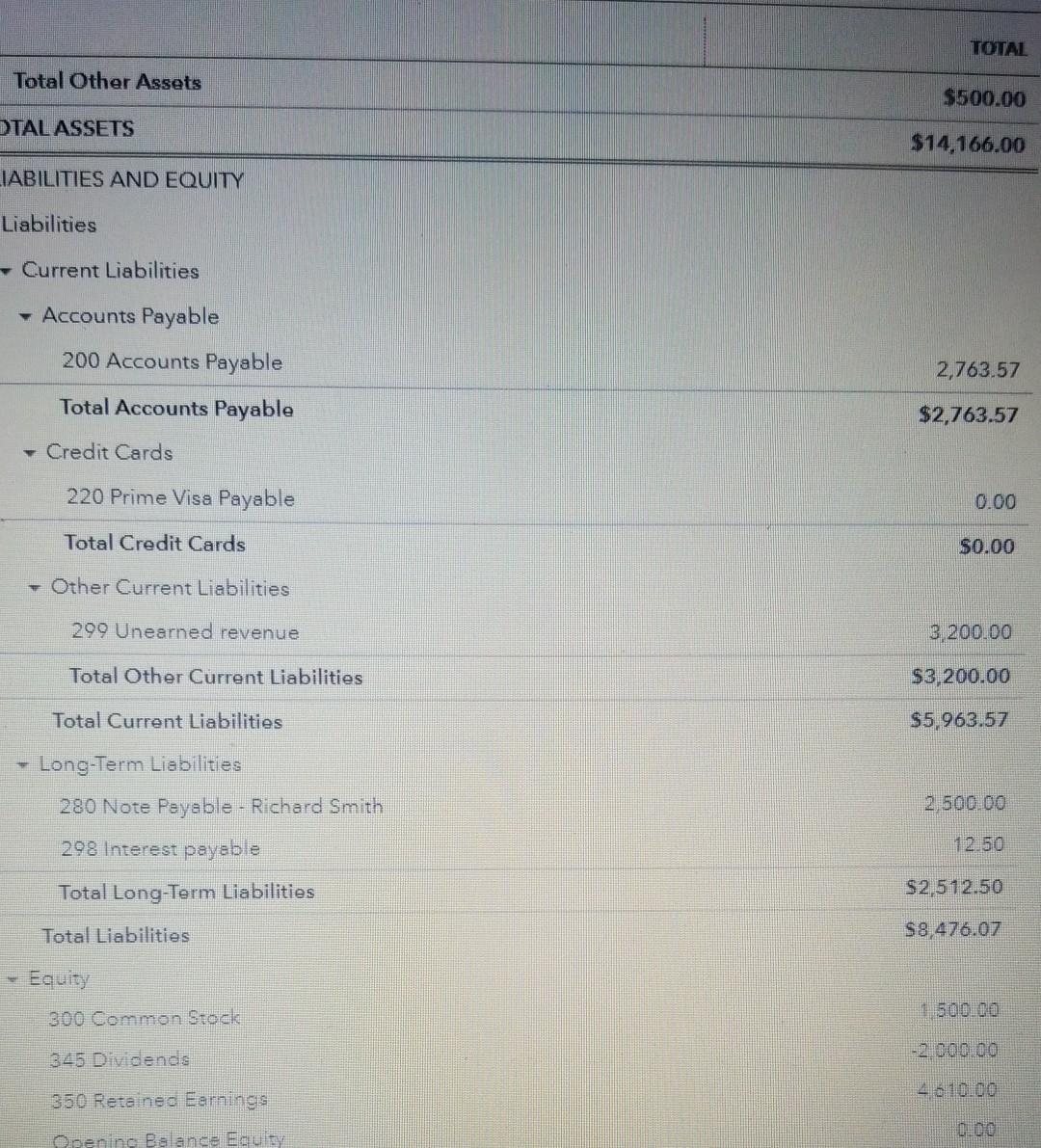

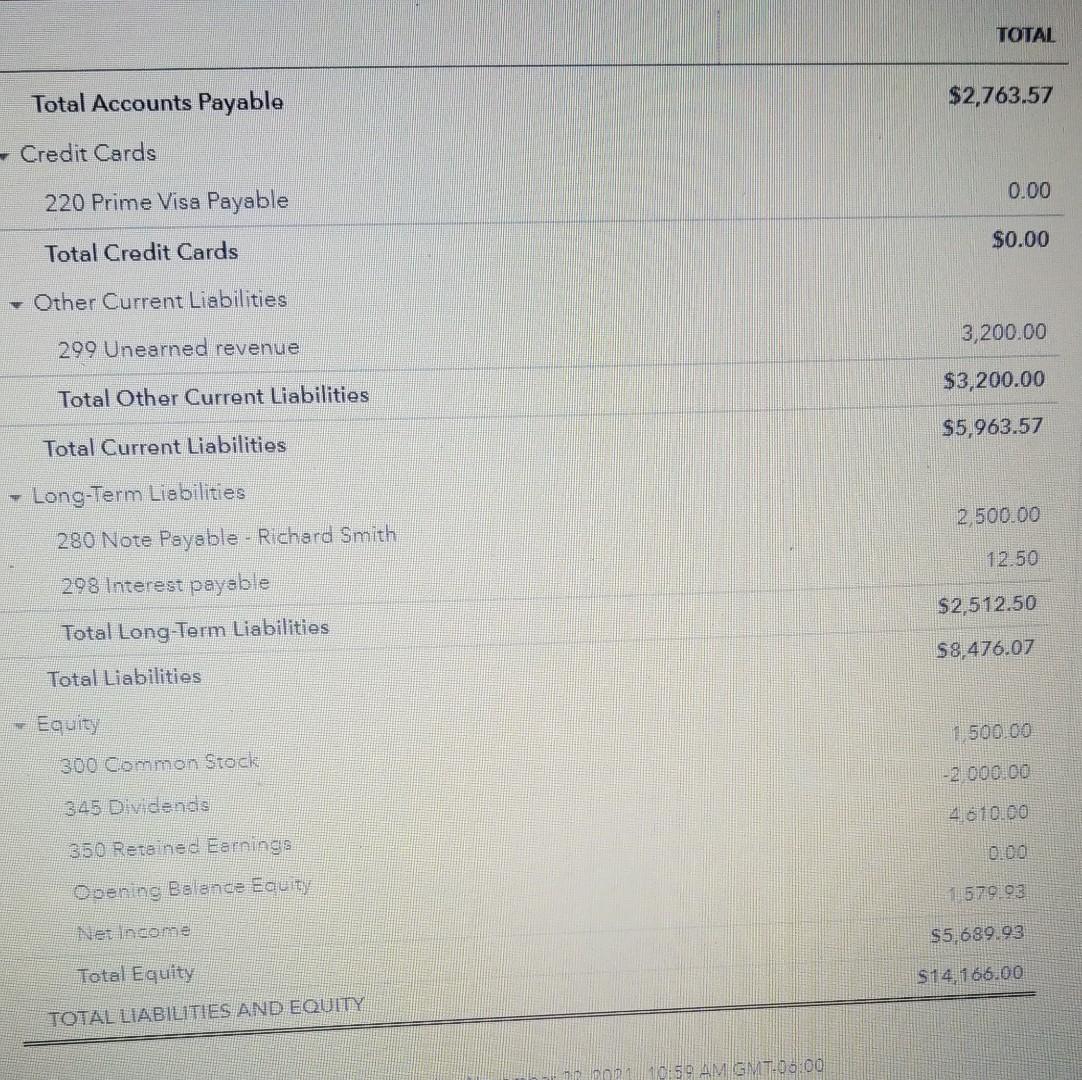

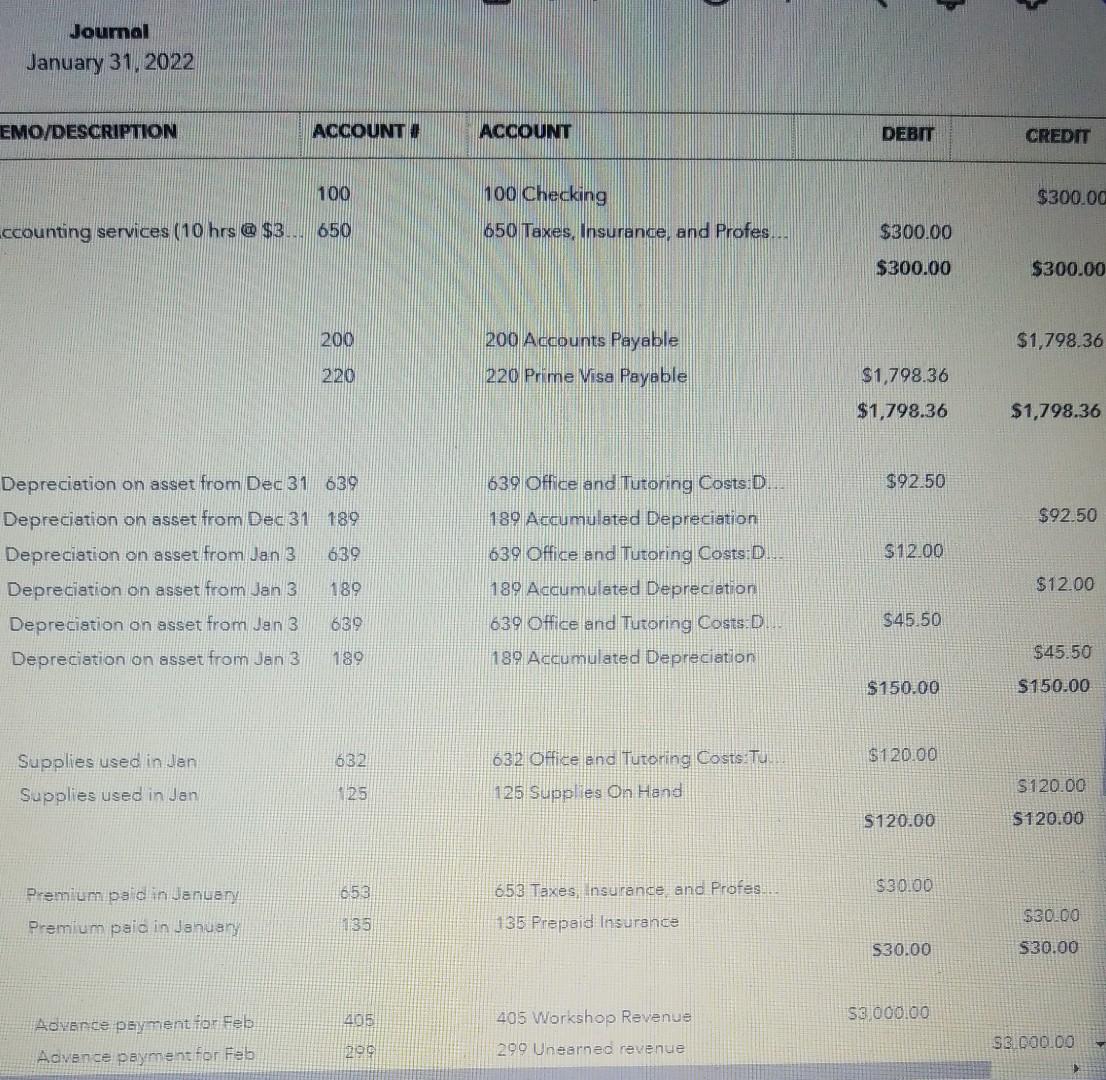

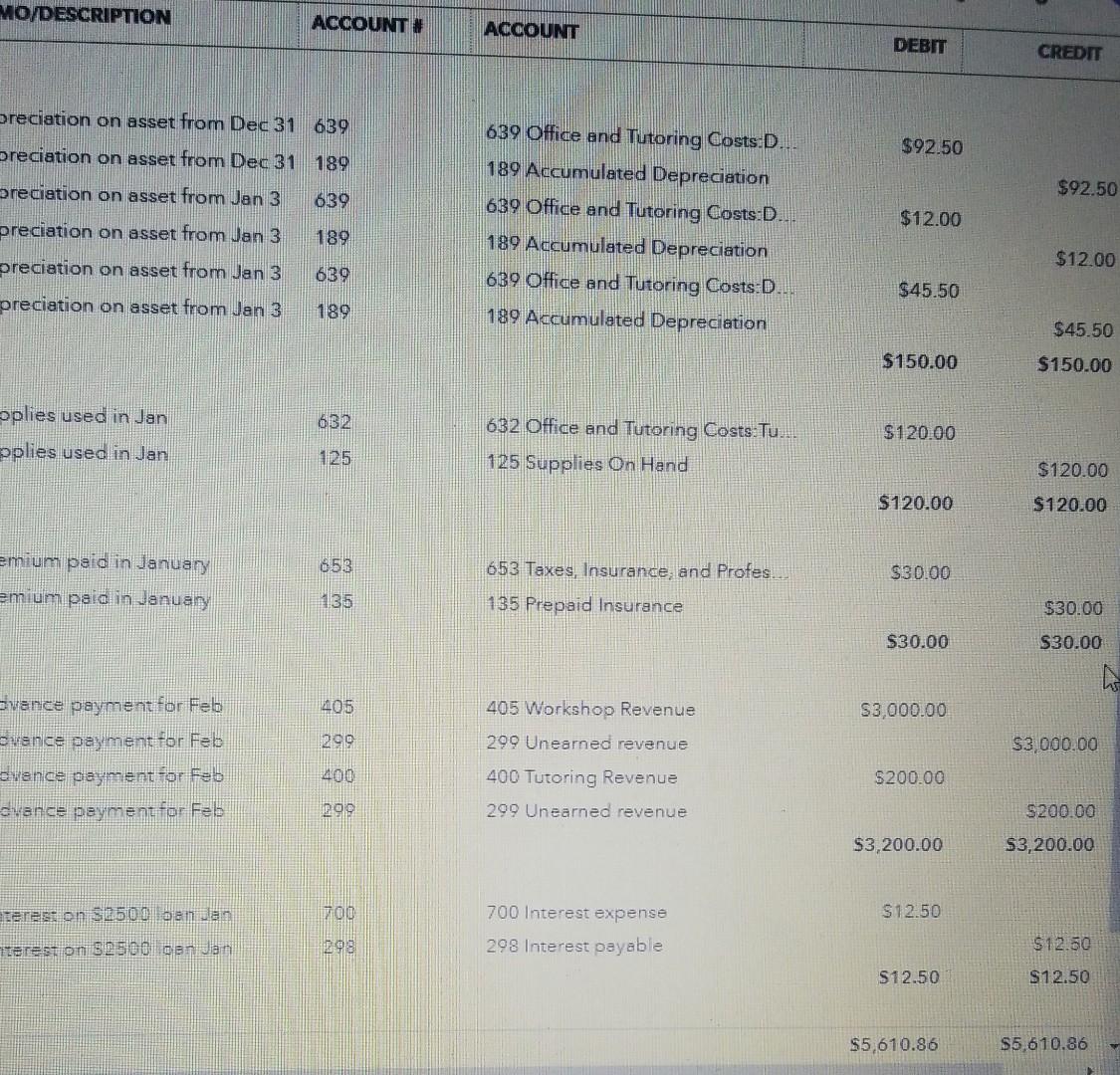

You make adjusting journal entries for the month of January as needed. (Start with Journal no. Jan22.1.) You carefully consider the following: Math Revealed! used the straight-line method to determine depreciation expense for all office equipment Monthly depreciation expense for the equipment purchased prior to 12/31 is $92.50. (Computer $75; Printer $10; Calculators $7.50) Math Revealed! purchased $726 of furniture on 1/3. You expect the furniture to last 4 years, with a $150 salvage value. You take a full month depreciation on the furniture. Two computers ($1,260) and three calculators ($441) were also purchased on 1/3. You expect the computers to have a 3-year life (no salvage value) and the calculators to have a 3-year life (563 salvage value). You take a full month depreciation on the equipment. On 1/29, shelving was installed. The cost of the shelving was $820. You expect the shelving to last for the term of the lease (24 months). You estimate the salvage value at $100 at the end of the 2 years. You started using the shelving on February 1. You check the supplies on hand. You estimate that $120 of supplies were used during January You charge the amount to a new account (Tutoring supplies expense, a sub-account of Office and Tutoring Costs). You use 632 as the account number and Other Business Expenses as the detail type. The insurance policy premium paid in January was $360. The policy term is 1/1-12/31/22. You check to make sure that all the revenue recorded in January was earned during the month. You realize that the $3,000 paid by Teacher's College on 1/27 was for a workshop to be held in February You also take a look at INV-1009 to Annie Wang. Half of the $400 billed on 1/14 was for February tutoring. TIP: Consider whether you need a new account here. Choose an account number that fits with the account numbering scheme (assets are 100s; liabilities are 200s; revenues are 400s; expenses are 600s). Martin has agreed to pay his father interest on the $2,500 loan to help get the business started. The last payment was made on 12/31/21. The annual interest rate (simple interest) on the loan is 6%. You forgot to pay him in January. You call and let him know that the check will come in February. TIP: Just because you didn't pay it in January doesn't mean you don't owe it in January. Consider whether you need a new account here. Check numbers as of 1/31 Checking account balance: Total assets: Total current liabilities: Net income (January only): .$ 4,002.93 .$14,166.00 .$ 5,976.07 .$ 1,579.93 Balance Sheet As of January 31, 2022 TOTAL SETS urrent Assets Bank Accounts 100 Checking 4,002.93 Total Bank Accounts $4,002.93 Accounts Receivable 120 Accounts Receivable 1,660.00 Total Accounts Receivable $1,660.00 - Other Current Assets 125 Supplies On Hand 81.07 130 Inventory Asset 1,510.00 330.00 135 Prepaid Insurance 0.00 150 Undeposited funds Total Other Current Assets $1,921.07 $7,584.00 Total Current Assets Fixed Assets 5.24100 180 Computer & Office Equipment 1.546.00 185 Ofice Furniture -705 00 180 Accumulated Depreciation S6,082.00 Total Fixed Assets Other Assets 500000 196 Security Deposit $500.00 Total Other Assets TOTAL Total Other Assets $500.00 TALASSETS $14,166.00 LIABILITIES AND EQUITY Liabilities Current Liabilities - Accounts Payable 200 Accounts Payable 2,763.57 Total Accounts Payable $2,763.57 - Credit Cards 220 Prime Visa Payable 0.00 Total Credit Cards $0.00 - Other Current Liabilities 299 Unearned revenue 3 200.00 Total Other Current Liabilities $3,200.00 Total Current Liabilities $5,963.57 Long-Term Liabilities 2 500.00 280 Note Peyable - Richard Smith 298 Interest payable 12.50 Total Long-Term Liabilities $2,512.50 Total Liabilities $8.476.07 Equity 300 Common Stock 1 500.00 - 2000.00 345 Dividenas 450.00 350 Rete nec Earnings 0.00 Openine Balance Equity TOTAL Total Accounts Payable $2,763.57 - Credit Cards 0.00 220 Prime Visa Payable $0.00 Total Credit Cards Other Current Liabilities 3,200.00 200 Unearned revenue $3,200.00 Total Other Current Liabilities $5,963.57 Total Current Liabilities 2.500.00 - Long-Term Liabilities 280 Note Payable - Richard Smith 298 Interest payable 12.50 $2,512.50 Total Long-Term Liabilities $8.476.07 Total Liabilities Equity 1 500.00 300 Common Stock -2 000.00 345 Dividend's 4 610.00 350 Retained Earnings Opening Balance Eden 1579 03 Ne come $5,689.93 Total Equity $14,166.00 TOTAL LIABILITIES AND EQUITY no 10:59 AM GMT-0600 Profit and Lose January 2022 TOTAL Income 400 Tutoring Revenue 3,630.00 405 Workshop Revenue 0.00 Total Income $3,630.00 GROSS PROFIT $3,630.00 Expenses 610 Facility Costs 611 Rent expense 750.00 615 Utilities expense 145.21 Total 610 Facility Costs 895.21 -620 Labor Costs 625 Contract Labor 125.00 628 Staff relations 8.75 Total 620 Labor Costs 133.75 = 630 Office and Tutoring Costs 631 Office supplies expense 28.01 632 Tutoring supplies expense 120.00 639 Depreciation expense 150.00 Total 630 Office and Tutoring Costs 298.61 - 640 Marketing Costs 641 Advertising expense 00.00 100.00 Total 640 Marketing Costs 650 Taxes Insurance and Professione Fees 300.00 662 ngurance expense 30100 TOTAL Zo contract Labor 120.00 28 Staff relations 8.75 Total 620 Labor Costs 133.75 30 Office and Tutoring Costs 631 Office supplies expense 28.61 120.00 632 Tutoring supplies expense 639 Depreciation expense 150.00 Total 630 Office and Tutoring Costs 298.61 640 Marketing Costs 100.00 641 Advertising expense - Total 640 Marketing Costs 100.00 300.00 = 650 Taxes Insurance, and Professional Fees 30.00 653 Insurance exoense 330.00 Total 650 Taxes, Insurance, and Professional Fees 690 Other Costs 60.00 502 Gasoline exoense 220.00 690 Miscellaneous exsensa 280.00 Total 690 Other Costs $2,037.57 Total Expenses $ 1.592.43 NET OPERATING INDONE Other Ebenses 12.50 300 aterest exoense S 12.50 Total Other Expenses IS -2.50 INETOTERI $1579.93 NET INDONE Cuc Mostly cloud 3 Journal January 31, 2022 EMO/DESCRIPTION ACCOUNT ACCOUNT DEBIT CREDIT 100 $300.00 100 Checking 650 Taxes, Insurance, and Profes.. ccounting services (10 hrs @ $3. 650 $300.00 $300.00 $300.00 200 $1,798.36 200 Accounts Payable 220 Prime Visa Payable 220 $1,798.36 $1,798.36 $1,798.36 $92.50 $92.50 $12.00 Depreciation on asset from Dec 31 639 Depreciation on asset from Dec 31 189 Depreciation on asset from Jan 3 639 Depreciation on asset from Jan 3 189 Depreciation on asset from Jan 3 639 Depreciation on asset from Jan 3 189 639 Office and Tutoring Costs:D... 180 Accumulated Depreciation 639 Office and Tutoring Costs:D. 189 Accumulated Depreciation 639 Office and Tutoring Costs:D! 189 Accumulated Depreciation $12.00 $45.50 $45.50 $ 150.00 $150.00 632 $ 120100 Supplies used in Jen Supplies used in Jan 632 Office and Tutoring Costs:Tu. 125 Supplies On Hand 125 S 120.00 S120.00 S120.00 653 653 Taxes Insurance and Profes.. $30.00 Premium paid in January Premium paid in January 135 135 Prepaid Insurance $30.00 $30.00 $30.00 405 $3.000.00 Anende payment for Feb Advance payment for Feb 405 Workshop Revenue 290 Unearned revenue 2016 S3.000.00 MO/DESCRIPTION ACCOUNT ACCOUNT DEBIT CREDIT Dreciation on asset from Dec 31 639 greciation on asset from Dec 31 189 $92.50 preciation on asset from Jan 3 $92.50 639 639 Office and Tutoring Costs:D. 189 Accumulated Depreciation 639 Office and Tutoring Costs:D... 189 Accumulated Depreciation 639 Office and Tutoring Costs:D... 189 Accumulated Depreciation $12.00 preciation on asset from Jan 3 189 $12.00 preciation on asset from Jan 3 639 $45.50 preciation on asset from Jan 3 189 $45.50 $150.00 $150.00 632 oplies used in Jan pplies used in Jan $120.00 632 Office and Tutoring Costs:Tu... 125 Supplies On Hand 125 $120.00 $120.00 $120.00 658 emium paid in January emium paid in January $30.00 653 Taxes, Insurance, and Profes... 135 Prepaid Insurance 135 $30.00 $30.00 $30.00 w 405 405 Workshop Revenue S3,000.00 290 299 Unearned revenue $3,000.00 Ovance payment for Feb cvance payment for Feb bvence payment for Feb avance payment for Feb 400 $200.00 400 Tutoring Revenue 299 Unearned revenue 299 $200.00 $3,200.00 $3,200.00 TOO $12.50 terest on 2500 aan Jan terest on 30500 banden 700 Interest expense 298 Interest payable 298 $12.50 $12.50 S12.50 $5,610.86 $5.610.86

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started