Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me - Given the following information for Exenflowx Power Co0, find the WACC. - Debt: 10,0008 percent coupon bonds outstanding, $1,000 par value,

please help me

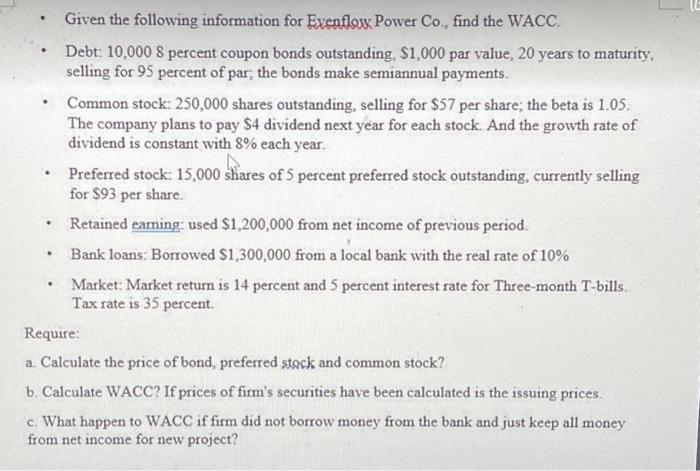

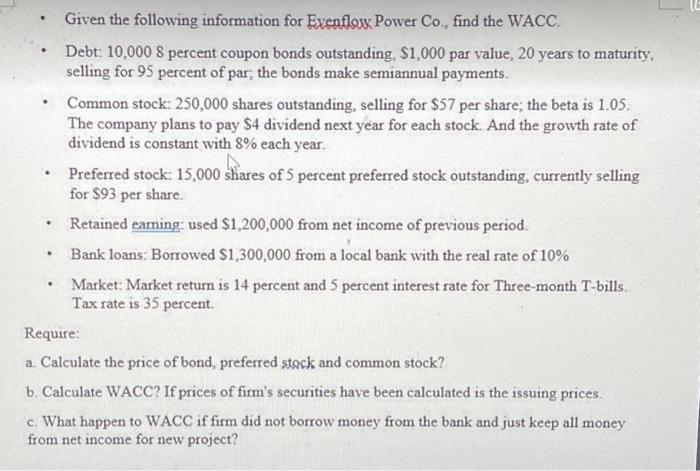

- Given the following information for Exenflowx Power Co0, find the WACC. - Debt: 10,0008 percent coupon bonds outstanding, $1,000 par value, 20 years to maturity, selling for 95 percent of par, the bonds make semiannual payments. - Common stock: 250,000 shares outstanding, selling for $57 per share; the beta is 1.05 . The company plans to pay $4 dividend next year for each stock. And the growth rate of dividend is constant with 8% each year. - Preferred stock: 15,000 shares of 5 percent preferred stock outstanding, currently selling for $93 per share. - Retained eaming: used $1,200,000 from net income of previous period. - Bank loans: Borrowed $1,300,000 from a local bank with the real rate of 10% - Market: Market retum is 14 percent and 5 percent interest rate for Three-month T-bills. Tax rate is 35 percent. Require: a. Calculate the price of bond, preferred stock and common stock? b. Calculate WACC? If prices of firm's securities have been calculated is the issuing prices. c. What happen to WACC if firm did not borrow money from the bank and just keep all money from net income for new project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started