Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me I need this ASAP or else I'll fail my class. Transaction 10 goes with Transaction 29. 29. The annual interest rate on

Please help me I need this ASAP or else I'll fail my class. Transaction 10 goes with Transaction 29.

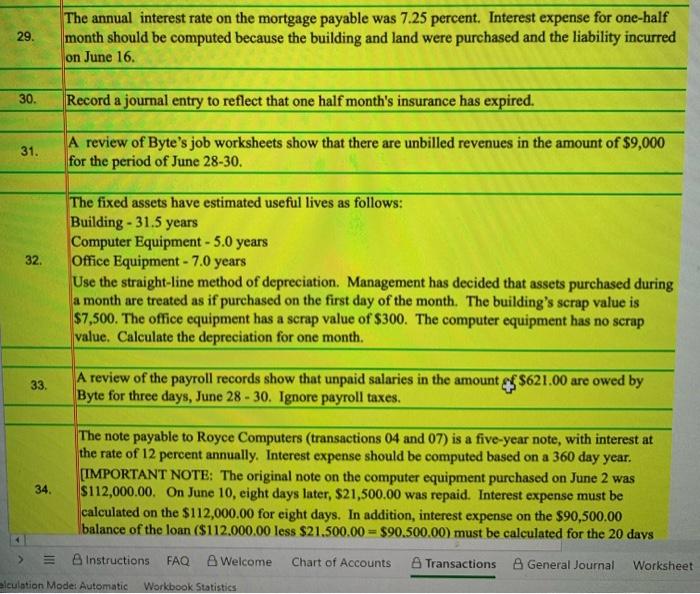

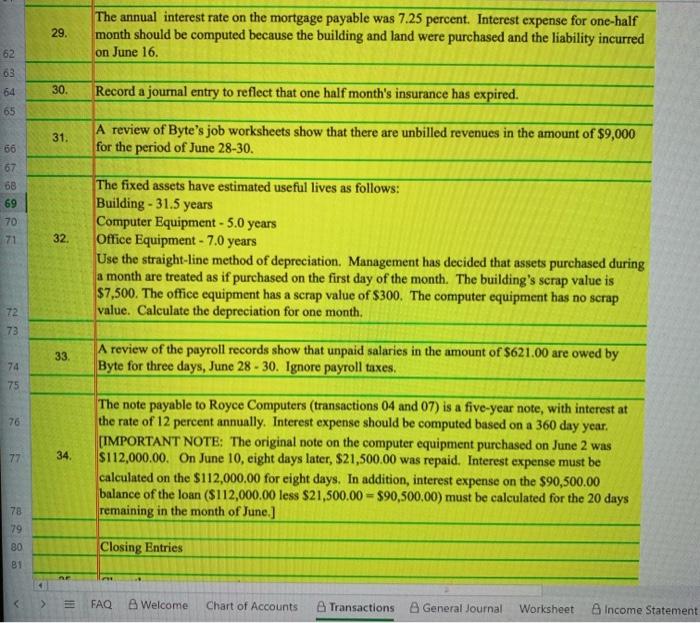

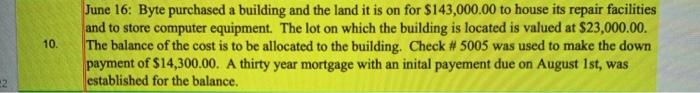

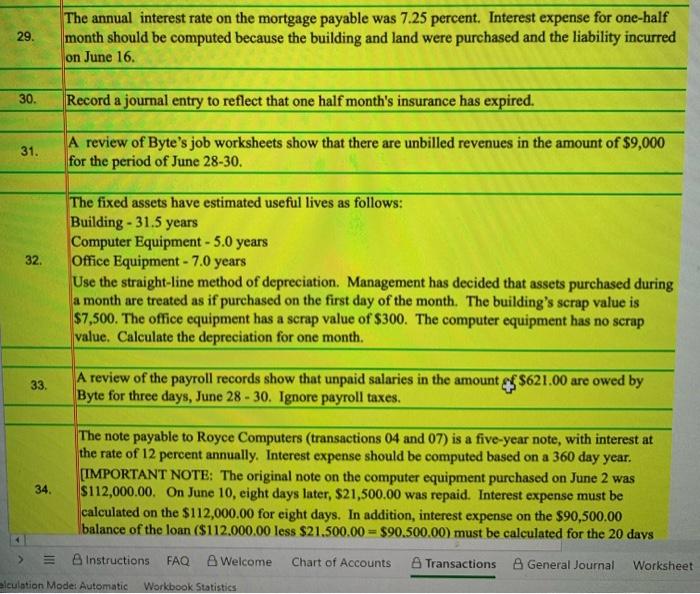

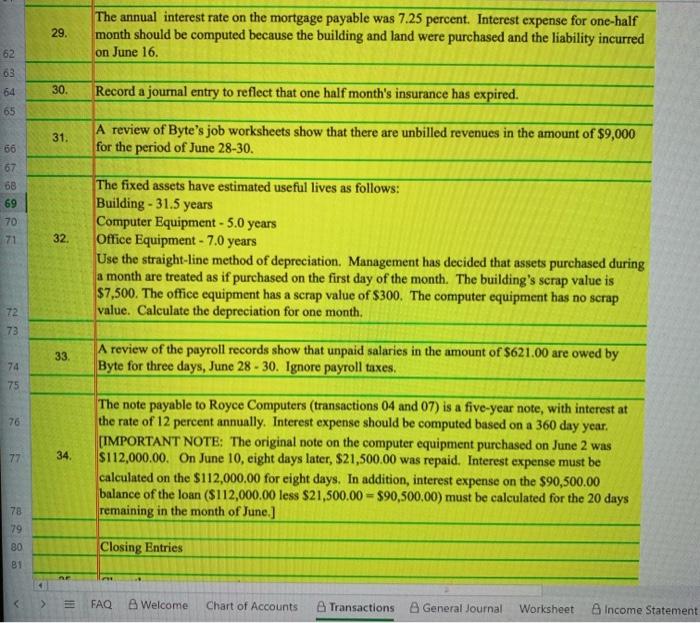

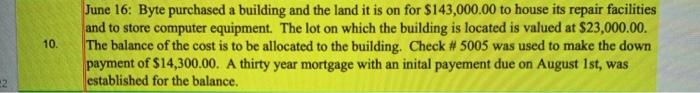

29. The annual interest rate on the mortgage payable was 7.25 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 30. Record a journal entry to reflect that one half month's insurance has expired. 31. A review of Byte's job worksheets show that there are unbilled revenues in the amount of $9,000 for the period of June 28-30. 32 The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,500. The office equipment has a scrap value of $300. The computer equipment has no scrap value. Calculate the depreciation for one month. 33 A review of the payroll records show that unpaid salaries in the amount $ $621.00 are owed by Byte for three days, June 28 - 30. Ignore payroll taxes. The note payable to Royce Computers (transactions 04 and 07) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $112,000.00. On June 10, eight days later, $21,500.00 was repaid. Interest expense must be calculated on the $112,000.00 for eight days. In addition, interest expense on the $90,500.00 balance of the loan ($112.000,00 less $21.500.00 = $90.500.00) must be calculated for the 20 days 34. = B Instructions FAQ Welcome Chart of Accounts Transactions General Journal Worksheet alculation Mode: Automatic Workbook Statistics 29 The annual interest rate on the mortgage payable was 7.25 percent. Interest expense for one-half month should be computed because the building and land were purchased and the liability incurred on June 16. 62 63 64 30. Record a journal entry to reflect that one half month's insurance has expired. 65 31, . A review of Byte's job worksheets show that there are unbilled revenues in the amount of $9,000 for the period of June 28-30. 66 67 68 69 70 71 32 The fixed assets have estimated useful lives as follows: Building - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-line method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,500. The office equipment has a scrap value of $300. The computer equipment has no scrap value. Calculate the depreciation for one month. 72 73 33 A review of the payroll records show that unpaid salaries in the amount of $621.00 are owed by Byte for three days, June 28 - 30. Ignore payroll taxes. 74 75 76 77 34. The note payable to Royce Computers (transactions 04 and 07) is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year. [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $112,000.00. On June 10, eight days later, $21,500.00 was repaid. Interest expense must be calculated on the $112,000.00 for eight days. In addition, interest expense on the $90,500.00 balance of the loan ($112,000.00 less $21,500.00 $90,500,00) must be calculated for the 20 days remaining in the month of June.] 78 79 80 B1 Closing Entries FAQ Welcome Chart of Accounts Transactions General Journal Worksheet Income Statement 10. June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to store computer equipment. The lot on which the building is located is valued at $23,000.00. The balance of the cost is to be allocated to the building. Check #5005 was used to make the down payment of $14,300.00. A thirty year mortgage with an inital payement due on August 1st, was established for the balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started