Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me i will give good rating a. b. Andora Bhd (ASB) is a company providing management consulting services to its client under the

please help me i will give good rating

a.

b.

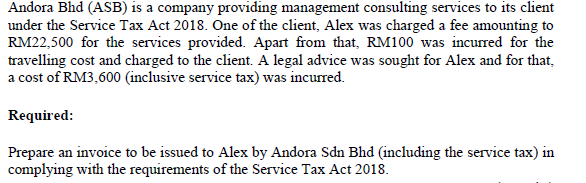

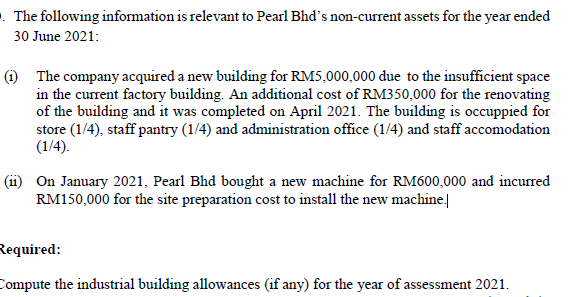

Andora Bhd (ASB) is a company providing management consulting services to its client under the Service Tax Act 2018. One of the client, Alex was charged a fee amounting to RM22,500 for the services provided. Apart from that, RM100 was incurred for the travelling cost and charged to the client. A legal advice was sought for Alex and for that, a cost of RM3,600 (inclusive service tax) was incurred. Required: Prepare an invoice to be issued to Alex by Andora Sdn Bhd (including the service tax) in complying with the requirements of the Service Tax Act 2018. . The following information is relevant to Pearl Bhd's non-current assets for the year ended 30 June 2021: (1) The company acquired a new building for RM5,000,000 due to the insufficient space in the current factory building. An additional cost of RM350,000 for the renovating of the building and it was completed on April 2021. The building is occuppied for store (1/4), staff pantry (1/4) and administration office (1/4) and staff accomodation (1/4). (11) On January 2021, Pearl Bhd bought a new machine for RM600,000 and incurred RM150,000 for the site preparation cost to install the new machine | Required: Compute the industrial building allowances (if any) for the year of assessment 2021. Andora Bhd (ASB) is a company providing management consulting services to its client under the Service Tax Act 2018. One of the client, Alex was charged a fee amounting to RM22,500 for the services provided. Apart from that, RM100 was incurred for the travelling cost and charged to the client. A legal advice was sought for Alex and for that, a cost of RM3,600 (inclusive service tax) was incurred. Required: Prepare an invoice to be issued to Alex by Andora Sdn Bhd (including the service tax) in complying with the requirements of the Service Tax Act 2018. . The following information is relevant to Pearl Bhd's non-current assets for the year ended 30 June 2021: (1) The company acquired a new building for RM5,000,000 due to the insufficient space in the current factory building. An additional cost of RM350,000 for the renovating of the building and it was completed on April 2021. The building is occuppied for store (1/4), staff pantry (1/4) and administration office (1/4) and staff accomodation (1/4). (11) On January 2021, Pearl Bhd bought a new machine for RM600,000 and incurred RM150,000 for the site preparation cost to install the new machine | Required: Compute the industrial building allowances (if any) for the year of assessment 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started