Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me! I'm not 100 % sure they are correct some I didn't know how to do it. For example, assume Amelia wants to

please help me! I'm not 100 % sure they are correct some I didn't know how to do it.

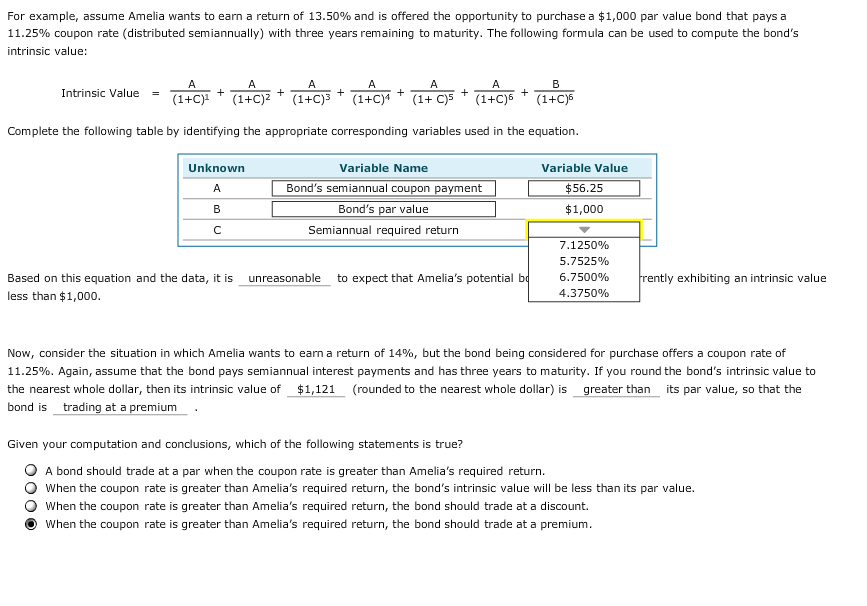

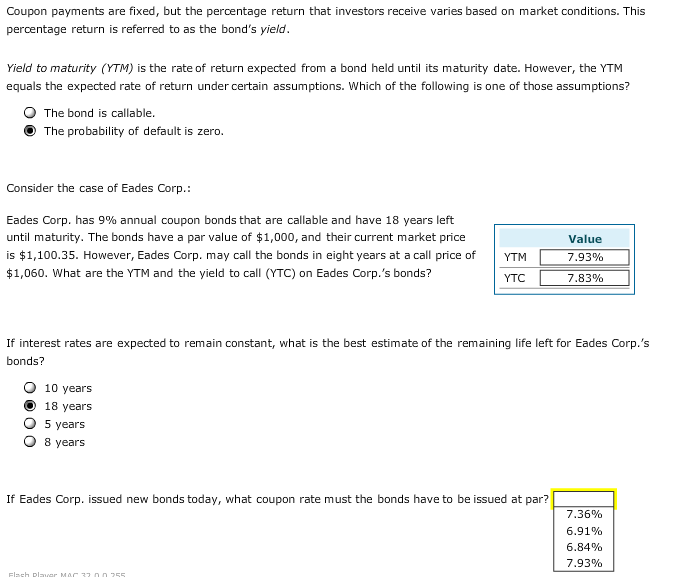

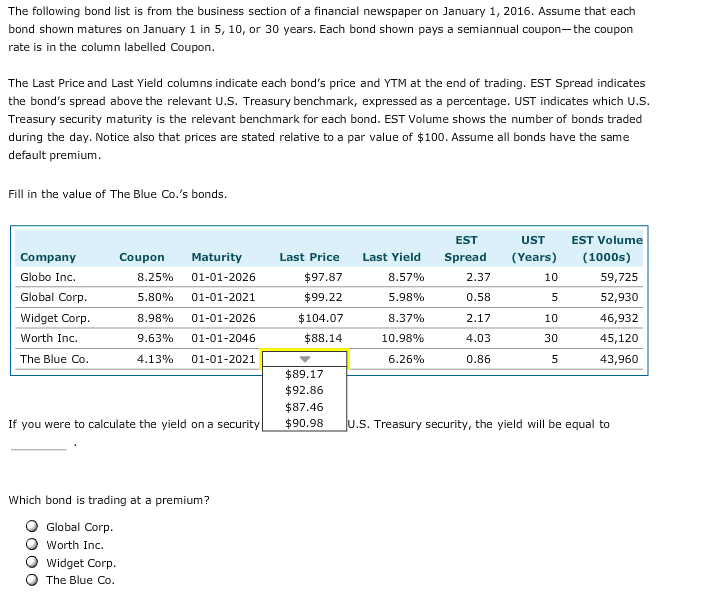

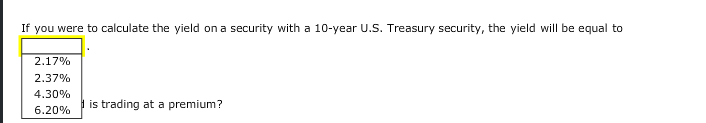

For example, assume Amelia wants to earn a return of 13.50% and is offered the opportunity to purchase a $1,000 par value bond that pays a 11.25% coupon rate (distributed semiannually) with three years remaining to maturity. The following formula can be used to compute the bond's intrinsic value: Intrinsic Value = (1+c+ + (1++)2 + (1+Cj3 + 12 C1a + (+ CJ8 + (24CJ8 + (1 cm Complete the following table by identifying the appropriate corresponding variables used in the equation. Unknown A B Variable Name Bond's semiannual coupon payment Bond's par value Semiannual required return Variable Value $56.25 $1,000 7.1250% 5.7525% 6.7500% 4.3750% unreasonable to expect that Amelia's potential be frently exhibiting an intrinsic value Based on this equation and the data, it is less than $1,000. Now, consider the situation in which Amelia wants to earn a return of 14%, but the bond being considered for purchase offers a coupon rate of 11.25%. Again, assume that the bond pays semiannual interest payments and has three years to maturity. If you round the bond's intrinsic value to the nearest whole dollar, then its intrinsic value of $1,121 (rounded to the nearest whole dollar) is greater than its par value, so that the bond is trading at a premium . Given your computation and conclusions, which of the following statements is true? A bond should trade at a par when the coupon rate is greater than Amelia's required return. When the coupon rate is greater than Amelia's required return, the bond's intrinsic value will be less than its par value. When the coupon rate is greater than Amelia's required return, the bond should trade at a discount. When the coupon rate is greater than Amelia's required return, the bond should trade at a premium. Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond's yield. Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? The bond is callable. The probability of default is zero. Consider the case of Eades Corp.: Eades Corp. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,100.35. However, Eades Corp. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on Eades Corp.'s bonds? YTM YTC Value 7.93% 7.83% If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Eades Corp.'s bonds? 10 years 18 years 5 years 8 years O O If Eades Corp. issued new bonds today, what coupon rate must the bonds have to be issued at par? 7.36% 6.91% 6.84% 7.93% The following bond list is from the business section of a financial newspaper on January 1, 2016. Assume that each bond shown matures on January 1 in 5, 10, or 30 years. Each bond shown pays a semiannual coupon-the coupon rate is in the column labelled Coupon. The Last Price and Last Yield columns indicate each bond's price and YTM at the end of trading. EST Spread indicates the bond's spread above the relevant U.S. Treasury benchmark, expressed as a percentage. UST indicates which U.S Treasury security maturity is the relevant benchmark for each bond. EST Volume shows the number of bonds traded during the day. Notice also that prices are stated relative to a par value of $100. Assume all bonds have the same default premium. Fill in the value of The Blue Co.'s bonds. Company Globo Inc. Global Corp. Widget Corp. Worth Inc. The Blue Co. Last Yield 8.57% 5.98% Coupon 8.25% 5.80% 8.98% 9.63% 4.13% Maturity 01-01-2026 01-01-2021 01-01-2026 01-01-2046 01-01-2021 Last Price $97.87 $99.22 $104.07 $88.14 EST USTEST Volume Spread (Years) (1000s) 2.37 10 59,725 0.58 5 52,930 2.17 10 46,932 4.03 30 45,120 0. 865 43,960 8.37% 10.98% 6.26% $89.17 $92.86 $87.46 $90.98 If you were to calculate the yield on a security | U.S. Treasury security, the yield will be equal to Which bond is trading at a premium? Global Corp. O Worth Inc. Widget Corp. The Blue Co. If you were to calculate the yield on a security with a 10-year U.S. Treasury security, the yield will be equal to 2.17% 2.37% 4.30% 6.20% is trading at a premiumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started