Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me on all parts For 2017 the actual tax brackets for a single tax filer were: - For taxable income from $0 to

please help me on all parts

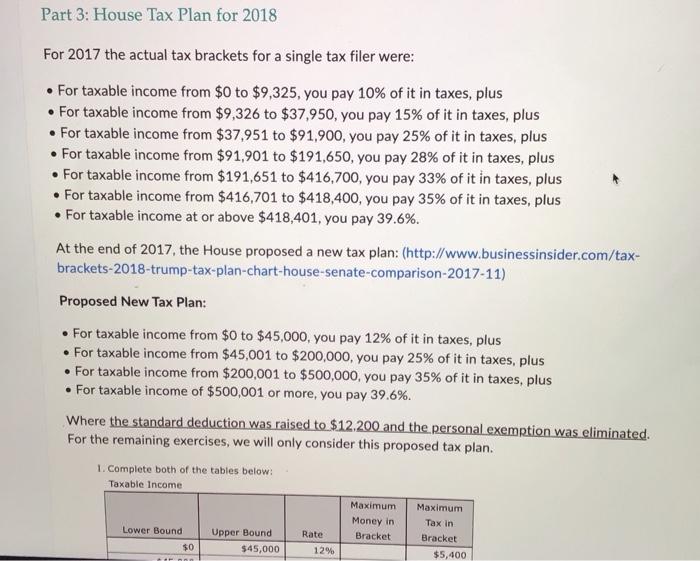

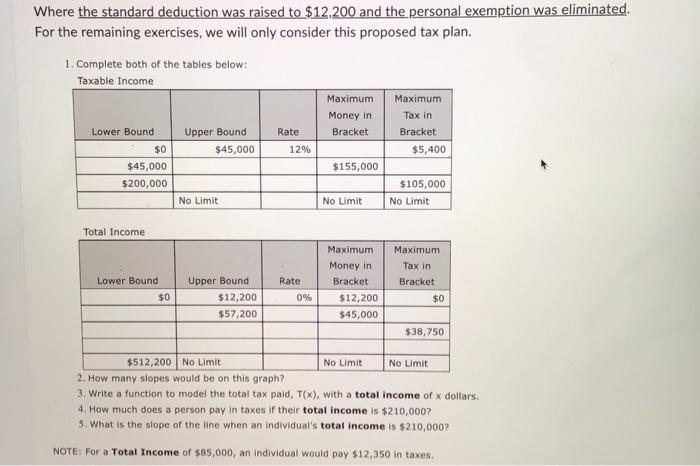

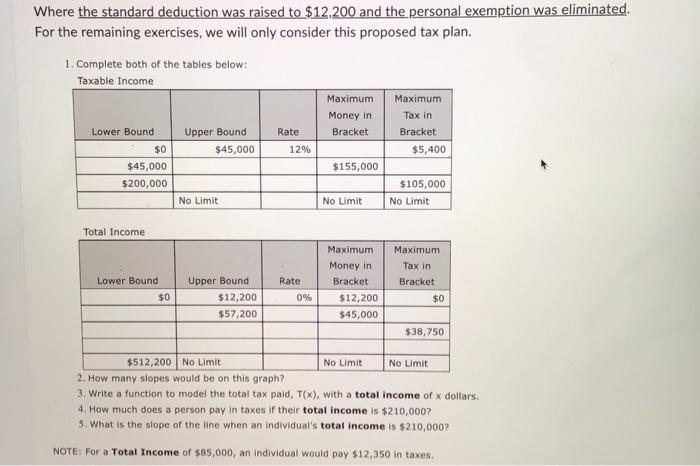

For 2017 the actual tax brackets for a single tax filer were: - For taxable income from $0 to $9,325, you pay 10% of it in taxes, plus - For taxable income from $9,326 to $37,950, you pay 15% of it in taxes, plus - For taxable income from $37,951 to $91,900, you pay 25% of it in taxes, plus - For taxable income from $91,901 to $191,650, you pay 28% of it in taxes, plus - For taxable income from $191,651 to $416,700, you pay 33% of it in taxes, plus - For taxable income from $416,701 to $418,400, you pay 35% of it in taxes, plus - For taxable income at or above $418,401, you pay 39.6%. At the end of 2017, the House proposed a new tax plan: (http://www. businessinsider.com/taxbrackets-2018-trump-tax-plan-chart-house-senate-comparison-2017-11) Proposed New Tax Plan: - For taxable income from $0 to $45,000, you pay 12% of it in taxes, plus - For taxable income from $45,001 to $200,000, you pay 25% of it in taxes, plus - For taxable income from $200,001 to $500,000, you pay 35% of it in taxes, plus - For taxable income of $500,001 or more, you pay 39.6%. Where the standard deduction was raised to $12.200 and the personal exemption was eliminated. For the remaining exercises, we will only consider this proposed tax plan. 1. Complete both of the tables below: Taxable Income Where the standard deduction was raised to $12,200 and the personal exemption was eliminated. For the remaining exercises, we will only consider this proposed tax plan. 1. Complete both of the tables below: Taxable Income 2. How many slopes would be on this graph? 3. Write a function to model the total tax paid, T(x), with a total income of x dollars. 4. How much does a person pay in taxes if their total income is $210,000 ? 5. What is the slope of the line when an individual's total income is $210,000 ? NOTE: For a Total Income of $85,000, an individual would pay $12,350 in taxes. For 2017 the actual tax brackets for a single tax filer were: - For taxable income from $0 to $9,325, you pay 10% of it in taxes, plus - For taxable income from $9,326 to $37,950, you pay 15% of it in taxes, plus - For taxable income from $37,951 to $91,900, you pay 25% of it in taxes, plus - For taxable income from $91,901 to $191,650, you pay 28% of it in taxes, plus - For taxable income from $191,651 to $416,700, you pay 33% of it in taxes, plus - For taxable income from $416,701 to $418,400, you pay 35% of it in taxes, plus - For taxable income at or above $418,401, you pay 39.6%. At the end of 2017, the House proposed a new tax plan: (http://www. businessinsider.com/taxbrackets-2018-trump-tax-plan-chart-house-senate-comparison-2017-11) Proposed New Tax Plan: - For taxable income from $0 to $45,000, you pay 12% of it in taxes, plus - For taxable income from $45,001 to $200,000, you pay 25% of it in taxes, plus - For taxable income from $200,001 to $500,000, you pay 35% of it in taxes, plus - For taxable income of $500,001 or more, you pay 39.6%. Where the standard deduction was raised to $12.200 and the personal exemption was eliminated. For the remaining exercises, we will only consider this proposed tax plan. 1. Complete both of the tables below: Taxable Income Where the standard deduction was raised to $12,200 and the personal exemption was eliminated. For the remaining exercises, we will only consider this proposed tax plan. 1. Complete both of the tables below: Taxable Income 2. How many slopes would be on this graph? 3. Write a function to model the total tax paid, T(x), with a total income of x dollars. 4. How much does a person pay in taxes if their total income is $210,000 ? 5. What is the slope of the line when an individual's total income is $210,000 ? NOTE: For a Total Income of $85,000, an individual would pay $12,350 in taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started