please help me on this 3 part question. (a, b, c)

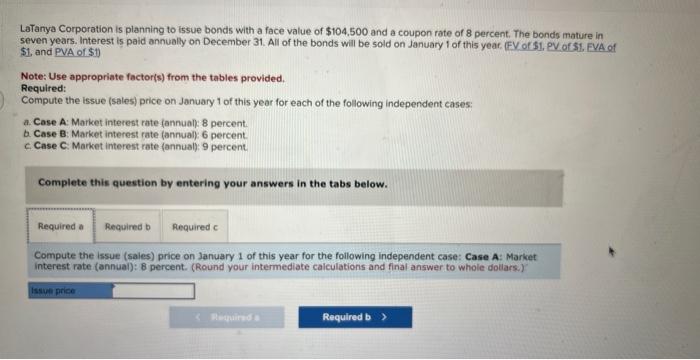

LaTanya Corporation is planning to issue bonds with a face value of $104,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annually on December 31. All of the bonds will be sold on January 1 of this year. (FV of S1, PV of S1, FVA of $1, and PVA of \$1] Note: Use appropriate factoris) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate fannual: 8 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (saies) price on January 1 of this year for the following independent case: Case A: Market interest rate (annual): 8 percent. (Round your intermediate calculations and final answer to whole dollars.) LaTanya Corporation is planning to issue bonds with a face value of $104,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annually on December 31. All of the bonds will be sold on January 1 of this year. (FV of S1. PV of St. FVA of 51, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual): 8 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual) 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case B: Markat interest rate (annual): 6 percent. (Round your intermediate calculations and final answer to whole dollars.) LaTanyo Corporation is planning to issue bonds with a face value of $104,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annualy on December 31. All of the bonds will be sold on January f of this year, (FV of.ST. PV of $1. FVA of Si, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annuaf; 8 percent. b. Case B: Market interest rate (annuali 6 percent. c. Case C: Market interest rate (annual): 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case C: Market interest rate (annual): 9 percent. (Round your intermediate calculations and final answer to whole dallars.) LaTanya Corporation is planning to issue bonds with a face value of $104,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annually on December 31. All of the bonds will be sold on January 1 of this year. (FV of S1, PV of S1, FVA of $1, and PVA of \$1] Note: Use appropriate factoris) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate fannual: 8 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual): 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (saies) price on January 1 of this year for the following independent case: Case A: Market interest rate (annual): 8 percent. (Round your intermediate calculations and final answer to whole dollars.) LaTanya Corporation is planning to issue bonds with a face value of $104,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annually on December 31. All of the bonds will be sold on January 1 of this year. (FV of S1. PV of St. FVA of 51, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annual): 8 percent. b. Case B: Market interest rate (annual): 6 percent. c. Case C: Market interest rate (annual) 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case B: Markat interest rate (annual): 6 percent. (Round your intermediate calculations and final answer to whole dollars.) LaTanyo Corporation is planning to issue bonds with a face value of $104,500 and a coupon rate of 8 percent. The bonds mature in seven years. Interest is paid annualy on December 31. All of the bonds will be sold on January f of this year, (FV of.ST. PV of $1. FVA of Si, and PVA of \$1) Note: Use appropriate factor(s) from the tables provided. Required: Compute the issue (sales) price on January 1 of this year for each of the following independent cases: a. Case A: Market interest rate (annuaf; 8 percent. b. Case B: Market interest rate (annuali 6 percent. c. Case C: Market interest rate (annual): 9 percent. Complete this question by entering your answers in the tabs below. Compute the issue (sales) price on January 1 of this year for the following independent case: Case C: Market interest rate (annual): 9 percent. (Round your intermediate calculations and final answer to whole dallars.)