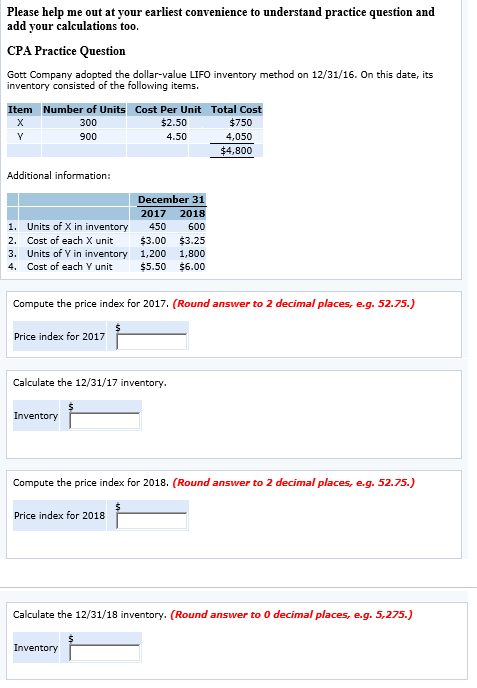

| Please help me out at your earliest convenience to understand practice question and add your calculations too. CPA Practice Question Gott Company adopted the dollar-value LIFO inventory method on 12/31/16. On this date, its inventory consisted of the following items. | Item | | Number of Units | | Cost Per Unit | | Total Cost | | X | | 300 | | | $2.50 | | | $750 | | | Y | | 900 | | | 4.50 | | | 4,050 | | | | | | | | | | | $4,800 | | Additional information: | | | | | December 31 | | | | | | 2017 | | 2018 | | 1. | | Units of X in inventory | | 450 | | 600 | | 2. | | Cost of each X unit | | $3.00 | | $3.25 | | 3. | | Units of Y in inventory | | 1,200 | | 1,800 | | 4. | | Cost of each Y unit | | $5.50 | | $6.00 | | | | | | |

| | Compute the price index for 2017. (Round answer to 2 decimal places, e.g. 52.75.) | | | |

| | Calculate the 12/31/17 inventory. | | | |

| | Compute the price index for 2018. (Round answer to 2 decimal places, e.g. 52.75.) | | | |

| | Calculate the 12/31/18 inventory. (Round answer to 0 decimal places, e.g. 5,275.) | Inventory | | $ | | | | | | |  | | | |

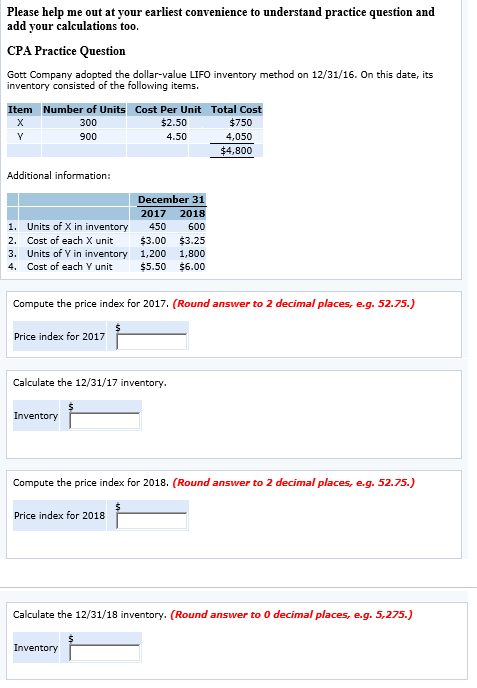

Please help me out at your earliest convenience to understand practice question and add your calculations too. CPA Practice Question Gott Company adopted the dollar-value LIFO inventory method on 12/31/16. On this date, its inventory consisted of the following items. tem Number of Units Cost per Unit Total Cost $2.50 $750 300 900 4.50 4,050 $4,800 Additional information: December 31 2017 2018 1. Units of X in inventory 450 600 2. Cost of each X unit $3.00 $3.25 3, Units of Yin inventory 1,200 1,800 4. Cost of each Y unit $5.50 $6.00 compute the price index for 2017. (Round answer to 2 decimal places, e.g. 52.75.) price index for 2017 Calculate the 12/31/17 inventory. Inventory Compute the price index for 2018. (Round answer to 2 decimal places, e.g. 52.75.) price index for 2018 Calculate the 18 inventory. (Round answer to o decimal places, e.g. 5,275.) Inventory