Question

Please help me solve all questions using the finance calculator BA II Plus method.i really need the help and i want to understand how to

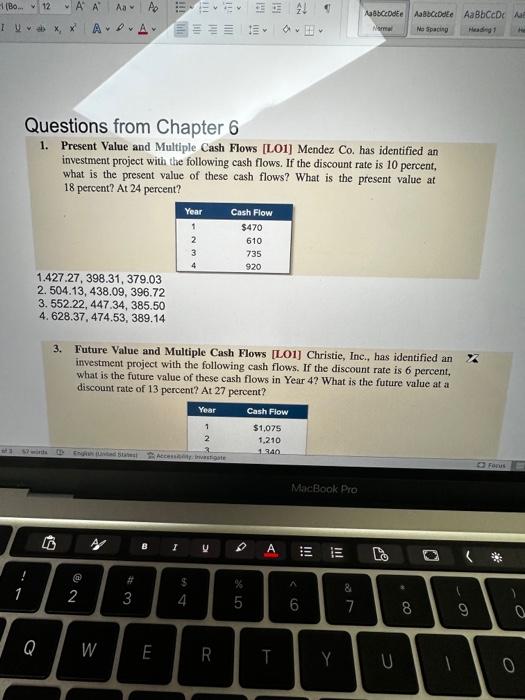

1. Present Value and Multiple Cash Flows [LO1] Mendez Co. has identified an investment project with the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? What is the present value at 18 percent? At 24 percent?

Year

1

2

3

4

Cash Flow

$470

610

735

920

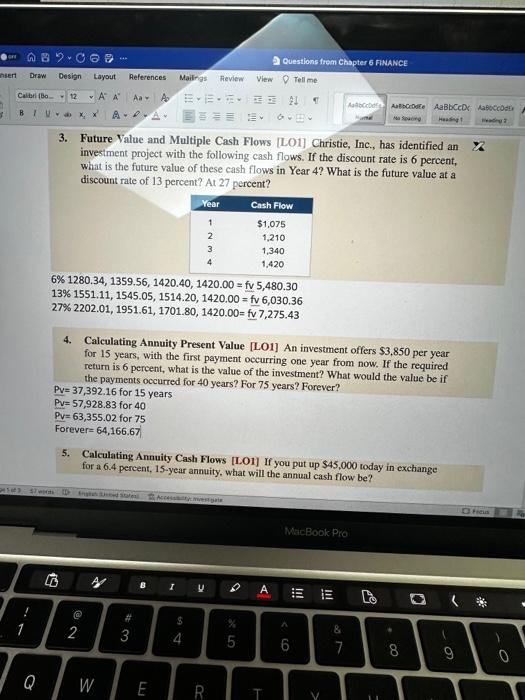

Future Value and Multiple Cash Flows [LO1] Christie, Inc., has identified an investment project with the following cash flows. If the discount rate is 6 percent, what is the future value of these cash flows in Year 4? What is the future value at a discount rate of 13 percent? At 27 percent?

Year

Cash Flow

1

2

3

4

$1,075

1,210

1,340

1,420

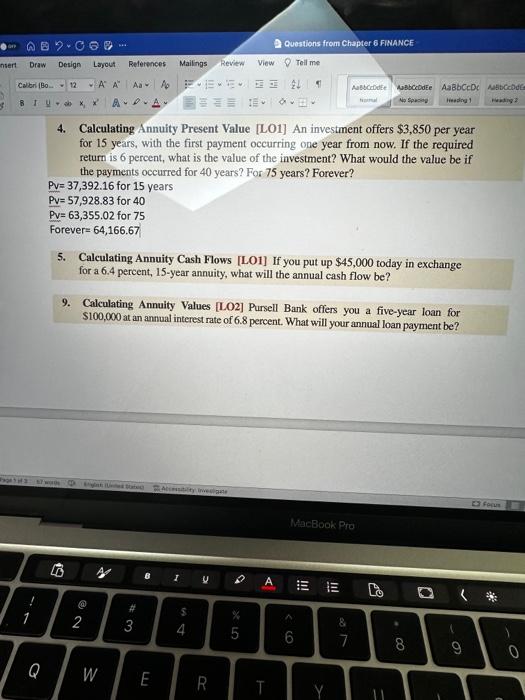

4. Calculating Annuity Present Value [LO1] An investment offers $3,850 per year for 15 years, with the first payment occurring one year from now. If the required return is 6 percent, what is the value of the investment? What would the value be if the payments occurred for 40 years? For 75 years? Forever?

Calculating Annuity Cash Flows [LO1] If you put up $45,000 today in exchange for a 6.4 percent, 15-year annuity, what will the annual cash flow be?

9. Calculating Annuity Values [LO2] Pursell Bank offers you a five-year loan for $100,000 at an annual interest rate of 6.8 percent. What will your annual loan payment be?

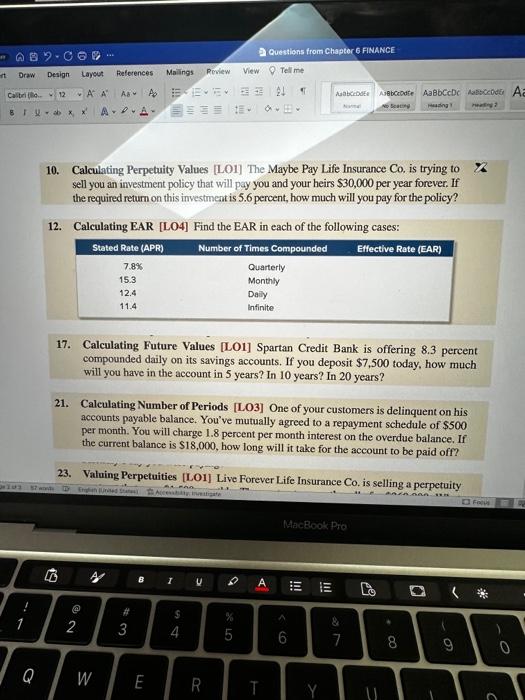

10. Calculating Perpetuity Values [L01] The Maybe Pay Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required return on this investment is 5.6 percent, how much will you pay for the policy?

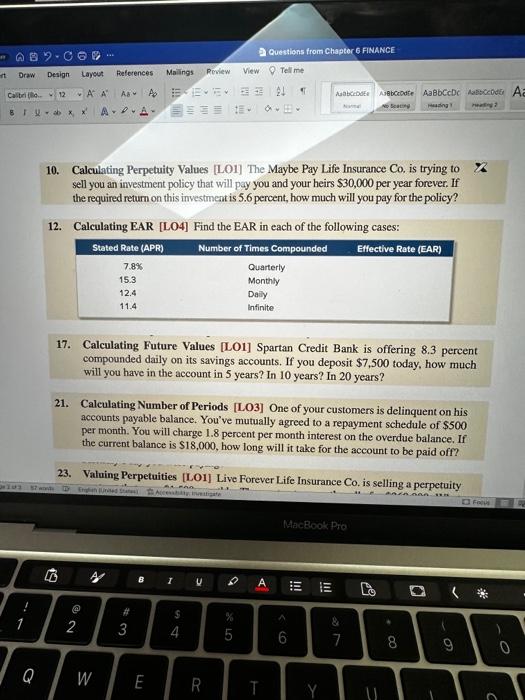

12. Calculating EAR [LO4] Find the EAR in each of the following cases:

Stated Rate (APR)

Number of Times Compounded

Effective Rate (EAR)

7.8%

15.3

12.4

11.4

Quarterly

Monthly

Daily

Infinite

17. Calculating Future Values [LO1] Spartan Credit Bank is offering 8.3 percent compounded daily on its savings accounts. If you deposit $7,500 today, how much will you have in the account in 5 years? In 10 years? In 20 years?

21. Calculating Number of Periods [LO3] One of your customers is delinquent on his accounts payable balance. You've mutually agreed to a repayment schedule of $500 per month. You will charge 1.8 percent per month interest on the overdue balance. If the current balance is $18,000, how long will it take for the account to be paid off?

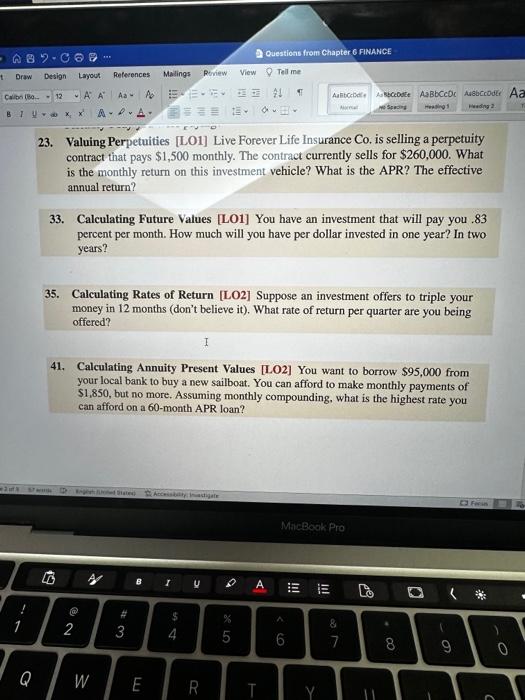

23. Valuing Perpetuities [LO1] Live Forever Life Insurance Co. is selling a perpetuity contract that pays $1,500 monthly. The contract currently sells for $260,000. What is the monthly return on this investment vehicle? What is the APR? The effective annual return?

33. Calculating Future Values [LO1] You have an investment that will pay you .83 percent per month. How much will you have per dollar invested in one year? In two years?

35. Calculating Rates of Return [LO2] Suppose an investment offers to triple your money in 12 months (don't believe it. What rate of return per quarter are you being offered?

41. Calculating Annuity Present Values [LO2] You want to borrow $95,000 from your local bank to buy a new sailboat. You can afford to make monthly payments of $1,850, but no more. Assuming monthly compounding, what is the highest rate you can afford on a 60-month APR loan?

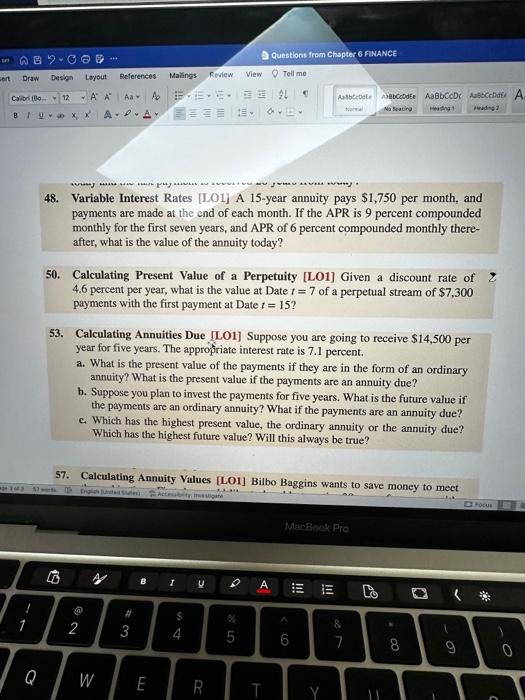

48.Variable Interest Rates [LO1] A 15-year annuity pays $1,750 per month, and payments are made at the end of each month. If the APR is 9 percent compounded monthly for the first seven years, and APR of 6 percent compounded monthly there-after, what is the value of the annuity today?

50.Calculating Present Value of a Perpetuity [LO1] Given a discount rate of

4.6 percent per year, what is the value at Date t = 7 of a perpetual stream of $7,300

payments with the first payment at Date t = 15?

53.Calculating Annuities Due [LO1] Suppose you are going to receive $14,500 per year for five years. The appropriate interest rate is 7.1 percent.

- What is the present value of the payments if they are in the form of an ordinary annuity? What is the present value if the payments are an annuity due?

- Suppose you plan to invest the payments for five years. What is the future value if the payments are an ordinary annuity? What if the payments are an annuity due?

- Which has the highest present value, the ordinary annuity or the annuity due? Which has the highest future value? Will this always be true?

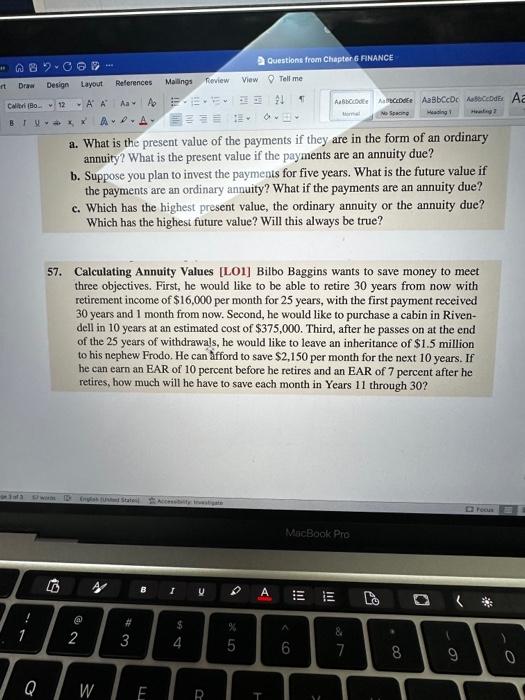

Calculating Annuity Values [LO1] Bilbo Baggins wants to save money to meet three objectives. First, he would like to be able to retire 30 years from now with retirement income of $16,000 per month for 25 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 10 years at an estimated cost of $375,000. Third, after he passes on at the end of the 25 years of withdrawals, he would like to leave an inheritance of $1.5 million to his nephew Frodo. He can fford to save $2,150 per month for the next 10 years. If he can earn an EAR of 10 percent before he retires and an EAR of 7 percent after he retires, how much will he have to save each month in Years 11 through 30?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started