please help me solve last question{17.07}

please help me solve last question{17.07}

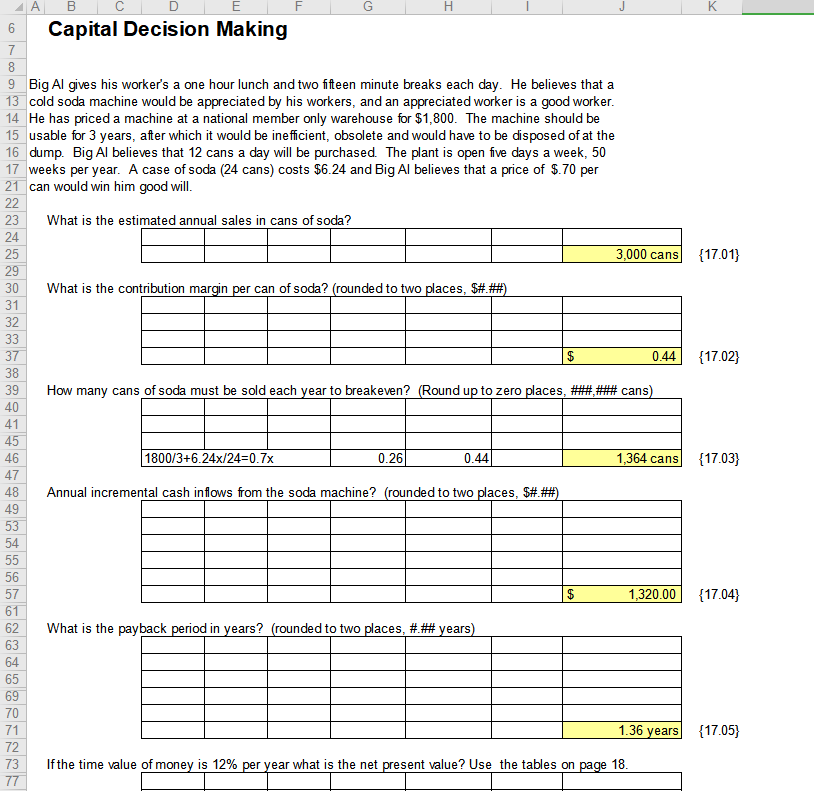

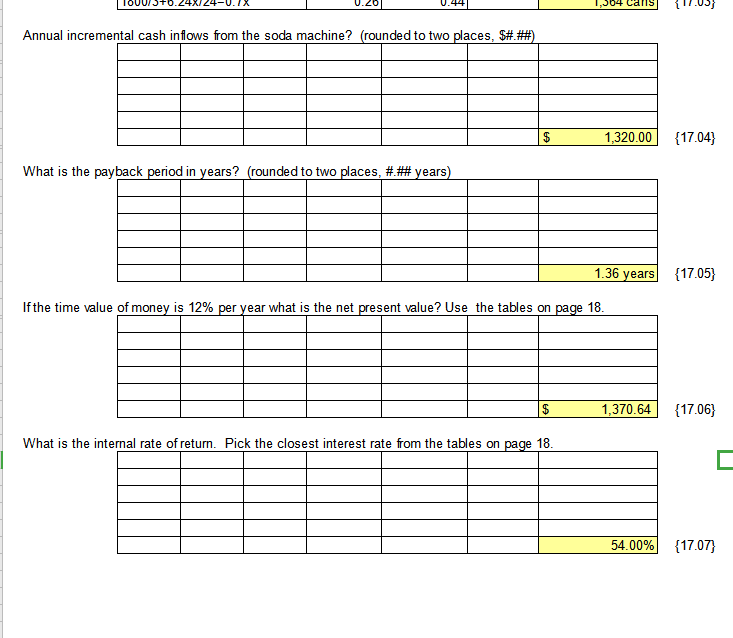

A F G 6 B C D E Capital Decision Making 9 Big Al gives his worker's a one hour lunch and two fifteen minute breaks each day. He believes that a 13 cold soda machine would be appreciated by his workers, and an appreciated worker is a good worker. 14 He has priced a machine at a national member only warehouse for $1,800. The machine should be 15 usable for 3 years, after which it would be inefficient, obsolete and would have to be disposed of at the 16 dump. Big Al believes that 12 cans a day will be purchased. The plant is open five days a week, 50 17 weeks per year. A case of soda (24 cans) costs $6.24 and Big Al believes that a price of $.70 per 21 can would win him good will. What is the estimated annual sales in cans of soda? 3,000 cans {17.01} What is the contribution margin per can of soda? (rounded to two places, $#.###) 0.44 {17.02} How many cans of soda must be sold each year to breakeven? (Round up to zero places, # # cans) 1800/3+6.24x/24=0.7x 0.26 0.44 1,364 cans (17.03} Annual incremental cash inflows from the soda machine? (rounded to two places, $#.##) 1,320.00 [17.04} What is the payback period in years? (rounded to two places, #.## years) 1.36 years {17.05} If the time value of money is 12% per year what is the net present value? Use the tables on page 18. | TOUUI5+6.24X124-U. IX U ? .441 1.964 Calis {17.03} Annual incremental cash inflows from the soda machine? (rounded to two places, $#.##) 1,320.00 [17.04) What is the payback period in years? (rounded to two places, #.## years) 1.36 years {17.05} If the time value of money is 12% per year what is the net present value? Use the tables on page 18. 1,370.64 {17.06} What is the internal rate of return. Pick the closest interest rate from the tables on page 18. 54.00% {17.07) A F G 6 B C D E Capital Decision Making 9 Big Al gives his worker's a one hour lunch and two fifteen minute breaks each day. He believes that a 13 cold soda machine would be appreciated by his workers, and an appreciated worker is a good worker. 14 He has priced a machine at a national member only warehouse for $1,800. The machine should be 15 usable for 3 years, after which it would be inefficient, obsolete and would have to be disposed of at the 16 dump. Big Al believes that 12 cans a day will be purchased. The plant is open five days a week, 50 17 weeks per year. A case of soda (24 cans) costs $6.24 and Big Al believes that a price of $.70 per 21 can would win him good will. What is the estimated annual sales in cans of soda? 3,000 cans {17.01} What is the contribution margin per can of soda? (rounded to two places, $#.###) 0.44 {17.02} How many cans of soda must be sold each year to breakeven? (Round up to zero places, # # cans) 1800/3+6.24x/24=0.7x 0.26 0.44 1,364 cans (17.03} Annual incremental cash inflows from the soda machine? (rounded to two places, $#.##) 1,320.00 [17.04} What is the payback period in years? (rounded to two places, #.## years) 1.36 years {17.05} If the time value of money is 12% per year what is the net present value? Use the tables on page 18. | TOUUI5+6.24X124-U. IX U ? .441 1.964 Calis {17.03} Annual incremental cash inflows from the soda machine? (rounded to two places, $#.##) 1,320.00 [17.04) What is the payback period in years? (rounded to two places, #.## years) 1.36 years {17.05} If the time value of money is 12% per year what is the net present value? Use the tables on page 18. 1,370.64 {17.06} What is the internal rate of return. Pick the closest interest rate from the tables on page 18. 54.00% {17.07)

please help me solve last question{17.07}

please help me solve last question{17.07}