Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me solve parts b and c problems. Thank You. b) New Look Ltd, manufactures glazed tiles. 10,000 boxes of tiles were manufactured. MRP

Please help me solve parts b and c problems. Thank You.

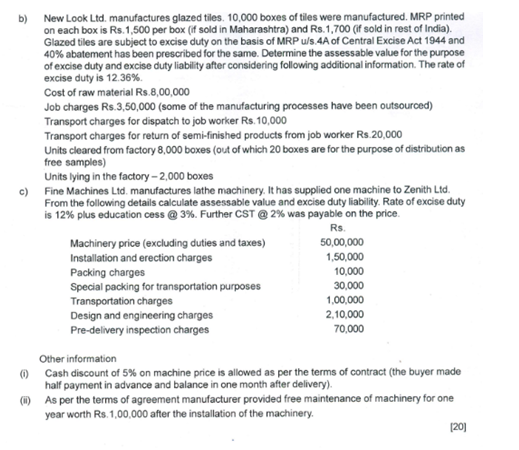

b) New Look Ltd, manufactures glazed tiles. 10,000 boxes of tiles were manufactured. MRP printed on each box is Rs.1,500 per box (if sold in Maharashtra) and Rs.1,700 (if sold in rest of India) Glazed tiles are subject to excise duty on the basis of MRP/S 4A of Central Excise Act 1944 and 40% abatement has been prescribed for the same. Determine the assessable value for the purpose of excise duty and excise duty liability after considering following additional information. The rate of excise duty is 12.36% Cost of raw material Rs.8,00,000 Job charges Rs.3,50,000 (some of the manufacturing processes have been outsourced) Transport charges for dispatch to job worker Rs. 10,000 Transport charges for return of semi-finished products from job worker Rs 20,000 Units cleared from factory 8,000 boxes (out of which 20 boxes are for the purpose of distribution as free samples) Units lying in the factory -2,000 boxes c) Fine Machines Ltd manufactures lathe machinery. It has supplied one machine to Zenith Ltd. From the following details calculate assessable value and excise duty liability. Rate of excise duty is 12% plus education cess @ 3%. Further CST @2% was payable on the price Rs. Machinery price (excluding duties and taxes) 50,00,000 Installation and erection charges 1,50,000 Packing charges 10,000 Special packing for transportation purposes 30,000 Transportation charges 1,00,000 Design and engineering charges 2,10,000 Pre-delivery inspection charges 70,000 Other information 0 Cash discount of 5% on machine price is allowed as per the terms of contract (the buyer made half payment in advance and balance in one month after delivery) m) As per the terms of agreement manufacturer provided free maintenance of machinery for one year worth Rs. 1,00,000 after the installation of the machinery. (20)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started