Please help me solve this assigment

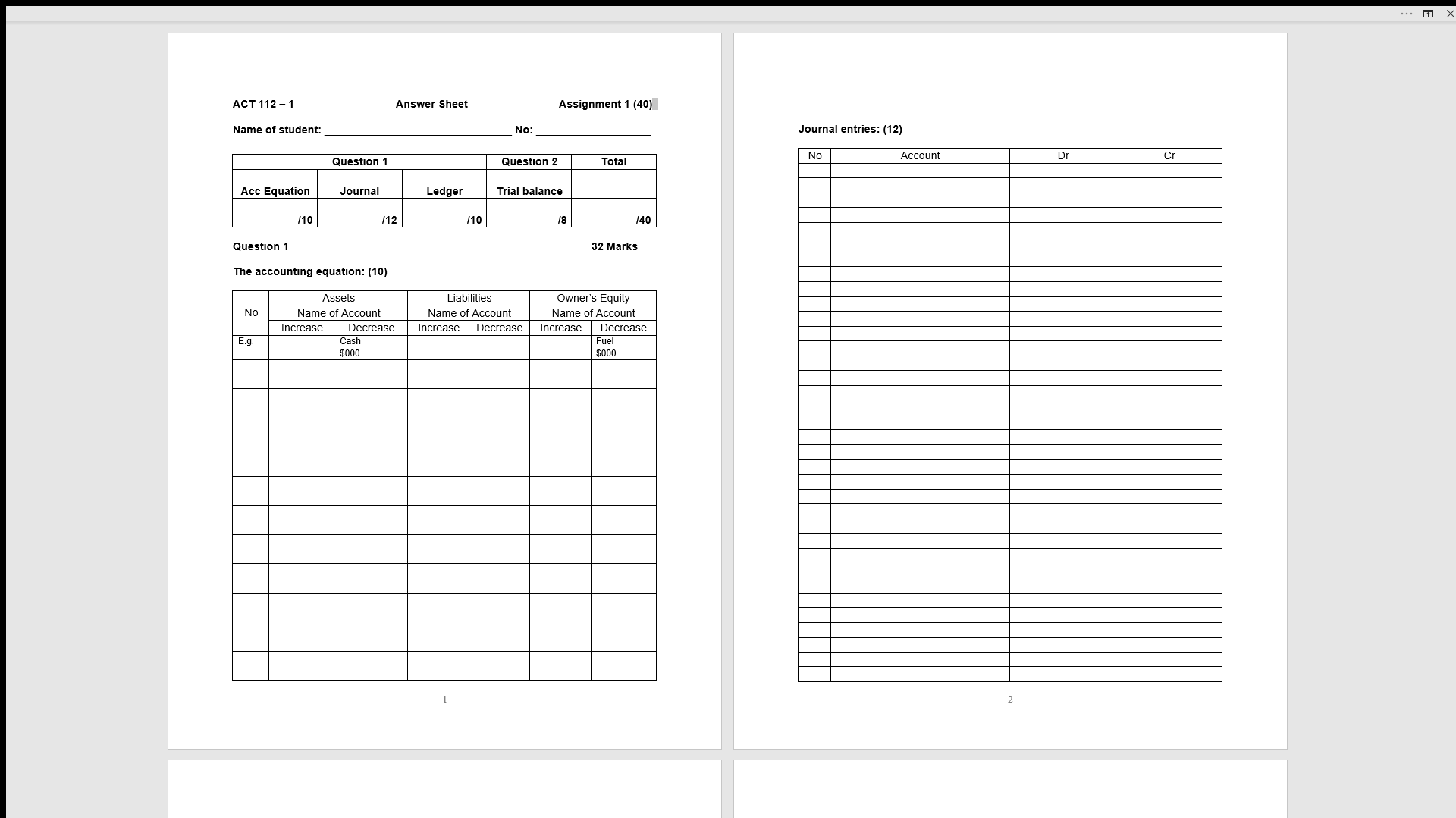

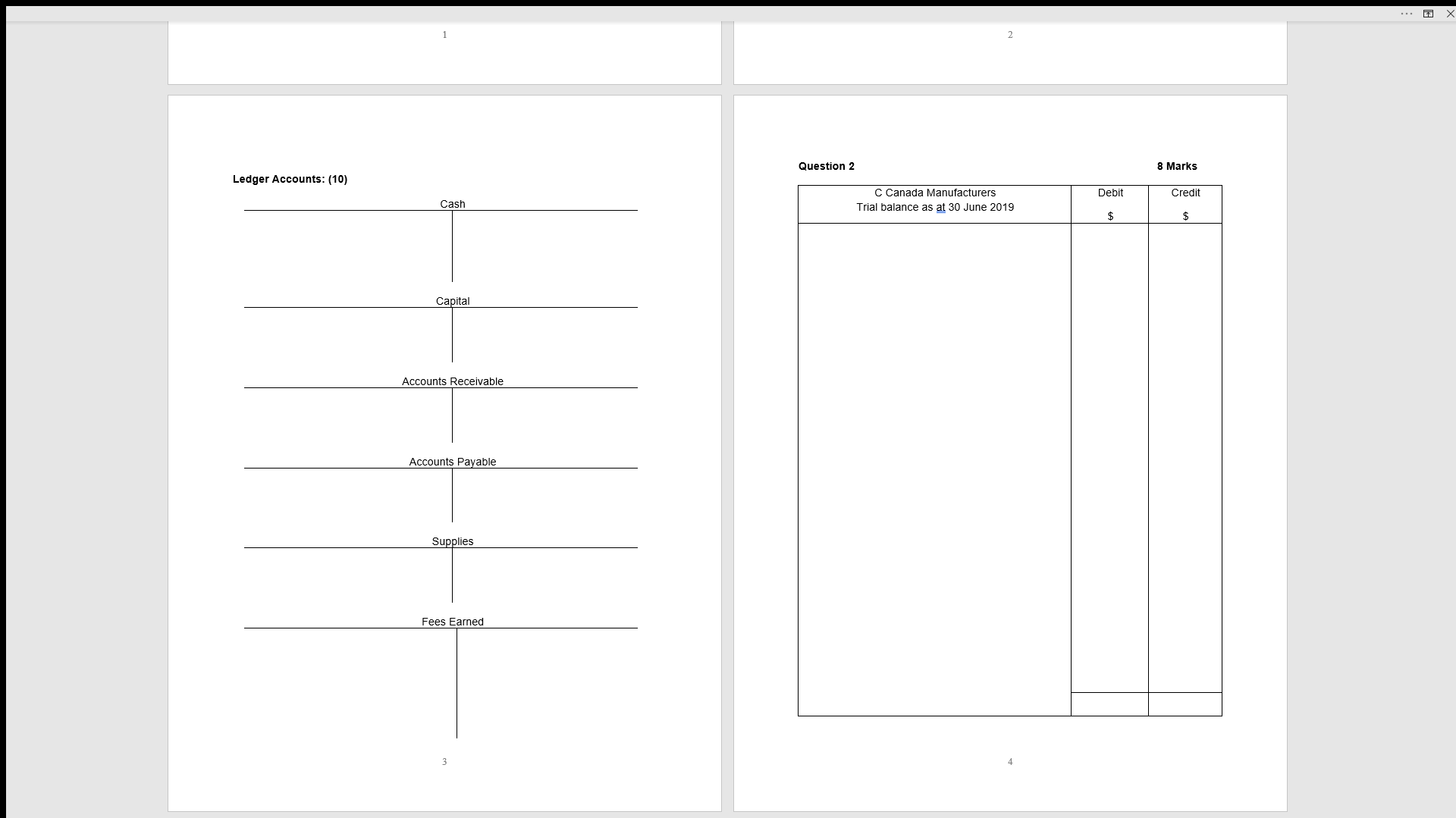

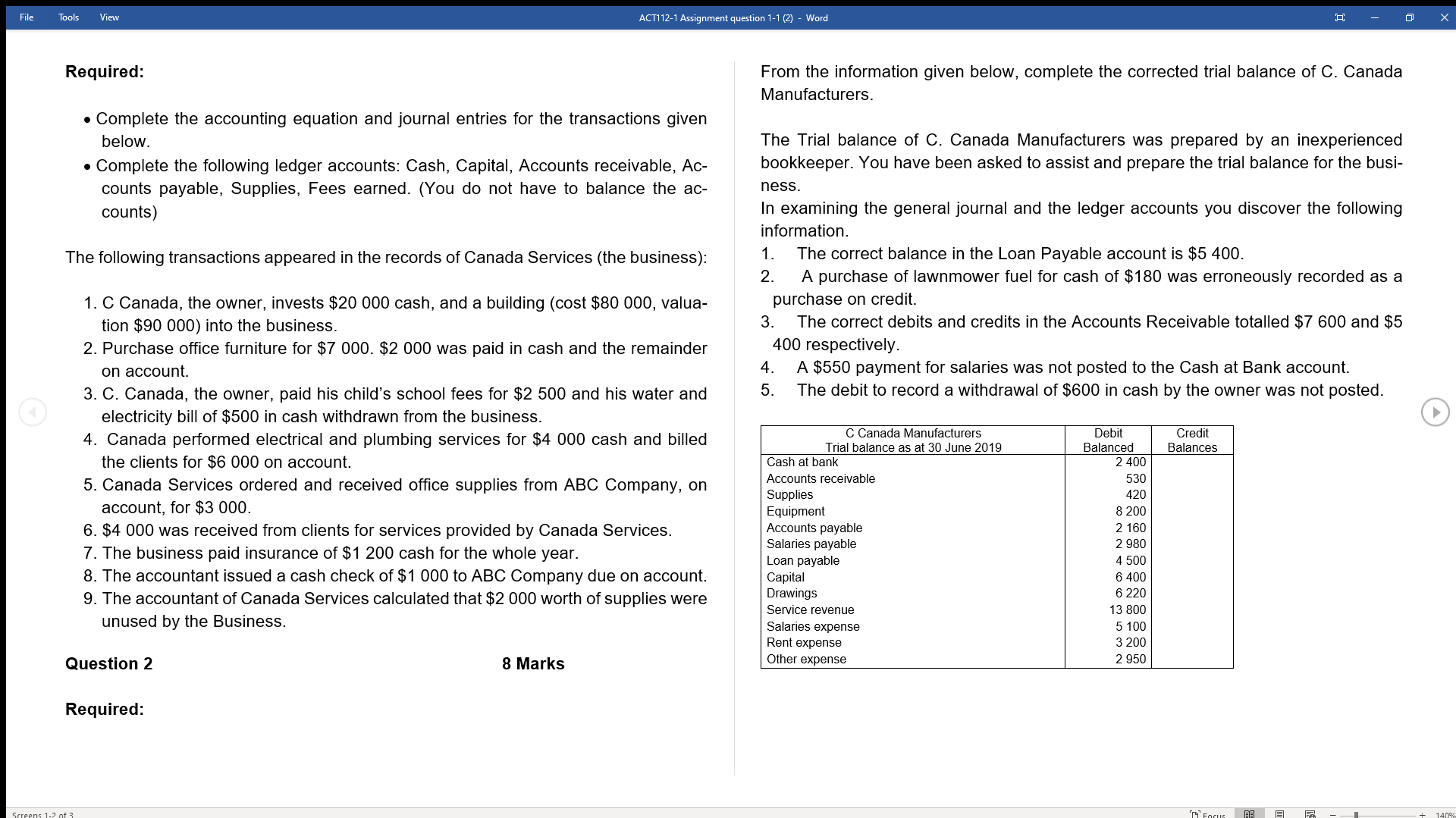

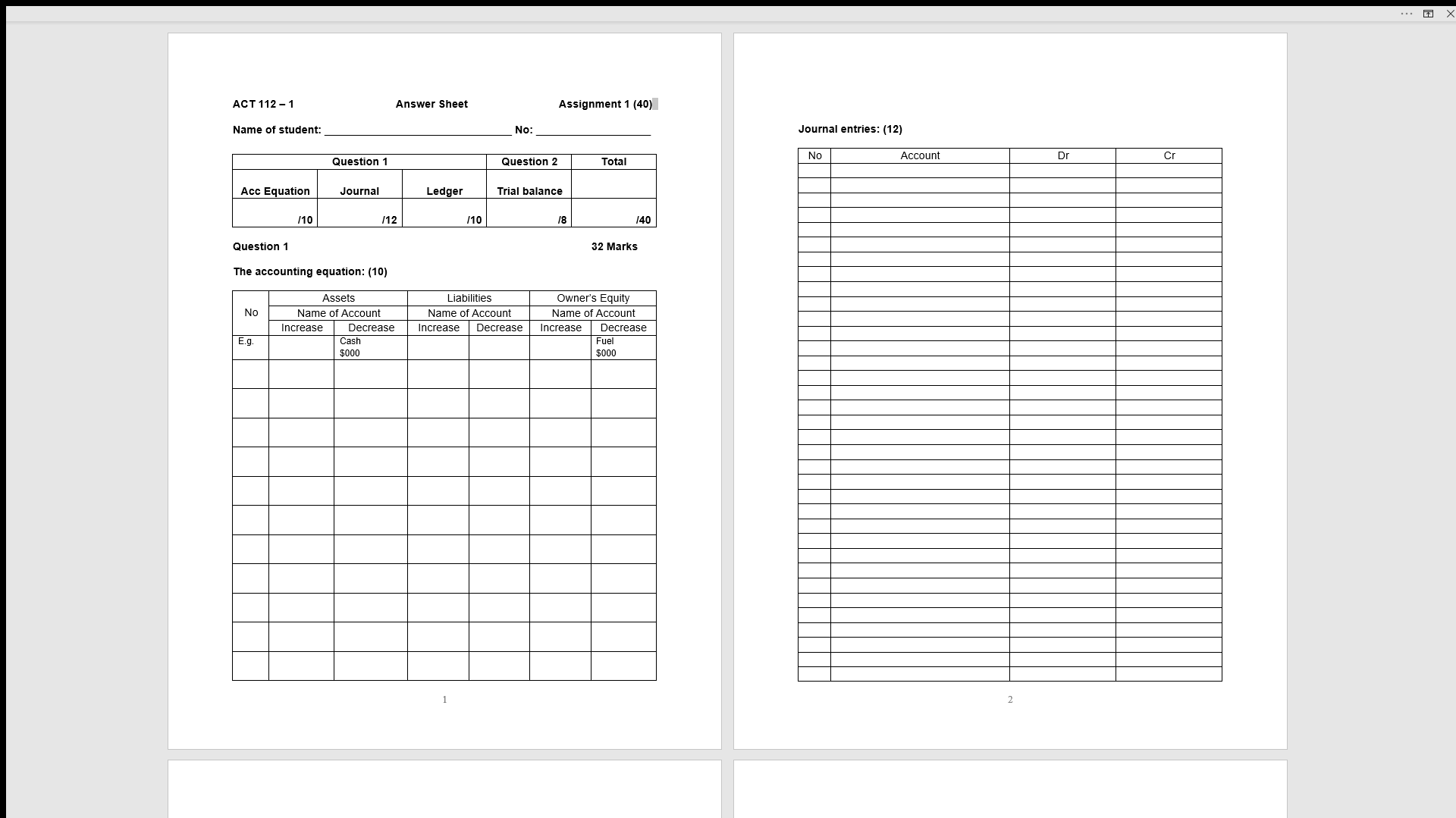

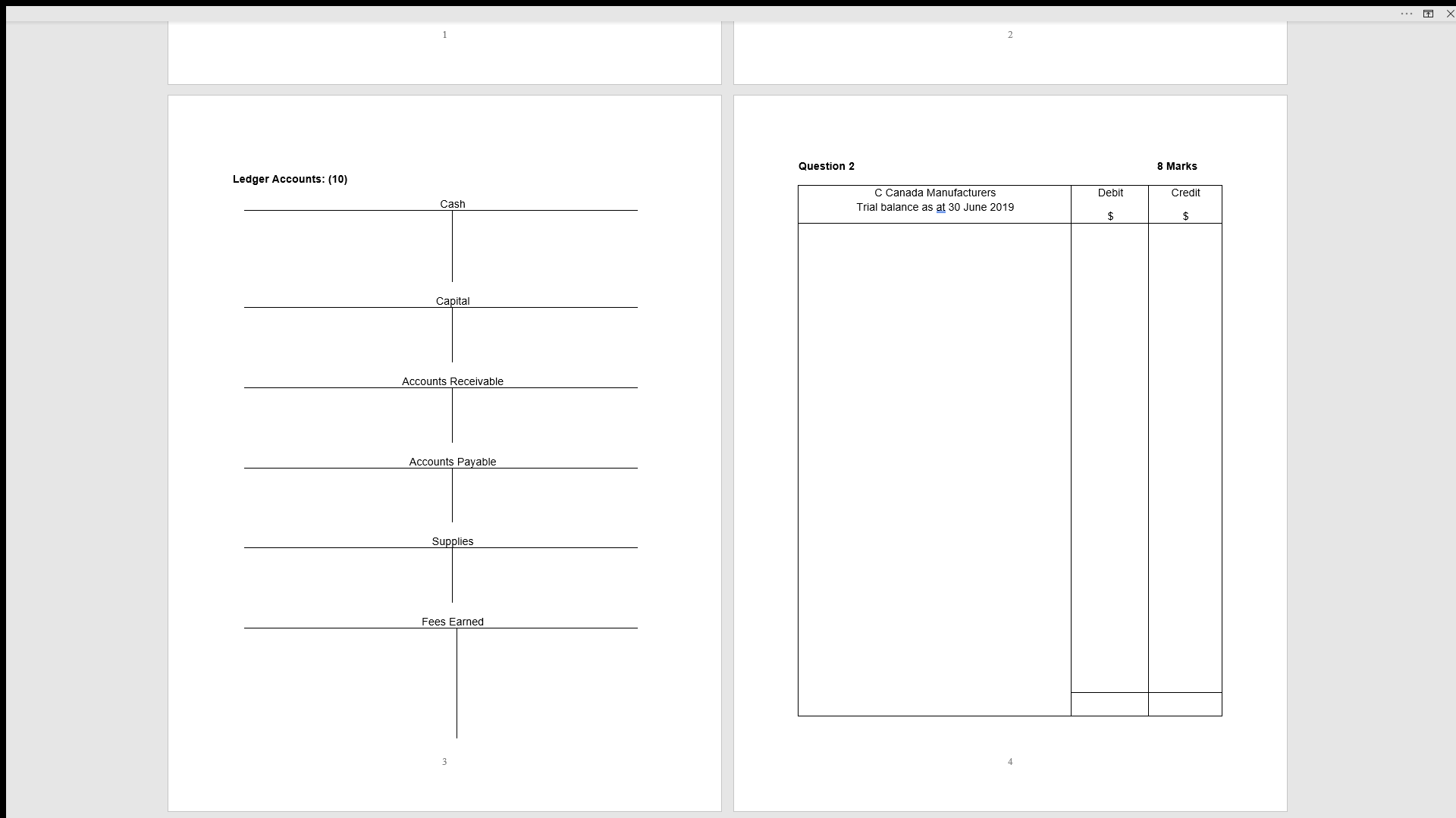

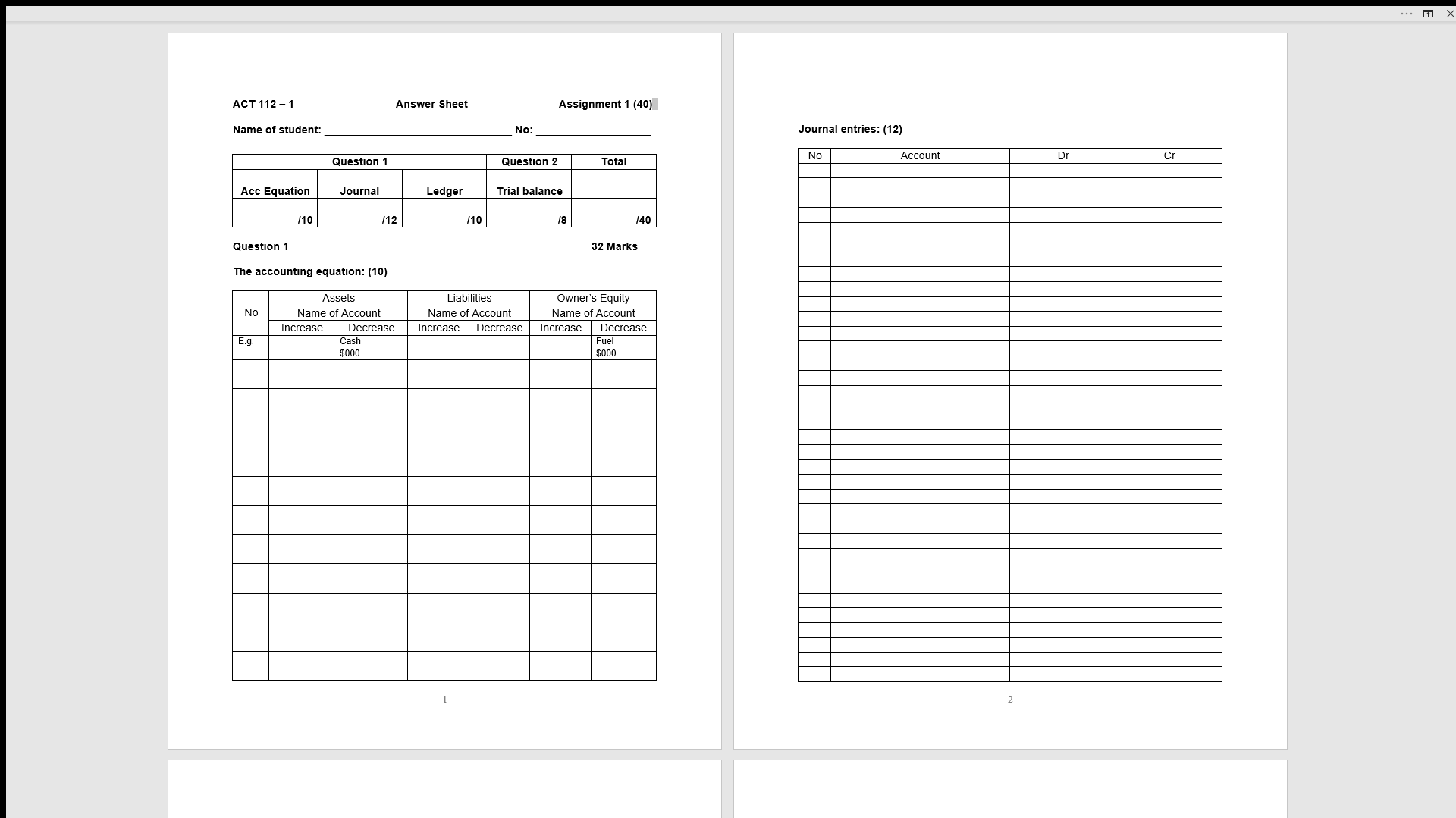

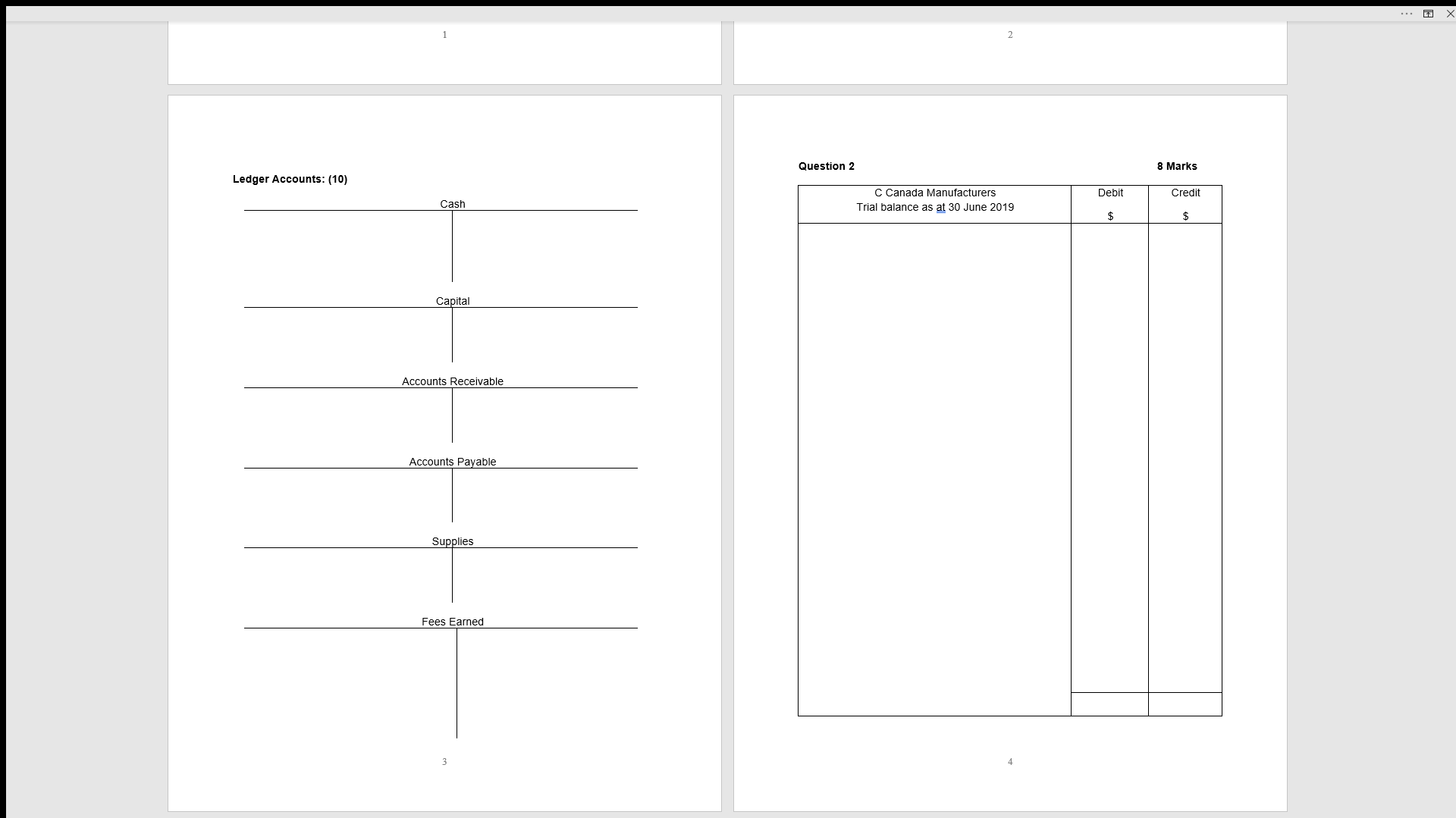

File Tools View ACT112-1 Assignment question 1-1 (2) - Word X Required: From the information given below, complete the corrected trial balance of C. Canada Manufacturers. . Complete the accounting equation and journal entries for the transactions given below. The Trial balance of C. Canada Manufacturers was prepared by an inexperienced . Complete the following ledger accounts: Cash, Capital, Accounts receivable, Ac- bookkeeper. You have been asked to assist and prepare the trial balance for the busi- counts payable, Supplies, Fees earned. (You do not have to balance the ac- ness. counts) In examining the general journal and the ledger accounts you discover the following information. The following transactions appeared in the records of Canada Services (the business): 1 . The correct balance in the Loan Payable account is $5 400. 2. A purchase of lawnmower fuel for cash of $180 was erroneously recorded as a 1. C Canada, the owner, invests $20 000 cash, and a building (cost $80 000, valua- purchase on credit. tion $90 000) into the business. 3 . The correct debits and credits in the Accounts Receivable totalled $7 600 and $5 2. Purchase office furniture for $7 000. $2 000 was paid in cash and the remainder 400 respectively. on account. 4. A $550 payment for salaries was not posted to the Cash at Bank account. 3. C. Canada, the owner, paid his child's school fees for $2 500 and his water and 5 . The debit to record a withdrawal of $600 in cash by the owner was not posted. electricity bill of $500 in cash withdrawn from the business. 4. Canada performed electrical and plumbing services for $4 000 cash and billed C Canada Manufacturers Debit Credit Trial balance as at 30 June 2019 Balanced Balances the clients for $6 000 on account. Cash at bank 2 400 5. Canada Services ordered and received office supplies from ABC Company, on Accounts receivable 530 Supplies 420 account, for $3 000. Equipment 8 200 6. $4 000 was received from clients for services provided by Canada Services. Accounts payable 2 160 7. The business paid insurance of $1 200 cash for the whole year. Salaries payable 2 980 Loan payable 4 500 8. The accountant issued a cash check of $1 000 to ABC Company due on account. Capital 6 400 9. The accountant of Canada Services calculated that $2 000 worth of supplies were Drawings 6 220 unused by the Business. Service revenue 13 800 Salaries expense 5 100 Rent expense 3 20 Question 2 8 Marks Other expense 2 950 Required:... ACT 112 - 1 Answer Sheet Assignment 1 (40) Name of student: No: Journal entries: (12) Question 1 Question 2 Total No Account Dr Cr Acc Equation Journal Ledger Trial balance /10 /12 /10 140 Question 1 32 Marks The accounting equation: (10) Assets Liabilities Owner's Equity No Name of Account Name of Account Name of Account Increase Decrease Increase Decrease Increase Decrease E.g Cash Fuel $000 $000... Question 2 8 Marks Ledger Accounts: (10) C Canada Manufacturers Debit Credit Cash Trial balance as at 30 June 2019 $ Capital Accounts Receivable Accounts Payable Supplies Fees Earned