Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me solve this question, course Accounting 107, thank you. Following are the non-strategic investment transactions of Corona Inc.: 2020 Jan. 1 Purchased for

please help me solve this question, course Accounting 107, thank you.

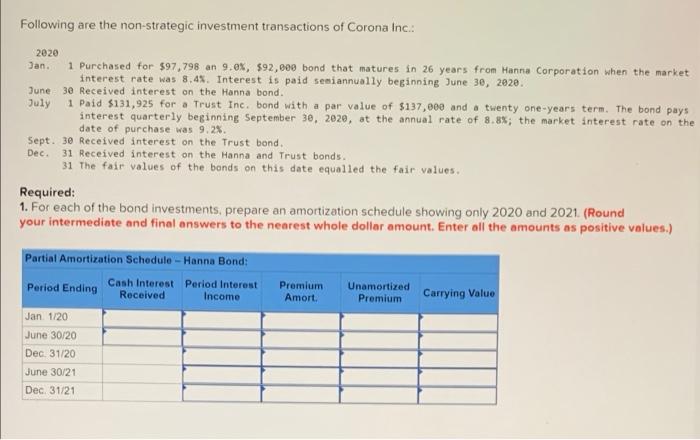

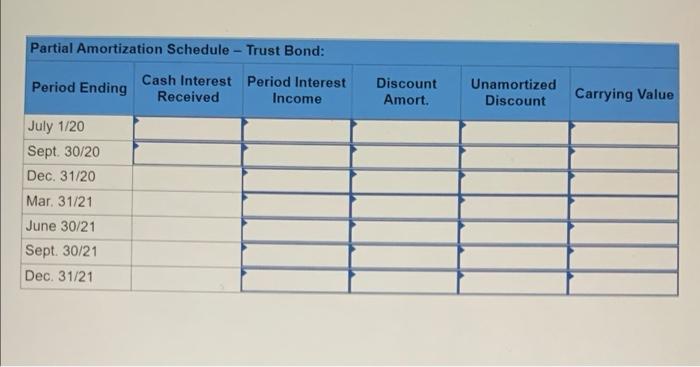

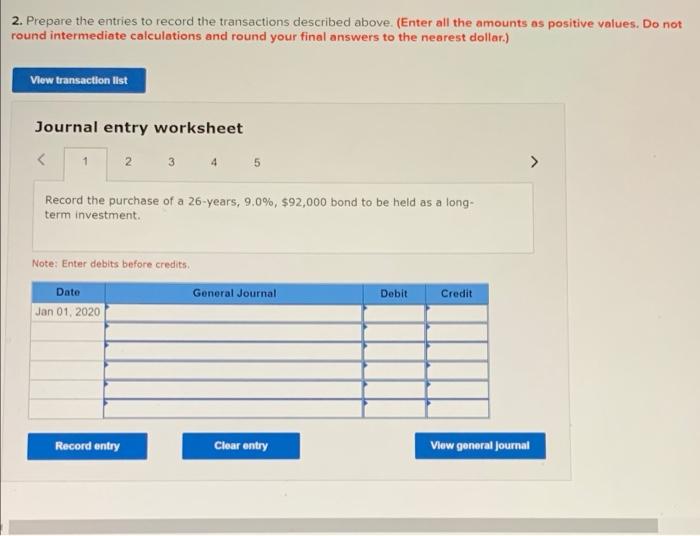

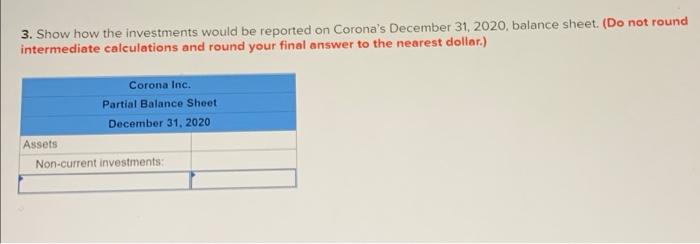

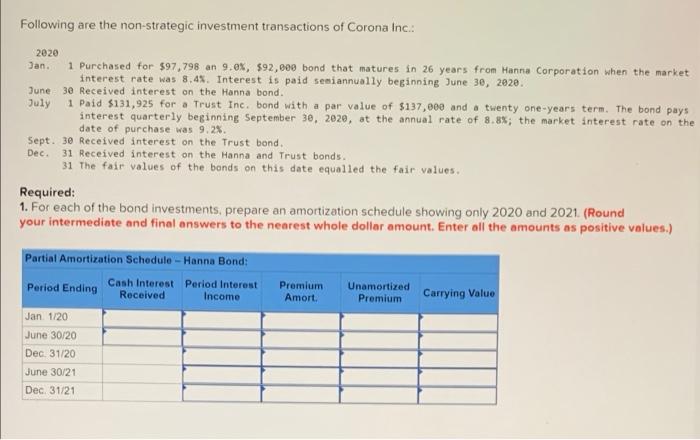

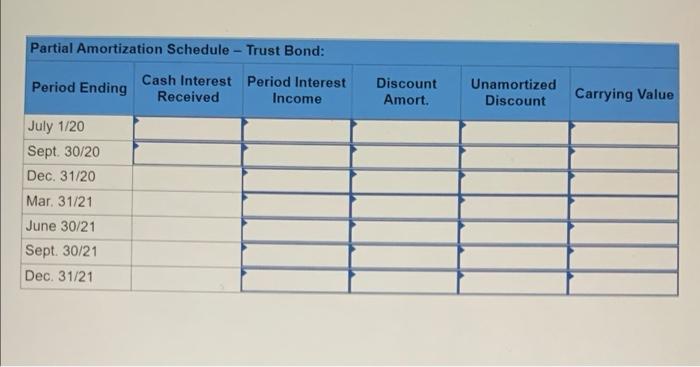

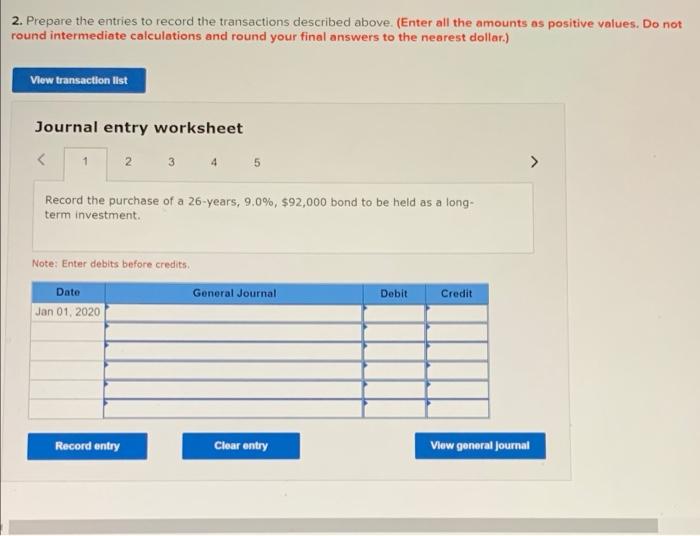

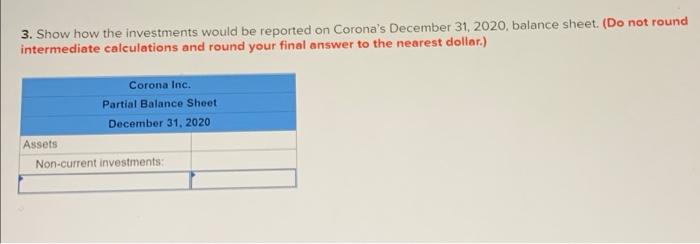

Following are the non-strategic investment transactions of Corona Inc.: 2020 Jan. 1 Purchased for $97,798 an 9.0%, 892,800 bond that matures in 26 years from Hanna Corporation when the market interest rate was 8,4%. Interest is paid semiannually beginning June 30, 2020. June 30 Received interest on the Hanna bond. July 1 Paid $131,925 for a Trust Inc. bond with a par value of $137,000 and a twenty one-years term. The bond pays interest quarterly beginning September 30, 2020, at the annual rate of 8.8%; the market interest rate on the date of purchase was 9.2%. Sept. 30 Received interest on the Trust bond. Dec. 31 Received interest on the Hanna and Trust bonds. 31 The fair values of the bonds on this date equalled the fair values. Required: 1. For each of the bond investments, prepare an amortization schedule showing only 2020 and 2021. (Round your intermediate and final answers to the nearest whole dollar amount. Enter all the amounts as positive values.) Premium Amort Unamortized Premium Carrying Value Partial Amortization Schedule - Hanna Bond: Cash Interest Period interest Period Ending Received Income Jan 1/20 June 30/20 Dec 31/20 June 30/21 Dec 31/21 Partial Amortization Schedule - Trust Bond: Period Ending Cash Interest Period Interest Received Income Discount Amort. Unamortized Discount Carrying Value July 1/20 Sept. 30/20 Dec. 31/20 Mar. 31/21 June 30/21 Sept. 30/21 Dec. 31/21 2. Prepare the entries to record the transactions described above. (Enter all the amounts as positive values. Do not round intermediate calculations and round your final answers to the nearest dollar.) View transaction list Journal entry worksheet Record the purchase of a 26-years, 9.0%, $92,000 bond to be held as a long- term investment Note: Enter debits before credits. General Journal Debit Credit Date Jan 01, 2020 Record entry Clear entry View general Journal 3. Show how the investments would be reported on Corona's December 31, 2020, balance sheet. (Do not round intermediate calculations and round your final answer to the nearest dolor.) Corona Inc. Partial Balance Sheet December 31, 2020 Assets Non-current investments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started