Answered step by step

Verified Expert Solution

Question

1 Approved Answer

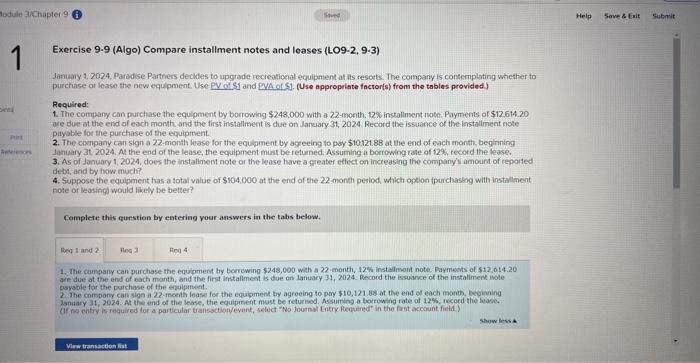

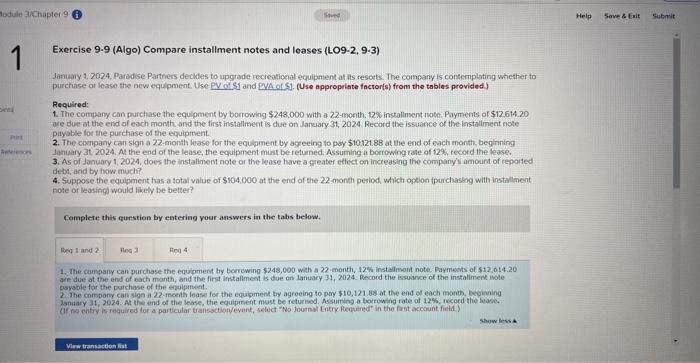

Please help me solve this, thanks! Exercise 99 (Algo) Compare installment notes and leases (LO9-2, 9.3) January 1, 2024, Paradise Partners decides to upgrade recreational

Please help me solve this, thanks!

Exercise 99 (Algo) Compare installment notes and leases (LO9-2, 9.3) January 1, 2024, Paradise Partners decides to upgrade recreational equipment at its resotts. The company is consemplating whicther to purchase of lease the new equpment, Use PV ofS1 and BVA af S1. (Use appropelate factor(s) from the tables provided) Required: 1. The company can purchase the equipment by borrowing $248.000 with a 22 -month. 129 installment note. Payments of $12.614.20 are due at the end of each month, and the first instalinent is due on lareary 31,2024. Record the issuance of the instaliment note payable for the purchase of the equipment. 2. The company can sign a 22-month lease for the equpinent by agreeing to poy $10121.88 at the end of each month. beginiting Janisary 3t, 2024. At the end of the lease, the equipment miast be returned. Assuming a borrowing rate of 129 , record the fease. 3. As of January 1, 2024, does the instaliment note or the lease tare a greater etcet on increasing the company's amount of teporied de-bt, and by how much? 4. Suppose the equipment has a total value of $104,000 at the end of the 22 -month petiod, which option ipurchashog with installinent note of leasingh would likety be better? Complete this question by entering your answers in the tabs below. 1. The campany can purchase the equipment by borrowing $248,000 wath a 22 -month, 12% instalmont note. Bayments of $12,0:4.20 are due at the end of each manth, and the first installment is due on lativary 31, 2024. Record the issuance of the instaliment iote psyable for the puichase of the eqalpiment. 1sniary 31, 2024. At the end of the lease, the equipinent must be returned. Assurting a borrowing rate of 125, recoed the tease. (if na entity is required for a particular transsoctionvevent, select "No Journsi Entry flecuired" in the fast acoount field. Exercise 99 (Algo) Compare installment notes and leases (LO9-2, 9.3) January 1, 2024, Paradise Partners decides to upgrade recreational equipment at its resotts. The company is consemplating whicther to purchase of lease the new equpment, Use PV ofS1 and BVA af S1. (Use appropelate factor(s) from the tables provided) Required: 1. The company can purchase the equipment by borrowing $248.000 with a 22 -month. 129 installment note. Payments of $12.614.20 are due at the end of each month, and the first instalinent is due on lareary 31,2024. Record the issuance of the instaliment note payable for the purchase of the equipment. 2. The company can sign a 22-month lease for the equpinent by agreeing to poy $10121.88 at the end of each month. beginiting Janisary 3t, 2024. At the end of the lease, the equipment miast be returned. Assuming a borrowing rate of 129 , record the fease. 3. As of January 1, 2024, does the instaliment note or the lease tare a greater etcet on increasing the company's amount of teporied de-bt, and by how much? 4. Suppose the equipment has a total value of $104,000 at the end of the 22 -month petiod, which option ipurchashog with installinent note of leasingh would likety be better? Complete this question by entering your answers in the tabs below. 1. The campany can purchase the equipment by borrowing $248,000 wath a 22 -month, 12% instalmont note. Bayments of $12,0:4.20 are due at the end of each manth, and the first installment is due on lativary 31, 2024. Record the issuance of the instaliment iote psyable for the puichase of the eqalpiment. 1sniary 31, 2024. At the end of the lease, the equipinent must be returned. Assurting a borrowing rate of 125, recoed the tease. (if na entity is required for a particular transsoctionvevent, select "No Journsi Entry flecuired" in the fast acoount field

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started