Answered step by step

Verified Expert Solution

Question

1 Approved Answer

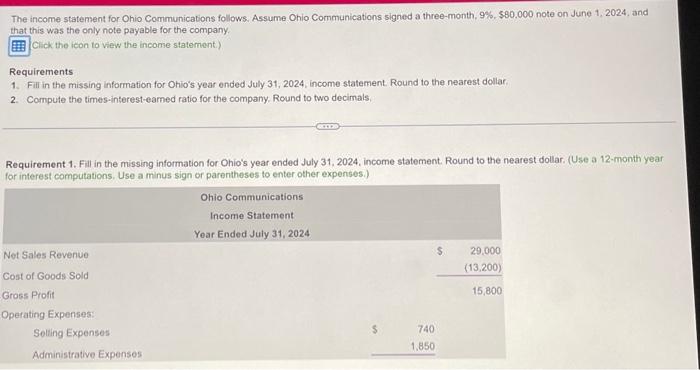

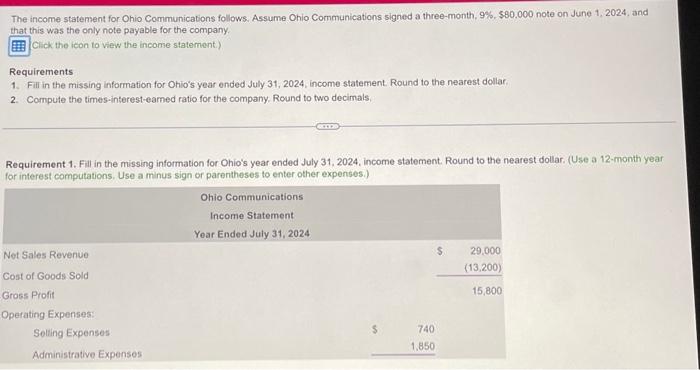

please help me solve this!! The income statement for Ohio Communications follows. Assume Ohio Communications signed a three-month, 9%. 580.000 note on June 1, 2024,

please help me solve this!!

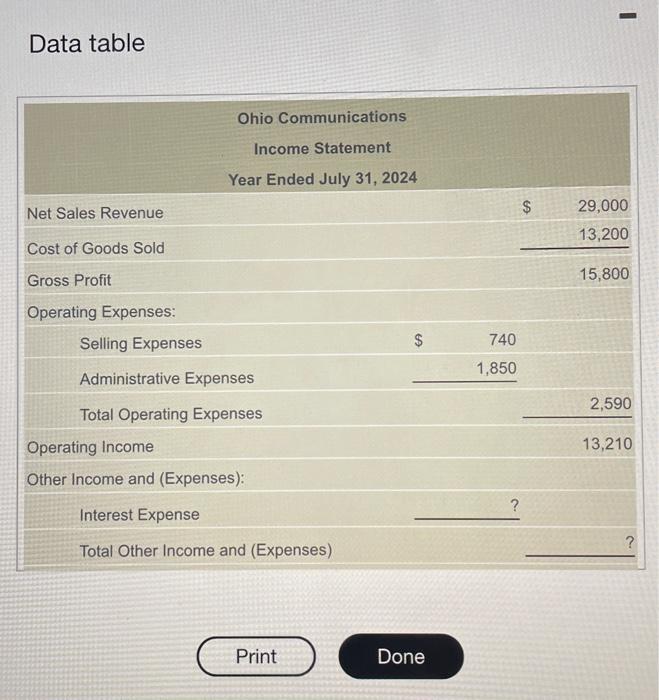

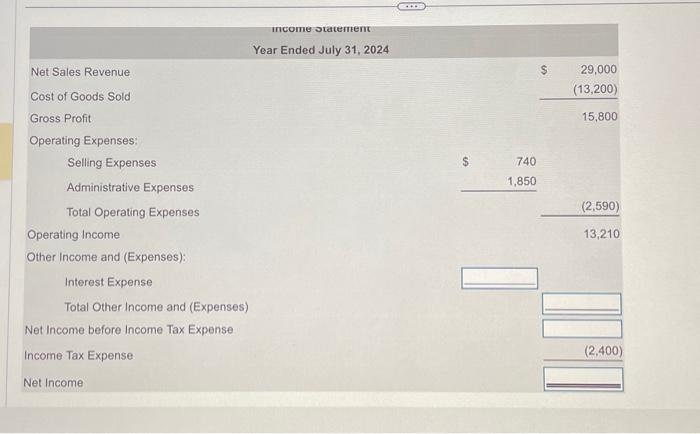

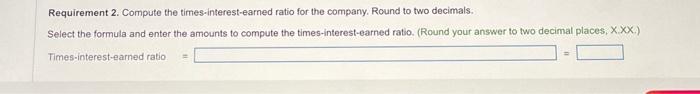

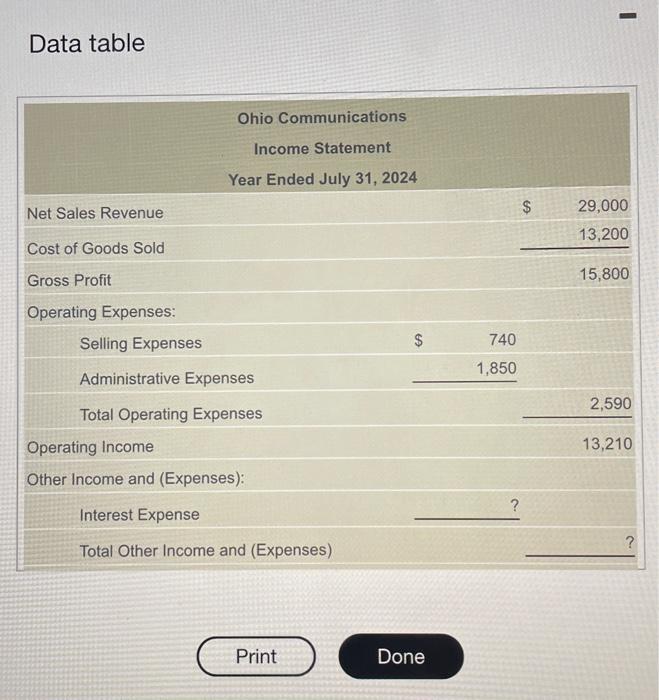

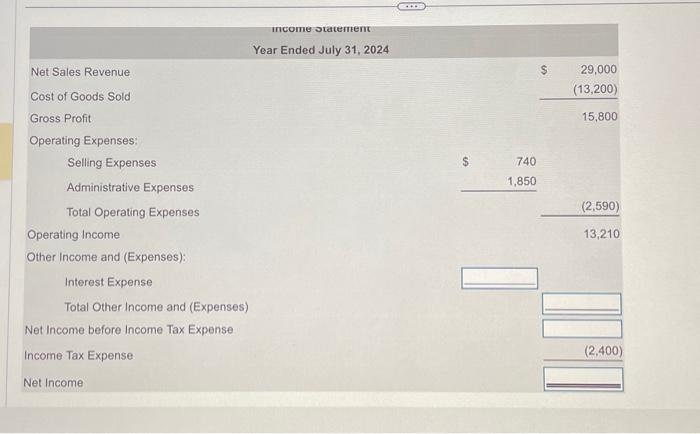

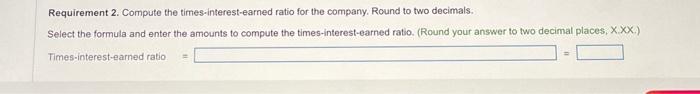

The income statement for Ohio Communications follows. Assume Ohio Communications signed a three-month, 9%. 580.000 note on June 1, 2024, and that this was the only note payable for the company. Click the icon to view the income statement.) Requirements 1. Fill in the missing information for Ohio's year ended July 31, 2024, income statement. Round to the nearest dollar. 2. Compute the timesinterest-eamed ratio for the company. Round to two decimals. Requirement 1. Fill in the missing information for Ohio's year ended July 31, 2024, income statement. Round to the nearest dollar. (Use a 12-month year for interest computations. Use a minus sign or parentheses to enter other expenses.) nata tahla Year Ended July 31, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit $9,000(13,200)15,800 Operating Expenses: Selling Expenses Administrative Expenses Operating Income \begin{tabular}{rr} $740 & \\ 1,850 & \\ \( {(2,590)} \\ {\hline} &{13,210} \) \end{tabular} Other Income and (Expenses): Interest Expense Total Other Income and (Expenses) Net Income before income Tax Expense Income Tax Expense Net Income Requirement 2. Compute the times-interest-earned ratio for the company. Round to two decimals. Select the formula and enter the amounts to compute the times-interest-earned ratio. (Round your answer to two decimal places, X. XX.) Times-interest-earned ratio =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started