Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me. thank you. On December 30, you decide to make a $3,400 charitable donation. (Assume you itemize your deductions.) (a) If you are

please help me. thank you.

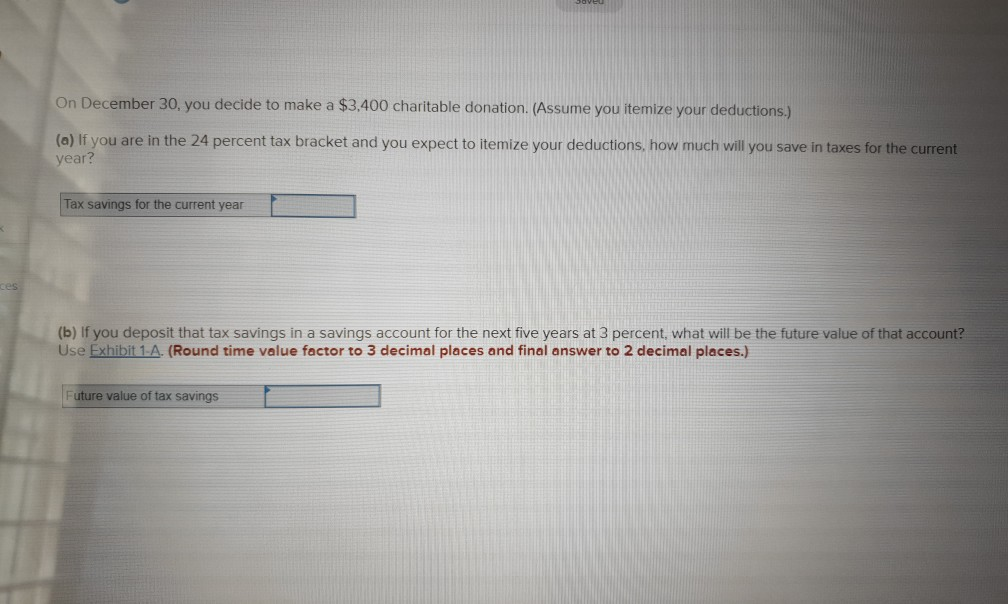

On December 30, you decide to make a $3,400 charitable donation. (Assume you itemize your deductions.) (a) If you are in the 24 percent tax bracket and you expect to itemize your deductions, how much will you save in taxes for the current year? Tax savings for the current year (b) If you deposit that tax savings in a savings account for the next five years at 3 percent, what will be the future value of that account? Use Exhibit 1-A. (Round time value factor to 3 decimal places and final answer to 2 decimal places.) Future value of tax savings If a person with a 24 percent tax bracket makes a deposit of $5,600 to a tax-deferred retirement account, what amount would be saved on current taxes? Current tax savings A payday loan company charges 7.75 percent interest for a two-week period. What is the annual interest rate? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Annual percentage rate %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started