Answered step by step

Verified Expert Solution

Question

1 Approved Answer

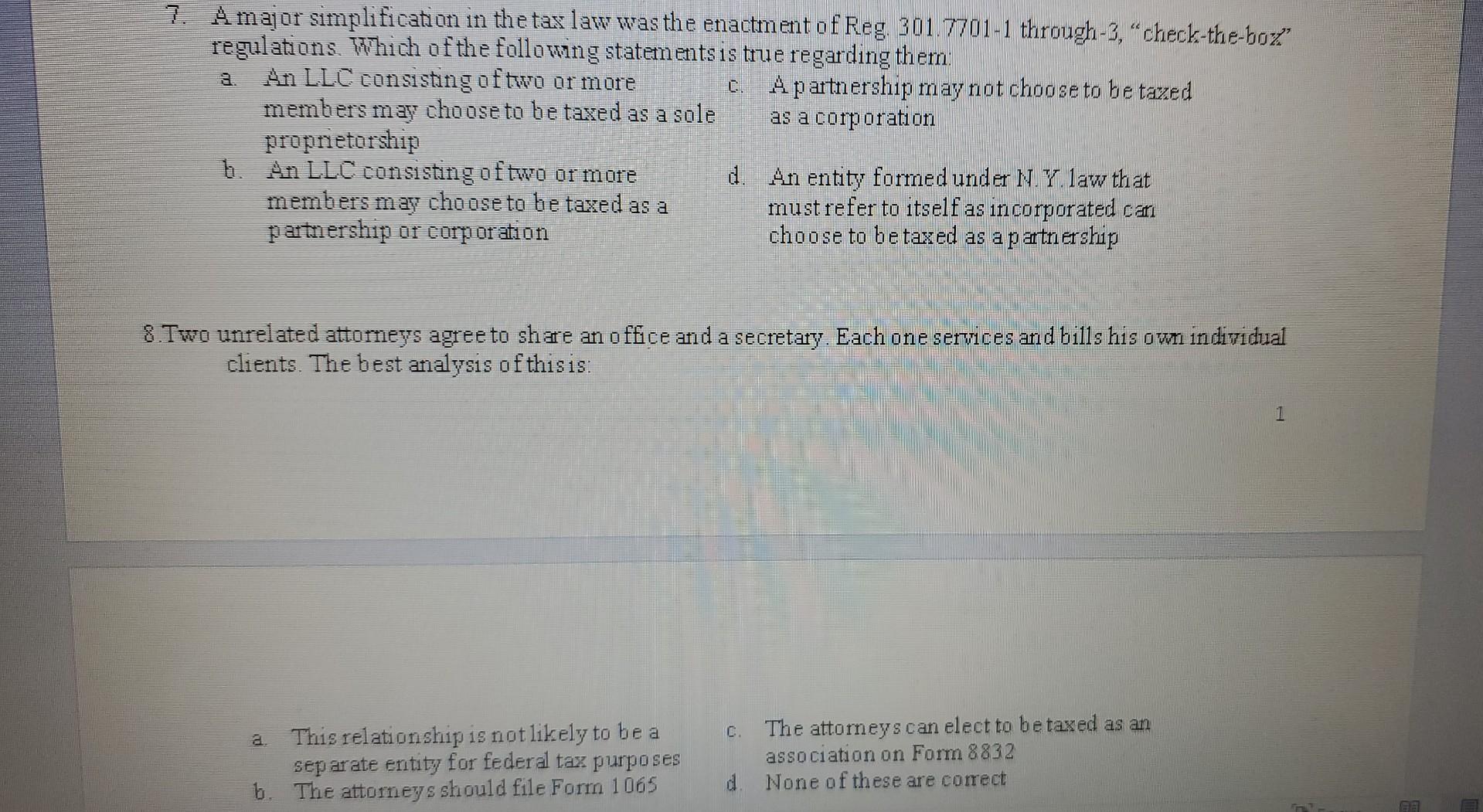

plz help 7. Amajor simplification in the tax law was the enactment of Reg. 301.77011 through-3, check-the-boz regulations. Which of the follomng statements is true

plz help

7. Amajor simplification in the tax law was the enactment of Reg. 301.77011 through-3, "check-the-boz" regulations. Which of the follomng statements is true regarding them: a. An LLC consisting of twa or more c. A partnership nay not choose to be tazed membersmay choose to be taxed as a sole as a corporation proptietorship b. An LLC consisting of two or more d. An entity formedunder N. Y. law that members may choose to be taxed as a must fefer to itself as incorporated can parthership or corporation choose to be taxed as a partriership 8. Two unrelated attorneys agree to share an office and a secretary. Each one serrices and bills his own individual clients. The best analysis of thisis: a. This relationship is not likely to be a c. The attomeys can elect to be taxed as an separate entity for federal tax purposes association an Farm 8832 b. The attorneys should file Form 1065 d. None of these are correctStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started