please help me the change probabilities

probability 0.33, 0.27, 0.10, 0.30

all numbers same

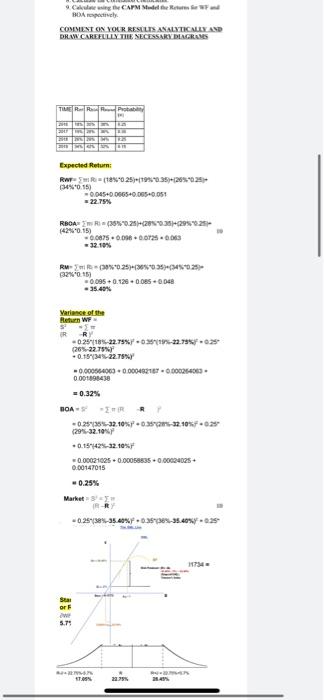

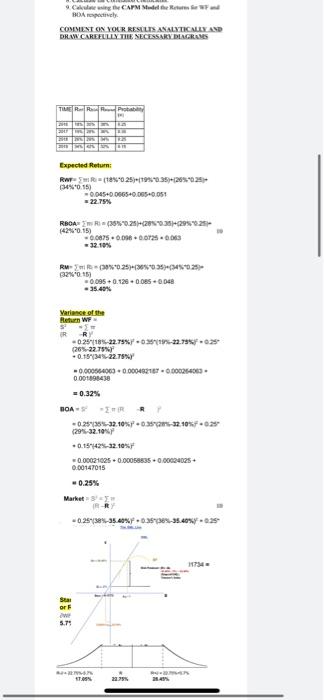

BA 1 Spring 2021 Time: 3:36-6.15 PM Question 1: (20 points) Dr. Poseidon", a young CEO of the "Aris Bunk bolds a Me of Science in Finance degree with speciali a Capote University from the Rinky Dinky Universe Stand 2021 D Poseidon would deliver lecture for er Finance Association the State Univery Meme in him her to compute the following variable TIME RWF) BOAR|Market Probability Assume that the Risk Free Rate is 3% Calculate the expected Raum Calculate the Variances Calculate the Risks Calculate the Covariances Calculate the Bets and commalytically Calculate the Sharpente and comment Calculate the resor'station and comment mytically 6.Draw the SML and the CML respectively 7. Calculate the Coeficients of Vatice & Calculate the correlation Coefficients Calculate using the CAPM Mode the course Want HOA respectively COMMENT ON YOUR RESULTS ANALYTICALLY AND DRAW CAREFULLY THE NECESSARY DIAGRAMS TIME RRR Pro 2003 Expected Return; RWF ET RI (18**0_25(****0.35+(28**0:25) (0.15) -0.0450.0065-0.0650.051 = 22.75% RBOAIER 35%*0:25)(2800.351210025 (425*0.15) -0.0875 0.098 0.0725 0.063 = 32.10% 10 Rm Ri (38%0.25)-36% 0:35)+(348 -0.25) (32% 0.15) -0.096 0.126 +0.005 0.04 - 35.40% Variance of the Return WF- 02518%-22.75% +0.35 [19%-22.79%+0.25 (25%-22.75% -0.153 BA 1 Spring 2021 Time: 3:36-6.15 PM Question 1: (20 points) Dr. Poseidon", a young CEO of the "Aris Bunk bolds a Me of Science in Finance degree with speciali a Capote University from the Rinky Dinky Universe Stand 2021 D Poseidon would deliver lecture for er Finance Association the State Univery Meme in him her to compute the following variable TIME RWF) BOAR|Market Probability Assume that the Risk Free Rate is 3% Calculate the expected Raum Calculate the Variances Calculate the Risks Calculate the Covariances Calculate the Bets and commalytically Calculate the Sharpente and comment Calculate the resor'station and comment mytically 6.Draw the SML and the CML respectively 7. Calculate the Coeficients of Vatice & Calculate the correlation Coefficients Calculate using the CAPM Mode the course Want HOA respectively COMMENT ON YOUR RESULTS ANALYTICALLY AND DRAW CAREFULLY THE NECESSARY DIAGRAMS TIME RRR Pro 2003 Expected Return; RWF ET RI (18**0_25(****0.35+(28**0:25) (0.15) -0.0450.0065-0.0650.051 = 22.75% RBOAIER 35%*0:25)(2800.351210025 (425*0.15) -0.0875 0.098 0.0725 0.063 = 32.10% 10 Rm Ri (38%0.25)-36% 0:35)+(348 -0.25) (32% 0.15) -0.096 0.126 +0.005 0.04 - 35.40% Variance of the Return WF- 02518%-22.75% +0.35 [19%-22.79%+0.25 (25%-22.75% -0.153 9 Cake wing the CAPM Model the BOA ply COMMENT ON YOUR RESULTS ANALYTICALLY AND DRAWN CAREFULLY THE NECESSARY DIAGRASS TIMER 20 Expected Returi RS=(1882-0 25(1900:35+2002- H%0.15) -0.0450.00654006540051 -22.79% RBOAR(388~0.261(2003+29:28 (42%0.15) -0.0075.000600125.000 -32.10% 32 015) RM225)-30303545025 -0.095 +0.128.000.000 - 35.40% Varience of the Return W OR -0294186-22.79%20-22.7997 (26% 22.7547 +0.1544 22.7817 0.00064063 0.000432167000240 0.00098430 = 0.32% DOAR 0.232385-3210%-032-221057025 (29-32.1011 0.1542-32-10% -0.00021025 0.00058835 0.00004025 0.00147015 -0.25% -0.25-384-35.40% Star or 5.15 ST.05% 21.5% BA 1 Spring 2021 Time: 3:36-6.15 PM Question 1: (20 points) Dr. Poseidon", a young CEO of the "Aris Bunk bolds a Me of Science in Finance degree with speciali a Capote University from the Rinky Dinky Universe Stand 2021 D Poseidon would deliver lecture for er Finance Association the State Univery Meme in him her to compute the following variable TIME RWF) BOAR|Market Probability Assume that the Risk Free Rate is 3% Calculate the expected Raum Calculate the Variances Calculate the Risks Calculate the Covariances Calculate the Bets and commalytically Calculate the Sharpente and comment Calculate the resor'station and comment mytically 6.Draw the SML and the CML respectively 7. Calculate the Coeficients of Vatice & Calculate the correlation Coefficients Calculate using the CAPM Mode the course Want HOA respectively COMMENT ON YOUR RESULTS ANALYTICALLY AND DRAW CAREFULLY THE NECESSARY DIAGRAMS TIME RRR Pro 2003 Expected Return; RWF ET RI (18**0_25(****0.35+(28**0:25) (0.15) -0.0450.0065-0.0650.051 = 22.75% RBOAIER 35%*0:25)(2800.351210025 (425*0.15) -0.0875 0.098 0.0725 0.063 = 32.10% 10 Rm Ri (38%0.25)-36% 0:35)+(348 -0.25) (32% 0.15) -0.096 0.126 +0.005 0.04 - 35.40% Variance of the Return WF- 02518%-22.75% +0.35 [19%-22.79%+0.25 (25%-22.75% -0.153 BA 1 Spring 2021 Time: 3:36-6.15 PM Question 1: (20 points) Dr. Poseidon", a young CEO of the "Aris Bunk bolds a Me of Science in Finance degree with speciali a Capote University from the Rinky Dinky Universe Stand 2021 D Poseidon would deliver lecture for er Finance Association the State Univery Meme in him her to compute the following variable TIME RWF) BOAR|Market Probability Assume that the Risk Free Rate is 3% Calculate the expected Raum Calculate the Variances Calculate the Risks Calculate the Covariances Calculate the Bets and commalytically Calculate the Sharpente and comment Calculate the resor'station and comment mytically 6.Draw the SML and the CML respectively 7. Calculate the Coeficients of Vatice & Calculate the correlation Coefficients Calculate using the CAPM Mode the course Want HOA respectively COMMENT ON YOUR RESULTS ANALYTICALLY AND DRAW CAREFULLY THE NECESSARY DIAGRAMS TIME RRR Pro 2003 Expected Return; RWF ET RI (18**0_25(****0.35+(28**0:25) (0.15) -0.0450.0065-0.0650.051 = 22.75% RBOAIER 35%*0:25)(2800.351210025 (425*0.15) -0.0875 0.098 0.0725 0.063 = 32.10% 10 Rm Ri (38%0.25)-36% 0:35)+(348 -0.25) (32% 0.15) -0.096 0.126 +0.005 0.04 - 35.40% Variance of the Return WF- 02518%-22.75% +0.35 [19%-22.79%+0.25 (25%-22.75% -0.153 9 Cake wing the CAPM Model the BOA ply COMMENT ON YOUR RESULTS ANALYTICALLY AND DRAWN CAREFULLY THE NECESSARY DIAGRASS TIMER 20 Expected Returi RS=(1882-0 25(1900:35+2002- H%0.15) -0.0450.00654006540051 -22.79% RBOAR(388~0.261(2003+29:28 (42%0.15) -0.0075.000600125.000 -32.10% 32 015) RM225)-30303545025 -0.095 +0.128.000.000 - 35.40% Varience of the Return W OR -0294186-22.79%20-22.7997 (26% 22.7547 +0.1544 22.7817 0.00064063 0.000432167000240 0.00098430 = 0.32% DOAR 0.232385-3210%-032-221057025 (29-32.1011 0.1542-32-10% -0.00021025 0.00058835 0.00004025 0.00147015 -0.25% -0.25-384-35.40% Star or 5.15 ST.05% 21.5%

please help me the change probabilities

please help me the change probabilities