Answered step by step

Verified Expert Solution

Question

1 Approved Answer

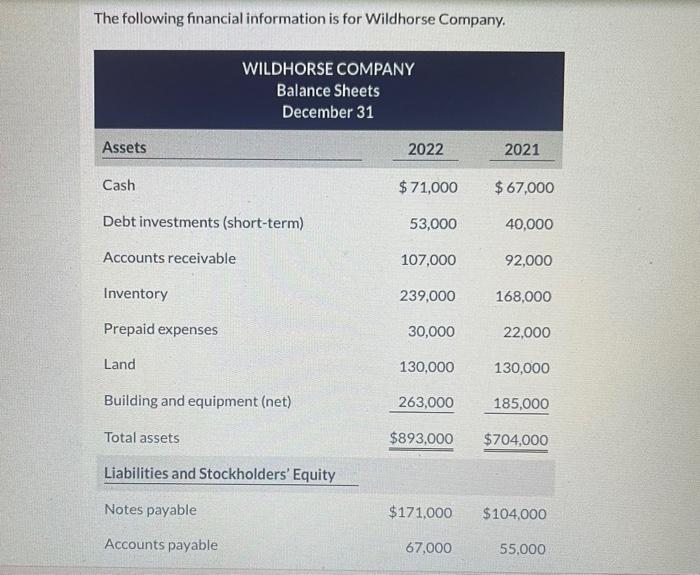

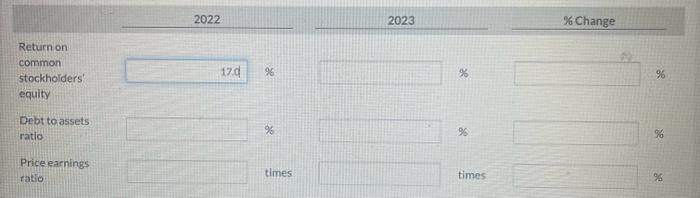

PLEASE HELP ME!!! The following financial information is for Wildhorse Company. Assets Cash Debt investments (short-term) Accounts receivable Inventory Prepaid expenses Land WILDHORSE COMPANY Balance

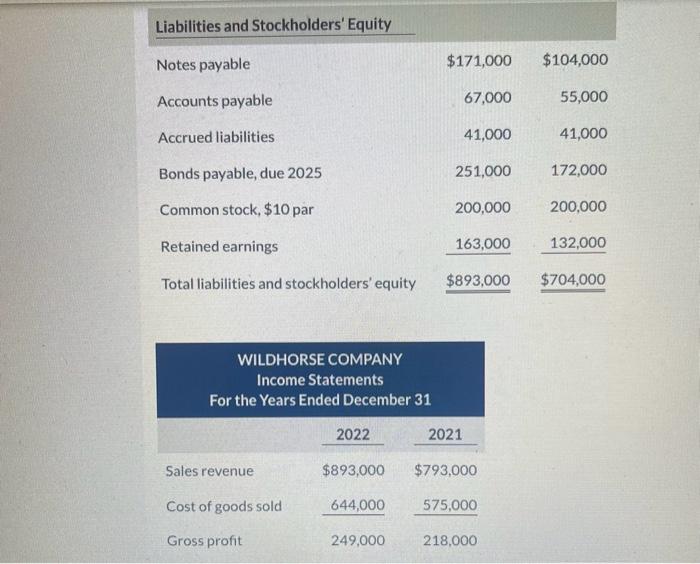

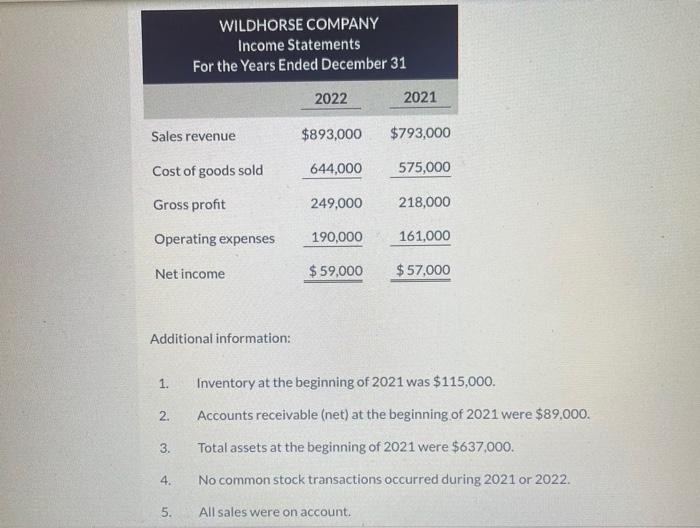

PLEASE HELP ME!!! The following financial information is for Wildhorse Company. Assets Cash Debt investments (short-term) Accounts receivable Inventory Prepaid expenses Land WILDHORSE COMPANY Balance Sheets December 31 Building and equipment (net) Total assets Liabilities and Stockholders' Equity Notes payable Accounts payable 2022 $ 71,000 53,000 107,000 239,000 30,000 130,000 263,000 $171,000 2021 67,000 $67,000 40,000 92,000 168,000 22,000 130,000 $893,000 $704,000 185,000 $104,000 55.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started