Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me to answer this question with this information. It's very important. Thanks a lot! Please answer the questions with the depreciation tables provided.

Please help me to answer this question with this information. It's very important. Thanks a lot!

Please answer the questions with the depreciation tables provided.

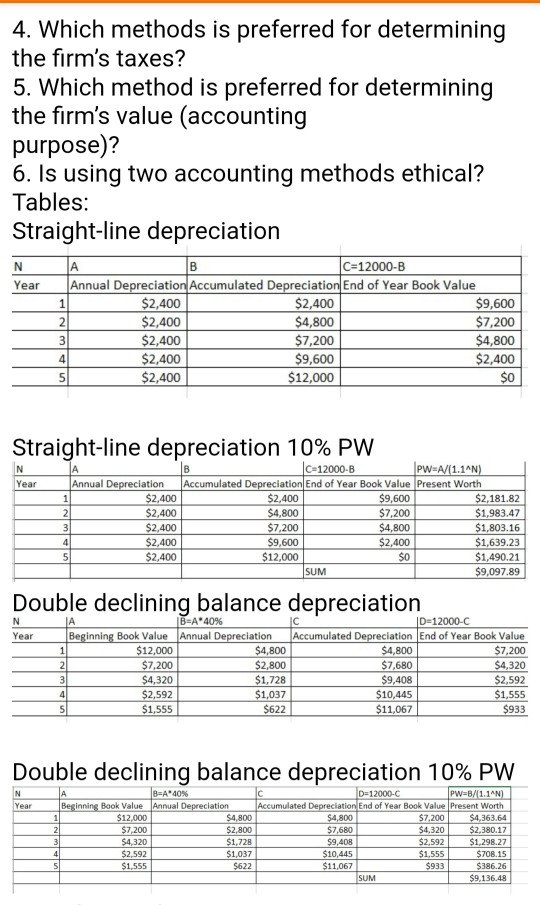

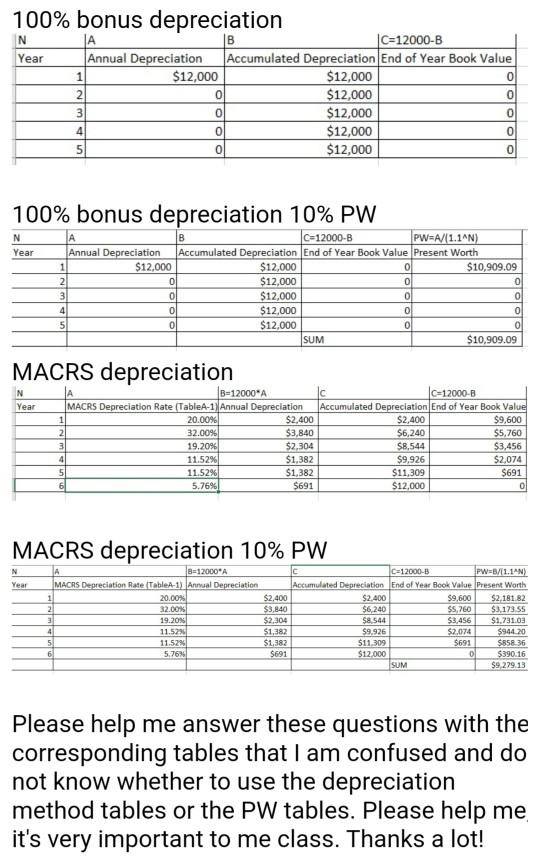

4. Which methods is preferred for determining the firm's taxes? 5. Which method is preferred for determining the firm's value (accounting purpose)? 6. Is using two accounting methods ethical? Tables: Straight-line depreciation N Year A C=12000-B Annual Depreciation Accumulated Depreciation End of Year Book Value $2,400 $2,400 $9,600 $2,400 $4,800 $7,200 $2,400 $7,200 $4,800 $2,400 $9,600 $2,400 $2,400 $12,000 $0 Straight-line depreciation 10% PW Year Annual Depreciation $2,400 21 $2,400 3 $2,400 $2,400 5 $2,400 C-12000-B PW=A/(1.1^N) Accumulated Depreciation End of Year Book Value Present Worth $2,400 $9,600 $2,181.82 $4,800 $7,200 $1,983.47 $7,200 $4,800 $1,803.16 $9,600 $2,400 $1,639.23 $12,000 $0 $1,490.21 SUM $9,097.89 Double declining balance depreciation Year Beginning Book Value $12,000 $7,200 $4,320 $2,592 $1,555 B-A 40% Annual Depreciation $4,800 $2.800 $1,728 $1,037 $622 D=12000-C Accumulated Depreciation End of Year Book Value $4,800 $7,200 $7,680 $4,320 $9,408 $2,592 $10,445 $1,555 $11,067 $933 Double declining balance depreciation 10% PW NA B=A*40% Year Beginning Book Value Annual Depreciation $12,000 $4,800 $7 200 $2.800 $4 320 $1.728 $2,592 $1,037 $1.555 $622 D=12000- C P WEB/1.14N) Accumulated Depreciation End of Year Book Value Present Worth $4,800 $7,200 $4.363.64 $7,680 $4,320 $2.380.17 $9,408 $2.592 $1.298.27 $10,445 $1.555 $11,067 $933 $386.26 $9,136.48 100% bonus depreciation C=12000-B Annual Depreciation | Accumulated Depreciation End of Year Book Value $12,000 $12,000 $12,000 $12,000 $12,000 $12,000 100% bonus depreciation 10% PW C=12000-B NAR PW=A/(1.14N) Year Annual Depreciation Accumulated Depreciation End of Year Book Value Present Worth $12,000 $12,000 $10,909.09 0 $12.000 0 $12,000 0 0 $12,000 ol $12.000 ol SUM $10.909.09 MACRS depreciation Year B=12000* MACRS Depreciation Rate (TableA-1) Annual Depreciation 20.00% $2,400 32.00% $3,840 19.20% $2.304 4 11.52% $1,382 11.52% $1,382 6 5.7696 $691 C-12000-B Accumulated Depreciation End of Year Book Value $2,400 $9,600 $6,240 $5,760 $8,544 $3,456 $9,926 $2,074 $11,309 $12,000 0 $691 MACRS depreciation 10% PW Year B=12000" MACRS Depreciation Rate (Table A-1) Annual Depreciation 20.00% 32.00 19.20% 11.5291 11.529 5.76% $2,400 $3,840 $2,304 $1,382 $1.382 C=12000-B PW=B/1.14N) Accumulated Depreciation End of Year Book Value Present Worth $2.400 59.600 $2.181.82 $6.240 $5,260 $3,173.55 $8.544 $3,456 $1,731.03 $9.926 $2,074 $944.20 $11,309 $691 $858 36 $12.000 ol $390.16 ISUM $9,279.13 Please help me answer these questions with the corresponding tables that I am confused and do not know whether to use the depreciation method tables or the PW tables. Please help me it's very important to me class. Thanks a lotStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started