please help me to complete the form

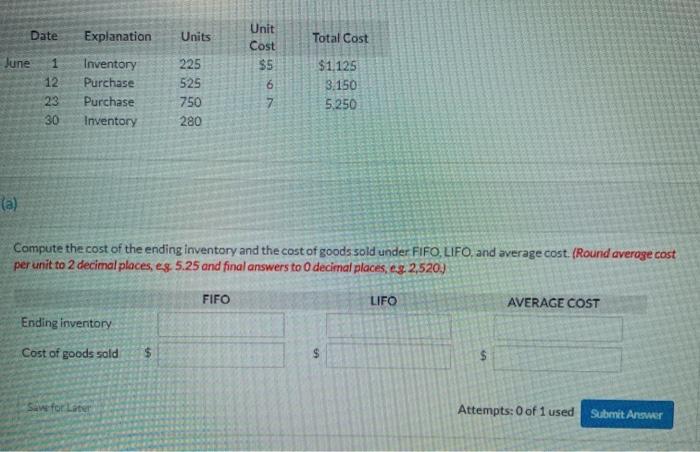

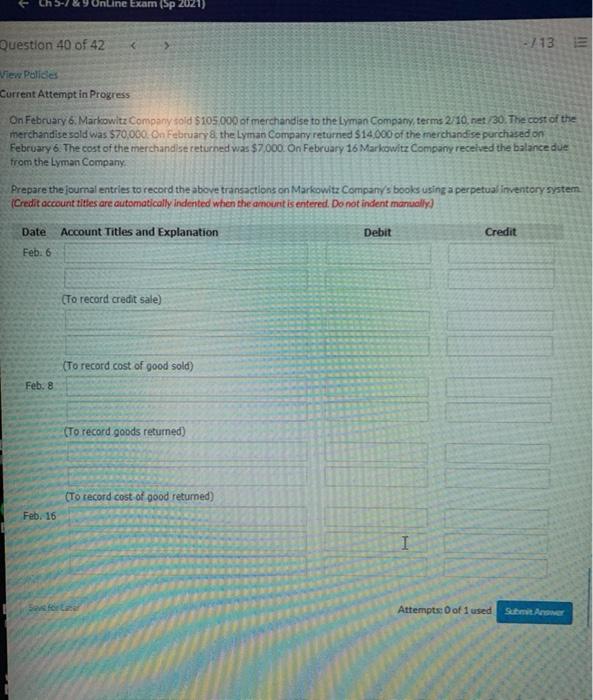

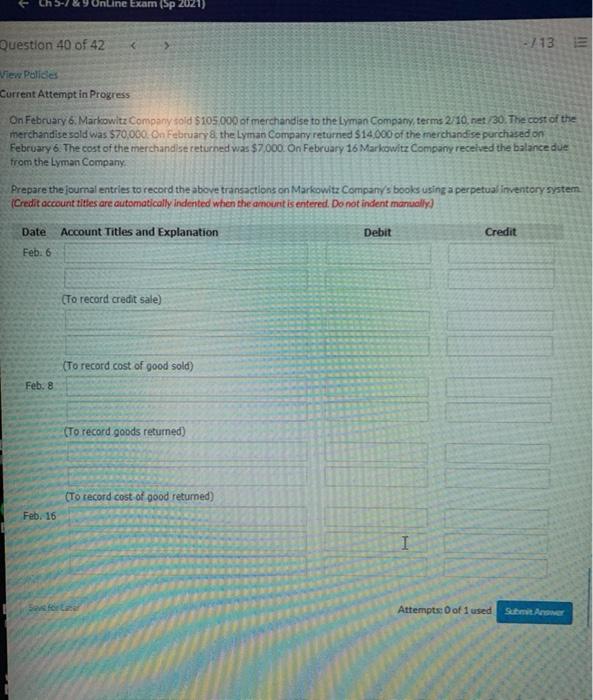

Ch 5-7 & 9 Online Exam (Sp 2021) Question 40 of 42 -713 View Polides Current Attempt in Progress On February 6, Markowitz Company told 5105000 of merchandise to the Lyman Company, terms 2/10, net 30. The cost of the merchandise sold was $70,000. On February& the Lyman Company returned $14.000 of the merchandise purchased on February 6. The cost of the merchandise returned was $7.000. On February 16 Markowitz Company received the balance due from the Lyman Company Prepare the journal entries to record the above transactions on Markowitz Company's books using a perpetual inventory system (Credit account tites are automatically Indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Feb. 6 (To record credit sale) To record cost of good sold) Feb. 8 (To record goods returned) (To record cost of good returned) Feb. 16 I Sasso Attempts of 1 used Submit Date Units Total Cost June 1 12 23 30 Explanation Inventory Purchase Purchase Inventory 225 525 750 280 Unit Cost $5 6 7 $1.125 3.150 5.250 a) Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO and average cost. (Round average cost per unit to 2 decimal places, es 5.25 and final answers to decimal places, eg 2,520.) AVERAGE COST Ending inventory FIFO LIFO Cost of goods sold $ $ Saw for Later Attempts: 0 of 1 used Submit Answer Ch 5-7 & 9 Online Exam (Sp 2021) Question 40 of 42 -713 View Polides Current Attempt in Progress On February 6, Markowitz Company told 5105000 of merchandise to the Lyman Company, terms 2/10, net 30. The cost of the merchandise sold was $70,000. On February& the Lyman Company returned $14.000 of the merchandise purchased on February 6. The cost of the merchandise returned was $7.000. On February 16 Markowitz Company received the balance due from the Lyman Company Prepare the journal entries to record the above transactions on Markowitz Company's books using a perpetual inventory system (Credit account tites are automatically Indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Feb. 6 (To record credit sale) To record cost of good sold) Feb. 8 (To record goods returned) (To record cost of good returned) Feb. 16 I Sasso Attempts of 1 used Submit Date Units Total Cost June 1 12 23 30 Explanation Inventory Purchase Purchase Inventory 225 525 750 280 Unit Cost $5 6 7 $1.125 3.150 5.250 a) Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO and average cost. (Round average cost per unit to 2 decimal places, es 5.25 and final answers to decimal places, eg 2,520.) AVERAGE COST Ending inventory FIFO LIFO Cost of goods sold $ $ Saw for Later Attempts: 0 of 1 used Submit

please help me to complete the form

please help me to complete the form