Please help me to fill out where my answer is wrong and the rest of the questions.

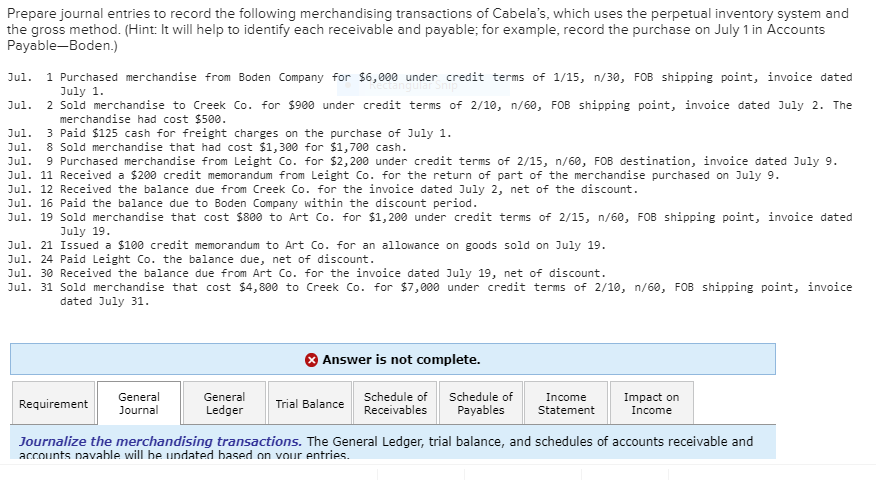

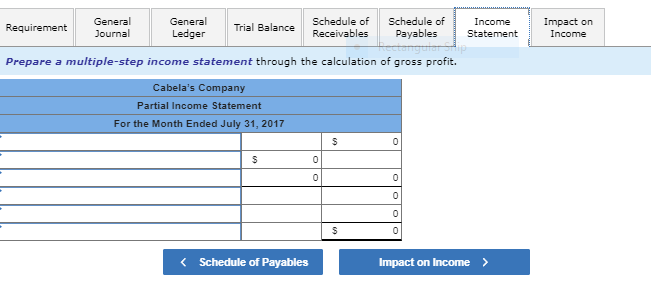

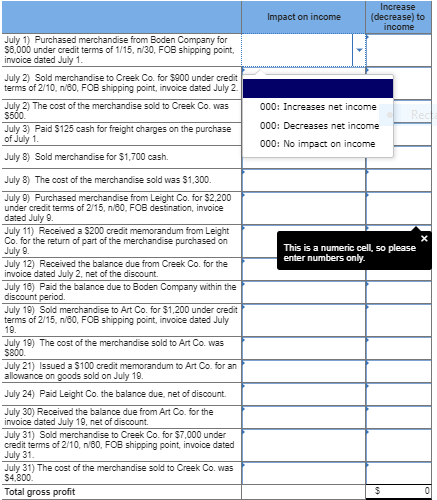

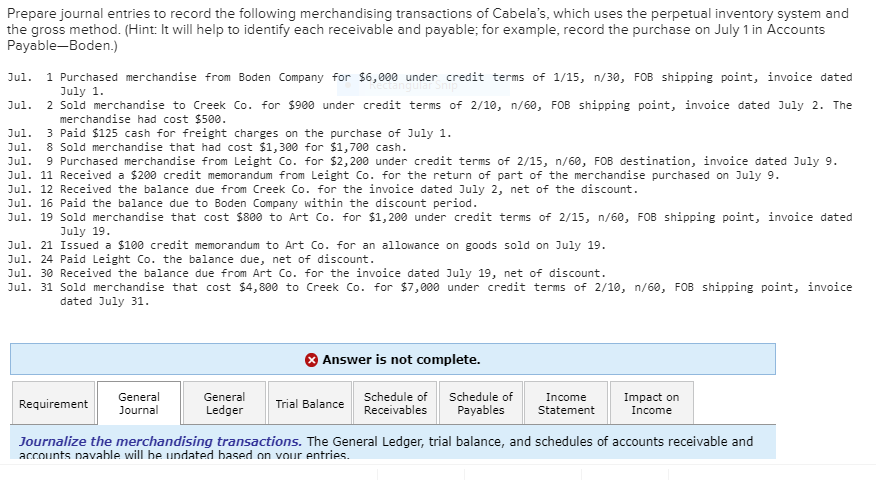

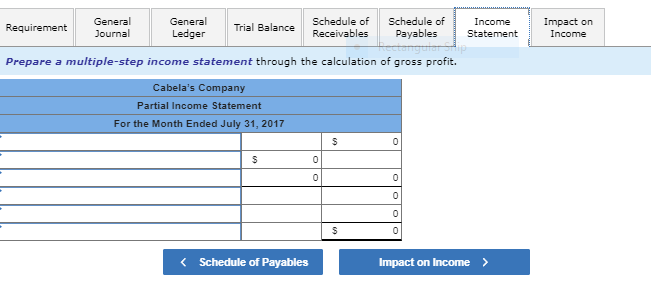

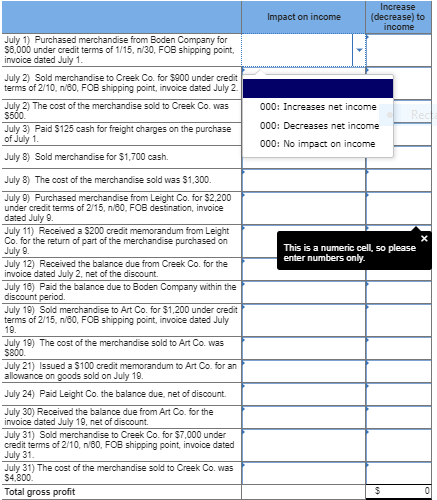

Prepare journal entries to record the following merchandising transactions of Cabela's, which uses the perpetual inventory system and the gross method. (Hint t will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts Payable-Boden.) Jul. 1 Purchased merchandise from Boden Company for $6,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1 Jul. 2 Sold merchandise to Creek Co. for $900 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $500 Jul. 3 Paid $125 cash for freight charges on the purchase of July 1 Jul. 8 Sold merchandise that had cost $1,300 for $1,700 cash Jul. 9 Purchased merchandise from Leight Co. for $2,200 under credit terms of 2/15, n/60, FOB destination, invoice dated July 9 Jul. 11 Received a $200 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9 Jul. 12 Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. Jul. 16 Paid the balance due to Boden Company within the discount period Jul. 19 Sold merchandise that cost $800 to Art Co. for $1,200 under credit terms of 2/15, n/60, FOB shipping point, invoice dated July 19 Jul. 21 Issued a $100 credit memorandum to Art Co. for an allowance on goods sold on July 19. Jul. 24 Paid Leight Co. the balance due, net of discount Jul. 30 Received the balance due from Art Co. for the invoice dated July 19, net of discount. Jul. 31 Sold merchandise that cost $4,800 to Creek Co. for $7,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31 Answer is not complete. General Journal General Ledger Scheduleof Schedule of Receivables ncome Statement Impact on Income Requirement Trial Balance Payables Journalize the merchandising transactions. The General Ledger, trial balance, and schedules of accounts receivable and accounts navahle will he undated hased on vour entries. 10 Jul 16 Accounts payable - Boden 6.000 Cash Jul 19 able Art 1.200 Sales 1.200 Jul 19 Cost of goods sold Jul 21 Sales returns and allowances Accounts receivable Art Jul 24 2,000 Cash 15 Jul 30 Cash 16 Jul 31 Sales 7 Jul 31 Cost of goods sold 4,800 Schedule ofInce Impact on Payables StatementIncome Requirement General Journal Ledger Trial Balance Schedule of Prepare a multiple-step income statement through the calculation of gross profit. Cabela's Company Partial Income Statement For the Month Ended July 31, 2017 Schedule of Payables Impact on Income Impact on income (decrease) to July 1) Purchased merchandise from Boden Company for 58,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1 July 2) Sold merchandise to Creek Co. for $900 under credit terms of 2/10, ni80, FOB shipping point, invoice dated July 2 July 2) The cost of the merchandise sold to Creek Co. was 5500. 000: Increases net income 000: Decreases net income 000: No impact on income July 3) Paid 5125 cash for freight charges on the purchase July 8) Sold merchandise for $1,700 cash. July 8) The cost of the merchandise sold was $1,300. July 9 Purchased merchandise from Leight Co. for 52,200 under credit terms of 2/15, ni80, FOB destination, invoice dated July9 July 11) Received a S200 credit memorandum from Leight Co. for the return of part of the merchandise purchased on July 9 July 12) Received the balance due from Creek Co. for the invoice dated July 2, net of the discount. July 16) Paid the balance due to Boden Company within the discount period. This is a numeric cell, so please enter numbers only. July 19) Sold merchandise to Art Co. for $1,200 under credit terms of 2-15. n 0, FOB shipping point, invoice dated July 19 July 19) The cost of the merchandise sold to Art Co. was 5800 July 21) Issued a 5100 credit memorandum to Art Co. for an allowance on s sold on July 24) Paid Leight Co. the balanoe due, net of discount July 30) Received the balance due from Art Co. for the invoice dated July 19, net of discount July 31) Sold merchandise to Creek Co. for $7,000 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 31 July 31) The cost of the merchandise sold to Creek Co. was 54,800 Total gross profit