Question

Please help me to get the answer with explanation( Answer each blank exactly with what the question need. For example, when there are an increase

Please help me to get the answer with explanation( Answer each blank exactly with what the question need. For example, when there are an increase and decrease in asset I know we have to debit and credit asset. But my question what should I put which one of them when I only have one raw for each transaction.

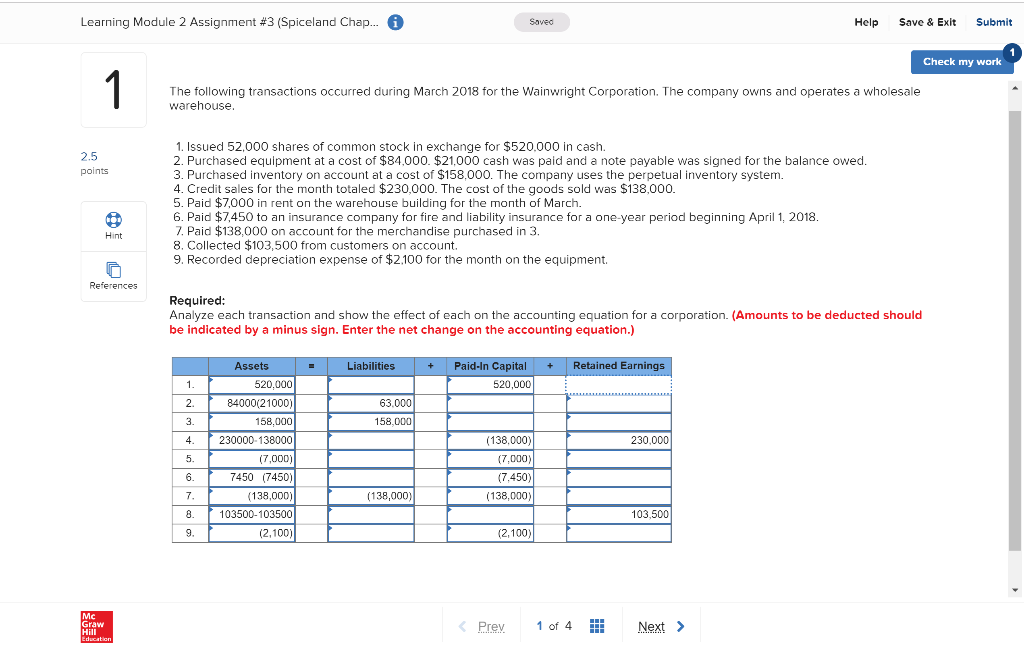

The following transactions occurred during March 2018 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. Issued 52,000 shares of common stock in exchange for $520,000 in cash. Purchased equipment at a cost of $84,000. $21,000 cash was paid and a note payable was signed for the balance owed. Purchased inventory on account at a cost of $158,000. The company uses the perpetual inventory system. Credit sales for the month totaled $230,000. The cost of the goods sold was $138,000. Paid $7,000 in rent on the warehouse building for the month of March. Paid $7,450 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2018. Paid $138,000 on account for the merchandise purchased in 3. Collected $103,500 from customers on account. Recorded depreciation expense of $2,100 for the month on the equipment. Required: Analyze each transaction and show the effect of each on the accounting equation for a corporation. (Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation.)

Learning Module 2 Assignment #3 (Spiceland Chap.. 0 Saved Help Save & Exit Submit Check my work The following transactions occurred during March 2018 for the Wainwright Corporation. The company owns and operates a wholesale warehouse 2.5 points 1. Issued 52,000 shares of common stock in exchange for $520,000 in cash. 2. Purchased equipment at a cost of $84,000. $21.000 cash was paid and a note payable was signed for the balance owed. 3. Purchased inventory on account at a cost of $158,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $230,000. The cost of the goods sold was $138,000. 5. Paid $7,000 in rent on the warehouse building for the month of March. 6. Paid $7,450 to an insurance company for fire and liability insurance for a one year period beginning April 1, 2018 7. Paid $138,000 on account for the merchandise purchased in 3. 8. Collected $103,500 from customers on account. corded depreciation expense of $2.100 for the month on the equipment. Hint References Required: Analyze each transaction and show the effect of each on the accounting equation for a corporation. (Amounts to be deducted should be indicated by a minus sign. Enter the net change on the accounting equation.) Liabilities + + Retained Earnings Paid-In Capital 520,000 1. 63.000 158,000 230,000 Assets 520.000 84000(21000) 158,000 230000-138000 (7,000) 7450 (7450) (138,000) | 103500-103500 (2,100) 5. (138,000) (7,000) (7.450) (138,000) 7. (138,000) 103,500 8. 9. (2,100)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started