Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me to solve question number 2 3 10 points Cycle Business manufactures and sells road and mountain bikes through a network of retail

please help me to solve question number 2

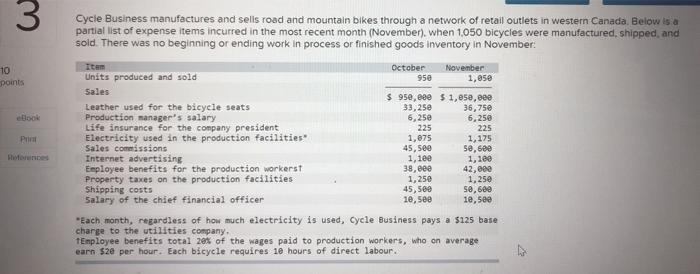

3 10 points Cycle Business manufactures and sells road and mountain bikes through a network of retail outlets in western Canada. Below is a partial list of expense items incurred in the most recent month (November), when 1.050 bleycles were manufactured shipped and sold. There was no beginning or ending work in process or finished goods inventory in November October November Units produced and sold 950 1,050 Sales $95e,eee $ 1,85e,eee Leather used for the bicycle seats 33,25e 36,750 Production manager's salary 6,250 6,250 Life insurance for the company president 225 225 Electricity used in the production facilities." 1,875 1,175 Sales comissions 45,5ee 50,600 Internet advertising 1,1ee 1,100 Employee benefits for the production workerst 38. eee 42,000 Property taxes on the production facilities 1,250 1,250 Shipping costs 45, 580 50,600 Salary of the chief financial officer 10,500 10,500 Each month, regardless of how much electricity is used, cycle Business pays a $125 bare charge to utilities company. Employee benefits total zes of the wages paid to production workers, who on average earn $2e per hour. Each bicycle requires 10 hours of direct labour. Pin Before 2. Assume that 1.250 bicycles will be monufactured and sold in December For the items you classified as manufacturing costs in requirement estimate the cost for December Assume that there will be no change in unit costs for any direct materials, hourly wages will remain the same, and employee benefits will continue at 20% of wages Rubelenco Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started