Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me! very confused, ill leave a like forsure! FIN3400 Financial Markets Chapter 6 Hw_Part2 Worth 0.6*10-6 points Submission Method: Upload your excel or

Please help me! very confused, ill leave a like forsure!

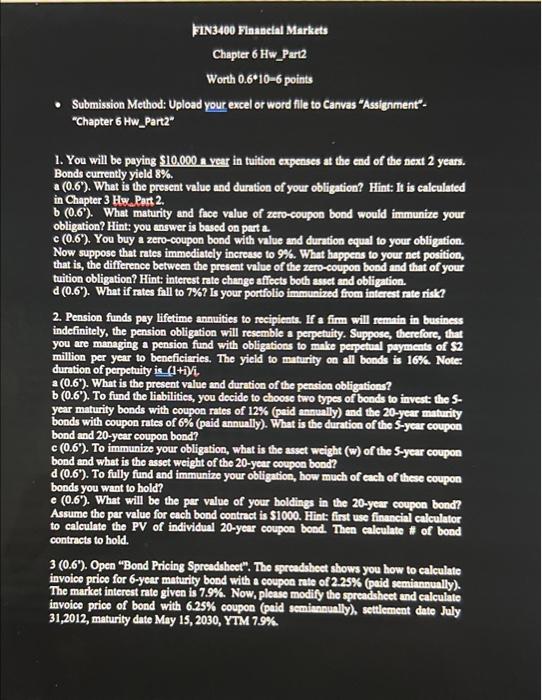

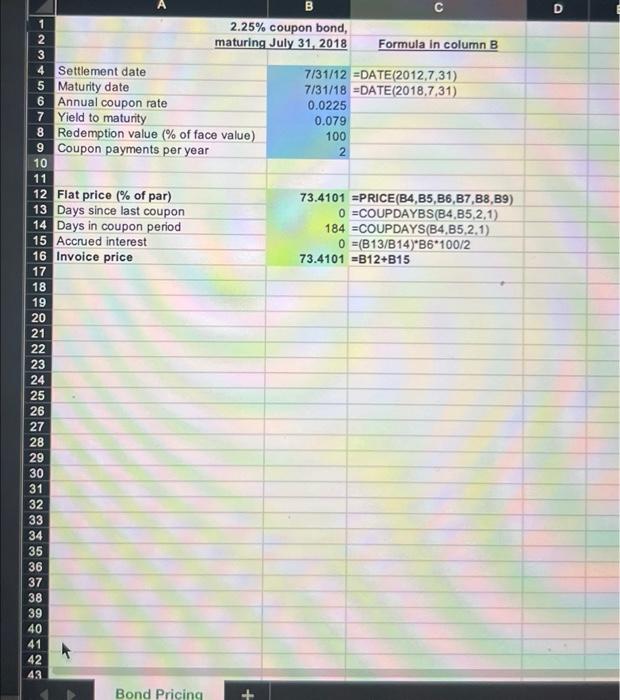

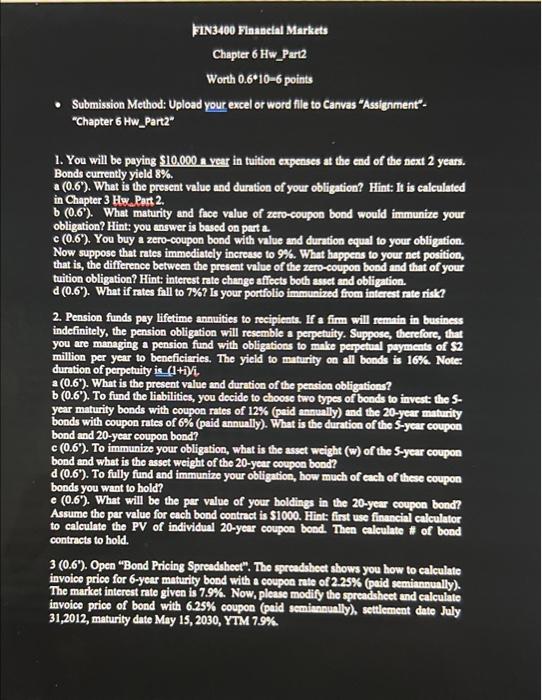

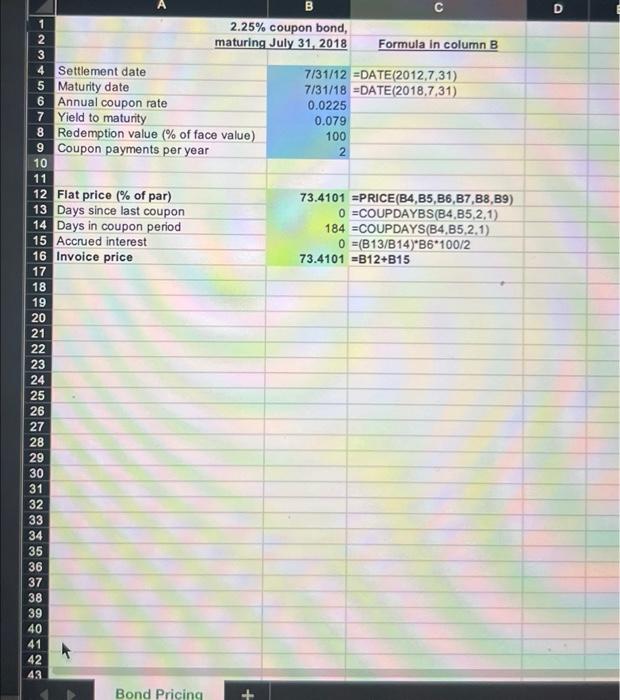

FIN3400 Financial Markets Chapter 6 Hw_Part2 Worth 0.6*10-6 points Submission Method: Upload your excel or word file to Canvas "Assignment". "Chapter 6 Hw_Part2 1. You will be paying $10.000 a year in tuition expenses at the end of the next 2 years. Bonds currently yield 8%. (0.6). What is the present value and duration of your obligation? Hint: It is calculated in Chapter 3 Hw.Part 2. b (0.6"). What maturity and face value of zero-coupon bond would immunize your obligation? Hint: you answer is based on parte c (0.6"). You buy a zero-coupon bond with value and duration equal to your obligation Now suppose that rates immediately increase to 9%. What happens to your net position, that is, the difference between the present value of the zero-coupon bond and that of your tuition obligation? Hint: interest rate change affects both asset and obligation. d(0.6"). What if rates fall to 7%? Is your portfolio immunized from interest rate risk? 2. Pension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of S2 million per year to beneficiaries. The yield to maturity on all bonds is 16%. Note: duration of perpetuity is (1+iVi. a (0.6"). What is the present value and duration of the pension obligations? b (0.6'). To fund the liabilities, you decide to choose two types of bonds to invest: the 5- year maturity bonds with coupon rates of 12% (paid annually) and the 20-year maturity bonds with coupon rates of 6% (paid annually). What is the duration of the 5-year coupon bond and 20-year coupon bond? c (0.6"). To immunize your obligation, what is the asset weight (w) of the 5-year coupon bond and what is the asset weight of the 20-year coupon bond? d (0.6'). To fully fund and immunize your obligation, how much of each of these coupon bonds you want to hold? (0.6"). What will be the per value of your holdings in the 20-year coupon bond? Assume the par value for each bond contract is $1000. Hint: first use financial calculator to calculate the PV of individual 20-year coupon bond. Then calculate # of bond contracts to hold. 3 (0.6"). Open "Bond Pricing Spreadsheet". The spreadsheet shows you how to calculate invoice price for 6-year maturity bond with a coupon rate of 2.25% (paid semiannually). The market interest rate given is 7.9%. Now, please modify the spreadsheet and calculate invoice price of bond with 6.25% coupon (paid semiannually), settlement date July 31,2012, maturity date May 15, 2030, YTM 7.9%. D B 1 2.25% coupon bond, 2 maturing July 31, 2018 Formula in column B 3 4 Settlement date 7/31/12 =DATE(2012,7,31) 5 Maturity date 7/31/18 =DATE(2018.7,31) 6 Annual coupon rate 0.0225 7 Yield to maturity 0.079 8 Redemption value (% of face value) 100 9 Coupon payments per year 2 10 11 12 Flat price (% of par) 73.4101 =PRICE(B4,B5,B6,B7,88,89) 13 Days since last coupon 0 =COUPDAYBS(B4,B5,2,1) 14 Days in coupon period 184 =COUPDAYS(B4,B5.2.1) 15 Accrued interest 0 =(B13/B14)*16*100/2 16 Invoice price 73.4101 =B12+B15 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Bond Pricing FIN3400 Financial Markets Chapter 6 Hw_Part2 Worth 0.6*10-6 points Submission Method: Upload your excel or word file to Canvas "Assignment". "Chapter 6 Hw_Part2 1. You will be paying $10.000 a year in tuition expenses at the end of the next 2 years. Bonds currently yield 8%. (0.6). What is the present value and duration of your obligation? Hint: It is calculated in Chapter 3 Hw.Part 2. b (0.6"). What maturity and face value of zero-coupon bond would immunize your obligation? Hint: you answer is based on parte c (0.6"). You buy a zero-coupon bond with value and duration equal to your obligation Now suppose that rates immediately increase to 9%. What happens to your net position, that is, the difference between the present value of the zero-coupon bond and that of your tuition obligation? Hint: interest rate change affects both asset and obligation. d(0.6"). What if rates fall to 7%? Is your portfolio immunized from interest rate risk? 2. Pension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of S2 million per year to beneficiaries. The yield to maturity on all bonds is 16%. Note: duration of perpetuity is (1+iVi. a (0.6"). What is the present value and duration of the pension obligations? b (0.6'). To fund the liabilities, you decide to choose two types of bonds to invest: the 5- year maturity bonds with coupon rates of 12% (paid annually) and the 20-year maturity bonds with coupon rates of 6% (paid annually). What is the duration of the 5-year coupon bond and 20-year coupon bond? c (0.6"). To immunize your obligation, what is the asset weight (w) of the 5-year coupon bond and what is the asset weight of the 20-year coupon bond? d (0.6'). To fully fund and immunize your obligation, how much of each of these coupon bonds you want to hold? (0.6"). What will be the per value of your holdings in the 20-year coupon bond? Assume the par value for each bond contract is $1000. Hint: first use financial calculator to calculate the PV of individual 20-year coupon bond. Then calculate # of bond contracts to hold. 3 (0.6"). Open "Bond Pricing Spreadsheet". The spreadsheet shows you how to calculate invoice price for 6-year maturity bond with a coupon rate of 2.25% (paid semiannually). The market interest rate given is 7.9%. Now, please modify the spreadsheet and calculate invoice price of bond with 6.25% coupon (paid semiannually), settlement date July 31,2012, maturity date May 15, 2030, YTM 7.9%. D B 1 2.25% coupon bond, 2 maturing July 31, 2018 Formula in column B 3 4 Settlement date 7/31/12 =DATE(2012,7,31) 5 Maturity date 7/31/18 =DATE(2018.7,31) 6 Annual coupon rate 0.0225 7 Yield to maturity 0.079 8 Redemption value (% of face value) 100 9 Coupon payments per year 2 10 11 12 Flat price (% of par) 73.4101 =PRICE(B4,B5,B6,B7,88,89) 13 Days since last coupon 0 =COUPDAYBS(B4,B5,2,1) 14 Days in coupon period 184 =COUPDAYS(B4,B5.2.1) 15 Accrued interest 0 =(B13/B14)*16*100/2 16 Invoice price 73.4101 =B12+B15 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 Bond Pricing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started