Please help me with 18-21 22 23 and 24

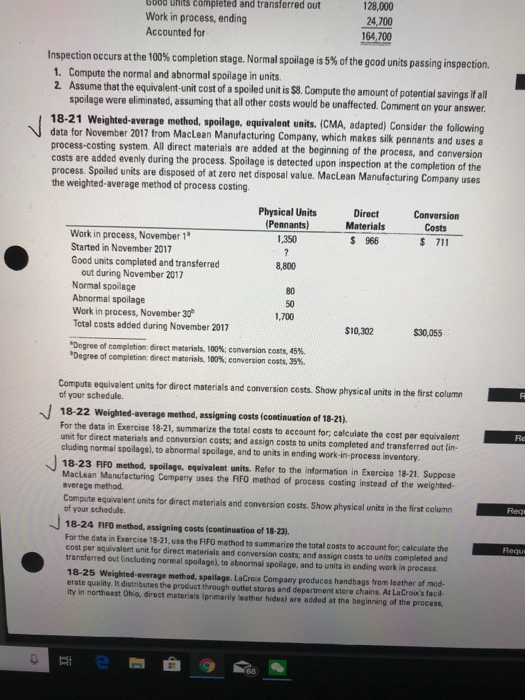

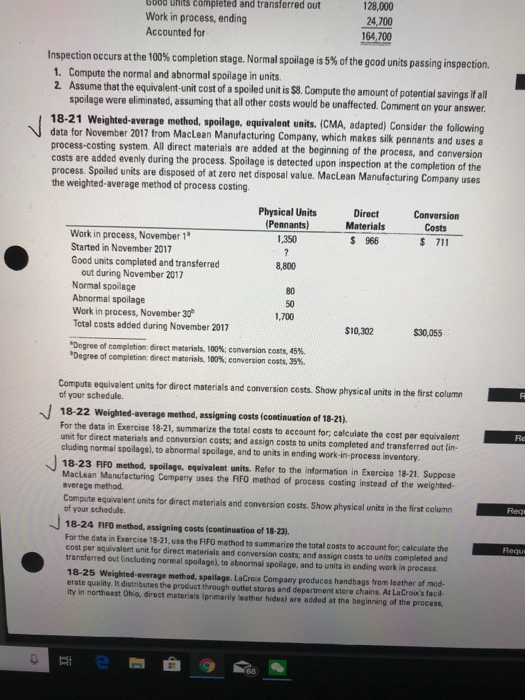

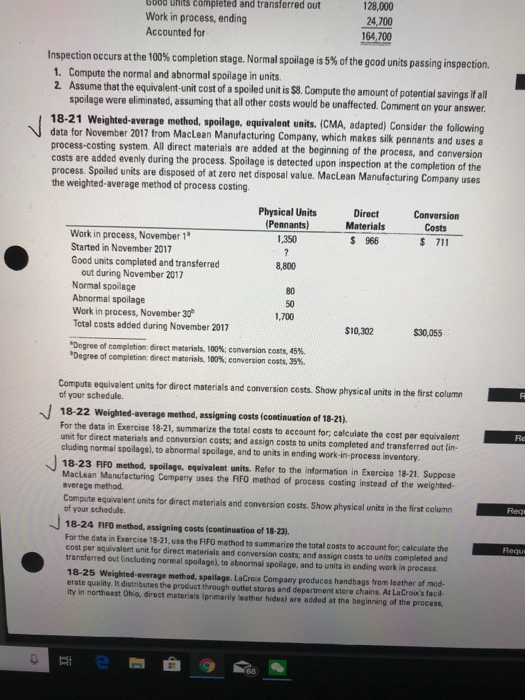

Gobd Uhilts completed and transferred out Work in process,ending Accounted for 128,000 24.700 164,700 Inspection occurs at the 100% completion stage. Normal spoilage is 5% of the good units passing inspection. 1. Compute the normal and abnormal spoilage in units. 2. Assume that the equivalent-unit cost of a spoiled unit is S8. Compute the amount of potential savings if all spoilage were eliminated, assuming that all other costs would be unaffected. Comment on 18-21 Weighted-average method, spoilage, equivalent units. (CMA, adapted) Consider the following data for November 2017 from MacLean Manufacturing Company, which makes silk penna process-costing system. All direct materials are added at the beginning of the process, and c nts and uses a costs are added evenly during the process. Spoilage is detected upon inspection at the completion of the process Spoiled units are disposed of at zero net disposal value. Maclean Manufacturing Company uses the weighted-average method of process costing Conversion Costs Physical Units Direct (Pennants)Materials Work in process, November Started in November 2017 Good units completed and transferred 1,350 S 966 8,800 out during November 2017 Normal spoilage Abnormal spoilage Work in process, November 30 Total costs added during November 2017 80 50 1,700 $10,302 $30,055 "Degree of completion: direct materials. 100%; conversion costs, 45%, "Degree of completion: drect materials, 100%, conversion costs, 35%. Compute equivalent units for direct materials and conversion costs. Show physical units in the first column of your schedule 18-22 Woighted-average method, assigning costs (comtinuation of 18-21). For the data in Exercise 18-21, summarize the total costs to account for, calculate the cost per equivalent unit for direct materials and conversion costs; and assign costs to units completed and transferred out (in cluding normal spoilage), to abnormal spoilage, and to units in ending work-in-process inventory Re 18-23 FIFO method, spoilage, equivalent units. Refer to the information in Exercise 18-21. Suppose MacLean Manufacturing Company uses the FIFO method of process costing instead of the weighted- average method. Compute equivalent units for direct materials and conversion costs Show physical units in the first column of your schedule. 18-24 FIFO method, assigning costs (continuation of 18-23) For the deta in Exercise 18-21, use the FIFO method to summarize the total costs to account for, calculate the cost per equivslent unit for direct materials and conversion costs; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process 18-25 Weighited-average method, spailage. LaCroix Company produces handbags from leather of mod- erate quality. It distributes the product through outlet stores and department store chains. At ity in northeest Ohio, direct materials (primerily leather hides) are added at the beginning of the process