Please help me with all of the remaining blank yellow boxes. I will rate good!

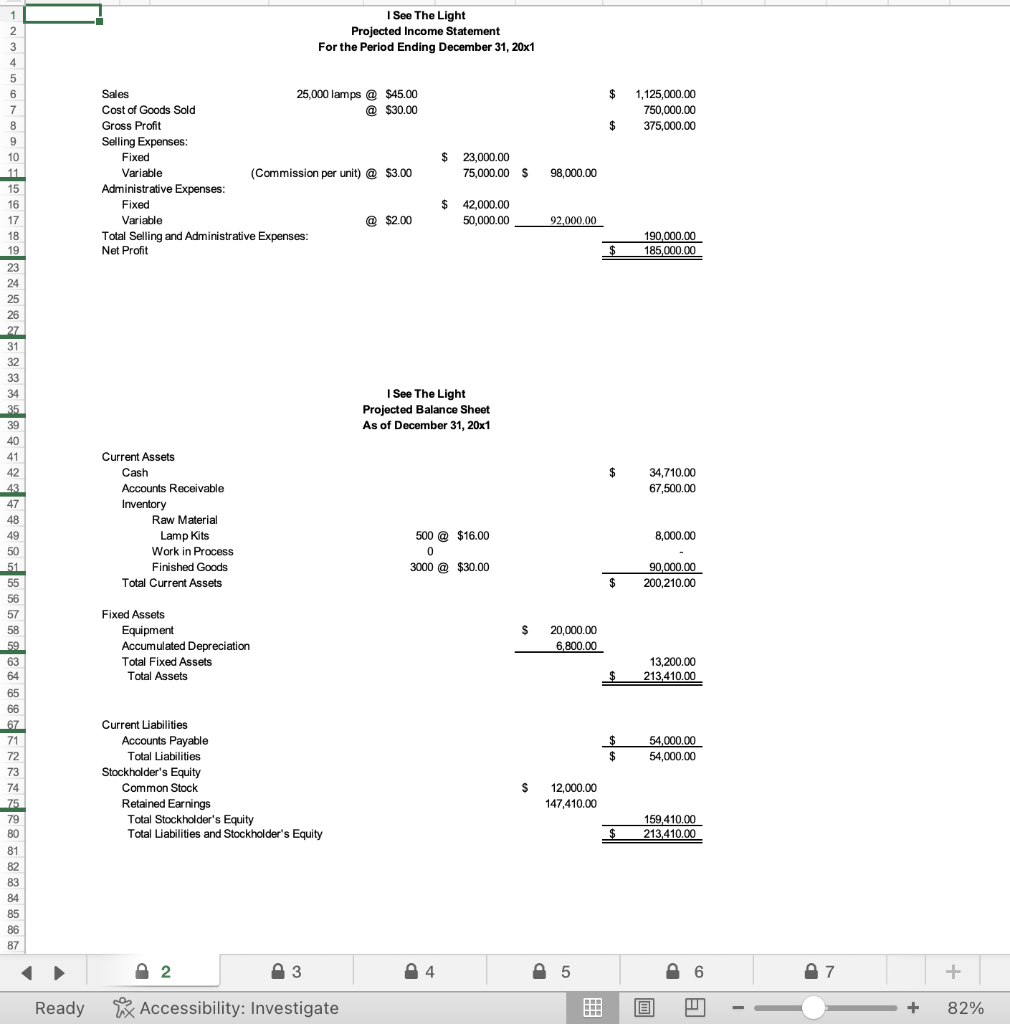

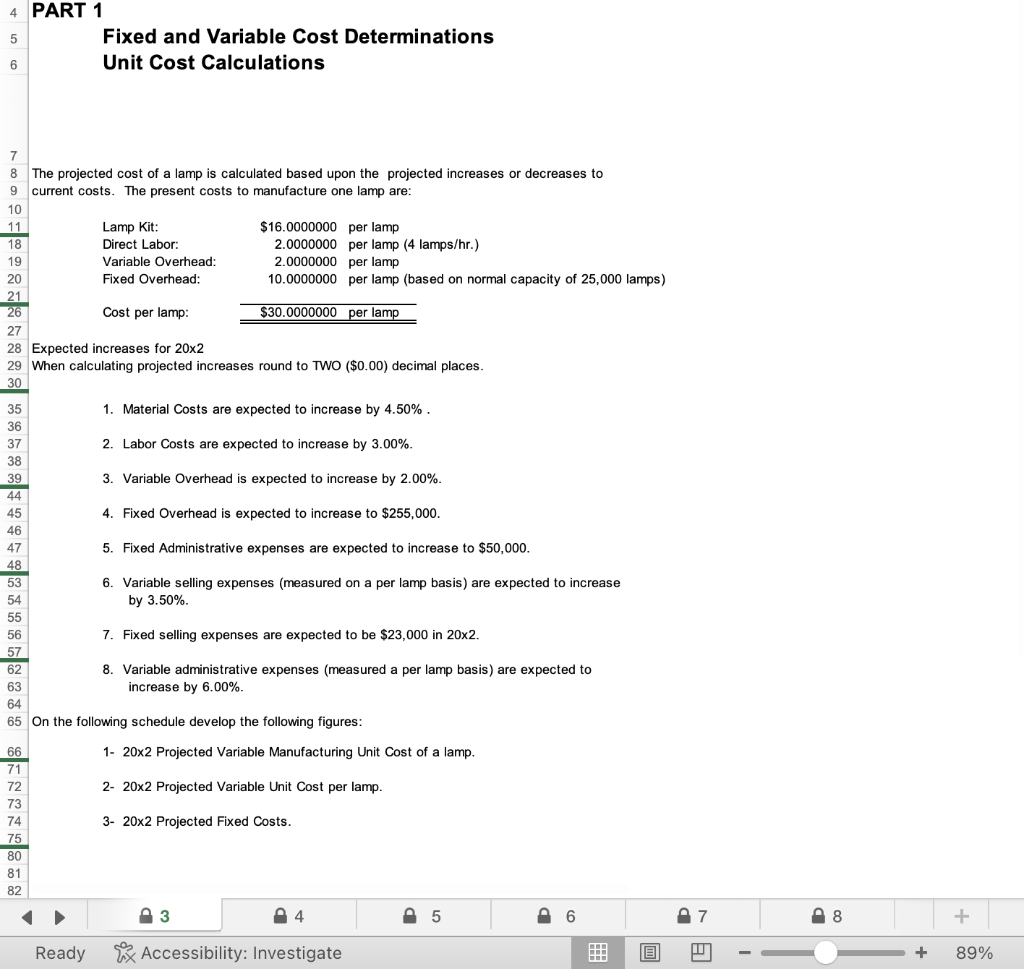

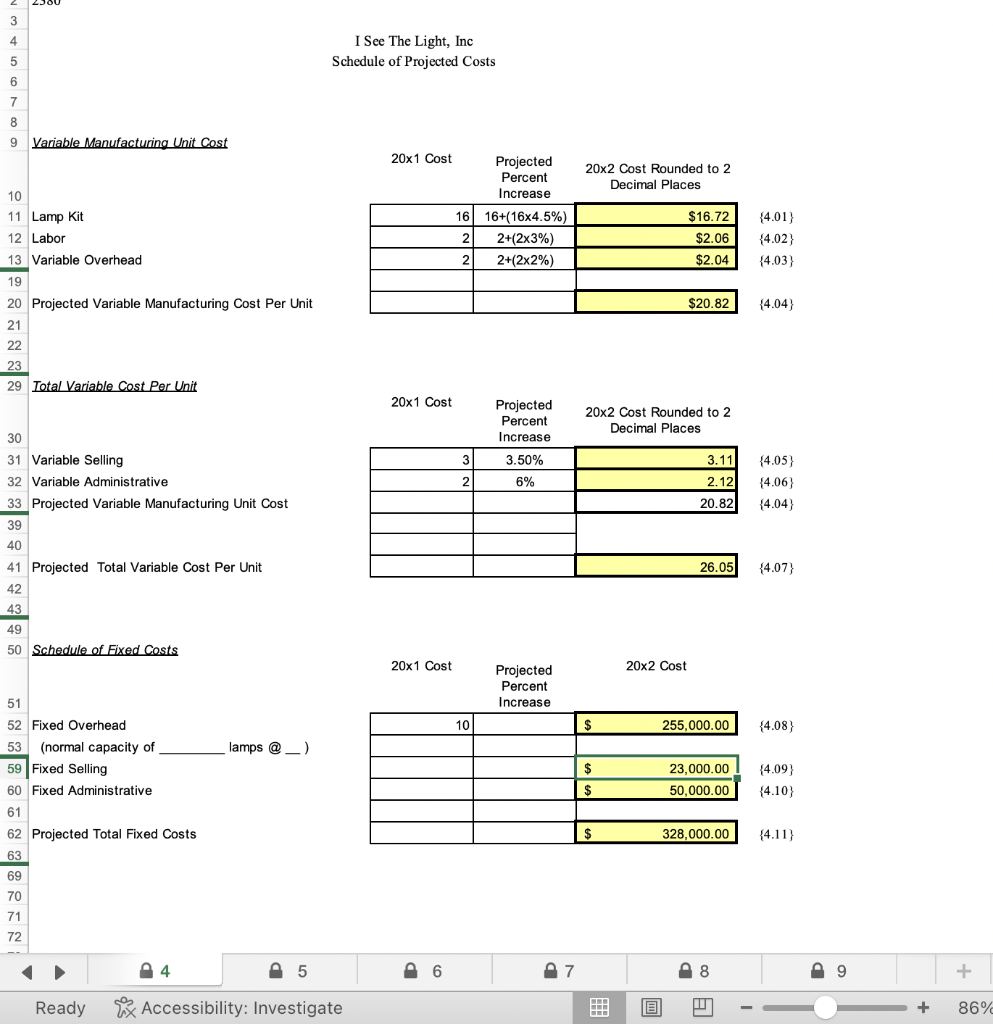

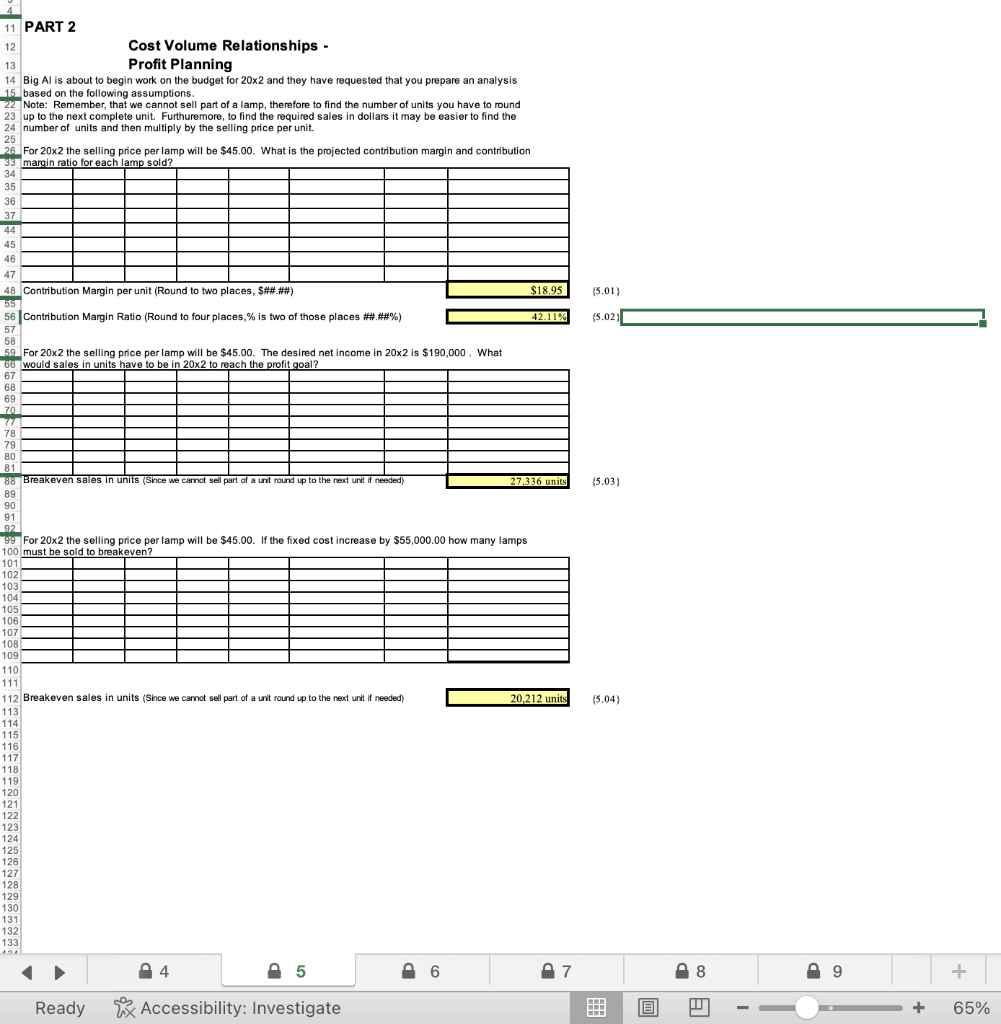

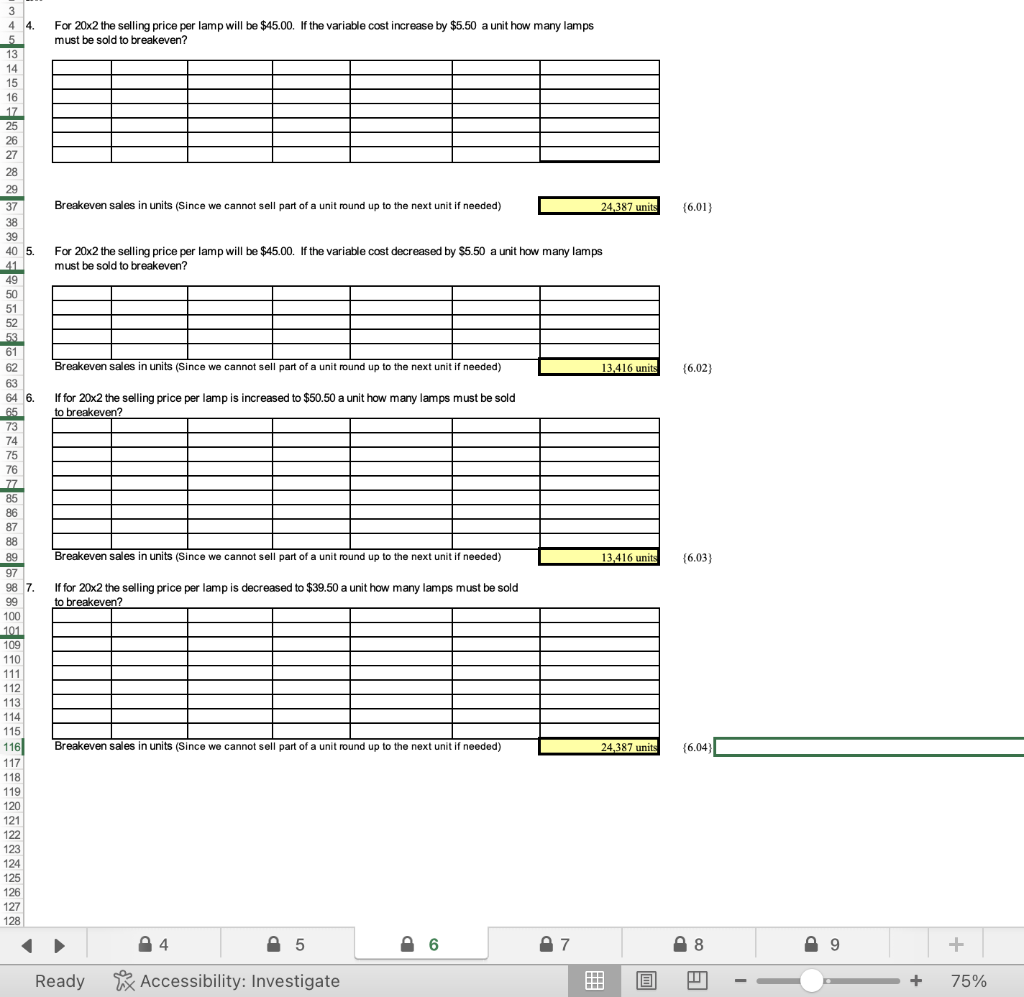

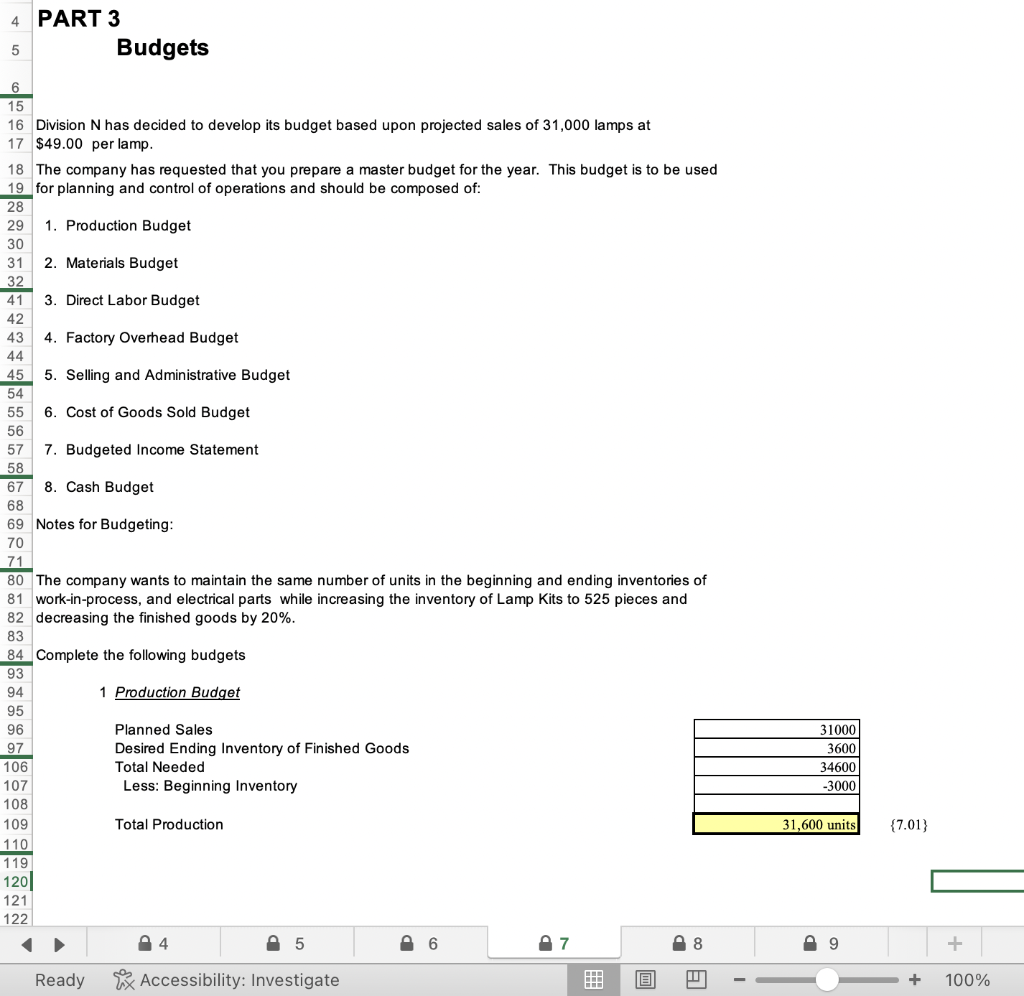

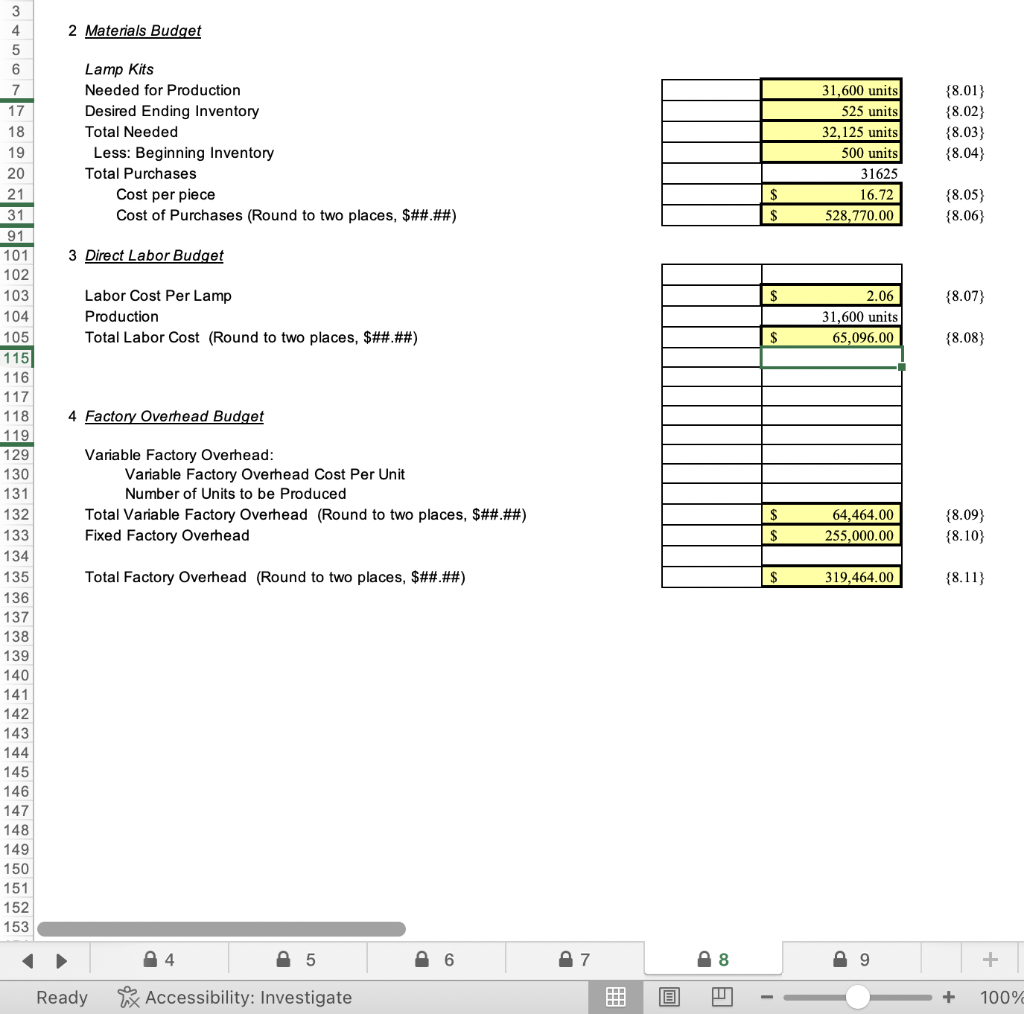

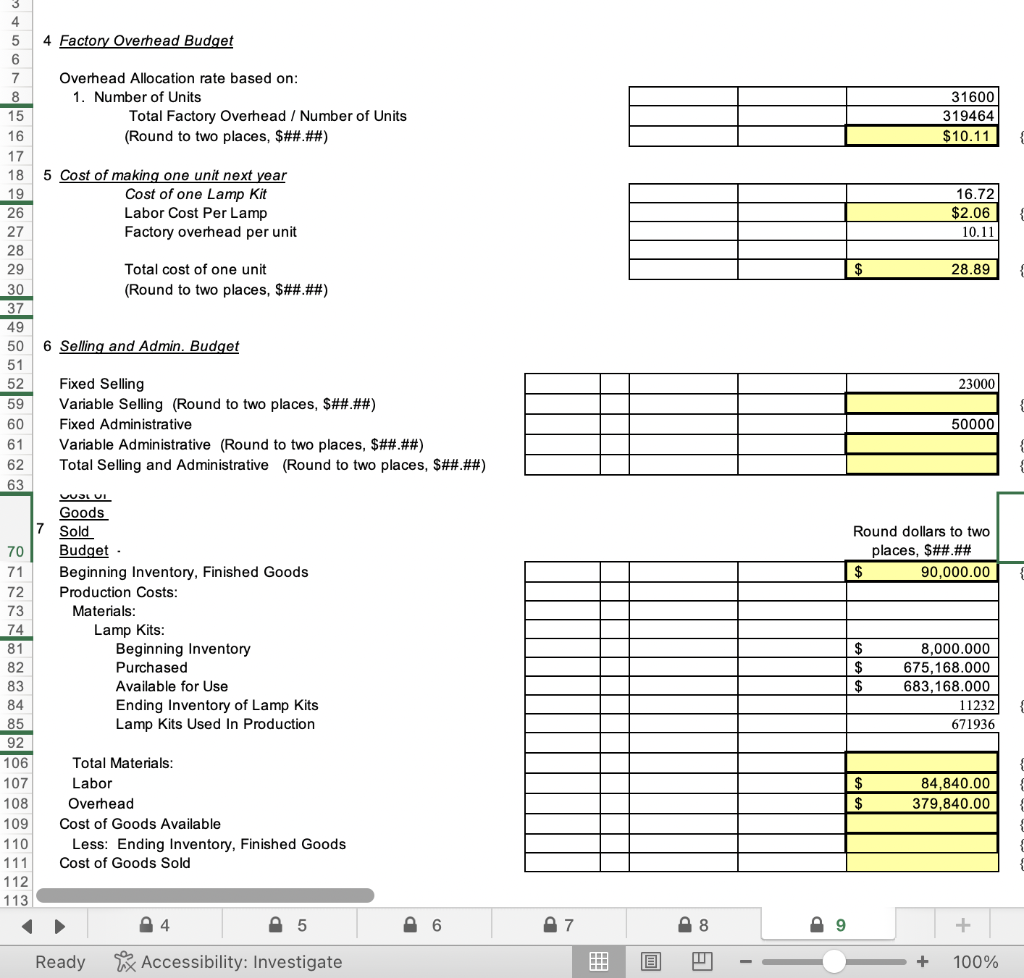

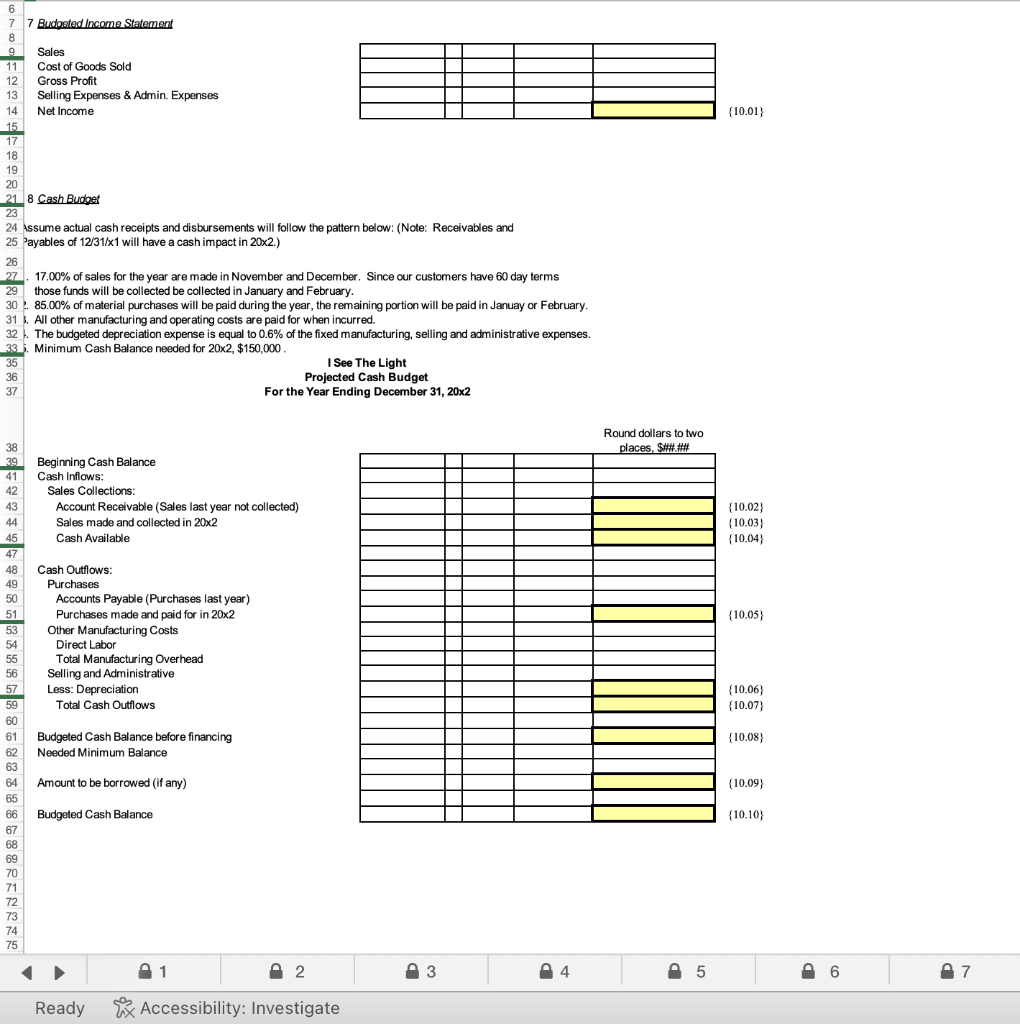

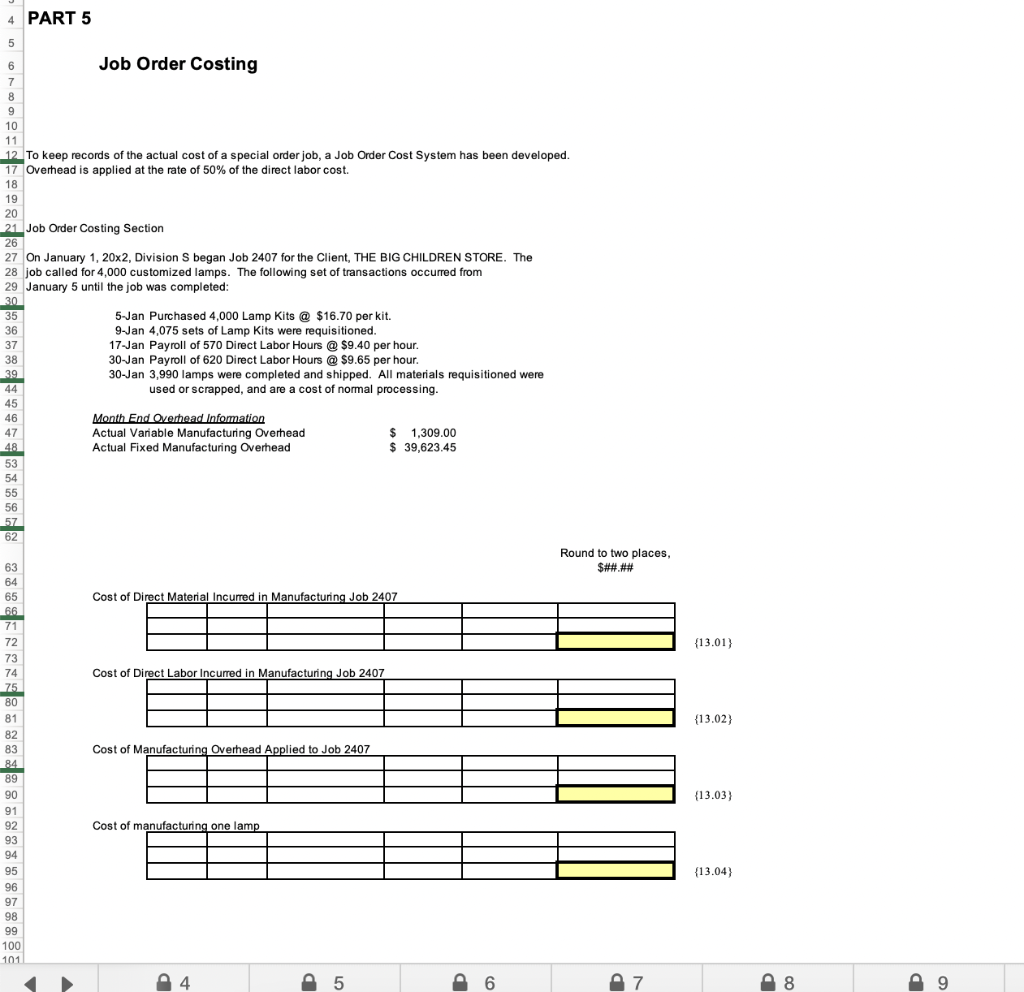

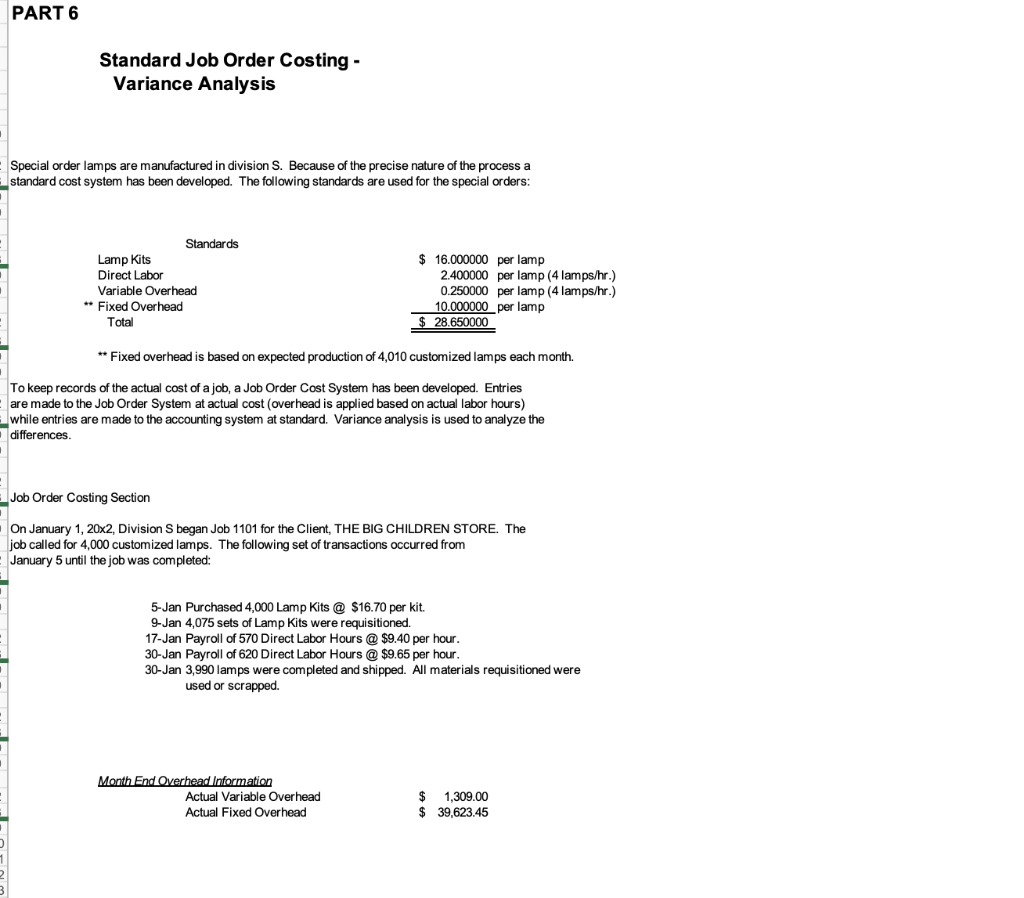

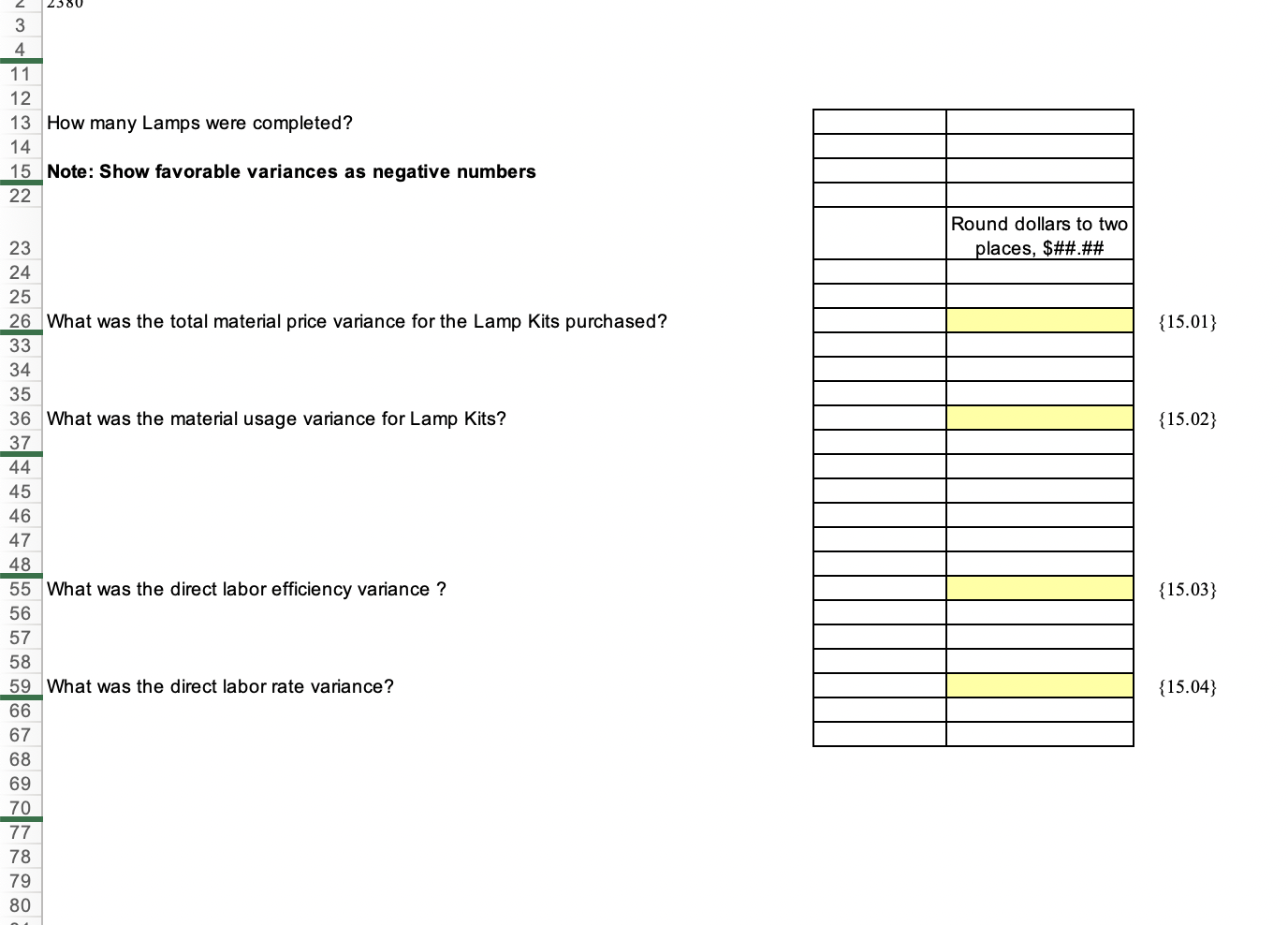

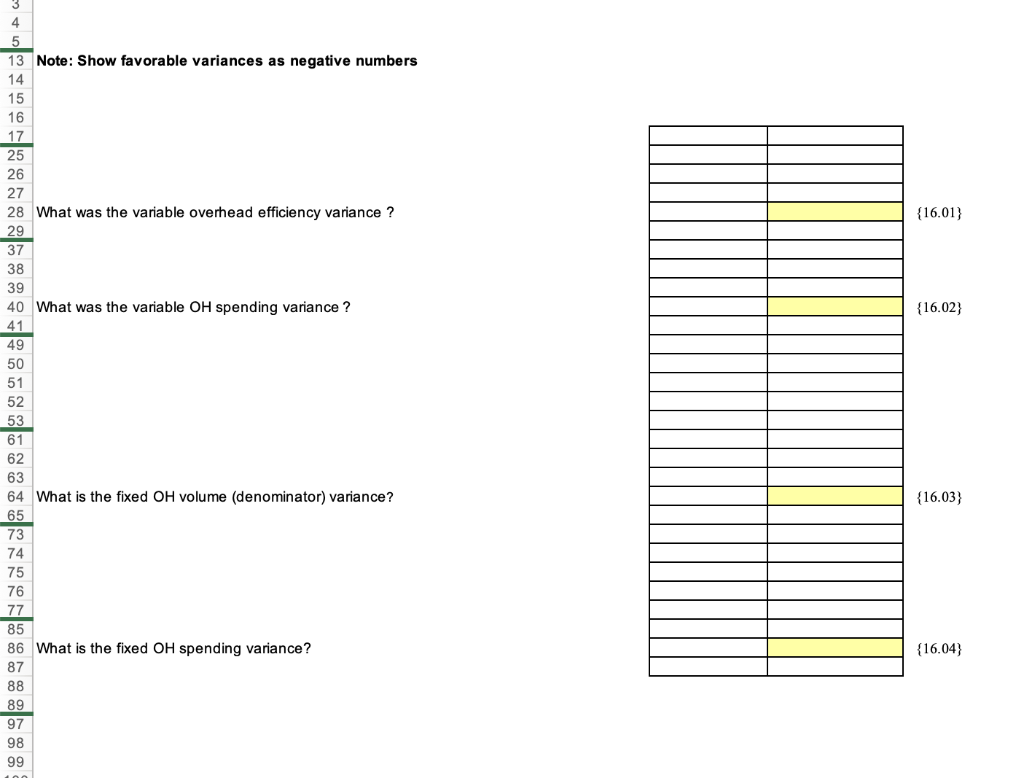

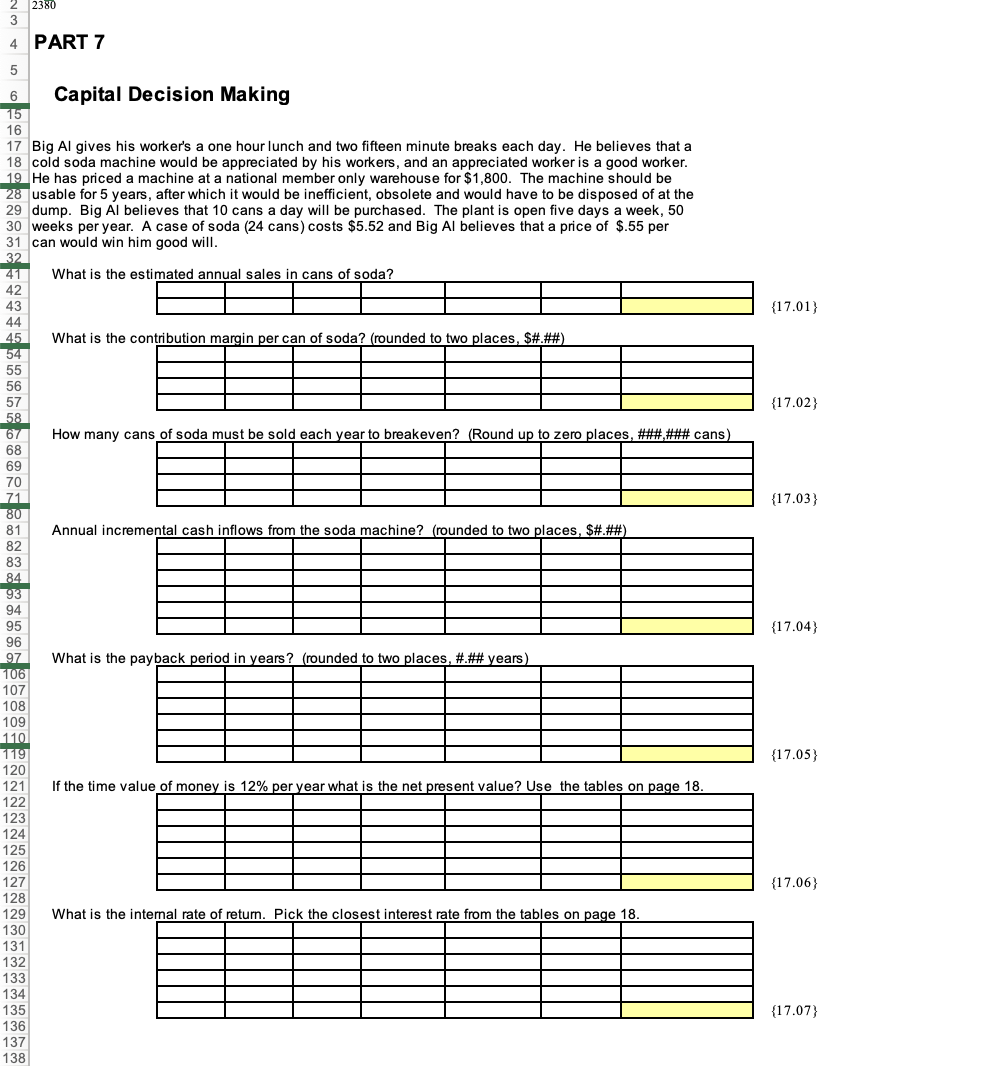

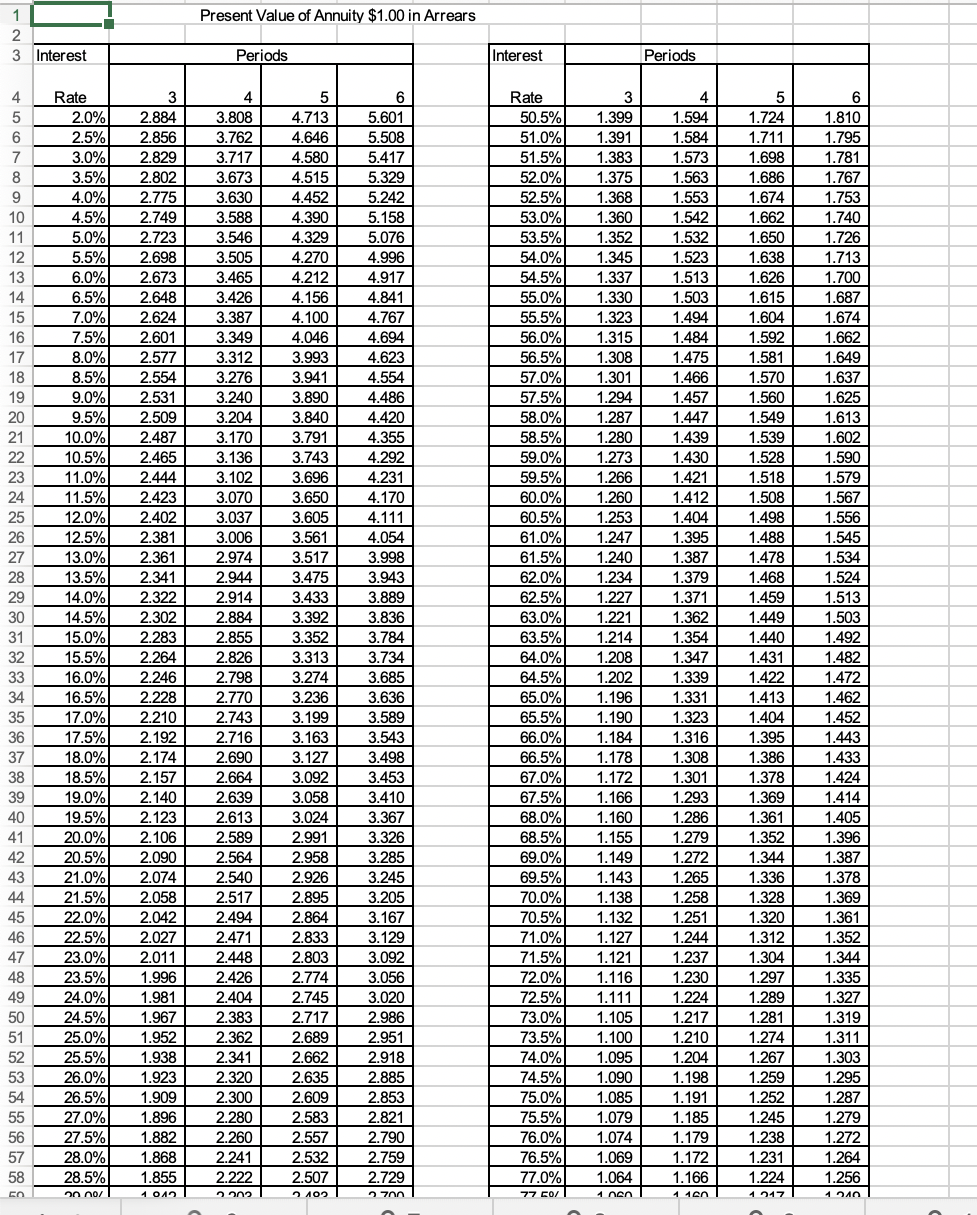

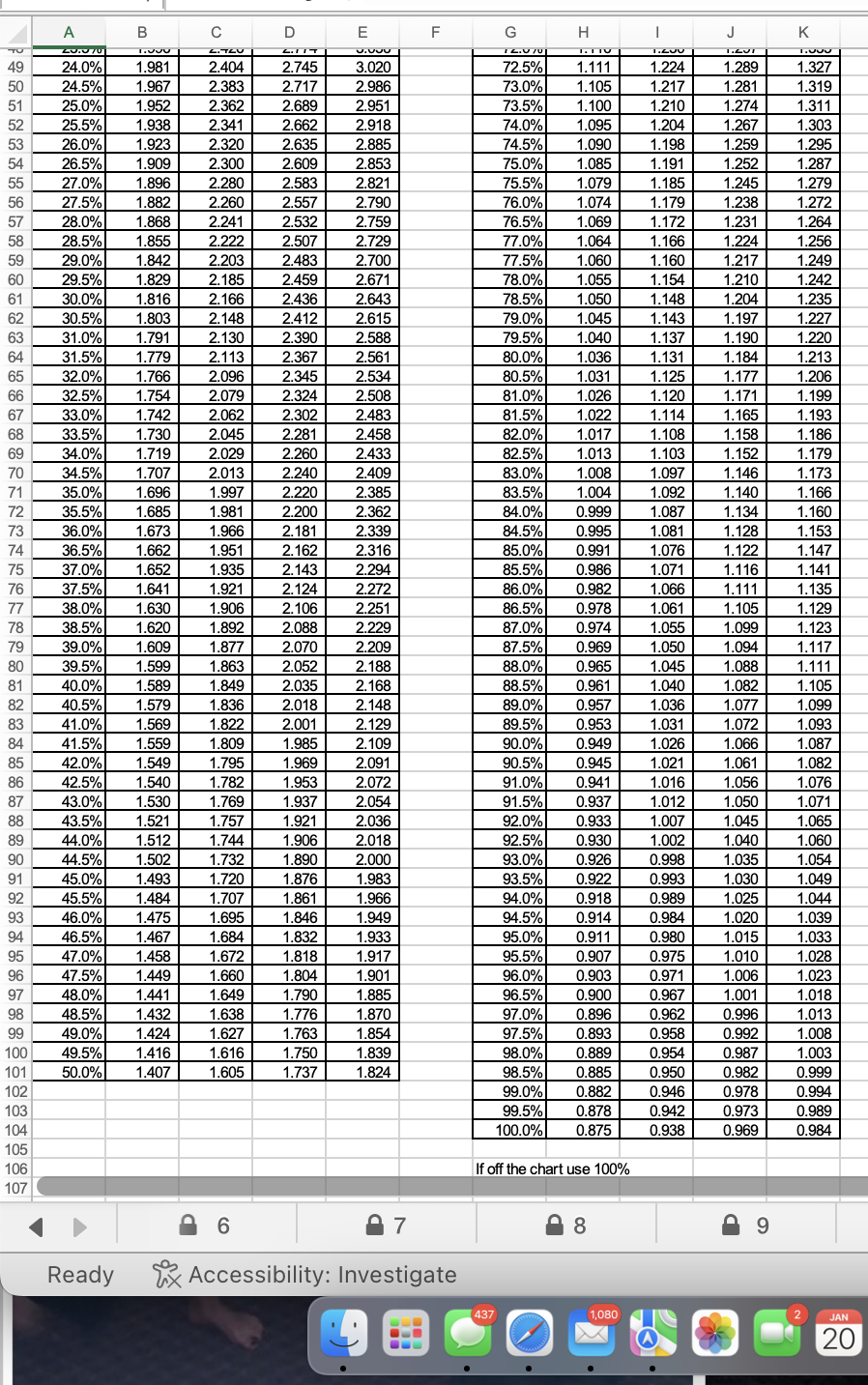

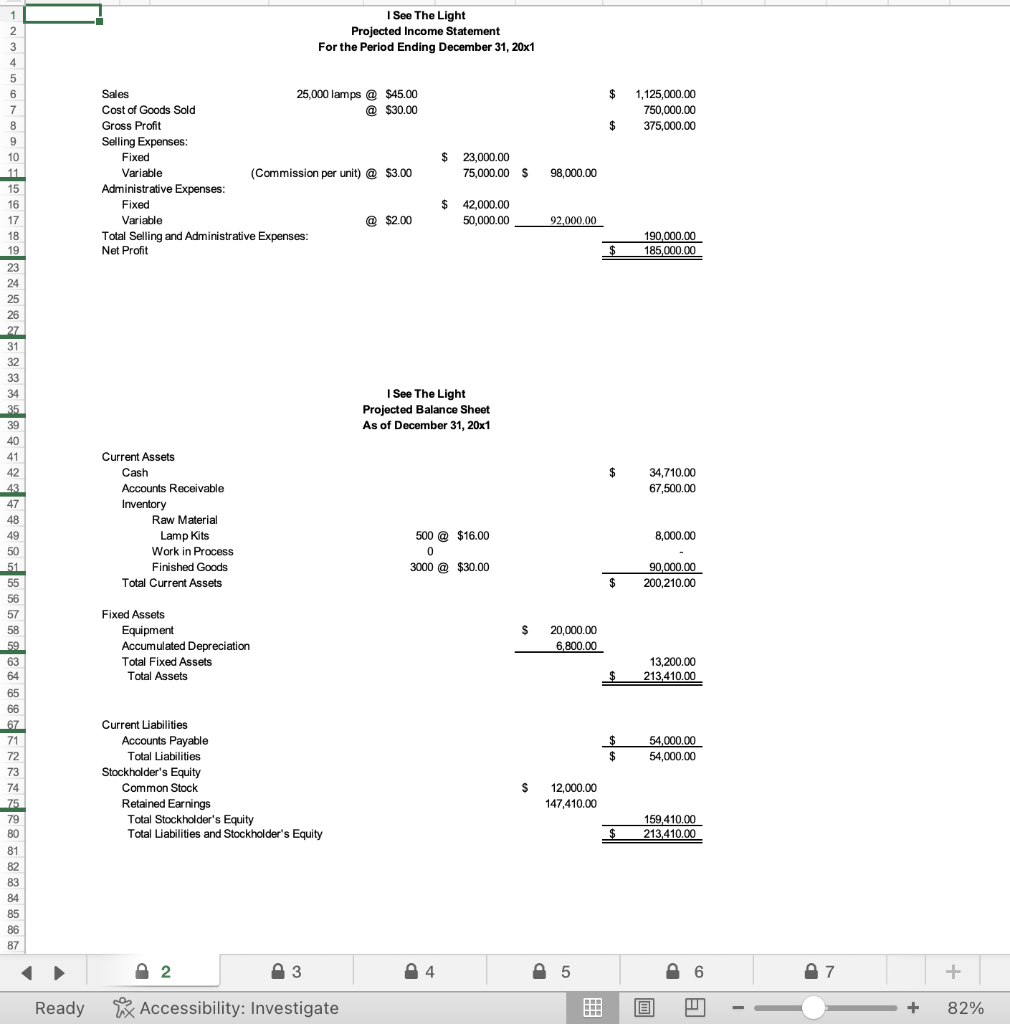

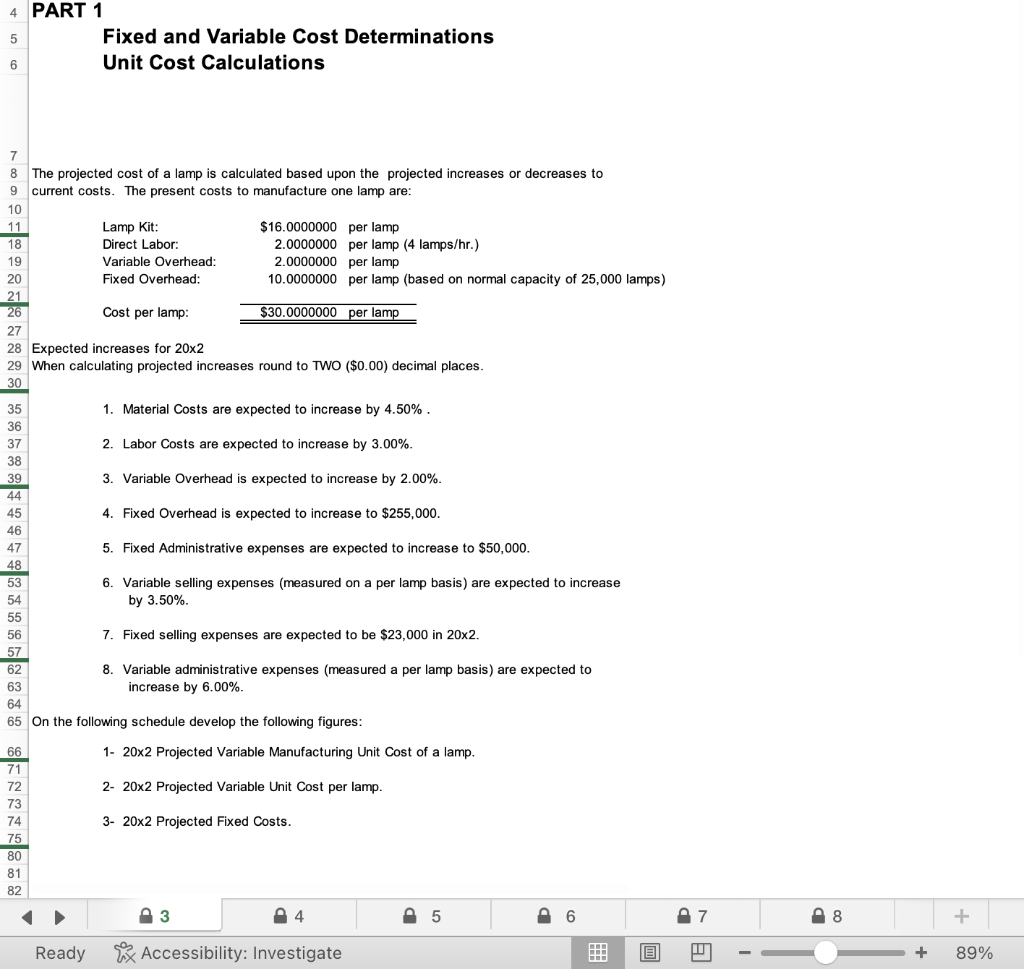

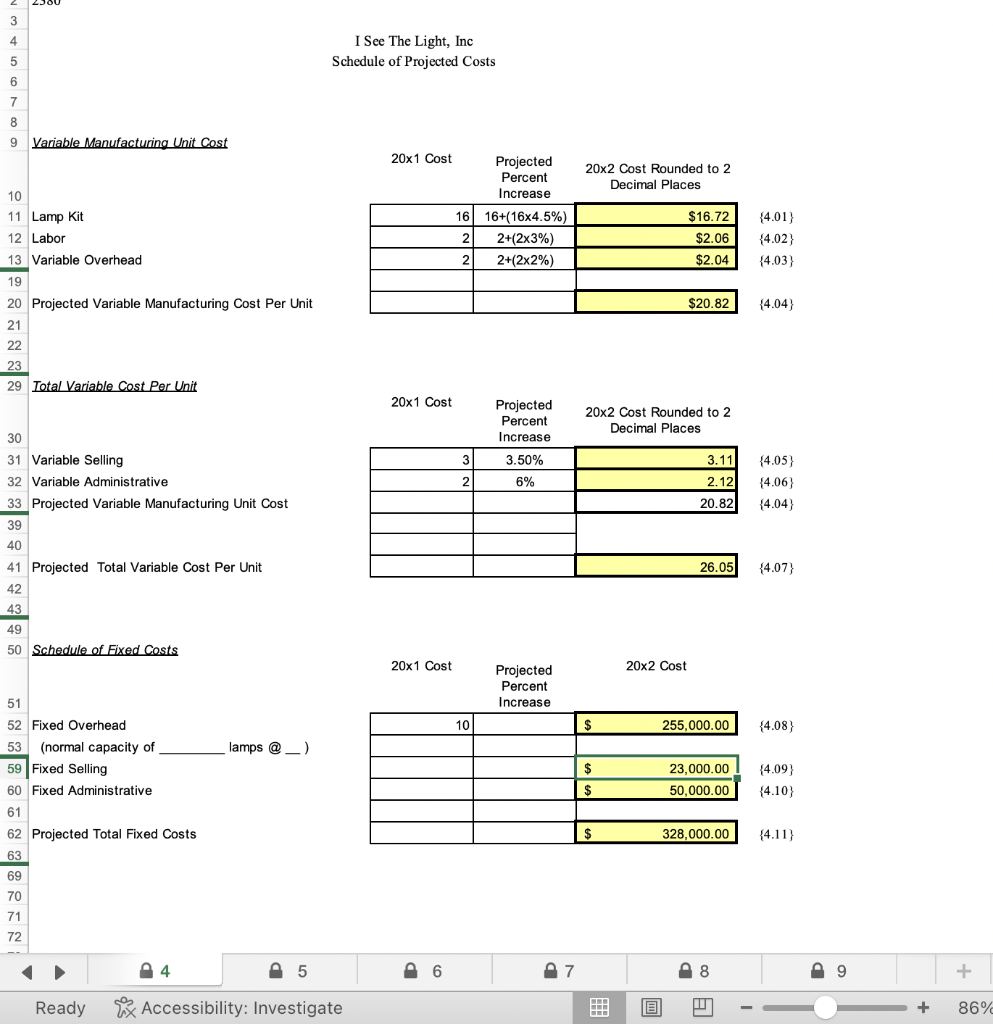

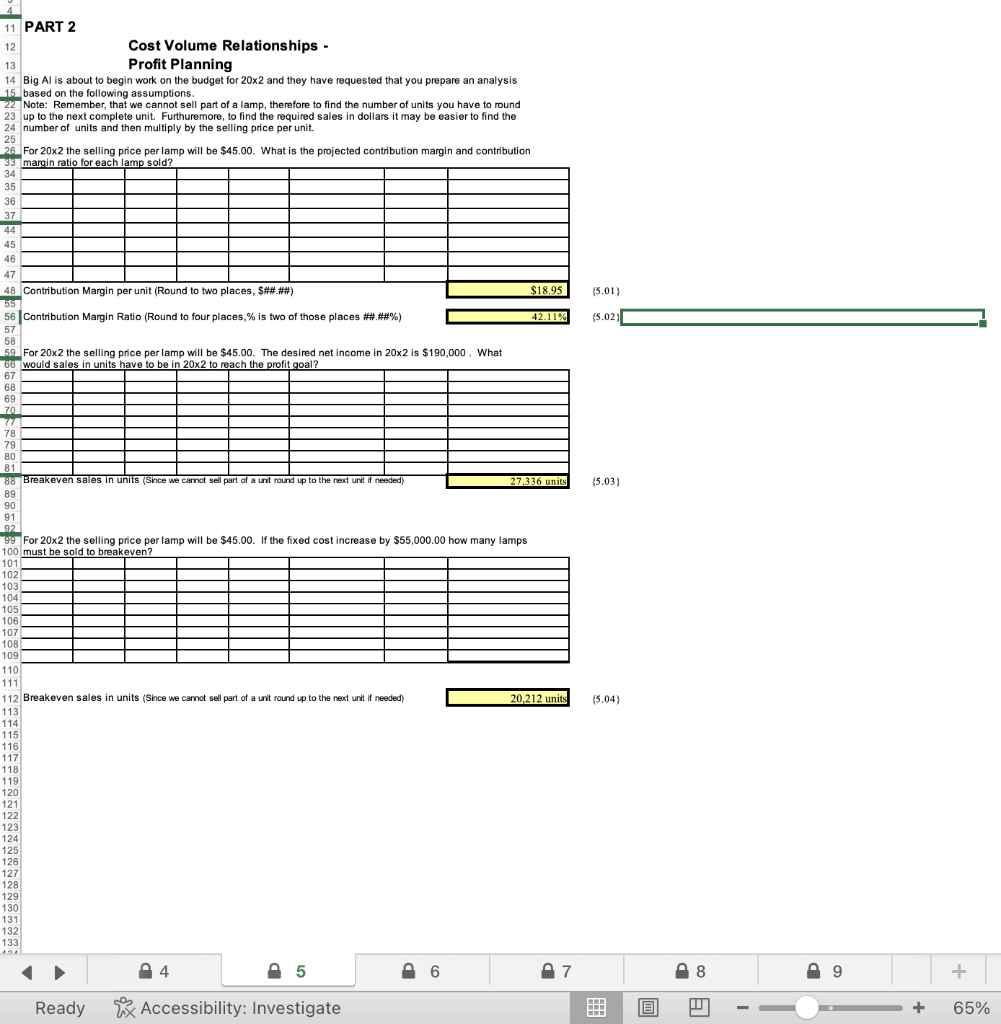

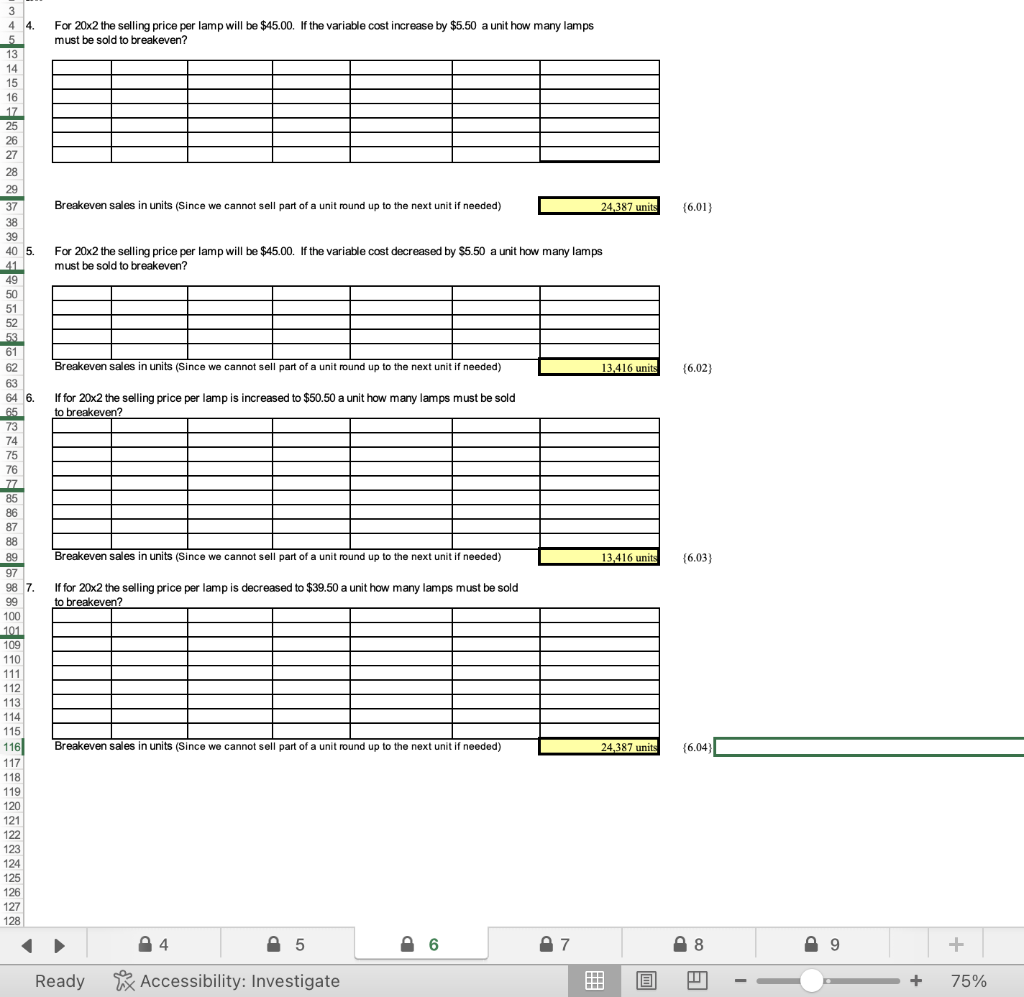

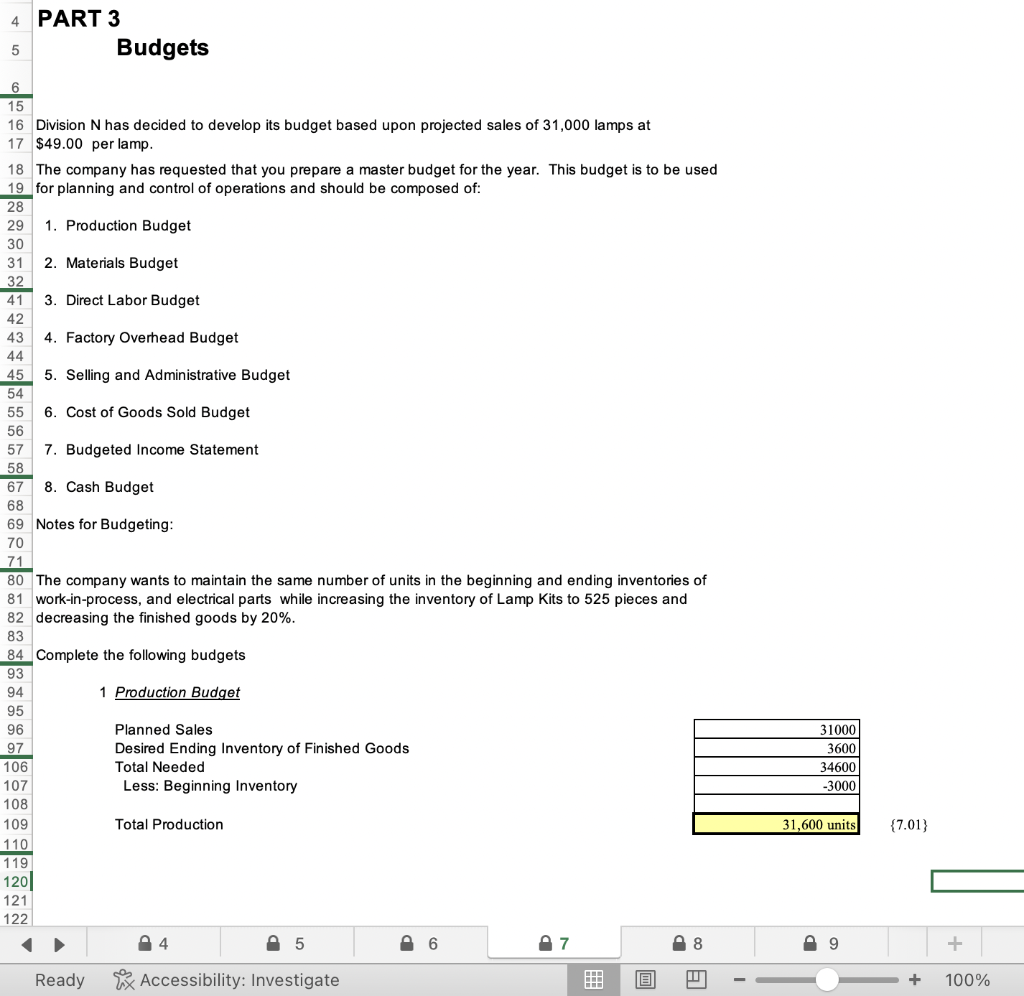

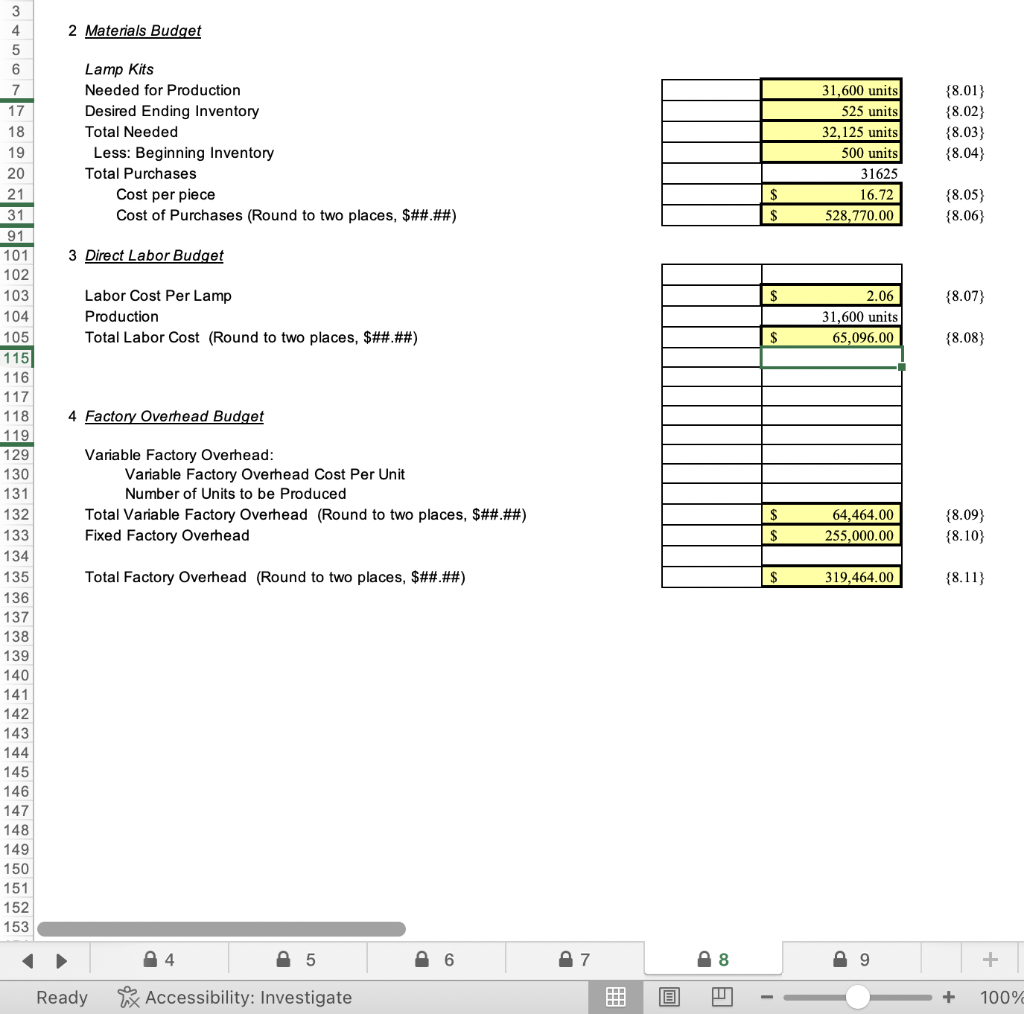

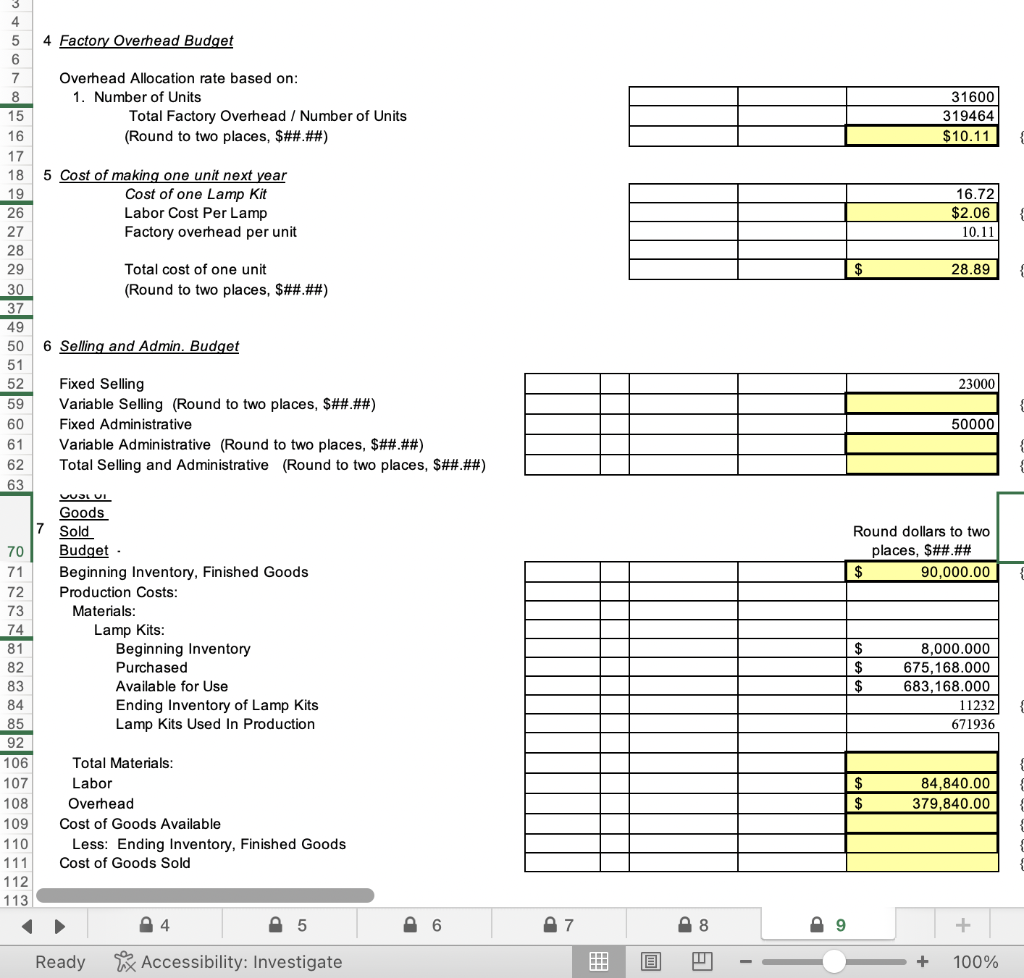

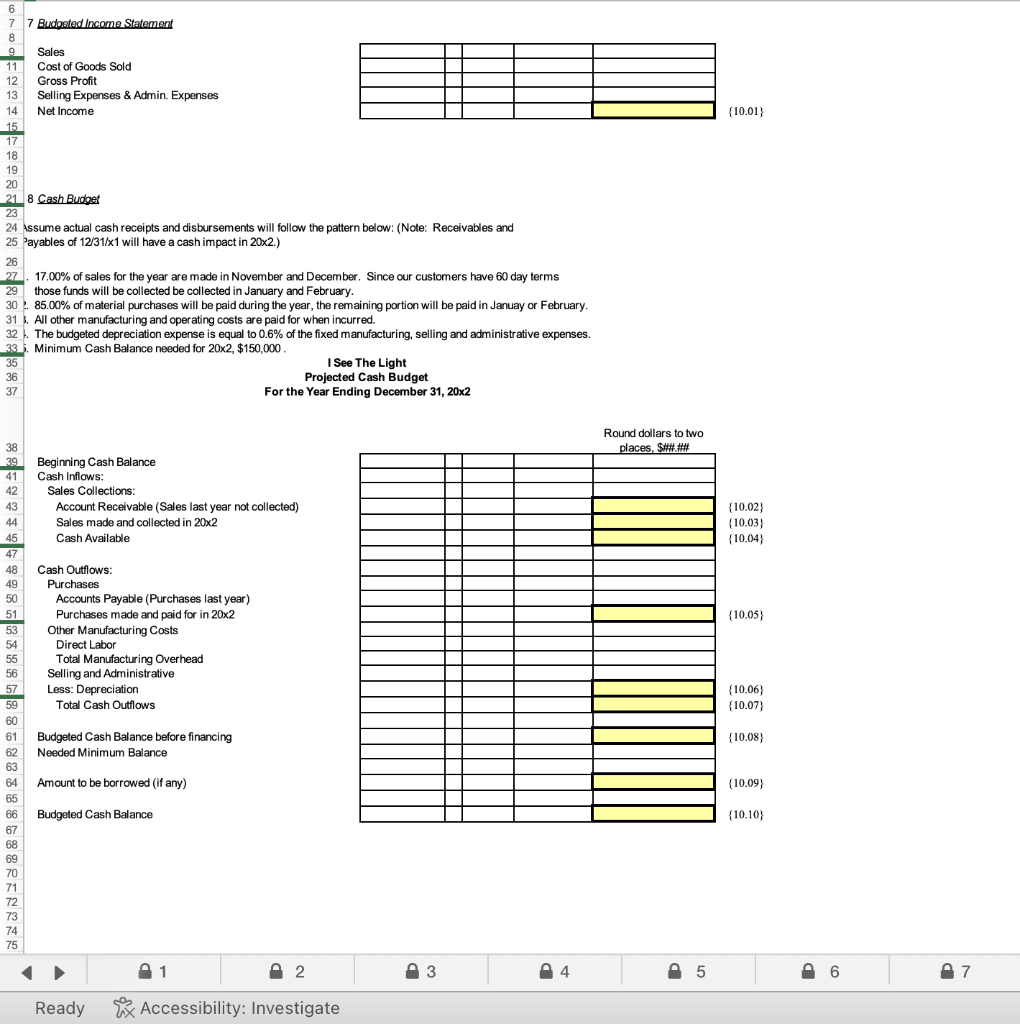

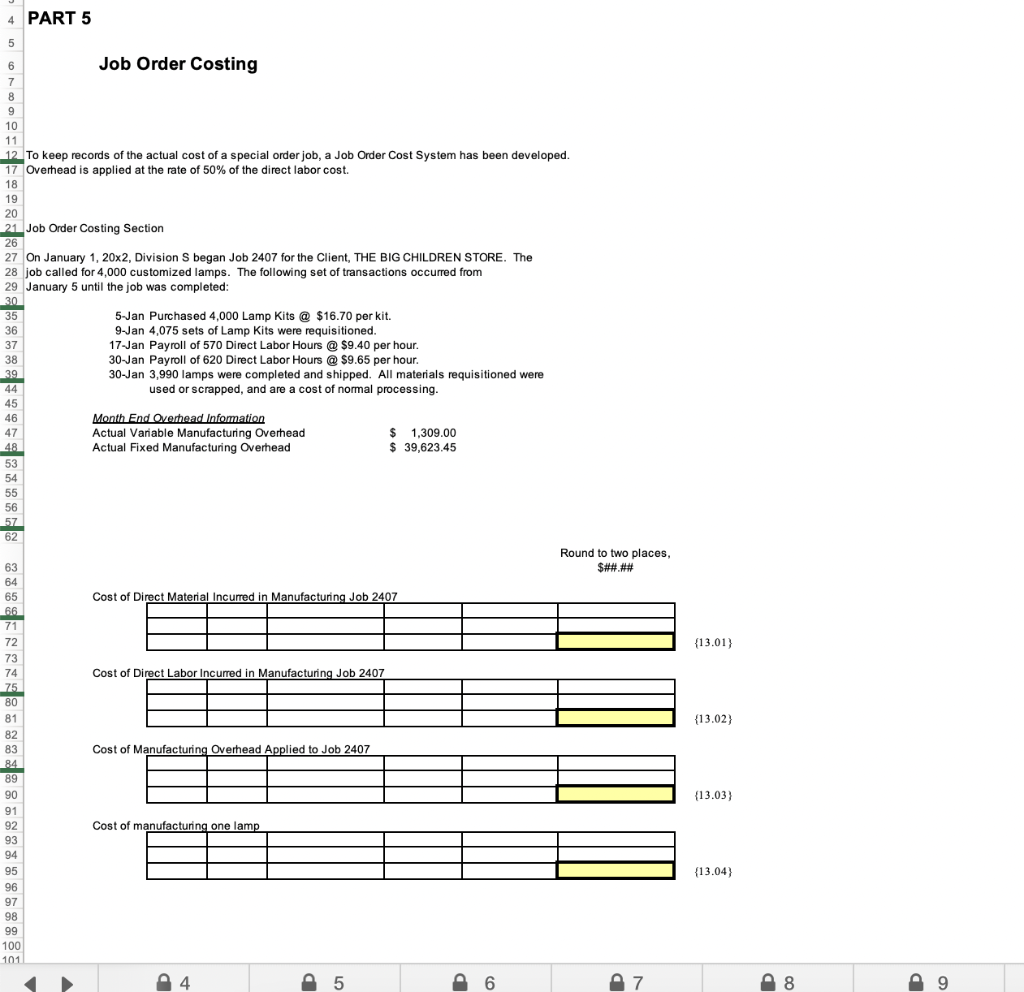

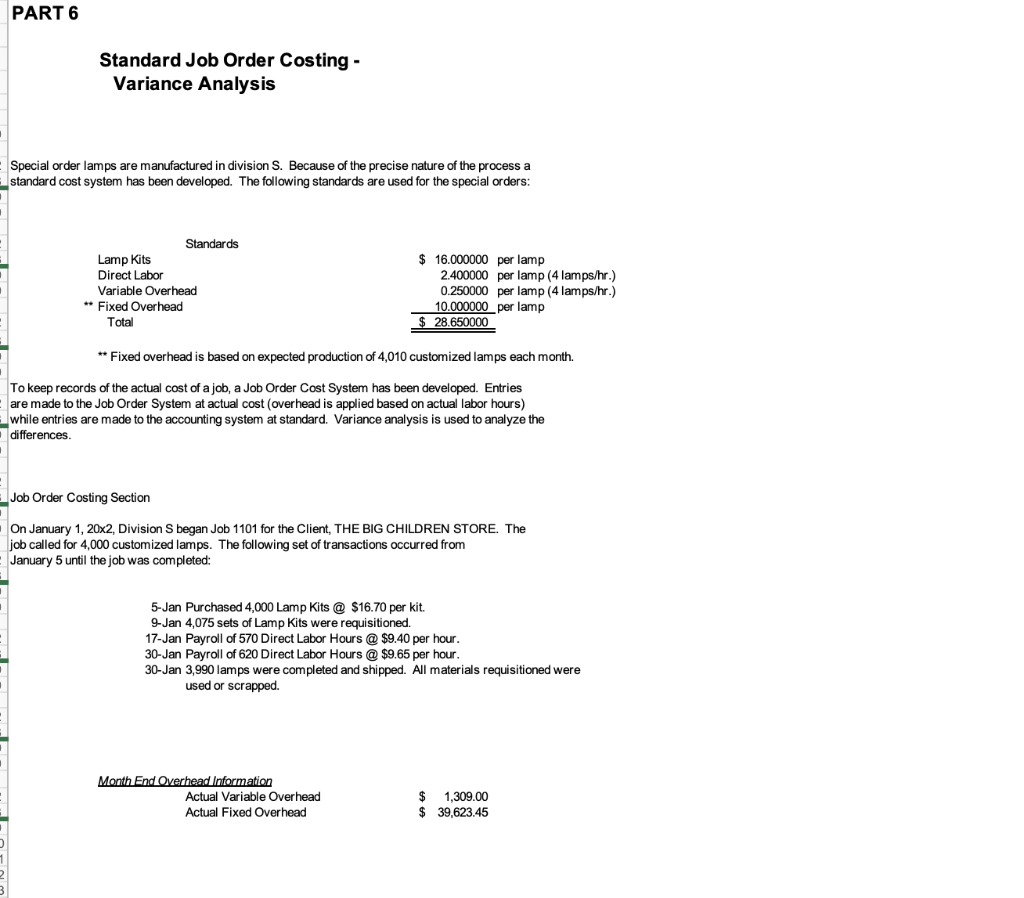

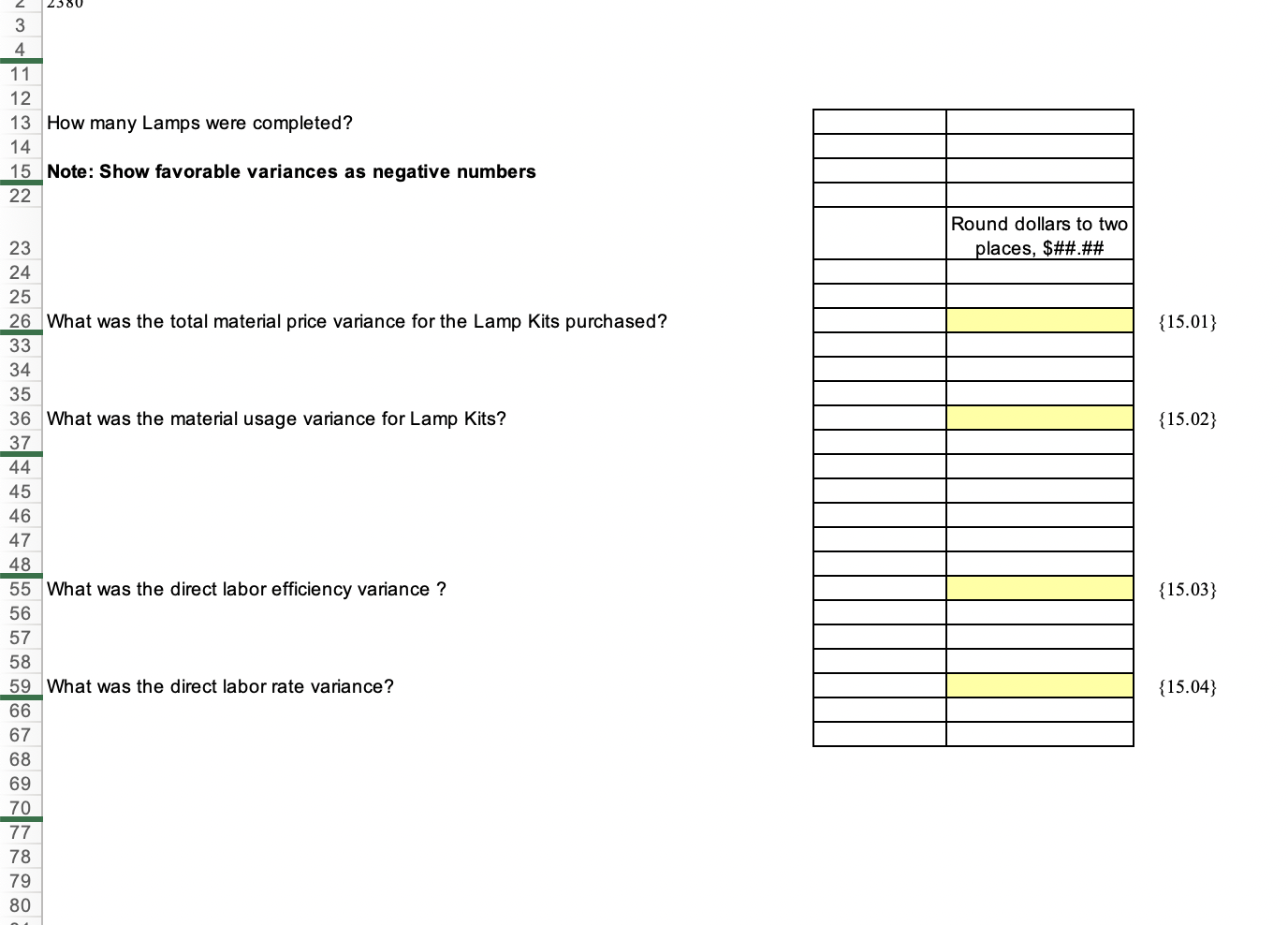

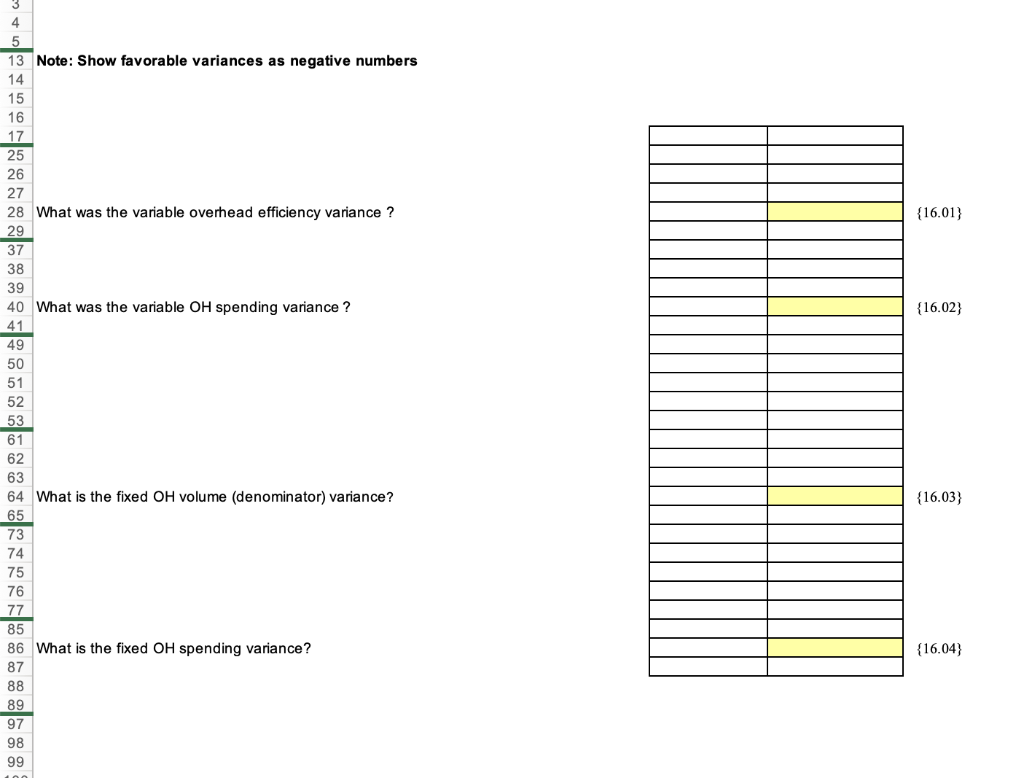

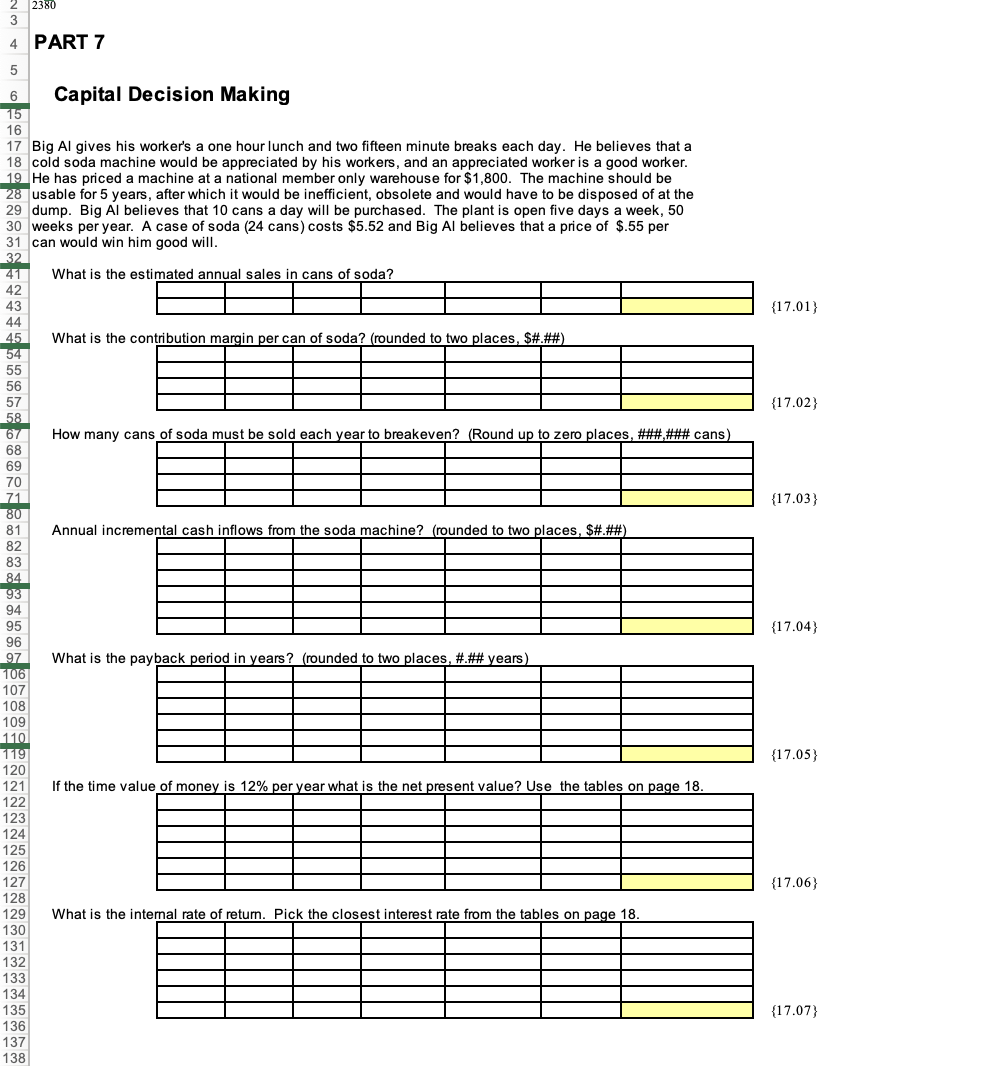

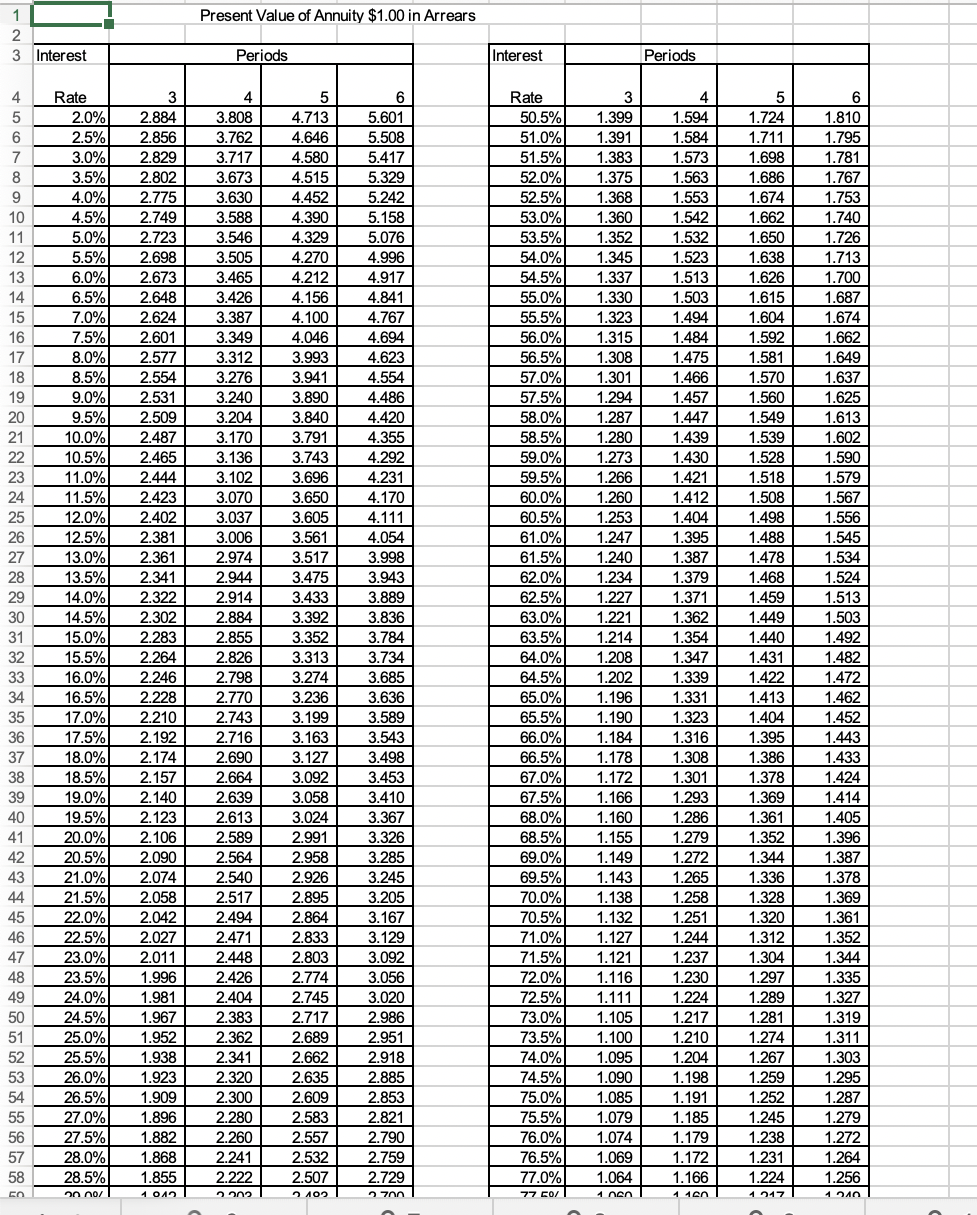

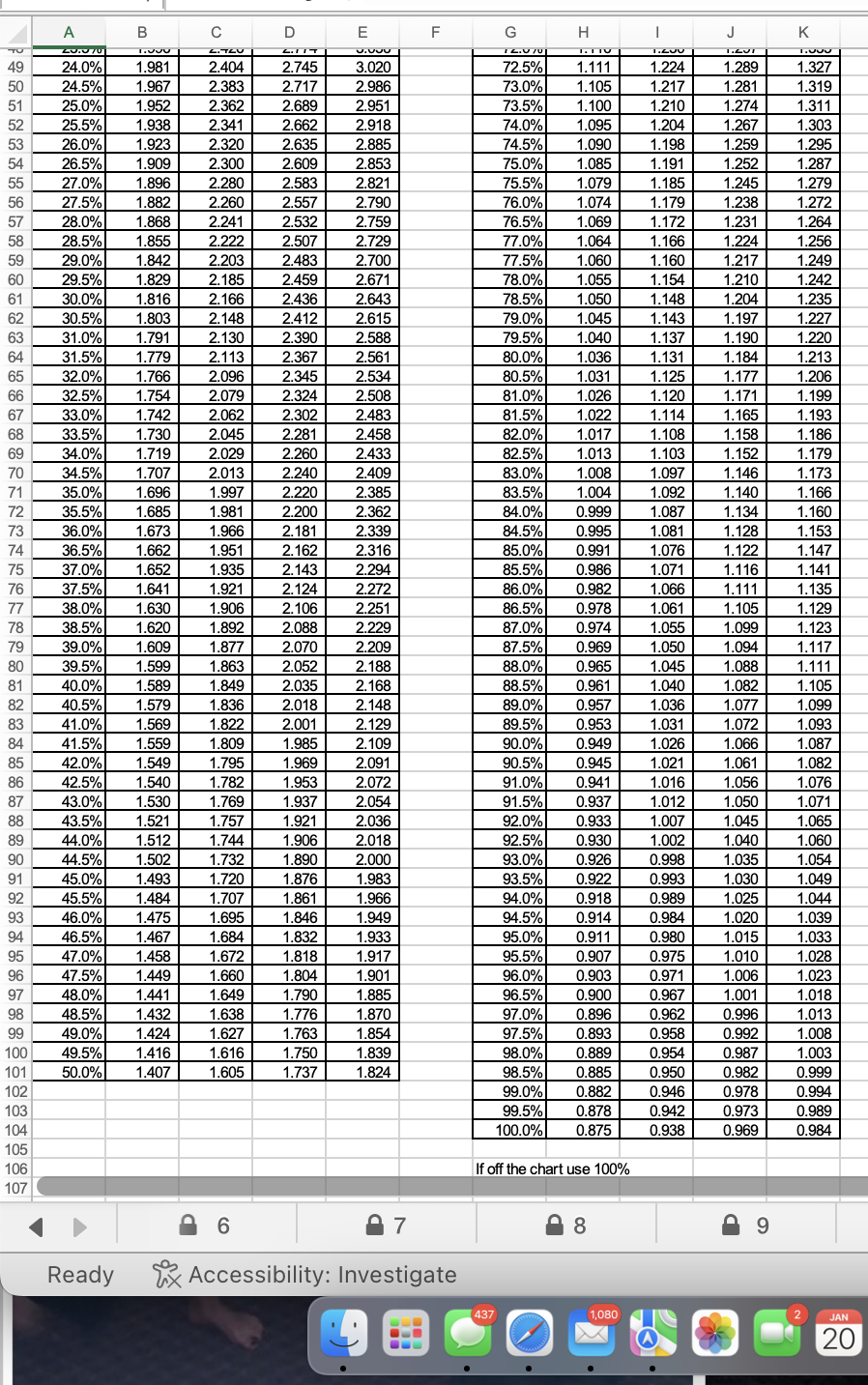

I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets CashAccountsReceivableInventory$3,710.00 Fixed Assets Equipment Accumulated Depreciation \begin{tabular}{rrr} $20,000.00 & \\ & 6,800.00 & \\ & & 13,200.00 \\ & $ & 213,410.00 \\ \hline \hline \end{tabular} Current Liabilities Accounts Payable Total Liabilities \begin{tabular}{ll} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} Stockholder's Equity Common Stock Retained Earnings Total Stockholder's Equity Total Liabilities and Stockholder's Equity \begin{tabular}{rrr} $12,000.00 & \\ 147,410.00 & \\ \cline { 2 - 3 } & $159,410.00 \\ \hline \hline213,410.00 \\ \hline \end{tabular} 2 3 Ready ix Accessibility: Investigate PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 4.50%. 2. Labor Costs are expected to increase by 3.00%. 3. Variable Overhead is expected to increase by 2.00%. 4. Fixed Overhead is expected to increase to $255,000. 5. Fixed Administrative expenses are expected to increase to $50,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 3.50%. 7. Fixed selling expenses are expected to be $23,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 6.00%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs. I See The Light, Inc Schedule of Projected Costs Variable Manufacturing Unit Cost {4.01} {4.02} {4.03} Projected Variable Manufacturing Cost Per Unit {4.04} 29 Iotal Variable Cost Per Unit {4.05} {4.06} {4.04} Projected Total Variable Cost Per Unit {4.07} Schedule of Fixed Costs {4.08} (normal capacity of lamps@__) Fixed Selling Fixed Administrative Projected Total Fixed Costs {4.09} {4.10} {4.11} Cost Volume Relationships - Profit Planning Big Al is about to begin work on the budget for 202 and they have requested that you prepare an analysis based on the following assumptions. Note: Remember, that we cannot sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to find the number of units and then multiply by the selling price per unit. For 202 the selling price per lamp will be $45.00. What is the projected contribution margin and contribution mamin matia farasaph lamn oald? |Contribution Margin Ratio (Round to four places, % is two of those places \#\#.H\#\%) For 202 the selling price per lamp will be $45.00. The desired net income in 202 is $190,000. What would sales in units have to be in 202 to reach the orofit aoal? For 20x2 the selling price per lamp will be $45.00. If the fixed cost increase by $55,000.00 how many lamps Breakeven sales in units (Shce we carnot sell part of a unit round up to the next urit if needed) For 20x2 the selling price per lamp will be $45.00. If the variable cost increase by $5.50 a unit how many lamps must be sold to breakeven? Breakeven sales in units (Since we cannot sell part of a unit round up to the next unit if needed) For 20x2 the selling price per lamp will be $45.00. If the variable cost decreased by $5.50 a unit how many lamps must be sold to breakeven? Dr eakeveri sales in unils (once we cannot sell part or a unit rouna up to the next unit it needed) 15,416 If for 202 the selling price per lamp is increased to $50.50 a unit how many lamps must be sold If for 202 the selling price per lamp is decreased to $39.50 a unit how many lamps must be sold Budgets Division N has decided to develop its budget based upon projected sales of 31,000 lamps at $49.00 per lamp. The company has requested that you prepare a master budget for the year. This budget is to be used for planning and control of operations and should be composed of: 1. Production Budget 2. Materials Budget 3. Direct Labor Budget 4. Factory Overhead Budget 5. Selling and Administrative Budget 6. Cost of Goods Sold Budget 7. Budgeted Income Statement 8. Cash Budget Notes for Budgeting: The company wants to maintain the same number of units in the beginning and ending inventories of work-in-process, and electrical parts while increasing the inventory of Lamp Kits to 525 pieces and decreasing the finished goods by 20%. Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods Total Needed Less: Beginning Inventory Total Production 4 5 6 7 8 3 Direct Labor Budget Labor Cost Per Lamp Production Total Labor Cost (Round to two places, \$\#\#.\#\#) 4 Factory Overhead Budget Variable Factory Overhead: Variable Factory Overhead Cost Per Unit Number of Units to be Produced Total Variable Factory Overhead (Round to two places, \$\#\#.\#\#) Fixed Factory Overhead Total Factory Overhead (Round to two places, \$\#\#.\#\#) 4 Factory Overhead Budget Overhead Allocation rate based on: 1. Number of Units Total Factory Overhead / Number of Units (Round to two places, \$\#\#.\#\#) \begin{tabular}{|r|r|r|} \hline & & 31600 \\ \hline & & 319464 \\ \hline & & $10.11 \\ \hline \end{tabular} 5 Cost of making one unit next year Cost of one Lamp Kit Labor Cost Per Lamp Factory overhead per unit Total cost of one unit (Round to two places, \$\#\#.\#\#) \begin{tabular}{|r|r|r|} \hline & & 16.72 \\ \hline & & $2.06 \\ \hline & & 10.11 \\ \hline & & 28.89 \\ \hline & & $ \\ \hline \end{tabular} 6 Selling and Admin. Budget Fixed Selling Variable Selling (Round to two places, \$\#\#.\#\#) Fixed Administrative Variable Administrative (Round to two places, \$\#\#.\#\#) Total Selling and Administrative (Round to two places, \$\#\#.\#\#) \begin{tabular}{|l|l|l|l|r|} \hline & & & & 23000 \\ \hline & & & & 50000 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} Total Materials: Labor Overhead Cost of Goods Available Less: Ending Inventory, Finished Goods Cost of Goods Sold Round dollars to two 8 Cash Burdast Issume actual cash receipts and disbursements will follow the pattern below: (Note: Receivables and Payables of 12/31/x1 will have a cash impact in 20x2.) 17.00% of sales for the year are made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and February. 85.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February. All other manufacturing and operating costs are paid for when incurred. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. Minimum Cash Balance needed for 20x2, \$150,000. I See The Light Projected Cash Budget For the Year Ending December 31, 20x2 Job Order Costing ep records of the actual cost of a special order job, a Job Order Cost System has been developed. iead is applied at the rate of 50% of the direct labor cost. Costing Section Inuary 1, 20x2, Division S began Job 2407 for the Client, THE BIG CHILDREN STORE. The alled for 4,000 customized lamps. The following set of transactions occurred from ary 5 until the job was completed: 5-Jan Purchased 4,000 Lamp Kits @ \$16.70 per kit. 9-Jan 4,075 sets of Lamp Kits were requisitioned. 17-Jan Payroll of 570 Direct Labor Hours @ $9.40 per hour. 30-Jan Payroll of 620 Direct Labor Hours @ \$9.65 per hour. 30-Jan 3,990 lamps were completed and shipped. All materials requisitioned were used or scrapped, and are a cost of normal processing. Month End Overhead Information Actual Variable Manufacturing Overhead $$1,309.0039,623.45 Actual Fixed Manufacturing Overhead Cost Cost of Manufonturina Nurahased A noliad in Inh 2A An Standard Job Order Costing - Variance Analysis Special order lamps are manufactured in division S. Because of the precise nature of the process a standard cost system has been developed. The following standards are used for the special orders: ** Fixed overhead is based on expected production of 4,010 customized lamps each month. To keep records of the actual cost of a job, a Job Order Cost System has been developed. Entries are made to the Job Order System at actual cost (overhead is applied based on actual labor hours) while entries are made to the accounting system at standard. Variance analysis is used to analyze the differences. Job Order Costing Section On January 1, 20x2, Division S began Job 1101 for the Client, THE BIG CHILDREN STORE. The job called for 4,000 customized lamps. The following set of transactions occurred from January 5 until the job was completed: 5-Jan Purchased 4,000 Lamp Kits @ \$16.70 per kit. 9-Jan 4,075 sets of Lamp Kits were requisitioned. 17-Jan Payroll of 570 Direct Labor Hours @ $9.40 per hour. 30-Jan Payroll of 620 Direct Labor Hours @ $9.65 per hour. 30-Jan 3,990 lamps were completed and shipped. All materials requisitioned were used or scrapped. Note: Show favorable variances as negative numbers What was the total material price variance for the Lamp Kits purchased? What was the material usage variance for Lamp Kits? What was the direct labor efficiency variance ? What was the direct labor rate variance? Note: Show favorable variances as negative numbers What was the variable overhead efficiency variance? What was the variable OH spending variance? What is the fixed OH volume (denominator) variance? What is the fixed OH spending variance? Capital Decision Making Big Al gives his worker's a one hour lunch and two fifteen minute breaks each day. He believes that a cold soda machine would be appreciated by his workers, and an appreciated worker is a good worker. He has priced a machine at a national member only warehouse for $1,800. The machine should be usable for 5 years, after which it would be inefficient, obsolete and would have to be disposed of at the dump. Big Al believes that 10 cans a day will be purchased. The plant is open five days a week, 50 weeks per year. A case of soda (24 cans) costs $5.52 and Big Al believes that a price of $.55 per can would win him good will. What is the es {17.01} What is the contribution marain ner can of soda? (rounded to two nlaces. \$\#.\#\#) {17.02} How many cans of soda must be sold each vear to breakeven? (Round un to zero blaces. \#\#\#.\#\#\# cans) {17.04} {17.05} If the time value of monev is 12% ner vear what is the net nresent value? Use the tables on nace 18 . {17.06} If off the chart use 100% 6 7 9 Ready Rx Accessibility: Investigate