Answered step by step

Verified Expert Solution

Question

1 Approved Answer

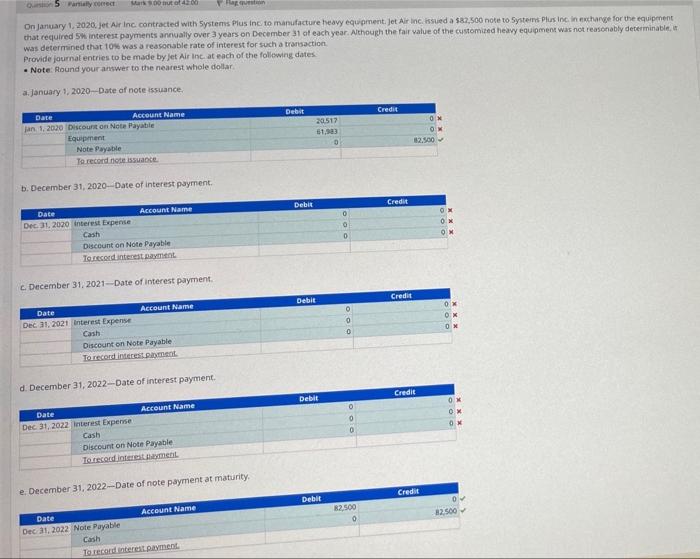

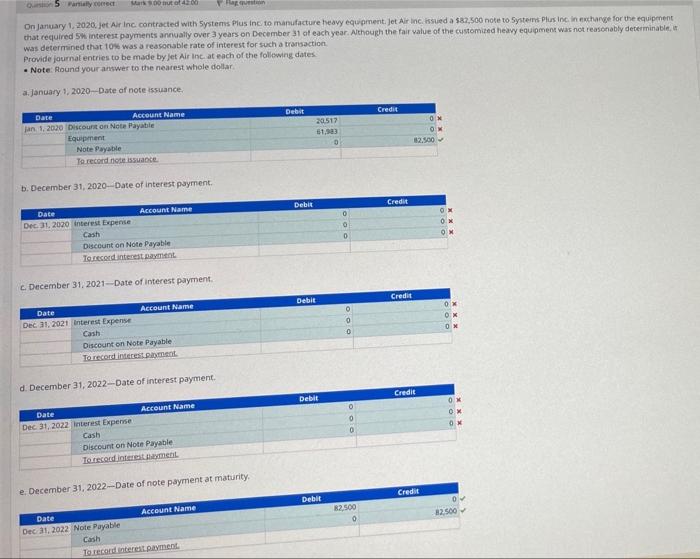

please help me with both questions thank you Santial com Maruto On January 1, 2020 Jet Air Inc contracted with Systems Plus Inc. to manufacture

please help me with both questions thank you

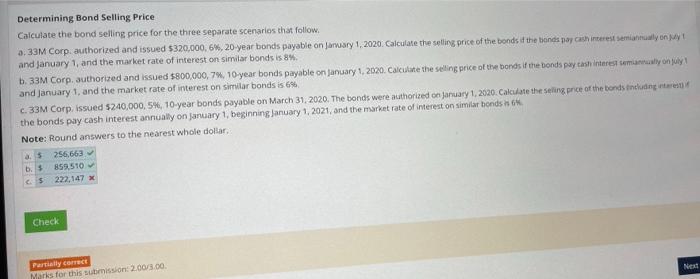

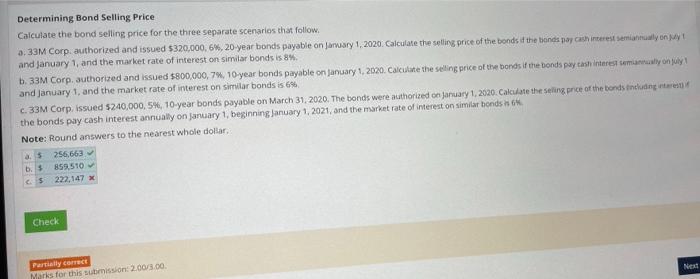

Santial com Maruto On January 1, 2020 Jet Air Inc contracted with Systems Plus Inc. to manufacture heavy equipment. Jet Alt loc issued a $87.500 note to Systern Plus Inc in exchange for the equipment that required interest payments annually over 3 years on December 31 of each year. Although the fair value of the customized heavy equipment was not reasonably determinable, was determined that 10% was a reasonable rate of interest for such a transaction Provide journal entries to be made by Jet Air Inc. at each of the following dates Note: Round your answer to the nearest whole dollar a. January 1, 2020-Date of note issuance. Debit Credit 20517 61,983 Date Account Name Jan 1, 2020 Discount on Note Payable Equipment Note Payable To record note issuance 12.500 b. December 31, 2020--Date of interest payment Debit Credit 0 Date Account Name Dec 31, 2020 interest Expense Cast Discount on Note Payable To record interest payment 0 December 31, 2021 Date of interest payment Debit Credit 0 0 0 Date Account Name Dec 31, 2021 Interest Expense Cast Discount on Note Payable To record interestment d. December 31, 2022-Date of interest payment. Credit Debit O 0 0 0 Date Account Name Dec 31, 2022 Interest Expense Cash Discount on Note Payable To record interestment e December 31, 2022-Date of note payment at maturity Credit Debit $2.500 0 2.500 Date Account Name Dec 31, 2022 Note Payable Cash To record inter payment Determining Bond Selling Price Calculate the bond selling price for the three separate scenarios that follow, a. 33M Corp. authorized and issued $320,000. 6%, 20 year bonds payable on January 1, 2020. Calculate the selling price of the bonds if the bonds pay cash interessenyony and January 1, and the market rate of interest on similar bonds is 8%. b. 33M Corp. authorized and issued $800,000, 7, 10 year bonds payable on January 1, 2020. Calculate the selling price of the bonds if the bonds pay tash interest milyon jy and January 1, and the market rate of interest on similar bonds is 6% C. 33M Corp, issued $240,000, 54, 10-year bonds payable on March 31, 2020. The bonds were authorized on January 1, 2020. Calculate the selling price of the bonds including the bonds pay cash interest annually on January 1, beginning January 1, 2021, and the market rate of interest on similar bonds 6 Note: Round answers to the nearest whole dollar 256.663 b. 899.510 5 222,147 x Check Next Partially correct Marks for this ission: 2.00/5.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started