Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with part b) show working so i can understand how to do it and put answer in % to 1d.p thank you

please help me with part b) show working so i can understand how to do it and put answer in % to 1d.p thank you

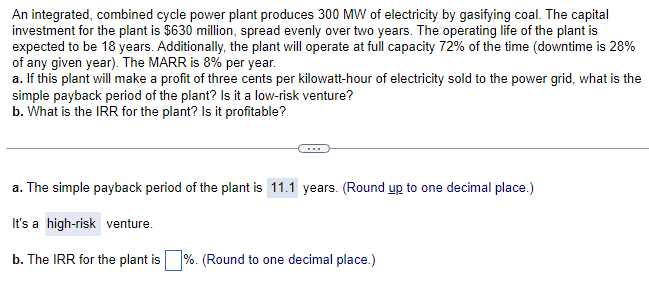

An integrated, combined cycle power plant produces 300 MW of electricity by gasifying coal. The capital investment for the plant is $630 million, spread evenly over two years. The operating life of the plant is expected to be 18 years. Additionally, the plant will operate at full capacity 72% of the time (downtime is 28% of any given year). The MARR is 8% per year. a. If this plant will make a profit of three cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is 11.1 years. (Round up to one decimal place.) It's a high-risk venture. b. The IRR for the plant is %. (Round to one decimal place.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started