Answered step by step

Verified Expert Solution

Question

1 Approved Answer

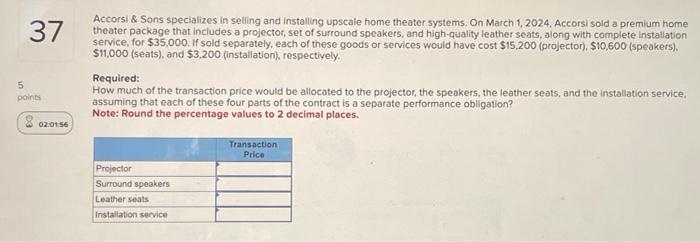

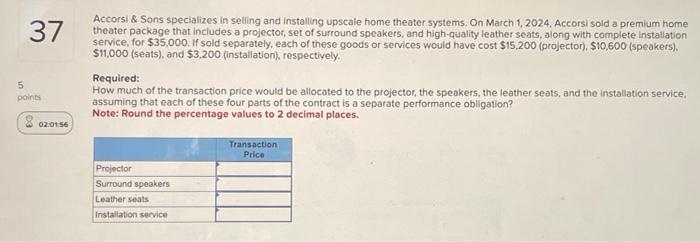

Please help me with questions 36 and 37 Accorsi & Sons specializes in selling and installing upscale home theater systems. On March 1, 2024. Accorsi

Please help me with questions 36 and 37

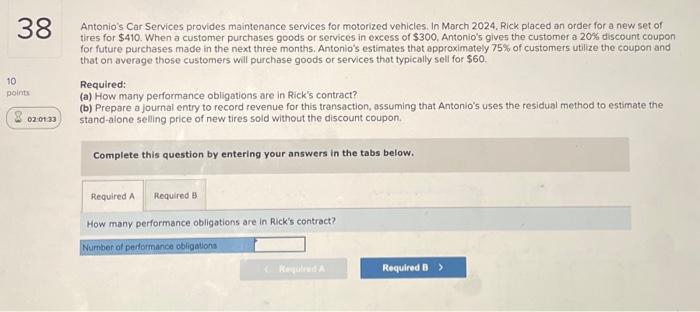

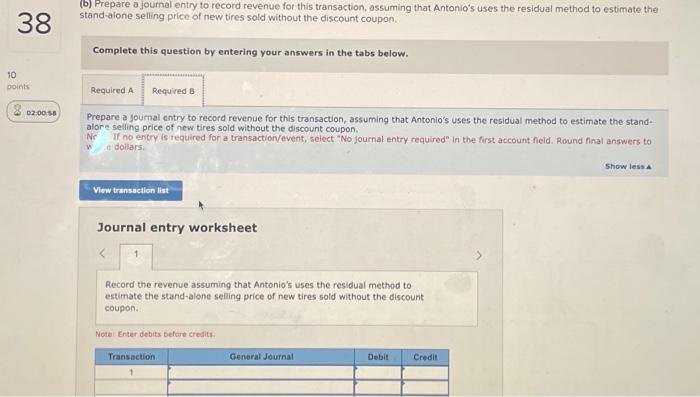

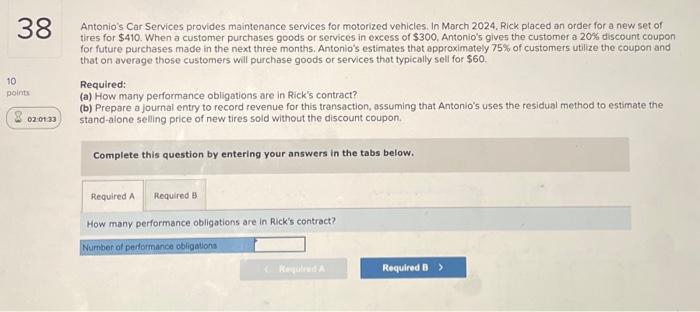

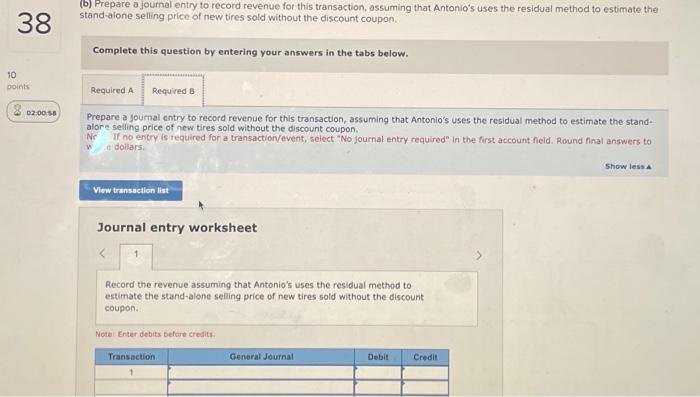

Accorsi \& Sons specializes in selling and installing upscale home theater systems. On March 1, 2024. Accorsi sold a premium home theater package that includes a projector, set of surround speakers, and high-quality leather seats, along with complete installation service, for $35,000. If sold separately, each of these goods or services would have cost $15,200 (projector), $10,600 (speakers). $11,000 (seats), and $3,200 (installation), respectively. Required: How much of the transaction price would be allocated to the projector, the speakers, the leather seats, and the installation service, assuming that each of these four parts of the contract is a separate performance obligation? Note: Round the percentage values to 2 decimal places. Antonio's Car Services provides maintenance services for motorized vehicles. In March 2024. Rick placed an order for a new set of tires for $410. When a customer purchases goods or services in excess of \$300, Antonio's gives the customer a 20% discount coupon for future purchases made in the next three months. Antonio's estimates that approximately 75% of customers utilize the coupon and that on average those customers will purchase goods or services that typically sell for $60. Required: (a) How many performance obligations are in Rick's contract? (b) Prepare a journal entry to record revenue for this transaction, assuming that Antonio's uses the residual method to estimate the stand-alone selling price of new tires sold without the discount coupon. Complete this question by entering your answers in the tabs below. How many performance obligations are in Rick's contract? b) Prepare a journal entry to record revenue for this transaction, assuming that Antonio's uses the residual method to estimate the stand-alone selling price of new tires sold without the discount coupon. Complete this question by entering your answers in the tabs below. Prepare a journal entry to record revenue for this transaction, assuming that Antonio's uses the residual method to estimate the standalore selling price of new tires sold without the discount coupon. Nr If no entry is required for a transaction/event, select "No journal entry required" In the first account field. Round final answers to u a dollars: Journal entry worksheet Record the revenue assuming that Antonio's uses the residual method to estimate the stand-alone selling price of new tires sold without the discount coupon. Note: Entar debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started