Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with the following (lated to Checkpoint 17.1) (Discretionary Financing needs) Hans Electronic Inc operaathin of electrical and future distribution controuge northema Thomson

please help me with the following

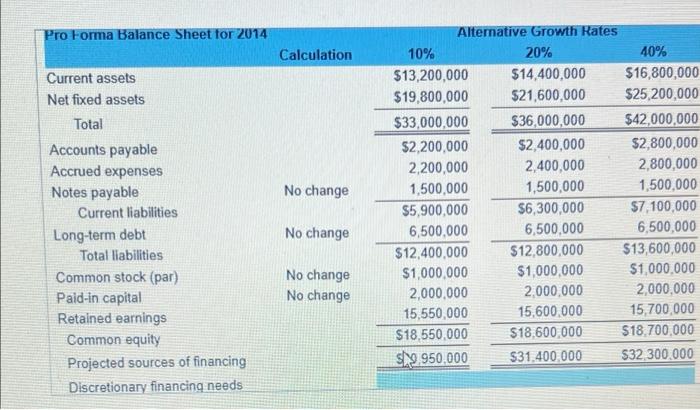

(lated to Checkpoint 17.1) (Discretionary Financing needs) Hans Electronic Inc operaathin of electrical and future distribution controuge northema Thomson to sales in the coming year as a result of recent population growth trends Themes franca nast has prepared pro forma lance sheets that face diferentes of growth intercom corresponding on discretionary sources of financing the timespects to love avalable as follow 2. What are the fimi's discretionary financing needs under each of the three growth scenarios What potential cocos of nanding and there for Morrison to fall its need for decretionary trancing? The diacretionary Financing dit for a 10% growth contos (Roond to the man dow) The dictionary franchig needs tot a 20% growth scenario escRound to the nearest detar) The discretionary financing neededor 40 growth scenario w Round to the new b. What potential sources of francing or them to Hurton to rede for decretionary tranchg? (Slut i chokes that oy ko) A Sale offe 3. Long term debe OC Retained gaming 0 Notepaalde DE Common stock Pro Forma Balance Sheet for 2014 Calculation No change Current assets Net fixed assets Total Accounts payable Accrued expenses Notes payable Current liabilities Long-term debt Total liabilities Common stock (par) Paid-in capital Retained earnings Common equity Projected sources of financing Discretionary financing needs Alternative Growth Rates 10% 20% 40% $13,200,000 $14,400,000 $16,800,000 $19,800,000 $21,600,000 $25,200,000 $33,000,000 $36,000,000 $42,000,000 $2,200,000 $2,400,000 $2,800,000 2,200,000 2,400,000 2,800,000 1,500,000 1,500,000 1,500,000 $5,900,000 $6,300,000 $7,100,000 6,500,000 6,500,000 6,500,000 $12,400,000 $12,800,000 $13,600,000 $1,000,000 $1,000,000 $1,000,000 2,000,000 2,000,000 2,000,000 15,550,000 15,600,000 15,700,000 $18,550,000 $18,600,000 $18.700,000 s119.950.000 $31,400,000 $32.300.000 No change No change No change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started