Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with the journal entries! I've posted this before, but didn't understand the wording of the previous professor's entries. 3/18/16 - Jordan pays

please help me with the journal entries! I've posted this before, but didn't understand the wording of the previous professor's entries.

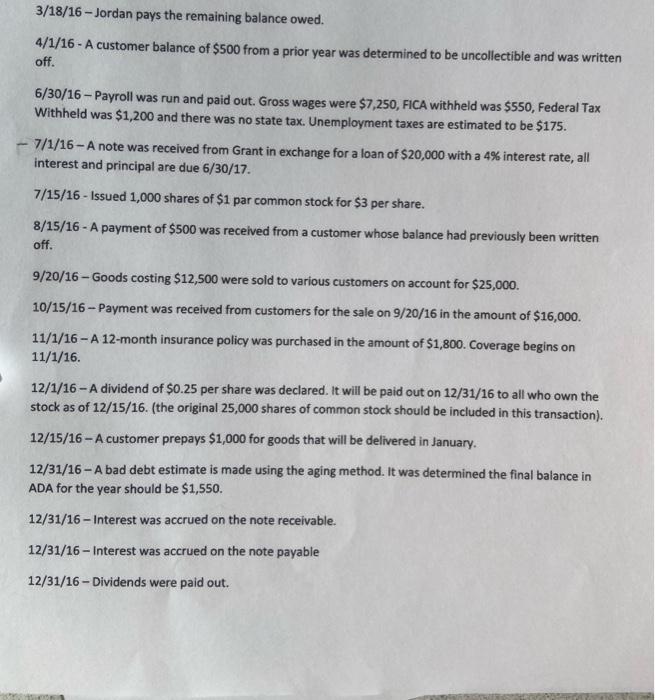

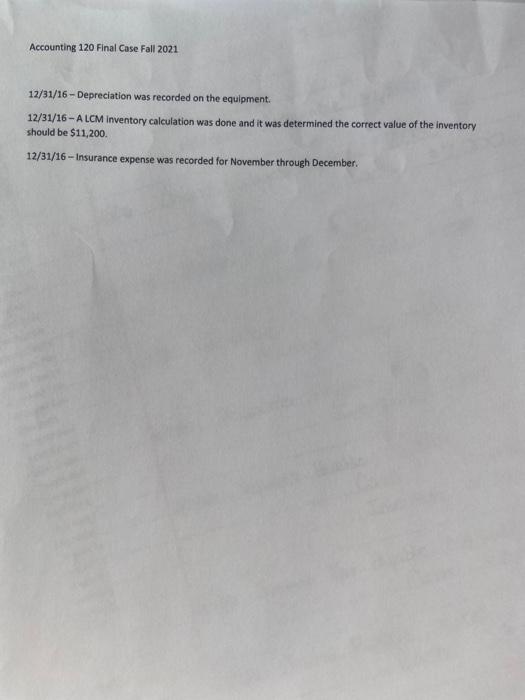

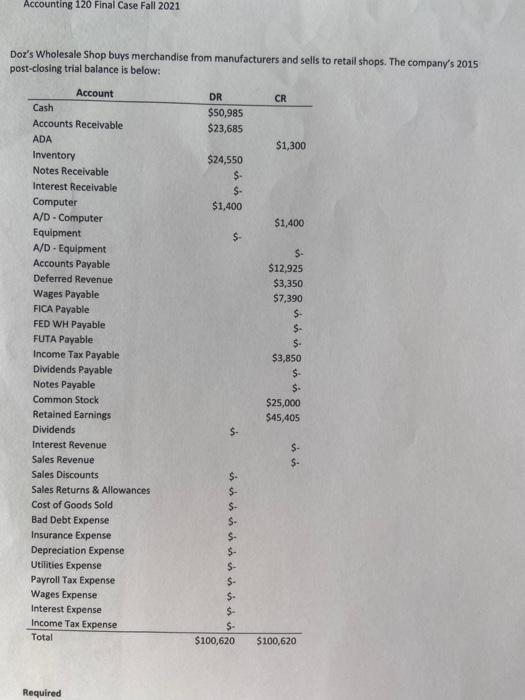

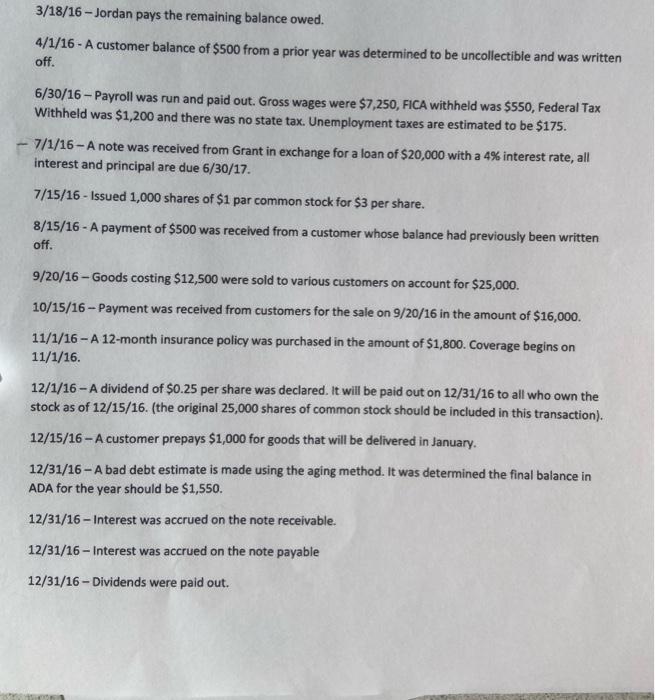

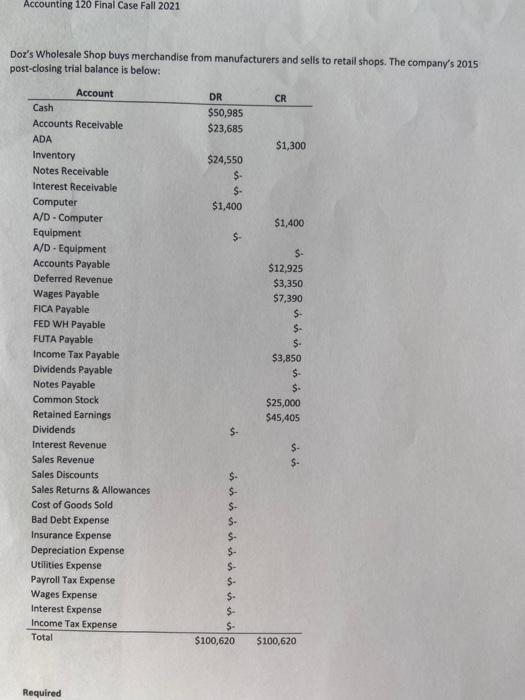

3/18/16 - Jordan pays the remaining balance owed. 4/1/16 - A customer balance of $500 from a prior year was determined to be uncollectible and was written off. 6/30/16 - Payroll was run and paid out. Gross wages were $7,250, FICA withheld was $550, Federal Tax Withheld was $1,200 and there was no state tax. Unemployment taxes are estimated to be $175. 7/1/16 - A note was received from Grant in exchange for a loan of $20,000 with a 4% interest rate, all interest and principal are due 6/30/17. 7/15/16 - Issued 1,000 shares of $1 par common stock for $3 per share. 8/15/16 - A payment of $500 was received from a customer whose balance had previously been written off. 9/20/16 - Goods costing $12,500 were sold to various customers on account for $25,000. 10/15/16 - Payment was received from customers for the sale on 9/20/16 in the amount of $16,000. 11/1/16 - A 12-month insurance policy was purchased in the amount of $1,800. Coverage begins on 11/1/16. 12/1/16 - A dividend of $0.25 per share was declared. It will be paid out on 12/31/16 to all who own the stock as of 12/15/16. (the original 25,000 shares of common stock should be included in this transaction). 12/15/16 - A customer prepays $1,000 for goods that will be delivered in January. 12/31/16- A bad debt estimate is made using the aging method. It was determined the final balance in ADA for the year should be $1,550. 12/31/16 - Interest was accrued on the note receivable. 12/31/16 - Interest was accrued on the note payable 12/31/16 - Dividends were paid out. Accounting 120 Final Case Fall 2021 12/31/16 - Depreciation was recorded on the equipment. 12/31/16-A LCM Inventory calculation was done and it was determined the correct value of the inventory should be $11,200. 12/31/16 - Insurance expense was recorded for November through December Accounting 120 Final Case Fall 2021 Dot's Wholesale Shop buys merchandise from manufacturers and sells to retail shops. The company's 2015 post-closing trial balance is below: CR DR $50,985 $23,685 $1,300 $24,550 $- $ $1,400 $1,400 $ Account Cash Accounts Receivable ADA Inventory Notes Receivable Interest Receivable Computer A/D - Computer Equipment A/D - Equipment Accounts Payable Deferred Revenue Wages Payable FICA Payable FED WH Payable FUTA Payable Income Tax Payable Dividends Payable Notes Payable Common Stock Retained Earnings Dividends Interest Revenue Sales Revenue Sales Discounts Sales Returns & Allowances Cost of Goods Sold Bad Debt Expense Insurance Expense Depreciation Expense Utilities Expense Payroll Tax Expense Wages Expense Interest Expense Income Tax Expense Total $ $12,925 $3,350 $7,390 S- 5- $. $3,850 $ $. $25,000 $45,405 S. $ is it is in $ $. $ $- $ $- $100,620 $100,620 Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started