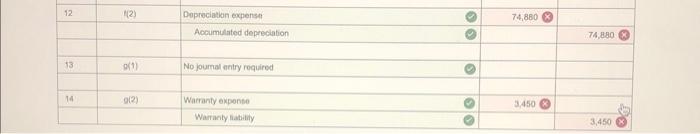

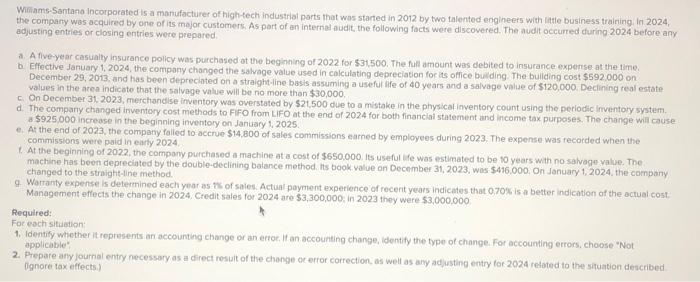

Please help me with the parts in red that I have missed.

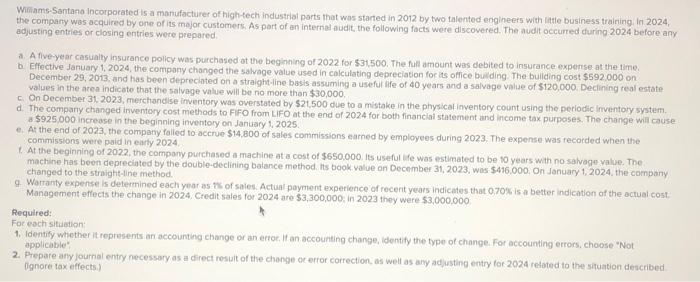

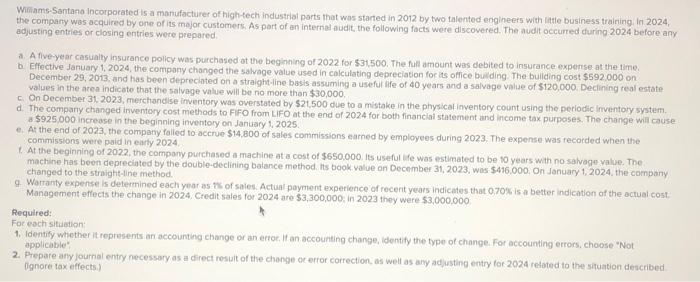

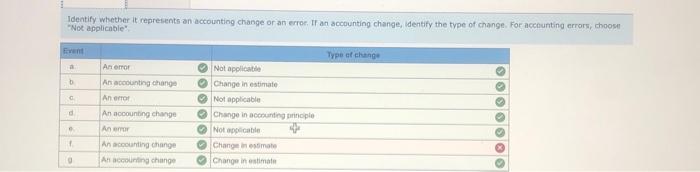

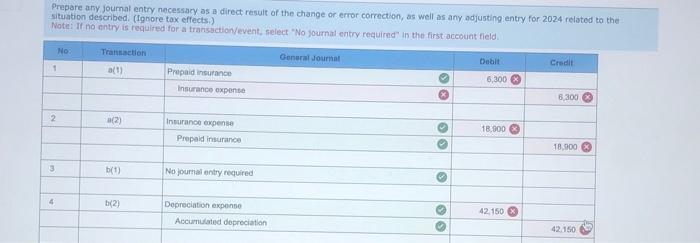

Wifams-Santano incorporated is a manufacturer of high-tech industrial ports that was started in 2012 by two talented engineers with latie business training. In 2024, the company was acquired by one of its mojor customers. As part of an internat audit, the following facts were discovered. The audit occurred during 2024 before any. adjusting entries or closing entries wete prepared a. A five-year casually insurance policy was purchased ot the begining of 2022 for $31,500. The full amount was debited to insurance expense at the time b. Effective January 1, 2024, the compony changed the salvage value used in colculating depreciation for its ofice buiding. The buliding cost $592.000 on December 29,2013 , and has been depreclated on a straight-line basis assuming a usefur ife of 40 years and a salvage value of 5120,000 . Declining teal estate valuef in the area indicote that the salvage value will be no more thon $30,000 c. On December 31, 2023, merchandise inventory was overstated by 521,500 due to a mistake in the physical inventory count using the periodic inventoty system. d. The company changed invenfory cost methods to FFFO from LiFO at the end of 2024 for both financiai statement and income tax purposes. The change will cause a $925,000 increose in the beginning inventory on Janiary 1,2025. e. At the end of 2023 , the compaty falied to accrue $14,800 of sales commissions earned by employees during 2023 . The expense-was recorded when the commissions were paid in earty 2024 1. At the beginning of 2022. the compony purchased a machine at a cost of $650.000. lts useful Me was estimated to be 10 years with no salvage yalue. The machine has been depreciated by the double-declining balance method. hs book value on December 31, 2023, was- 5416.000 . On January 1,2024. the company changed to the straight-line method. 9. Warranty expense is determined each year as . Ns of sales. Actual payment experience of rocent years indicates that 0,70% is a better indication of the actual cost. Management effects the change in 2024. Credit sales for 2024 are 53,300,000 in 2023 they were 53,000,000 Required: For each sitidion: 1. Identify whether it represents an accounting change or an ecrot, If an accounting change, identify the type of change. For accounting errors, choose "Not. applicable" 2. Prepare any journal entry necessory as a direct result of the change of error correction, as well as any adjusting entry for 202a redated to the sifuation described (ignore tax effects.) Identify whethar it represents an accounting change or an erre. If an accounting change, ldentify the type of change. For acenunting errors, thoose "Noe applicable". Prepare any Joumal entry necessacy as a direct result of the change or error correction, as well as any adjusting entry for 2024 related to the situation described. (Igoore tox effects.) Note: If no entry is required for a transsectionvevent, felect "No yournat entry requirnd" in the first account field